Abstract

In this chapter, we provide a historic overview of the origin and definitions of Central Bank Digital Currencies (CBDCs), by examining relevant research dating back to the 1990s. We find that digital versions of sovereign money accessible by the private sector were motivated by advancements and challenges emerging from the private sector itself. We present the factors that necessitate their issuance, and especially focus on financial stability, monetary policy, and the increased competition in payments leading to threats in financial and monetary sovereignty. Finally, we assess the appeal of the various technical options for CBDCs against what has emerged as their universally desirable features.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Understanding CBDCs

1.1 A Brief History of Definitions

The European Blockchain Observatory and Forum (EUBOF), in their recent report titled “Central Bank Digital Currencies & a Euro for the Future”, defines CBDCs as “a form of digital money that is issued by a central bank”. This lean and abstractive definition is the most recent in line with exploratory work on CBDCs. The Bank for International Settlements (BIS) was among the first to highlight the features of, and concerns surrounding, electronic money. Many of the concepts presented in the paper remain surprisingly topical when applied to cryptocurrencies and even inform today’s dominant narrative that views CBDCs as a secure alternative to private and decentralised money [4].

BIS’ papers have remained a notable facilitator of the discussion on new forms of central bank money. More recently, a paper from BIS sparked the discussion around CBDCs. In the 2017 report titled “Central Bank Cryptocurrencies”, the authors lean heavily on the concepts introduced by cryptocurrencies and present the concept of a central bank cryptocurrency (CBCC). CBCCs are defined as “an electronic form of central bank money that can be exchanged in a decentralised manner, […] meaning that transactions occur directly between the payer and the payee without the need for a central intermediary”. The paper also distinguishes CBCC from other prevalent forms of money cash, deposits and e-money [5]. The report can be read as a partial response to concerns raised in a 2015 paper by the Committee on Payments and Market Infrastructure regarding the implications of cryptocurrencies for central banks, the financial market infrastructure, its intermediaries and the wider monetary policy [8].

Most recently, in 2020, the central banks of Canada, Europe, Japan, Sweden, Switzerland, England and the Federal Reserve and the BIS collaborated on a report that addressed the foundational principles and core features of CBDCs [14]. Therein, they are defined as “a digital form of central bank money that is different from balances in traditional reserve or settlement accounts” and “a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank”. The report also highlights the influence of the private sector on CBDC design, predominantly in the form of increased payment diversity. Individually, the BoE [20] has defined CBDCs as “an electronic form of central bank money that could be used by households and businesses to make payments and store value”, again noting the importance of the ever-changing payment landscape and impact of new forms of money such as stablecoins. The Central Bank of Sweden [34], leaning heavily on prior work of the BIS, describes their national version of a CBDC, known as an e-krona, as “money denominated in the national value unit, the Swedish krona, a claim on the central bank, electronically available at all times, and accessible by the general public”. The European Central Bank (ECB) [23] defines their version of a CBDC, also known as a digital euro, as “a central bank liability offered in digital form for use by citizens and businesses for their retail payments [that would] complement the current offering of cash and wholesale central bank deposits” and also underlines how competition in payments and money necessitate a new euro to address modern and future needs.

The common denominator of virtually every report on digital versions of sovereign money accessible by the private sector is that they were motivated by advancements and challenges emerging from the private sector itself. By examining this nonexhaustive collection of definitions, we can denote that CBDCs are digital forms of money denominated in the national currency of the issuing country/authority, accessible by either parts of or the wider private sector. Ultimately, CBDCs are to provide an alternative to the offerings of the private sector, through broad access to a central bank money and its accompanying protection and guarantees, while serving the needs of end consumers and the wider economy.

1.2 How CBDCs Differ from Other Forms of Money

However, the above definitions do not make immediately apparent how CBDCs differ from other forms of money prevalent in today’s world. Intuitively, CBDCs are novel neither because of their digital nature nor due to their issuance by a central bank. In fact, electronic forms of money have existed for the better part of the century, and money is issued by a central authority, such as a bank for millenniums. The novelty of CBDCs relies on two primary factors [22]:

-

1.

The extent to which this digital claim with the central bank is extended to the wider private sector – and the accompanying implications of this shift

-

2.

The technology behind CBDCs – and the new options that it might enable

By studying the nature of claims of modern money, we can observe that one relational connection is notably absent, as there is no way for the private sector to maintain a direct claim with the central bank electronically. Cash, meaning physical notes and coinage, constitute a liability of the central bank and asset of the wider private sector, including commercial banks, households and individuals. Deposits are a liability of commercial banks and asset for the private sector, while central bank reserves a liability of the central bank and asset for commercial banks. E-money, meaning currency stored in software or hardware and backed by a fiat currency, does not necessarily involve bank accounts; hence, it serves as a liability of payment service providers (PSPs) from the private sector and an asset for businesses, households and individuals. Finally, cryptocurrencies while an asset for the private, and more recently the public sector [26], are a liability of neither. CBDCs occupy a new space, one that offers the option for central bank money with modern features to be widely accessible by the private sector.

1.3 Wholesale and Retail CBDCs

Depending on how this electronic claim of the central bank is made available to the private sector, CBDCs are separated into a “wholesale” and “retail” variant. Wholesale CBDCs are devised for use between designated entities and the central bank. Those entities can include commercial banks, payment service providers and other financial institutions. Thus, wholesale CBDCs can be thought as an iteration on the existing reserve system. As nonconsumer facing money, their scope would be limited to streamlining intrabank operations such as improving efficiency of payments, minimising counterparty risk of the settlement and interbank lending process and reducing overhead costs. As reserves with the central bank already exist, the wholesale variant of CBDCs is not an entirely novel concept. Conversely, retail CBDCs would fulfil the functions of money, serving as a unit of account, store of value and medium of exchange, backed by the protection and guarantees of the central bank.

The premise of an electronic form of money to maintain, or even further, the relationship of the private sector with the central bank is seemingly superfluous. However, multifaceted factors that relate financial stability and inclusion, payment efficiency and safety and implementation of monetary policy among other satellite considerations contribute to the appeal of CBDCs.

1.4 Motivations of CBDCs

While at different stages in development and research, approximately 90% of central banks globally are exploring the issuance of CBDCs. Across the different national and regional motives, a broad agreement on the factors that necessitated the issuance of CBDCs and informed their design and, ultimately, their utility can be observed [7]. We broadly categorise factors to those that relate to financial stability and monetary policy and those that relate to increased competition in payments and threats to financial sovereignty.

1.4.1 Financial Stability and Monetary Policy

The 2008 recession officially ended in 2010, with annual global GDP rates demonstrating steady growth coupled with low volatility throughout the decade. The American economy experienced the longest expansion in its history and 50-year low unemployment rates [29]. The S&P 500 tripled in value, Apple, Amazon, Alphabet and Microsoft reached a market capitalisation of $1 trillion, while start-up growth was unprecedented. Yet, echoing the lasting effects of the great recession, global GDP growth levels have retraced from their 2000–2008 pace [35]. Wages, labour productivity [36] and the quality of jobs deteriorated [27], the overall number of IPOs fell [33], and the start-up miracle gave its place to some of the biggest scandals of the decade [24]. The COVID-19 pandemic spurned the largest plunge [32] for the Dow Jones in its history, not once, but thrice within less than a week. Surging unemployment and plummeting asset prices followed, igniting fears of a looming global economic recession.

Over the past decades, government, central banks and policy-makers adopted increasingly unorthodox approaches to keep economies and societies afloat, employing tools ranging from forward guidance to quantitative easing and, more recently, even handouts or “helicopter money”, that overall proved less effective than initial estimates [31]. These gave room rise to CBDCs as mediums for enhancing financial stability through streamlining existing monetary policy tools and creating new ones. While an in-depth analysis of the role of CBDCs for monetary policy is beyond the scope of the present, it is generally accepted that their digital nature could provide better insight into the inner workings of economies, contribute towards elimination of the lower zero-bound interest rate, offer granularity and control over social benefits and streamline the monetary policy transmission mechanism [14]. Additionally, CBDCs can also offer new options for monetary policy, such as a new obligation clearing system enabling a collaborative economy [22]. As demonstrated in the latest BIS report/survey, the above are well realised and of increasing importance especially for central banks in advanced economies (AEs).

1.4.2 Increased Competition in Payments and Threats to Financial Sovereignty

Besides the need for solutions that relate to monetary policy, the promises of new technological advancements are, in many cases, too substantial to ignore. On January 3, 2009, Bitcoin emerged as the birth child of converging technological advancements and rising dismay for the then unfolding economic events. Through its novel technological backbone, decentralised structure and reliance on social consensus, it showcased the advantages of money birthed by, and for the needs of, the internet. Disregarding the accompanying anti-systemic narrative, its promise for fast, cheap, reliable, inclusive and borderless value transfer is still appealing and, in many cases, unattainable by existing systems. Over the years, countless imitators and iterators materialised, and while most faded to obscurity, others such as Ethereum expanded upon Bitcoin’s functionality. Ethereum showcased the full range of applications that can be achieved with programmable DLT-enabled forms of electronic value and systems built upon these. Programmable money, new innovative financial services by the name of decentralised finance (DeFi) and the enabling of novel forms of commerce, such as machine-to-machine economy, digital identities and decentralised governance schemes, are only some of the concepts largely nurtured in the decentralised space, which could benefit the economies through CBDCs. Decentralised stablecoins showcased how the advances of cryptocurrencies can be brought to digital money denominated in sovereign currencies, free from the volatility of other digital assets. Over the years, stablecoins emerged as a blockchain native unit of account while maintained most of the desirable characteristics of their non-stable counterparts, including fast borderless payments, programmability and reliability. Their popularity and explosive growth sparked initial discussions around CBDCs, as evident by early statements from central banks globally. An indicative example is the joint press release by the European Council and the European Commission in 2019, in which the significance of stablecoins as fast, cost-effective and efficient payment mediums to address consumer’s needs is outlined [18]. In the same press release, the possibility of CBDCs as a sovereign alternative to stablecoins is also discussed. Similar reports from central banks further solidify how stablecoins influenced the design and accelerated the discussion around CBDCs [1, 6, 20]. Yet, before central banks could offer an alternative to stablecoins, free of the ambiguity and risks of their decentralised issuance and nature, the private sector was quick to react.

An alternative to the decentralised issuance-induced ambiguity and lack of synergy with existing infrastructure came with Facebook’s announcement of Libra (later rebranded to Diem) and its network of partners. Despite a significant scale-back, Libra/Diem aims to build a blockchain-backed financial network to enable open, instant and low-cost movement of money and further financial inclusion by enabling universal access to related services [15].

In parallel to Facebook’s announcement, China’s pilots for the country’s version of a CBDC, the Digital Currency Electronic Payment (DCEP), commenced through the People’s Bank of China (PBoC), also involving four state-owned banks and the public. A few months later, Fan Yifei, deputy governor of the PBoC in his speech at the Sibos 2020 conference, confirmed that more than 110,000 consumer wallets and 8000 corporate digital wallets were opened for citizens of Shenzhen, Suzhou and Xiong’an. With over €150 million worth of DCEP processed, China became the first major economy to successfully employ CBDCs in that scale [25].

In light of privately issued global currencies and escalating interest in CBDCs from other nations, the mobilisation of regulators was unprecedented. Within days of Libra’s announcement, top financial authorities globally issued statements foreshadowing the regulatory scrutiny that Libra/Diem would face in the following months and years. Perhaps most notably, the G7, consisting of financial leaders from the world’s seven biggest economies, openly opposed the launch of Libra/Diem in the absence of proper supervision and regulatory framework [28]. Lastly in the EU in particular, top representatives from France, the UK and Germany were quick to underline that Facebook’s Libra/Diem will be held at the highest regulatory standards. Moreover, the Markets in Crypto-Assets (MiCA) regulation developed in response aims at regulating Libra/Diem and similar deployments.

The driving motives behind cryptocurrencies, decentralised and global stablecoins, fintech and neobanks solidified the need for enhances in payment efficiency and innovation, as well as the furthering of financial inclusion [16]. As demonstrated by BIS recent report/survey, the above constitute fundamental design principles of CBDCs. Specifically, while financial stability and inclusion have over the years attracted the interest of emerging market and developing economies (EMDEs), both AEs and EMDEs are equally motivated by the implications of retail CBDCs for payment efficiency and robustness. Finally, maintaining access to central bank money in light of the declining use of cash is another important factor behind the issuance of CBDCs.

With regard to wholesale CBDCs, as noted in the previous section, those are not an entirely novel concept, and thus, many of their potential benefits are already enjoyed by commercial banks. As such, they are not a priority for most central banks, with this insouciance reflected in the report/survey of BIS. The motives behind wholesale CBDCs generally follow that of their retail counterparts, save for the notion of financial inclusion.

2 From Motivations to Design Options

The motives presented above have informed a collection of foundational principles and specific characteristics for CBDCs. Indicatively, the European central bank presented a comprehensive collection of core principles and scenario-specific and general requirements for a potential digital euro, Europe’s name for a CBDC [19]. Across those three-category issues that relate to monetary policy, financial stability and sovereignty, efficiency, security, cost-effectiveness and innovation are highlighted. The Bank of England noted 15 design principles across reliable and resilient, fast and efficient, innovative and open to competition [20]. The Central Bank of Sweden, in their second project report on the country’s CBDC, the e-krona, highlighted its desirable functions. The report cites comprehensive range of services, wide availability and ease of use, transaction capacity and performance, robustness, security, reliability and integrity as well as trackability [34]. Similar considerations have been highlighted in reports produced by the Bank of Thailand [10] and others.

The convergence of central banks pertains to not only the definition and motives behind CBDCs but also the foundational principles that should characterise their design. This is intuitive to the extent that the overarching mandate of central banks is universal and relates to the monetary and financial stability, as well as the provision of trusted money. The reports presented above fall in line with BIS’ research on the desirable characteristics of CBDC [14]. As a collaborative effort involving the central banks of Canada, Europe, Japan, Sweden, Switzerland, England and the Federal Reserve, the factors presented have largely informed the reports on a national and supranational level and vice versa. As such, we feel that they can be treated as a middle ground of universally shared and generally accepted principles of CBDC design, save for the caveats stemming from national and local considerations.

The report identifies a total of 14 desirable characteristics that relate to instrument features, meaning the characteristics of the CBDC itself; system features, which relate to the technology enabling the CBDC; and institutional features, meaning the policy underpinnings of a CBDC. Of those, 5 are promoted as core features. The features fall in line with the three common objectives of all central banks as identified in the report. Those are:

-

(i)

Do no harm, meaning that new money should not interfere with the central banks mandate for financial and monetary stability.

-

(ii)

Coexistence, as CBDC should complement and not compete with private solutions and other forms of money, as long as those serve a purpose for the public.

-

(iii)

Innovation and efficiency, in a safe and accessible manner.

The desirable core CBDC features include the following:

Instrument features | System features | Institutional features |

|---|---|---|

Convertible | Secure | Robust legal framework |

Convenient | Instant | Standards |

Accepted and available | Resilient | |

Low cost | Available | |

(High) Throughput | ||

Scalable | ||

Flexible and adaptable |

2.1 The Design Space of CBDCs

As demonstrated, a lot of ink has been spilled on the factors that necessitate the issuance of CBDCs and their desirable features. Yet little effort has been put towards identifying universally preferable technology options for CBDC to satisfy their desirable characteristics.

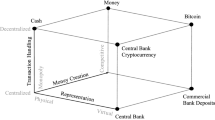

As with the definition for CBDC, the EUBOF has introduced a lean framework for mapping out the design space and options for a digital Euro, Europe’s version of a CBDC. The framework considers previous work on the area and predominately draws for a study by BIS titled “The technology of retail central bank digital currency” [3]. The framework highlights three primary choices for CBDCs, namely, the evidence of ownership (E-Own), the ledger infrastructure and the management scheme, which collectively make up the design space of a digital euro. For the E-Own, they identify the alternatives of account-based and token-based systems as potential mechanisms for “verifying ownership of value and authorisation of transactions”. In terms of the technology that underpins the digital euro, EUBOF proposes the alternatives of Europe’s existing real-time gross settlement system (RTGS) and TIPS and that of a novel distributed ledger technology (DLT) or blockchain infrastructure. Finally, regarding the management scheme, the authors coin the umbrella terms centralist and federalist to respectively describe a CBDC managed by the central bank alone or by the central bank in collaboration with commercial banks and other entities. The entire design space defined by EUBOF is presented in the Fig. 5.1.

While the framework was initially devised for assessing the design space and options for a digital euro, there is nothing to suggest that the same principles do not directly apply to any other potential CBDCs. Moreover, while wholesale CBDC options are not considered, as discussed above, those are largely overshadowed as redundant especially when compared to their retail counterparts. As such, we opt to evaluate the desirable characteristics for a CBDC introduced by the relevant BIS report, against the derivative options stemming from EUBOF’s framework. To facilitate for this analysis, we assign unique names to every derivative option. We utilise the same naming scheme proposed by EUBOF and substitute the term digital Euro for CBDC. As an example, a CBDC utilising an account-based E-own, RTGS infrastructure and centralist management scheme would be abbreviated as “ARC CBDC”. While not the most elegant option, this naming scheme is intuitive in its simplicity.

2.2 Assessing Design Space Against Desirable Characteristics

In accessing the options, we consider the instrument features and system features, against the design space presented above, as they are directly relevant to those technical options, unlike the institutional features. Additionally, we will opt to utilise TIPS as an example when referring to RTGS systems. However, this can be substituted for any other RTGS deployment without influencing the evaluation.

2.2.1 Instrument Features

Convertible

In every potential version of a CBDC, regardless of the technology, or management scheme, convertibility with other forms of money in the economy and in particular those issued by the central bank can be established as a prerequisite. Central banks, in collaboration with the government, can, and likely will, establish CBDCs as a form of legal tender in the country of issuance. This would mean that both cash and deposits with the central bank will also be convertible for CBDCs and vice versa. While a convertibility at par might facilitate for undesirable events in times of stress, such as bank runs, and even be undesirable by commercial banks for profitability reasons [22], nevertheless, the technology options presented above allow for it. Whether it is implemented or not is strictly a policy decision.

Convenient

The growing popularity of digital payments in the form of fintech, neobanks, e-money and cryptocurrencies has showcased their convenience over other forms of money such as cash or cheques. CBDCs regardless of the technological infrastructure, or other design choices, would offer comparable features and convenience.

Accepted and Available

BIS’ report establishes POS functionality and offline capabilities as main prerequisites for a CBDC to be considered “accepted and available”. As we have established, CBDCs draw from advancements in digital payments and thus will likely adopt payments with NFC, QR codes and plastic. While the digital nature of a CBDC will necessitate communication with a remote database, to facilitate for offline transactions, this could be done asynchronously [13]. The Bank of Japan published a research paper [9] examining the options for offline transactions. The solutions proposed cover a wide range of mediums including an IC chip on a SIM card, PASMO/Suica cards otherwise electronic money and railway and transport tickets and finally debit cards with built-in keypads and screens. Visa has also published a paper [12] outlining how offline transactions utilise secure elements in mobile devices. The options presented above do not rely on the technological infrastructure as the components responsible (smartphone, servers, etc.) would be most likely shared among any CBDC deployment. Thus, offline CBDC transactions are possible and likely.

Low Cost

When it comes to costs, those largely depend on the infrastructure as well as management scheme of a CBDC. In terms of the latter, as centralist schemes are entirely managed by the central bank, the costs of research, development and management of the infrastructure and end-customer relationships would be incurred by the central bank alone. This is in contrast to federalist schemes that involve entities besides the central bank. In those, the costs would be shared between the central bank and the various participating entities. Regarding the infrastructure, the operational costs of CBDC deployed existing RTGS infrastructures that would be comparable to existing systems. On the other hand, DLT solutions would, at least initially, necessitate costs in the form of research and deployment. Whether the central banks can afford not to pass those costs to the end consumers is debatable.

2.2.2 System Features

Secure

BIS’ report considers resistance to cyberattacks and counterfeiting as primary components of security. While cyber incidents involving both RTGS systems and blockchains have taken place in the past, indicatively [11, 30], both RTGS systems and DLT/blockchain have proven overall cyber-resilient and cyber-efficient against counterfeiting. Financial institutions employ high levels of security to protect information and funds, and the nature of the immediate settlement makes data vulnerable for a briefer time window. Blockchains, by employing a novel form of distributed consensus and protocol rules, ensure the validity of value transfers and mitigate instances of double spent. While some of those benefits are lost in networks with trusted entities, a proof-of-authority consensus mechanism, involving reputable entities that can be held accountable for wrongdoing, would offer comparable security to RTGS deployments.

Instant

In RTGS systems such as Europe’s TIPS, transactions are almost “instant”, with 99 per cent of them settling in under 5 s [37]. In blockchains, most of the inefficiencies stem from the use of novel forms of consensus mechanisms and artificial limits to block size that result in limited processing capacity. While the above serve a purpose in networks comprised of mutually distrusting nodes, in the case of CBDCs, their use of blockchain technology will be different. Specifically, with trusted entities, most of the limitations presented above would be redundant; thus, transaction times will be comparable to that of existing RTGS schemes.

Resilient

BIS’ report defines resilience as the extreme resistance to operational failures and disruptions such as natural disasters and electrical outages. Both RTGS systems and DLT/blockchains utilise geographically distributed architectures that ensure data integrity in case of disruption. Moreover, RTGS systems such as TIPS operate on a continuous basis with recovery times in case of disaster limited to a maximum of 15 min [37].

Available

Availability is defined as the capacity of a system to process transactions 24 h per day, 7 days per week, 365 days per year. Like DLT/blockchain, RTGS systems operate on a continuous automated basis, beyond business hours and without the need for human interference. Indicatively, the longest running blockchain network, Bitcoin, boasts an uptime of 99. 98% with only two downtime events, aggregately amounting to 15 h of downtime.

Throughput

Intuitively, throughput translates to the number of transactions that can be processed in a given timeframe. RTGS systems, such as TIPS, can process north of 40 million transactions per day with a maximum capacity of 2000 transactions per second. Moreover, their usability, speed and efficiency can also serve as the platform for the deployment of a CBDC [37]. The throughput of many decentralised deployments is much more limited. Indicatively, the processing capacity of Bitcoin is approximately 4.5 transactions per second. However, it would be faulty to assume that this limitation is inherent for all DLT/blockchain-based systems. In fact, for Bitcoin and many other decentralised cryptocurrencies, this limited capacity is a conscious design choice in the blockchain trilemma. Simply put, the blockchain trilemma is “an oversimplification of the multidimensional mutually exclusive choices made by developers, users, and markets alike”, with Vitalik Buterin defining the trilemma as the balancing act between decentralisation, security and scalability [17]. Simply put, many decentralised networks favour security and decentralisation over scalability and, as a result, have a lower processing capacity. Proof-of-authority CBDC deployments utilising DLT/blockchain can, and likely will, favour scalability and security at the expense of decentralisation, to achieve processing capacity comparable to RTGS deployments.

Scalable

BIS’ report defines scalability as the ability of a system to “accommodate the potential for large future volumes”. A plethora of schemes have been proposed for scaling both RTGS and DLT/blockchain systems. Indicatively, in a recent report, the Bank of Italy showcases how existing RTGS systems such as TIPS can be succeeded by “by a distributed, horizontally scalable system” that will facilitate for greater processing capacity [2]. Moreover, recent advancements leading up to Ethereum 2.0, such as sharding, present universally applicable solutions for scaling blockchain-based systems [21].

Interoperable

“Interoperability refers to the technical ability of two or more disparate systems to exchange information in a manner that maintains the ‘state and uniqueness’ of the information being exchanged” [38]. RTGS systems are widely available and interoperable. In Europe, TIPS is widely available in 56 countries and integrates with domestic payment systems and procedures. Moreover, it also offers the ability to settle transactions in foreign currency. Besides the traditional financial system, solutions have been proposed for interoperability of RTGS systems with deployments from the private sector through a decentralised network of oracles [38]. For DLT/blockchain systems, a plethora of interoperable solutions have been proposed over the years [17].

Flexible and Adaptable

BIS’ report defines flexibility and adaptability as the ability of a CBDC system to be able to change according to policy imperatives. Given the modularity of RTGS and DLT/blockchain systems, as evident by the applications that they enable, they are likely to be adaptable to changing condition and policy imperatives.

Our analysis indicates that for the most favourable options for CBDCs, the dichotomy between accounts or token-based E-Own and the RTGS and DLT/blockchain infrastructure is redundant, as the choices do not represent material differences. This comes as an extension to recent bibliography from the Bank of England and Riksbank, which underline the insignificance of the account versus token debate for privacy [13, 20]. Moreover, the convergence of CBDC deployments on an RTGS versus a DLT/blockchain infrastructure in how they satisfy the necessary features relies on the permissioned nature of the deployment. As put by the Bitcoin white paper, “the main benefits are lost if a trusted third party is still required”, and hence DLT/blockchain solutions more closely resemble their centralised counterparts.

References

Adrian. (2019). Stablecoins, Central Bank digital currencies, and cross-border payments: A new look at the International Monetary System. IMF. Available at: https://www.imf.org/en/News/Articles/2019/05/13/sp051419-stablecoins-central-bank-digital-currencies-and-cross-border-payments. Accessed 14 June 2021.

Arcese, M., Giulio, D. D., & Lasorella, V. (2021). Real-time gross settlement systems: Breaking the wall of scalability and high availability, Mercati, infrastrutture, sistemi di pagamento (Markets, Infrastructures, Payment Systems). 2. Bank of Italy, Directorate General for Markets and Payment System. Available at: https://ideas.repec.org/p/bdi/wpmisp/mip_002_21.html. Accessed 16 June 2021.

Auer, R., & Böhme, R. (2020). The technology of retail central bank digital currency. www.bis.org. [online] Available at: https://www.bis.org/publ/qtrpdf/r_qt2003j.htm.

Bank of International Settlements (Ed.). (1996). Implications for central banks of the development of electronic money. Basle.

Bank of International Settlements. (2017). Central bank cryptocurrencies (p. 16).

Bank of International Settlements. (2019). Investigating the impact of global stablecoins (p. 37).

Bank of International Settlements. (2021). Ready, steady, go? Results of the third BIS survey on central bank digital currency. Available at: https://www.bis.org/publ/bppdf/bispap114.pdf. Accessed 9 June 2021.

Bank of International Settlements and Committee on Payments and Market Infrastructures. (2015). Digital currencies.

Bank of Japan. (2020). 中銀デジタル通貨が現金同等の機能を持つための技術的課題 (p. 26).

Bank of Thailand. (2021). BOT_RetailCBDCPaper.pdf.

Carnegie Endowment for International Peace. (2017). Timeline of cyber incidents involving financial institutions. Carnegie Endowment for International Peace. Available at: https://carnegieendowment.org/specialprojects/protectingfinancialstability/timeline. Accessed 15 June 2021.

Christodorescu, M., et al. (2020). Towards a two-tier hierarchical infrastructure: An offline payment system for Central Bank digital currencies. arXiv:2012.08003 [cs]. Available at: http://arxiv.org/abs/2012.08003. Accessed 15 June 2021.

Claussen, C.-A., Armelius, H., & Hull, I. (2021). On the possibility of a cash-like CBDC (p. 15).

Cœuré, B., et al. (2020), Central bank digital currencies: foundational principles and core features report no. 1 in a series of collaborations from a group of central banks. Available at: https://www.bis.org/publ/othp33.pdf. Accessed 7 June 2021.

Diem Association. (2020). White Paper | Diem Association. Available at: https://www.diem.com/en-us/white-paper/. Accessed 14 June 2021.

Diez de los Rios, A., & Zhu, Y. (2020). CBDC and monetary sovereignty. Bank of Canada. https://doi.org/10.34989/san-2020-5

Dionysopoulos, L. (2021). Big data and artificial intelligence in digital finance. INFINITECH OA Book.

EC. (2019). Joint statement by the Council and the Commission on “stablecoins.” [online] www.consilium.europa.eu. Available at: https://www.consilium.europa.eu/en/press/press-releases/2019/12/05/joint-statement-bythe-council-and-the-commission-on-stablecoins/#:~:text=12%3A54-. Accessed 21 Feb 2022.

ECB. (2020). Report on a digital euro. [online] Available at: https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf.

England, B. (2020). Discussion paper – Central Bank digital currency: Opportunities, challenges and design (p. 57).

Ethereum. (2020). Shard chains. ethereum.org. Available at: https://ethereum.org. Accessed 16 June 2021.

EU Blockchain Observatory & Forum. (2021). Central Bank digital currencies and a Euro for the future.

European Central Bank. (2020). Report on a digital Euro (p. 55).

Holmes, A. (2019). The biggest tech scandals of the 2010s, from NSA spying to Boeing’s deadly crashes to WeWork. Business Insider. Available at: https://www.businessinsider.com/biggest-tech-scandals-2010s-facebook-google-apple-theranos-wework-nsa-2019-10. Accessed 17 June 2021.

Insights, L. (2020) SIBOS 2020: Chinese central bank says 1.1 billion digital yuan paid so far. Ledger Insights – enterprise blockchain. Available at: https://www.ledgerinsights.com/sibos-2020-chinese-central-bank-digital-yuan-currency-cbdc/. Accessed 14 June 2021.

Kharpal, A. (2021). El Salvador becomes first country to adopt bitcoin as legal tender after passing law. CNBC. Available at: https://www.cnbc.com/2021/06/09/el-salvador-proposes-law-to-make-bitcoin-legal-tender.html. Accessed 16 June 2021.

Kiersz, A. (2019). 10 simple charts that show the wild ways America has changed since 2010. Business Insider. Available at: https://www.businessinsider.com/charts-show-how-americas-economy-and-population-changed-since-2010. Accessed 17 June 2021.

Koranyi, T. W., & Balazs. (2019). Facebook’s Libra cryptocurrency faces new hurdle from G7 nations. Reuters, 18 October. Available at: https://www.reuters.com/article/us-imf-worldbank-facebook-idUSKBN1WW33B. Accessed 14 June 2021.

Li, Y. (2019). This is now the longest US economic expansion in history. CNBC. Available at: https://www.cnbc.com/2019/07/02/this-is-now-the-longest-us-economic-expansion-in-history.html. Accessed 17 June 2021.

MIT Technology Review. (2019). Once hailed as unhackable, blockchains are now getting hacked. MIT Technology Review. Available at: https://www.technologyreview.com/2019/02/19/239592/once-hailed-as-unhackable-blockchains-are-now-getting-hacked/. Accessed 15 June 2021.

Simmons, R., Dini, P., Culkin, N., & Littera, G. (2021). Crisis and the role of money in the real and financial economies—An innovative approach to monetary stimulus. Journal of Risk and FinancialManagement, 14(3), 129. Available at: https://www.mdpi.com/1911-8074/14/3/129 Accessed 21 Feb. 2022.

Soergel. (2020). Dow plunges to biggest loss in history on Coronavirus fears | Economy | US News, US News & World Report. Available at: www.usnews.com/news/economy/articles/2020-02-27/dow-plunges-to-biggest-loss-in-history-on-coronavirus-fears. Accessed 17 June 2021.

Statista. (2020). Number of IPOs in the U.S. 1999–2020. Statista. Available at: https://www.statista.com/statistics/270290/number-of-ipos-in-the-us-since-1999/. Accessed 17 June 2021.

Sveriges Riksbank. (2017). The Riksbank’s e-krona project. S E (p. 44).

The World Bank. (2021). GDP growth (annual %) | Data. Available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2019&start=1970&view=chart. Accessed 17 June 2021.

U.S. Bureau of Labor Statistics. (2017). Below trend: the U.S. productivity slowdown since the Great Recession: Beyond the numbers. U.S. Bureau of Labor Statistics. Available at: https://www.bls.gov/opub/btn/volume-6/below-trend-the-us-productivity-slowdown-since-the-great-recession.htm. Accessed 17 June 2021.

Visco, I. (2020). The role of TIPS for the future payments landscape Speech by Ignazio Visco Governor of the Bank of Italy Virtual conference “Future of Payments in Europe.” [online] Available at: https://www.bis.org/review/r201130c.pdf.

World Economic Forum. (2020). WEF_Interoperability_C4IR_Smart_Contracts_Project_2020 (1).pdf. Available at: http://www3.weforum.org/docs/WEF_Interoperability_C4IR_Smart_Contracts_Project_2020.pdf

Acknowledgments

Part of this work has been carried out in the H2020 INFINITECH project, which has received funding from the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement No. 856632.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Dionysopoulos, L., Giaglis, G. (2022). Towards Optimal Technological Solutions for Central Bank Digital Currencies. In: Soldatos, J., Kyriazis, D. (eds) Big Data and Artificial Intelligence in Digital Finance. Springer, Cham. https://doi.org/10.1007/978-3-030-94590-9_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-94590-9_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-94589-3

Online ISBN: 978-3-030-94590-9

eBook Packages: EngineeringEngineering (R0)