Abstract

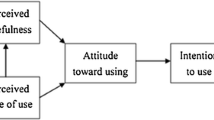

This paper aims to analyse the pandemic impact on internet banking services offered to Albanian customers. We will examine the online banking environment and the latest trends in Albania based on secondary data from the Bank of Albania reports. Based on a focus group interview with banking customers, we used some variables from the technology acceptance model (TAM), indicating the pandemic impact on online banking services acceptance and usage among private banking customers in Albania. The study utilized a questionnaire design based on a 7-point scale to obtain primary data from a sample (n = 384). Our results show that age, education, income level, perceived credibility, and safety are essential factors that influence its use. Perceived usefulness, perceived ease of use, and gender were not significant. The findings will be helpful to both scholars and practitioners seeking to understand the pandemic effect’s challenges.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Alagheband, P.: Adoption of electronic banking Services by Iranian Customers Master thesis. Sweden, Luleå University of technology (2006)

Baldwin, R., Mauro, B.W.D.: Economics in the Time of COVID-19. CEPR Press, Washington (2020)

Boshkoska, M., Sotiroski, K.: An empirical study of customer usage and satisfaction with e-banking services in the Republic of Macedonia. Croatian Rev. Econ. Bus. Soc. Stat. 4(1), 1–13 (2018). https://doi.org/10.2478/crebss-2018-0001

Davis, F.D.: Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 13(3), 319–340 (1989)

Flavián, C., Guinaliu, M., Torres, E.: How bricks and mortar attributes affect online banking adoption. Int. J. Bank Mark. 24(6), 406–423 (2006). https://doi.org/10.1108/02652320610701735

Gholami, R., Clegg, B.T., Al-Somali, S.A.: Internet banking acceptance in the context of developing countries (Aston Business School research papers). Aston University. Available at Research Gate (2008)

Gerrard, P., Cunningham, J.: The diffusion of internet banking among Singapore consumer. Int. J. Bank Market. 21, 16–28 (2003). https://doi.org/10.1108/02652320310457776

Guangying, H.: An experimental investigation of online banking adoption in China. J. Internet Bank. Commer. 14(1), 1–12 (2009). https://aisel.aisnet.org/amcis2008/36

Hussain, Z., Das, D., Bhutto, Z., Hammad-u-Salam, M., Talpur, F., Rai, G.: E-banking challenges in pakistan: an empirical study. J. Comput. Commun. 5, 1–6 (2017). https://doi.org/10.4236/jcc.2017.52001

Hannoon, A., Al-Sartawi, A.M.A.M., Khalid, A.A.: Relationship between financial technology and financial performance. In: Musleh Al-Sartawi, A.M.A. (ed.) The Big Data-Driven Digital Economy: Artificial and Computational Intelligence. SCI, vol. 974, pp. 337–344. Springer, Cham (2021). https://doi.org/10.1007/978-3-030-73057-4_26

Islam, T., Saif-Ur-R., Abid, C., Muhammad, S., Ahmer, Z.: How perceptions about ease of use and risk explain intention to use mobile payment services in Pakistan? The mediating role of perceived trust. Pakistan J. Commer. Soc. Sci. (PJCSS) 14(1), 34–48 (2020). http://hdl.handle.net/10419/216863

Jiménez, J.R.Z., Aguiar-Díaz, I.: Educational level and Internet banking. J. Behav. Exp. Finance 22, 31–40 (2019). https://doi.org/10.1016/j.jbef.2019.01.004

Karjaluoto, H., Mattila, M., Pento, T.: Factors underlying attitude formation towards online banking in Finland. Int. J. Bank Mark. 20, 261–272 (2002). https://doi.org/10.1108/02652320210446724

Katz, J., Rice, E.R., Aspden, P.: The Internet, 1995–2000 access, civil involvement, and social interaction. Am. Behav. Sci. 45(3), 405–419 (2001). https://doi.org/10.1177/00027640121957268

Kavitha, S.: Factors influencing satisfaction on e-banking. AIMS Int. J. Manage. 11, 103–115 (2017). https://doi.org/10.26573/2017.11.2.2

Kripa, E., Seitaj, M.: Brief survey on use of e-banking in Albania. Acad. J. Interdis. Stud. 4(2), 407–420 (2015). https://doi.org/10.5901/ajis.2015.v4n2p407

Kumar, A., Adlakaha, A., Mukherjee, K.: The effect of perceived security and grievance redressal on continuance intention to use m-wallets in a developing country. Int. J. of Bank Market. 36(7), 1170–1189 (2018). https://doi.org/10.1108/ijbm-04-2017-0077

Maeroufi, F., Nouri, H., Iman, K.Z.: Examination of the role of factors influencing the acceptance of e-banking. J. Appl. Sci. 15(6), 845–849 (2015). https://doi.org/10.3923/jas.2015.845.849

Mathieson, K.: Predicting user intentions: comparing the technology acceptance model with the theory of planned behaviour. Inf. Syst. Res. 2(3), 173–191 (1991)

Naeem, M., Ozuem, W.: The role of social media in internet banking transition during COVID-19 pandemic: using multiple methods and sources in qualitative research. J. Retail. Consum. Serv. 60 (2021). https://doi.org/10.1016/j.jretconser.2021.102483

Nasri, W.: Factors influencing the adoption of Internet banking in Tunisia. Int. J. Bus. Manage. 6(8), 143–160 (2011). https://doi.org/10.5539/ijbm.v6n8p143

Polasik, M., Piotr Wisniewski, T.: Empirical analysis of internet adoption in Poland. Int. J. Bank Market. 27(1), 32–52 (2009). https://doi.org/10.1108/02652320910928227

Saraçi, P., Shterbela, S.: E-banking usages in albania: case study of shkodra region. Int. J. Econ. Commer. Manage. 5(3), 370–379 (2017). http://ijecm.co.uk/wp-content/uploads/2017/03/5328.pdf

Shao, Z., Zhang, L., Li, X., Guo, Y.: Antecedents of trust and continuance intention in mobile payment platforms: the moderating effect of gender. Electron. Commer. Res. Appl. 33 (2019). https://doi.org/10.1016/j.elarap.2018.100823

Shankar, A., Jebarajakirthy, C.: The influence of e-banking service quality on customer loyalty. Int. J. Bank Market. 37(5) (2019). https://doi.org/10.1108/IJBM-03-2018-0063

Stavins, R.N.: An Approach to Developing a Research Agenda for Environmental Economics Washington, DC US Environmental Protection Agency Science Advisory Board (2001)

Ulhaq, I., Awan, T.: Impact of e-banking service quality on e-loyalty in pandemic times through interplay of e-satisfaction 17(1/2), 39–55 (2020). https://doi.org/10.1108/XJM-07-2020-0039

Wójcik, D., Ioannou, S.: COVID-19 and finance: market developments so far and potential impacts on the financial sector and centres. Tijdschr. Econ. Soc. Geogr. 111(3), 387–400 (2020). https://doi.org/10.1111/tesg.12434

Alansari, Y., Al-Sartawi, A.: IT governance and E-banking in GCC listed banks. Procedia Comput. Sci. 183, 844–848 (2021). https://doi.org/10.1016/j.procs.2021.03.008

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Pelari, O.M., Hoxhaj, M. (2022). An Empirical Investigation of the Influence of the Pandemic on Albanian Internet Banking Service Usage. In: Musleh Al-Sartawi, A.M.A. (eds) Artificial Intelligence for Sustainable Finance and Sustainable Technology. ICGER 2021. Lecture Notes in Networks and Systems, vol 423. Springer, Cham. https://doi.org/10.1007/978-3-030-93464-4_15

Download citation

DOI: https://doi.org/10.1007/978-3-030-93464-4_15

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-93463-7

Online ISBN: 978-3-030-93464-4

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)