Abstract

This chapter summarizes all the calculated energy demands for the industry, service, transport, and building sectors. The supply side results for the OECM 1.5 °C scenario are documented. Electricity generation and the power generation required globally are provided by technology, together with the corresponding renewable and fossil energy shares. A detailed overview of the heat demand by sector, the heat temperature levels required for industrial process heat, and the OECM 1.5 °C heat supply trajectories by technology are presented, in both total generation and installed capacities. The calculated global final and primary energy demands, carbon intensities by source, and energy-related CO2 emissions by sector are given. Finally, the chapter provides the global carbon budgets by sector.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Global electricity generation

- Final electricity demand

- Power plant capacities

- Heat generation capacities

- Final energy demands of energy-intensive industries

- Global carbon budget

1 Introduction

The final energy demands for the industries, services, transport, and buildings sectors, including residential buildings, were determined based on the assumed global population and economic development until 2050 (for details see Chap. 2), within the context of increased energy efficiencies across all sectors. All supply scenarios were developed on the basis of a global carbon budget of 400 GtCO2 between 2020 and 2050, in order to qualify as an IPCC Shared Socioeconomic Pathway 1 (SSP1) no- or low-overshoot scenario (IPCC 2021).

The supply side of this 1.5 °C energy scenario pathway builds upon modelling undertaken in an interdisciplinary project led by the University of Technology Sydney (UTS). The project modelled sectorial and regional decarbonization pathways to achieve the Paris climate goals—to maintain global warming well below 2 °C and to ‘pursue efforts’ to limit it to 1.5 °C. That project produced the OneEarth Climate Model (OECM), a detailed bottom-up examination of the potential to decarbonize the energy sector. The results of this ongoing research were published in 2019 (Teske et al. 2019), 2020 (Teske et al. 2020), and 2021 (Teske et al. 2021). For this analysis, the 1.5 °C supply scenario has been updated to match the detailed bottom-up analysis documented in Chaps. 5, 6, 7, and 8.

2 OECM 1.5 °C Pathway for the Global Electricity Supply

The global electricity demand has grown continuously over the past decades. Global electricity generation more than doubled over the past 30 years, from 12,030 TWh (IEA WEO 1994) in 1991 to 26,942 TWh in 2019 (IEA WEO 2020). The COVID-19 pandemic led to a small reduction of about 2%, or 500 TWh (IEA WEO 2020), equal to Germany’s annual electricity demand in 2020. The decline in demand was due to lockdowns and the consequent reductions in industrial manufacturing and services. However, the electricity demand increased again to pre-COVID levels in 2021. Increasing market shares of electric vehicles also increased the electricity demand in the transport sector globally. The OECM 1.5 °C pathways will accelerate this trend and the electrification of the transport sector and the provision of space and process heat to replace fossil fuels will continue to increase the global electricity demand.

2.1 Global Final Electricity Demand

Figure 12.1 shows the development of the final electricity demand by sector between 2019 and 2050. The significant increase in the demand is due to the electrification of heat, for both space and process heating, and to a lesser extent for hydrogen and synthetic fuels. The overall global final demand in 2050 will be 2.5 times higher than in the base year, 2019. In 2050, the production of fuels alone will consume the same amount of electricity as the total global electricity demand in 1991. Therefore, the demand shares will change completely, and 47% of all electricity (Fig. 12.2) will be for heating and fuels that are mainly used in the industry and service sectors. Electricity for space heating—predominantly from heat pumps—will also be required for residential buildings.

2.2 Global Electricity Supply

Just as the electricity demand has changed over the past three decades, the global electricity supply has changed significantly in the same period. In 1994, 63% of electricity was generated from fossil fuels, 19% from hydropower, and 17% from nuclear power (UN 1996). Since 2010, the share of renewable electricity has increased every year. By the end of 2019, renewables contributed 27.3%, and by 2020, the share was expected to have increased to 29%. For the second consecutive year, electricity production from fossil fuels was estimated to have declined, driven mainly by a 2% reduction in coal-based power generation (REN21 GSR 2020).

The global installed capacity, by power plant technology and as a whole, has also changed rapidly. In 2010, just under 50% of all new annual additions to power-generating capacities were renewables, and 10 years later, this share had risen to 83%. Since 2012, net additions of renewable power generation capacity have outpaced the net installation of both fossil fuel and nuclear power capacity combined (REN21 GSR 2020). With the cost competitiveness achieved by renewables (mainly solar photovoltaic PV and wind power), this trend is expected to continue. China continues to be the world leader in bringing new renewable power generation on line, and the country contributed nearly half of all renewables-based installations in 2020.

In 2020, 256 GW of new renewable power generation capacity was added globally, leading to a total capacity of 1668 GW, or 2838 GW when hydro power is included (REN21 GSR 2020). By the end of 2020, the combined capacity of all solar photovoltaic installations was 760 GW, and wind power capacity summed to 743 GW. By comparison, the total global power generation capacity was 7484 GW, 2124 GW of which was from coal power plants, 1788 GW from gas power plants, and 415 GW from nuclear power plants (IEA WEO 2020). Thus, the trend in global generation is clearly in favour of cost-competitive new solar PV and wind power.

Table 12.1 shows the development of the projected global electricity generation shares. Under the OECM 1.5 °C pathway, coal- and lignite-based power plants will be phased out first, followed by gas power plants as the last fossil-fuelled power-generation technology to be taken out of service after 2040. Renewable power plants, especially solar photovoltaic and onshore and offshore wind, are projected to have the largest growth rates, leading to a combined share of 70% of electricity generation globally by 2050. To fully decarbonize the power sector, the overall renewable electricity share will increase from 25% in 2019 to 74% in 2030 and to 100% by 2050.

Global power plant capacities will quadruple between 2019 and 2050, as shown in Fig. 12.3. Capacity will increase more than actual power generation, because the capacity factors for solar photovoltaic and wind power are lower than those for fuel-based power generation. By 2030, solar photovoltaic and wind will make up 70% of the generation capacity, compared with 15% in 2019, and will clearly dominate by 2050, with 78% of the total global generation capacity.

To implement the generation capacity required for the OECM 1.5 °C pathway, the global annual market for solar photovoltaic must increase from 139 GW per year (market in 2020) to an average of 800–1000 GW additional capacity per year from 2025 onwards to 2040. Thereafter, the overall additional annual capacity will decrease to under 100 GW to reach the required capacity calculated for 2050. However, solar photovoltaic is likely to remain at an annual market level of around 1000 GW—predominantly to provide the replacement capacity for plants that reach the end of their lifetimes after 25–30 years.

The annual market for onshore wind must increase from 87 GW in 2020 to 134 GW in 2025 and 373 GW in 2035. The total onshore wind capacity will continue to rise by 250 GW per year until 2050—including repowering. The annual onshore wind market is therefore likely to stabilize at around 300 GW per year. The size of the annual offshore wind market must increase from 6 GW in 2020 to 47 GW in 2025 to implement the 1.5 °C pathway and to grow further to around 100 GW per year throughout 2050, with increasing market shares for repowering after 2040 (Table 12.2).

However, fossil-fuel-based power generation must be decommissioned and the global total capacity will not increase over current levels but will remain within the greenhouse gas (GHG) emissions limits. By 2025, global capacities of 63 GW from hard coal plants and 55 GW from brown coal power plants must go offline. All coal power plants in the Organization for Economic Cooperation and Development (OECD) must cease electricity generation by 2030, and the last coal plants must finish operation globally by 2045 to remain within the carbon budget for power generation to limit the global mean temperature increase to +1.5 °C. Specific CO2 emission per kilowatt-hour will decrease from 509 g of CO2 in 2019 to 136 g by 2030 and 24 g in 2040 to be entirely CO2 free by 2050 (see Table 12.1, last row).

3 OECM 1.5 °C Pathway for Global Space and Process Heat Supply

Analogous to electricity, the energy demand for space and process heat has been determined for the industry and service sectors and for residential and commercial buildings. The specific value for each sub-sector, such as the steel and aluminium industries, has been documented in Chaps. 5, 6, and 7. In this section, we focus on the cumulative heat demand and the supply structure required for the two main sectors, service and buildings and industry.

Services and buildings usually do not require temperatures over 100 °C. Therefore, the supply technologies are different from those of the industry sector, which requires temperature up to 1000 °C and above. The overall final heat demand will increase globally under the OECM 1.5 °C pathway, but the demand shares will change significantly. With energy efficiency measures for buildings (see Chap. 7), the overall space heating demand will decrease globally, even with increased floor space. However, the industrial process heat demand is projected to increase, because energy efficiency measures will not compensate for the increasing production due to the expected increase in global GDP to 2050. In 2019, the industry sector consumed 43% of the global heat demand and the service and buildings sector the remaining 57%. By 2050, these shares will be exchanged and the industry sector will consume close to 60% of the global heat demand (Fig. 12.4).

Table 12.3 shows the supply structure for the services and buildings and industry sectors. District heat is projected to remain the smallest part of the global heat supply, followed by cogeneration. Direct heating systems installed on-site will continue to supply the majority of the heat demand. The most important technologies required to implement the OEM 1.5 °C pathway for buildings will be heat pumps and solar thermal heating for buildings, while on-site generation for industry will allow the transition from fossil-fuel-based heating plants to electrical systems, such as electric resistance ovens, electric arc furnaces, and, to a lesser extent, bioenergy or synthetic-fuel-based heating plants.

Cogeneration plants for buildings and the service sector will decline as the on-site heating demand decreases with increased efficiency. For industry, cogeneration will remain an alternative and slightly increase overall generation. However, cogeneration requires fuel, and after the phase-out of fossil fuels, only biofuels, hydrogen, or synthetic fuels will be an option for CO2-free operation. The limited sustainable potential for bioenergy-based fuels and the relatively high costs of synthetic fuels will allow only minor growth of cogeneration plants or heating plants for the industry sector.

To develop the 1.5 °C pathways for process heat based on a renewable energy supply, it is necessary to separate the temperature levels for the required process heat, because not all renewable energy technologies can produce high-temperature heat. Whereas the heat generation for low-temperature heat can be achieved with renewable-electricity-supplied heat pumps or solar collectors, temperatures over 500 °C are assumed to be generated predominantly by combustion processes based on bioenergy up until 2030. After 2030, the share of electric process heat from electric resistance heat and electric arc furnaces is projected to increase to replace fossil fuels. Hydrogen and synthetic fuels will also play increasing roles in supplying high-temperature process heat.

The OECM model differentiates four temperature levels: low (<100 °C), medium low (100–500 °C), medium high (500–1000 °C), and high (>1000 °C).

Figure 12.5 shows the development of the industry process heat demand by temperature level. Whereas the values will increase over time despite energy efficiency measures, the shares of the temperature levels will remain constant. This arises from the assumption that all industry products will increase with the assumed development of the global GDP. No replacement of products, e.g. cement produced with alternative materials, is assumed because this was beyond the scope of this research.

Table 12.4 shows the total process heat demand by temperature level for three major industries combined: aluminium, steel, and chemicals. The overall heat demand of these sectors represented 20% of the global heat demand in 2019. This share is projected to increase to 37% due to a significant reduction in the heat demand in the building sector (see Chap. 7). The steel and chemical industries had similar process heat demands in 2019, at 13 EJ/year and 12 EJ/year, respectively. In contrast, the process heat demand of the aluminium industry was a quarter of this, at 3 EJ/year. Most of the process heat required by the aluminium industry is high-temperature heat (72%), whereas the iron ore and steel industry require only 57% high-temperature heat. The majority of the process heat required by the chemical industry is in the medium–high level (48%), between 500 °C and 1000 °C (Table 12.4).

3.1 Global Heat Supply

The process heat supply in 2019 relied heavily on fossil fuels (83%), mainly coal (33%) and gas (36%). Renewables played a minor role and the majority of renewable process heat was from biomass. To increase the renewable energy shares—especially for high-temperature heat—is more challenging than for the electricity sector. The fuel switch from coal and gas to biomass requires fewer technical changes than a transition towards geothermal energy, all forms of heat pumps, or direct electricity use (Keith et al. 2019). However, the OECM assumes that the global limit for sustainable biomass is around 100 EJ per year (Seidenberger et al. 2008). The generation of high-temperature heat requires concentrated solar thermal plants. However, solar thermal process heat is limited to low temperatures in most regions, because concentrated solar plants require direct sunlight with no cloud coverage, and can therefore only operate in the global sunbelt range in most regions (Farjana et al. 2018). Therefore, it is assumed that process heat will increasingly derive from electricity-based technologies: heat pumps, for low-temperature levels, and direct resistance electricity and electric arc furnaces, for medium- and high-temperature levels. However, to adapt appliances to generate electricity-based process heat will require significant changes in the production process. A significant increase in this technology is assumed to be unavailable before 2025 but will increase rapidly between 2026 and 2030. Hydrogen and synthetic fuels produced with renewable electricity will increase after 2030, especially for processes that cannot be electrified.

A global phase-out of coal for heat production is a priority objective to reduce specific CO2 emissions. To replace fuel-based heat production, electrification, especially for low- (<100 °C) and medium-level (100–500 °C) process heat, is extremely important in achieving decarbonization.

Table 12.5 shows the assumed trajectory for the generation of industry process heat between 2019 and 2050. In 2019, gas and coal dominated global heat production. Renewables only contributed 9%—mainly biomass—and electricity had a minor share of 1%. District heat—mainly from gas-fired heating plants—contributed the remaining 7% of the process heat supply, whereas hydrogen and synthetic fuels contributed no measurable proportion. The global OECM 1.5 °C pathway phases out coal and oil for process heat generation between 2035 and 2040, and gas is phased-out as the last fossil fuel by 2050. The most important process heat supply technologies are electric heat systems, such as heat pumps, direct electric resistance heating, and arc furnace ovens for process heat; the share will increase to 22% by 2030 and 60% by 2050. Bioenergy will remain an important source of heat, accounting for 25% in 2050—2.5 times more than in 2019. Synthetic fuels and hydrogen are projected to grow to 8% of the total industry heat supply by 2050.

Based on the annual heat demand, the generation capacities required by the three renewable heating technologies (solar thermal, geothermal, and bioenergy) have been calculated with average capacity factors.

A capacity factor is defined as ‘the overall utilization of a power or heat-generation facility or fleet of generators. The capacity factor is the annual generation of a power plant (or fleet of generators) divided by the product of the capacity and the number of hours of operation over a given period. In other words, it measures a power plant’s actual generation compared to the maximum amount it could generate in a given period without any interruption. As power or heating plants sometimes operate at less than full output, the annual capacity factor is a measure of both how many hours in the year the power plant operated and at what percentage of its entire production’ (Pedraza 2019).

The same annual capacity factors are assumed for solar thermal as for photovoltaic, at around 1000 hours per year (h/yr), whereas 3000 h/yr is estimated for geothermal energy, and 4500 h/yr. for bioenergy. For electrical systems, 4500 h/yr. is assumed. The capacities shown in Table 12.6 are indicative; the actual installed capacity required under industrial conditions is dependent on a variety of factors, one of which is the production volume of a specific manufacturing plant.

4 OECM 1.5 °C Final and Primary Energy Balances

The European statistics bureau, EUROSTAT, defines ‘final energy consumption’ as ‘total energy consumed by end users, such as households, industry and agriculture. It is the energy which reaches the final consumer’s door and excludes that which is used by the energy sector itself’ (EUROSTAT 2021). Therefore, final energy is the energy actually used from the analysed industry, service sector, or building, or for transport.

Figure 12.6 shows the global final energy trajectory for Industry as a whole and for five analysed sectors, as well as for transport and service and buildings. The overall Industry demand will increase significantly—as the only sector— from 120 EJ in 2019 to 177 EJ in 2050 (over 40%), whereas the transport energy demand will increase by more than 50%, due mainly to electrification and the introduction of strict efficiency standards for all vehicles. The demand of the service and buildings sector will decrease by just over 10%, leading to a global total final energy demand in 2050 that is 7% lower than in 2019. A combination of ambitious efficiency measures and the replacement of a significant amount of fuels for transport and heating with electrification will reduce the global energy demand despite a growing population and constant economic growth. The energy demands of energy-insensitive industries—chemicals, cement, steel, and aluminium—will increase continuously throughout the entire modelling period to 2050, but specific energy demands per production unit will decrease, decoupling economic growth from energy demands.

4.1 Final Energy Demands of Energy-Intensive Industries: Aluminium, Steel, and Chemicals

A closer look at the energy-intensive industries shows that the aluminium, steel, and chemical industries combined accounted for 34% of the global industrial final energy demand and 11% of the total final energy demand in 2019 (Table 12.7). The combined energy share of these three sectors will increase to 41% by 2050 under the OECM scenario, in response to the assumed higher efficiencies in other industry sectors, such as construction and mining. The overall energy demand of the three sectors will increase from 41 EJ/year to 72 EJ/year in this period, driven mainly by the projected increase in the global GDP and therefore their production volumes.

A comparison of the consumption shares of industry, transport, and service and buildings shows that their shares in the OECM 1.5 °C pathway will shift very much in favour of industry. The technical energy efficiency potential in the buildings sector (Chap. 7) and the transport sector (Chap. 8) will be significant, whereas the energy demand of the service sector (Chap. 6) is projected to increase further—mainly with the growing population and therefore the growing demand for products produced by this sector.

Figure 12.7 shows that the energy demand for transport will decrease by more than half (to 16%) and that this share will be taken up by the industry sector. The demand of the service and buildings sector will remain at the same level, because the reduced energy demand for buildings—mainly achieved by climatization—will be compensated by the increase in the energy demand of service industries, mainly for food production.

In the next section, we present the generation components for the three main sectors industry, transport, and service and buildings. The latter group is called other sectors by the International Energy Agency (IEA). Table 12.8 shows the total final energy demand for each of the three sectors and their supply by technology. The transport energy demand is almost exclusively supplied by oil, whereas natural gas and electricity provide only minor contributions, and coal is not used at all for transport. Industry uses the majority of coal and almost half the global demand for gas.

The data show the transition towards renewable energy and an increased electricity demand between 2025 and 2050. The renewable energy share in the other sectors group will increase fastest, whereas the renewable energy supply for transport will grow slowly.

4.2 Global Primary Energy Demand: OECM 1.5 °C Pathway

The global primary energy demand under the OECM 1.5 °C pathway is shown in Table 12.9. Primary energy includes all losses and defines the total energy content of a specific energy source. In 2019, coal and oil made the largest contributions to the global energy supply, followed by natural gas, whereas renewable energies contributed only 15%. The table also provides the projected trajectories for supplies for non-energy uses, e.g. oil for the petrochemical industry. The OECM does not phase-out fossil fuels for non-energy use, because their direct replacement with biomass is not always possible. A detailed analysis of the feedstock supply for non-energy uses was beyond the scope of this research.

5 Global CO2 Emissions and Carbon Budget

In the last step, we calculated the energy-related carbon emissions. The OECM 1.5 °C net-zero pathway is based on efficient energy use and a renewable energy supply only, leading to full energy decarbonization by 2050. No negative emission technologies are used and the OECM results in zero energy-related carbon emissions. However, process emissions are compensated by nature-based solutions, such as increased forest coverage. The details are documented by Meinshausen and Dooley (2019) and in Chaps. 11 and 14.

The global carbon budget identifies the total amount of energy-related CO2 emissions available to limit global warming to a maximum of 1.5 °C with no or only a low overshoot. The Intergovernmental Panel on Climate Change (IPCC) is the United Nations body that assesses the science related to climate change. In August 2021, the IPCC published a report that identified the global carbon budget required to achieve a global temperature increase of 1.5 °C with 67% likelihood as 400 GtCO2 between 2020 and 2050 (IPCC 2021).

5.1 Global CO2 Emissions by Supply Source

The CO2 emissions per petajoule (PJ) of energy depend upon the quality and energy content of the energy source, e.g. coal. The German Environment Agency (UBA) has reported the specific CO2 emissions for a variety of fossil fuels in order to calculate Germany’s annual carbon emissions. In terms of coal, the UBA reports that ‘most varieties of hard coal have a carbon content (with respect to the original substance) between 60 and 75%. The average content, which can vary from year to year, ranges between 65 and 66%. Hard coal within the lower range, up to a carbon content of about 56%, and a net calorific value of no more than 22 MJ/kg, is referred to as low-grade coal. Hard coal within the upper range is of coking-coal quality. The highest carbon content, reaching values over 30%, is found in anthracite coal’ (UBA 2016). The OECM uses global average emission factors for hard coal, brown coal, oil, and gas, as shown in Table 12.10.

Based on the development of the primary energy supply from fossil fuels, as defined in Table 12.9, the annual energy-related CO2 emissions are calculated as the average global emission factors. Table 12.11 shows the calculated CO2 emissions for fossil power generation and cogeneration and for specific sectors. The sectorial breakdown provided follows the IEA sectorial breakdown and therefore varies from the values provided for end-use sectors in Table 12.12. The specific CO2 intensities for power generation are made available in grams of CO2 per kilowatt-hour across total electricity generation—and therefore include carbon-free electricity generation, such as from renewables—and for fossil-fuel-generated power only. The reduction in CO2 intensity for fossil-fuel-based power generation between 2019 and 2040 indicates that the share of natural gas will increase and that power plants will become more efficient and therefore generate more units of electricity per unit of fuel.

Table 12.11 shows the energy-related CO2 from the supply side and therefore defines the carbon budgets for coal, lignite, oil, and gas. The OECM also determines the carbon budget for end-use sectors.

5.2 Global CO2 Budget

The remaining carbon budget for each of the following sectors has been defined based on the bottom-up demand analysis of the 12 main industry and service sectors, as documented in Chaps. 5, 6, 7, and 8. Each of those industry and service sectors must complete the transition to fully decarbonized operation within the carbon budget provided. It is very important that the carbon budget shows the cumulative emissions up to 2050, and not the annual emissions. A rapid reduction in annual emissions is therefore vital.

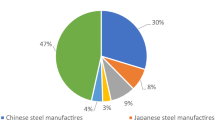

The shares of the cumulative carbon budget required to achieve the 1.5 °C net-zero target are shown in Fig. 12.8. Table 12.12 shows the remaining cumulative CO2 emissions in gigatonnes. The total energy-related CO2 for the aluminium industry between 2020 and 2050 is calculated to be 6.1 Gt, 1.5% of the total budget. For the steel industry, the remaining budget is 19.1 Gt of CO2 (4.8%), whereas the chemical industry has the highest carbon budget of 24.8 GtCO2 or 6.2% of the total carbon budget. All other remaining industries can emit 27.1 GtCO2 (6.8%), and all other energy-related activities, such as for buildings, transport, and residential uses, have a combined remaining emissions allowance of 323 GtCO2, or 80.7% of the budget.

References

EUROSTAT. (2021). EUROSTAT – Statistics explained, online database viewed December 2021. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Final_energy_consumption

Farjana, S. H., Huda, N., Mahmud, M. A. P., Saidur, R. (2018) Solar process heat in industrial systems—A global review. Renewable and Sustainable Energy Reviews, 82, 2270–2286. https://doi.org/10.1016/J.RSER.2017.08.065

IEA WEO. (1994). International Energy Agency—World Energy Outlook 1994, IEA, 9 rue de la Fédération, 75739 Paris Cedex 15, France.

IEA WEO. (2020). International Energy Agency—World Energy Outlook 2020, IEA, 9 rue de la Fédération, 75739 Paris Cedex 15, France.

IPCC. (2021). Climate change 2021: The physical science basis. In V. Masson-Delmotte, P. Zhai, A. Pirani, S. L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M. I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J. B. R. Matthews, T. K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, & B. Zhou (Eds.), Contribution of Working Group I to the sixth assessment report of the intergovernmental panel on climate change. Cambridge University Press.

Keith, L., Dani, A., Roman, B., Stephen, E., Michael, L., Ahmad, M., Jay, R., Hugh, S., Cameron, S., Kali, U., Muriel, W. (2019). Renewable energy options for industrial process heat. Australian Reneable Energy Agency (ARENA). https://arena.gov.au/assets/2019/11/renewable-energyoptions-for-industrial-process-heat.pdf

Meinshausen, M., Dooley, K. (2019). Mitigation scenarios for non-energy GHG. In: Teske, S. (ed.), Achieving the Paris climate agreement goals global and regional 100% renewable energy scenarios with non-energy GHG pathways for +1.5°C and +2°C. Springer Open. https://elib.dlr.de/126810/1/Teskeetal.-Achieving theParisClimateAgreementGoals-Globalandregional100percentrenewableenergyscenarios-2019.pdf

Pedraza. (2019). Conventional energy in North America, ISBN 978-0-12-814889-1, https://doi.org/10.1016/B978-0-12-814889-1.00004-8

REN21 GSR. (2020). Renewables 2021, Global status report, REN21 Secretariat, c/o UN Environment Programme; 1 rue Miollis, Building VII, 75015 Paris, France, ISBN 978-3-948393-03-8

Seidenberger, T., Thrän, D., Offermann, R., Seyfert, U., Buchhorn, M., Zeddies, J. (2008). Global biomass potentials. Report prepared for Greenpeace International, German Biomass Research Center, Leipzig. https://www.proquest.com/docview/816398809

Teske, S., Pregger, T., Simon, S., Naegler, T., Pagenkopf, J., van den Adel, B., Meinshausen, M., Dooley, K., Briggs, C., Dominish, E., Giurco, D., Florin, N., Morris, T., Nagrath, K., Deniz, Ö., Schmid, S., Mey, F., Watari, T., & McLellan, B. (2019). Achieving the Paris climate agreement goals global and regional 100% renewable energy scenarios with non-energy GHG pathways for +1.5°C and +2°C. In S. Teske (Ed.), Achieving the Paris climate agreement goals: Global and regional 100% renewable energy scenarios with non-energy GHG pathways for +1.5C and +2C. Springer International Publishing. https://doi.org/10.1007/978-3-030-05843-2

Teske, S., Niklas, S., Atherton, A., Kelly, S., & Herring, J. (2020). Sectoral pathways to net zero emissions. https://www.uts.edu.au/sites/default/files/2020-12/OECMSectorPathwaysReportFINAL.pdf

Teske, S., Pregger, T., Simon, S., Naegler, T., Pagenkopf, J., Deniz, Ö., van den Adel, B., Dooley, K., & Meinshausen, M. (2021). It is still possible to achieve the paris climate agreement: Regional, sectoral, and land-use pathways. Energies, 14(8), 1–25. https://doi.org/10.3390/en14082103

UBA. (2016). CO2 emission factors for fossil fuels, climate change 28/2016, Kristina Juhrich, Emissions Situation (Section I 2.6), German Environment Agency (UBA) June 20.

UN. (1996). United Nations Press release, 9th October 1996, New United Nations Handbook Indicates Global Energy Production and Consumption Pattern in Years 1991–1994 https://www.un.org/press/en/1996/19961009.dev2120.html

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Teske, S., Pregger, T. (2022). OECM 1.5 °C Pathway for the Global Energy Supply. In: Teske, S. (eds) Achieving the Paris Climate Agreement Goals . Springer, Cham. https://doi.org/10.1007/978-3-030-99177-7_12

Download citation

DOI: https://doi.org/10.1007/978-3-030-99177-7_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99176-0

Online ISBN: 978-3-030-99177-7

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)