Abstract

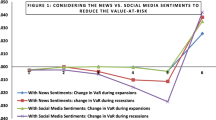

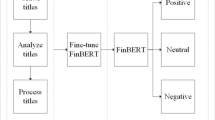

This paper analyzes the dependence between a newspaper-based economic sentiment index of the United States and four climate-themed financial indices since the outbreak of the COVID-19 pandemic. We use the quantile cross-spectral technique of Barunik and Kley (The Econometrics Journal 22:131–152, 2019), which allows dependence to vary across different time horizons and market conditions. Results show that when market conditions were very poor, dependence is strongest between economic sentiment and green bonds index in the intermediate time. However, under normal market returns, results show a similar pattern of increased dependence across the weekly, monthly and yearly cycles for all the climate-themed indices except green bonds. Besides, at the peak of the COVID-19 pandemic, normal returns dependence with economic sentiment was mostly positive and stronger than the lower and higher quantiles. Lastly, the strongest dependence under the 0.05|0.95 quantiles during the peak of COVID-19 pandemic occurred with green bonds in the short-term.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Aguilar, P., Ghirelli, C., Pacce, M., & Urtasun, A. (2021). Can news help measure economic sentiment? An application in COVID-19 times. Economics Letters, 199, 109730.

Asur, S., & Huberman, B. A. (2010). Predicting the future with social media. In 2010 IEEE/WIC/ACM international conference on web intelligence and intelligent agent technology (Vol. 1, pp. 492–499). IEEE.

Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross section of stock returns. The Journal of Finance, 61(4), 1645–1680.

Balcilar, M., Bouri, E., Gupta, R., & Kyei, C. K. (2020). High-frequency predictability of housing market movements of the United States: The role of economic sentiment. Journal of Behavioral Finance, 1–9.

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics, 49(3), 307–343.

Baruník, J., & Kley, T. (2019). Quantile coherency: A general measure for dependence between cyclical economic variables. The Econometrics Journal, 22(2), 131–152.

Bessec, M., & Fouquau, J. (2020). Green sentiment in financial markets: A global warning. Available at SSRN 3710489.

Black, F. (1986). Noise. The Journal of Finance, 41(3), 528–543.

Bollen, J., Mao, H., & Zeng, X. (2011). Twitter mood predicts the stock market. Journal of Computational Science, 2(1), 1–8.

Boroumand, R. H., Porcher, T., & Urom, C. (2021). Negative oil price shocks transmission: the comparative effects of the GFC, shale oil boom, and Covid-19 downturn on French gasoline prices. Research in International Business and Finance, 101455.

Broadstock, D. C., & Cheng, L. T. (2019). Time-varying relation between black and green bond price benchmarks: Macroeconomic determinants for the first decade. Finance Research Letters, 29, 17–22.

Broock, W. A., Scheinkman, J. A., Dechert, W. D., & LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric Reviews, 15(3), 197–235.

Brown, G. W., & Cliff, M. T. (2005). Investor sentiment and asset valuation. The Journal of Business, 78(2), 405–440.

Buckman, S. R., Shapiro, A. H., Sudhof, M., & Wilson, D. J. (2020). News sentiment in the time of COVID-19. FRBSF Economic Letter, 8, 1–05.

Caldecott, B. (2020). Defining transition finance and embedding it in the post-Covid-19 recovery. Journal of Sustainable Finance & Investment, 1–5.

Calomiris, C. W., & Mamaysky, H. (2019). How news and its context drive risk and returns around the world. Journal of Financial Economics, 133(2), 299–336.

CERES. (2020). Addressing climate as a systemic risk: A call to action for U.S. financial regulators. Retrieved from https://www.ceres.org/resources/reports/addressing-climate-systemic-risk.

Chien, F., Sadiq, M., Kamran, H. W., Nawaz, M. A., Hussain, M. S., & Raza, M. (2021). Comovement of energy prices and stock market return: Environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environmental Science and Pollution Research, 1–15.

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psychology and security market under-and overreactions. Journal of Finance, 53(6), 1839–1885.

De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703–738.

Gan, B., Alexeev, V., Bird, R., & Yeung, D. (2020). Sensitivity to sentiment: News vs social media. International Review of Financial Analysis, 67, 101390.

Garcia, D. (2013). Sentiment during recessions. The Journal of Finance, 68(3), 1267–1300.

He, Q., Liu, J., Wang, S., & Yu, J. (2020). The impact of COVID-19 on stock markets. Economic and Political Studies, 8(3), 275–288.

Hudson, Y., & Green, C. J. (2015). Is investor sentiment contagious? International sentiment and UK equity returns. Journal of Behavioral and Experimental Finance, 5, 46–59.

Khelifa, S. B., Guesmi, K., & Urom, C. (2021). Exploring the relationship between cryptocurrencies and hedge funds during COVID-19 crisis. International Review of Financial Analysis, 76, 101777.

Kim, S. H., & Kim, D. (2014). Investor sentiment from internet message postings and the predictability of stock returns. Journal of Economic Behavior & Organization, 107, 708–729.

Lee, H. S. (2020). Exploring the initial impact of COVID-19 sentiment on US stock market using big data. Sustainability, 12(16), 6648.

Lehrer, S., Xie, T., & Zhang, X. (2021). Social media sentiment, model uncertainty, and volatility forecasting. Economic Modelling, 102, 105556.

Liu, S. (2015). Investor sentiment and stock market liquidity. Journal of Behavioral Finance, 16(1), 51–67.

López-Cabarcos, M., Pérez-Pico, A. M., & López-Pérez, M. L. (2019). Does social network sentiment influence S&P 500 environmental & socially responsible index? Sustainability, 11(2), 320.

Maghyereh, A., & Abdoh, H. (2020). Tail dependence between Bitcoin and financial assets: Evidence from a quantile cross-spectral approach. International Review of Financial Analysis, 71, 101545.

Maghyereh, A., & Abdoh, H. (2021). Tail dependence between gold and Islamic securities. Finance Research Letters, 38, 101503.

Mendel, B., & Shleifer, A. (2012). Chasing noise. Journal of Financial Economics, 104(2), 303–320.

Mittal, A., & Goel, A. (2012). Stock prediction using twitter sentiment analysis. Standford University, , p. 15.

Mzoughi, H., Urom, C., Uddin, G. S., & Guesmi, K. (2020). The effects of COVID-19 pandemic on oil prices, CO2 emissions and the stock market: Evidence from a VAR model. SSRN Electronic Journal, 2020, 1–8.

Nguyen, T. H., Shirai, K., & Velcin, J. (2015). Sentiment analysis on social media for stock movement prediction. Expert Systems with Applications, 42(24), 9603–9611.

Oh, C., & Sheng, O. (2011). Investigating predictive power of stock micro blog sentiment in forecasting future stock price directional movement.

Piñeiro-Chousa, J., López-Cabarcos, M. Á., Caby, J., & Šević, A. (2021). The influence of investor sentiment on the green bond market. Technological Forecasting and Social Change, 162, 120351.

Piñeiro-Chousa, J., López-Cabarcos, M. Á., Pérez-Pico, A. M., & Ribeiro-Navarrete, B. (2018). Does social network sentiment influence the relationship between the S&P 500 and gold returns? International Review of Financial Analysis, 57, 57–64.

Ranco, G., Aleksovski, D., Caldarelli, G., Grčar, M., & Mozetič, I. (2015). The effects of Twitter sentiment on stock price returns. PLoS One, 10(9), e0138441.

Shapiro, A. H., Sudhof, M., & Wilson, D. J. (2020). Measuring news sentiment. Journal of Econometrics. https://doi.org/10.1016/j.jeconom.2020.07.053.

Shiller, R. C. (2000). Irrational exuberance. Philosophy and Public Policy Quarterly, 20(1), 18–23.

Taghizadeh-Hesary, F., Yoshino, N., & Phoumin, H. (2021). Analyzing the characteristics of Green Bond Markets to Facilitate Green Finance in the post-COVID-19 world. Sustainability, 13(10), 5719.

Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. The Journal of Finance, 62(3), 1139–1168.

Urom, C., Mzoughi, H., Abid, I., & Brahim, M. (2021). Green markets integration in different time scales: A regional analysis. Energy Economics, 98, 105254.

Weber, O., & Saravade, V. (2019). Green bonds: current development and their future. CIGI Papers, (210).

Ye, J., & Xue, M. (2021). Influences of sentiment from news articles on EU carbon prices. Energy Economics, 105393.

You, J., & Wu, J. (2012). Spiral of silence: Media sentiment and the asset mispricing. Economic Research Journal, 7(2), 141–152.

Zhang, W., Li, X., Shen, D., & Teglio, A. (2016). Daily happiness and stock returns: Some international evidence. Physica A: Statistical Mechanics and its Applications, 460, 201–209.

Zhang, X., Fuehres, H., & Gloor, P. A. (2011). Predicting stock market indicators through twitter “I hope it is not as bad as I fear”. Procedia-Social and Behavioral Sciences, 26, 55–62.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Ndubuisi, G., Yuni, D., Tingum, E.N. (2022). Economic Sentiment and Climate Transition During the COVID-19 Pandemic. In: Goutte, S., Guesmi, K., Urom, C. (eds) Financial Market Dynamics after COVID 19 . Contributions to Finance and Accounting. Springer, Cham. https://doi.org/10.1007/978-3-030-98542-4_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-98542-4_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-98541-7

Online ISBN: 978-3-030-98542-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)