Abstract

Price-based climate change policy instruments, such as carbon taxes or cap-and-trade systems, are known for their potential to generate desirable results such as reducing the cost of meeting environmental targets. Nonetheless, carbon pricing policies face important economic and political hurdles. Powerful stakeholders tend to obstruct such policies or dilute their impacts. Additionally, costs are borne by those who implement the policies or comply with them, while benefits accrue to all, creating incentives to free ride. Finally, costs must be paid in the present, while benefits only materialize over time. This chapter analyses the political economy of the introduction of a carbon tax in Mexico in 2013 with the objective of learning from that process in order to facilitate the eventual implementation of an effective cap-and-trade system in Mexico. Many of the lessons in Mexico are likely to be applicable elsewhere. As countries struggle to meet the goals of international environmental agreements, it is of utmost importance that we understand the conditions under which it is feasible to implement policies that reduce carbon emissions.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

Why Is It so Difficult to Implement Effective Climate Change Policies Based on Carbon Pricing?

Carbon pricing is a policy concept used at the national and subnational levels across the world to incentivize carbon dioxide emission reductions. Carbon pricing entails charging emitters for the carbon dioxide emissions for which they are responsible. Such emissions result from burning fossil fuels for essential activities such as electricity generation, industrial production, transportation, and heating and air-conditioning in residential and commercial buildings.

Since Pigou (1932) formalized the idea that with the right fiscal intervention, prices could lead to socially efficient (desirable) outcomes, correcting market failures caused by externalities, economists have advocated pricing signals as the main driver of environmental policies. Climate change is no exception. Economic instruments in the form of pricing signals, such as taxes and cap-and-trade systems, have an outstanding theoretical performance with regard to important evaluation criteria such as efficiency, effectiveness and cost-effectiveness.Footnote 1 Flexible responses by economic agents are essential to explaining efficiency and cost-effectiveness, as carbon pricing allows firms to decide on the most efficient ways to mitigate emissions in response to carbon prices. Similarly, equalizing marginal cost of mitigation across firms and sectors is a necessary condition for cost-effectiveness, i.e. minimizing overall costs of mitigation. This is accomplished if a uniform carbon price applies across all firms and sectors, regardless of the emissions source.

If economists had their way, price signals would constitute the pillar of environmental policy. With regard to climate change, there may be disagreements among economists as to whether a carbon tax outperforms a cap-and-trade system, or vice versa, but most economists agree that pricing carbon emissions should be an essential component of emissions-mitigation policy. Weitzman (1974) was the first to explain the basic difference between taxes and cap-and-trade systems. Under perfect certainty, in principle, both lead to the same socially efficient outcome. However, when the marginal benefits and marginal costs functions of mitigation are not known, taxes are preferred if the main policy objective is to provide price certainty, as regulated agents know the price per ton emitted. Notice that the tax does not guarantee that the desired emission reduction will take place, as the exact reaction of the regulated entities is uncertain. On the other hand, cap-and-trade programmes provide emission reductions certainty but uncertainty about the price per ton of emissions. Taxes and cap-and-trade methods also differ with regard to the political dynamics to which they give rise. Stavins (2012) argues that “the key difference is that political pressures on a carbon tax system will most likely lead to exemptions of sectors and firms, which reduces environmental effectiveness and drives up costs, as some low-cost emission reduction opportunities are left off the table;” whereas “…[the] political pressures on a cap-and-trade system lead to different allocations of the free allowances, which affect distribution, but not environmental effectiveness, and not cost-effectiveness.”

Whether in the form of a tax or a cap-and-trade system, a carbon price would provide consumers and producers incentives to make changes, sometimes marginal but sometimes significant, to their behavioural patterns leading to less carbon dioxide emissions. This would, in turn, lead to a more efficient, or at least a cost-effective, outcome. However, despite the growing importance that carbon pricing has had in the last decade—almost 23% of global emissions today are affected by a carbon pricing schemeFootnote 2—prices still do not play the role they will need to play if they are to limit emissions in a manner consistent with climate change goals.

Why is it so difficult for governments to implement the right policies? The nature of climate change as a global-public-bad (i.e. the non-rivalry and non-excludability of its impacts) and the temporal asymmetry of the relevant costs and benefits represent major obstacles to the design and implementation of effective public policies. On the one hand, the benefits of emissions-mitigation actions are distributed globally, while mitigation costs are borne entirely by those who take such actions. This is an instance of the famous free-rider problem.Footnote 3 Importantly, the free-rider problem arises both between countries as well as within countries, across sectors of economic activity, and even across firms.

At the same time, the temporal dimension of costs and benefits further complicates the establishment of emissions-mitigation policies, since the costs are borne in the present, while most of the benefits are obtained in the future. The existence of high initial costs and deferred benefits creates a political challenge. Politically, it is much easier to offer benefits in the present and pass the costs on to future generations. Free riding and the intertemporal asymmetry of the costs and benefits of emissions-mitigation actions hinder the implementation of mitigation policies and highlight the importance of considering both political and economic incentives in policy design and execution.

The next section provides a brief history of climate change policy in Mexico as background to understand the difficulties faced by efforts to introduce price-based mechanisms. The section after that analyses the conditions that provided a favourable scenario for the Mexican Treasury (Secretaría de Hacienda y Crédito Público or SHCP) to consider introducing a carbon tax. Next, we describe the tax design process as well as the negotiations and lobbying that transformed the proposed tax into the tax that was eventually approved by the Mexican Congress; next, we analyse political opposition to the tax; and finally, we draw some lessons and offer conclusions.

A Brief History of Climate Change Policy in Mexico Before the Carbon Tax Was Passed

Despite a very active and positive international agenda and a determined domestic institutional strengthening programme, prior to the 2013 carbon tax, Mexico had not taken any policy measures that would impose costs on important economic sectors for emitting carbon dioxide.

The Mexican government began analysing climate change in the late 1980s, focusing on its potential impacts on the country. The ministry charged with this task was the Ecology under-Secretariat of the Department of Ecology and Urban Development (Secretaría de Ecología y Desarrollo Urbano y Ecología or SEDUE). This made it possible for Mexico to participate in the meetings that led to the adoption of the United Nations Framework Convention on Climate Change (UNFCCC) in 1992. That same year, SEDUE was transformed into the Ministry of Social Development (Secretaría de Desarrollo Social or SEDESOL). In addition to environmental and urban development policies, the new ministry was responsible for poverty alleviation. Meanwhile, two new environmental agencies were created: The National Institute of Ecology (Instituto Nacional de Ecología or INE),Footnote 4 responsible for policy formulation and implementation, and an environmental enforcement agency (Procuraduría Federal de Protección al Ambiente or PROFEPA). Despite this surge in institutional capacity focusing on the environment, climate change itself continued to be analysed—like at SEDUE and SEDESOL—mainly by a small staff of advisors to the president of the INE.

In December 1994, responsibility for environmental and natural resource policy moved from SEDESOL to a new specialized ministry, the Secretaría del Medio Ambiente, Recursos Naturales y Pesca (SEMERNAP) at the beginning of President Ernesto Zedillo’s administration. INE and PROFEPA were moved from SEDESOL to SEMARNAP and a special climate change office was created at INE. Both in Mexico and globally, 1997 was a special year for climate change-related institutions. That year, Mexico launched the Climate Change Inter-Departmental Committee, led by SEMARNAP, in order to improve policy coordination within the federal government and to facilitate meeting its commitments under the UNFCCC. The Kyoto Protocol was also adopted in December 1997. During the process, Mexico was pressed to become an Annex B country due to its recently acquired status as an OECD member. In 1999, the federal government issued the Climate Action Programme (Programa de Acción Climática). The programme helped Mexico resist the pressure to become an Annex 1 country or to commit to more ambitious goals than the ones established under the UNFCCC. Before 2000 (the last year of President Zedillo’s administration), when Mexico ratified the Kyoto Protocol, the government focused its climate change-related actions on scientific research and important support studies such as the greenhouse gas inventory.

The first mechanism based on economic instruments to mitigate emissions in Mexico was the Clean Development Mechanism or CDM (Mecanismo de Desarrollo Limpio). The Clean Development Mechanism was a Kyoto Protocol instrument that allowed Annex 1 countries—those with binding mitigation commitments under the protocol—to invest in mitigation projects in foreign developing countries as an alternative to investing in more-expensive mitigation projects in their own countries. The CDM raised expectations among environmentalists and industry in Mexico because it was considered to be an excellent vehicle to finance emissions reductions in various industrial sectors. However, those expectations never came to fruition, partly because of the large transaction costs of the mechanism, largely stemming from the inherent practical difficulty of verifying emission baselines and reductions.

Under President Felipe Calderón’s administration (2006–2012), Mexico enhanced its leadership in climate policy. On the domestic front, in 2007 the government passed the Climate Change National Strategy (Estrategia Nacional de Cambio Climático or ENCC) and, in 2008, the Climate Change Special Programme (Programa Especial de Cambio Climático or PECC). Additionally, the Mexican congress enacted the General Law on Climate Change (Ley General de Cambio Climático) in 2012. This law established, conditional on financial and technological support from the international community, mitigation targets for greenhouse gas (GHG) emission reductions: a 30% reduction in emissions by 2020 with respect to a business-as-usual scenario and a 50% reduction by 2050 with respect to the year 2000 emissions.

In the international arena, Mexico was one of the countries that proposed the creation of the Green Climate Fund at the G8 meeting in Rome in 2008. However, Mexico is best remembered for its role in re-establishing trust in the multilateral process, when it hosted the 16th Conference of the Parties (COP16) in Cancún. Despite all its domestic and international accomplishments, President Calderón did not use carbon pricing to promote emissions-mitigation actions during his administration.

President Peña Nieto’s administration began in December 2012, and climate change was not one of its priorities. He proposed a very ambitious set of reforms including, among others, major changes in the labour, antitrust, telecom, energy, and fiscal sectors. Even though President Peña Nieto did not have the same personal passion for climate change as his predecessor, it can be argued that his reform of the electricity sector (through the promotion of renewable energy) and fiscal reform (through the introduction of the carbon tax) had the potential to have a very significant impact on GHG emissions. Why was there a fiscal reform? And why and how was a carbon tax part of it? We now turn to these questions.

Lack of Resources and Oil Dependency in Mexican Public Finances

The fiscal reform of 2013 had two important drivers. The first was to increase government revenue. Due to lack of resources, the government of Mexico was not able to meet the most basic needs of its population, including health, education, infrastructure and security. Excluding oil revenues, tax collection represented only 10% of GDP in Mexico in 2012, compared to 19 and 25% for Latin American and OECD countries, respectively. The second driver of the fiscal reform was the imperative of reducing the degree to which government revenue depended on oil. Due to the inherent volatility of the price of crude oil and the production platform, government dependence on oil production was a major source of uncertainty, variability and risk for Mexican public finances.

After the discovery of Cantarell, a giant oil-field, at the beginning of the 1980s, the Mexican economy became heavily oil-dependent. In 1982, oil accounted for around two thirds of exports and one-third of federal government revenue, and taxes paid by PEMEX—the national state-owned oil monopoly—amounted to a full 10% of GDP. The 1994 North American Free Trade Agreement diversified and increased non-oil-related exports, but government revenues continued to be oil-dependent. Oil-related revenue reached 44% of total government revenue in 2008. However, oil prices collapsed in 2009 (from US$92 to US$54 per barrel), clearly signalling to the federal government the risks of its oil dependency.

Seeking to reduce government dependence on oil revenue, in December 2012, the Peña Nieto administration began promoting a series of structural reforms. Energy reform was one of the most conspicuous because it went against a long history of nationalistic policies in the sector. The reform would require PEMEX to compete with private companies, but it would not be able to do so successfully unless its tax scheme changed.

The Mexican treasury (SHCP) issued a fiscal reform project in 2013 aimed at increasing government revenue. Environmental taxes were among the new proposed sources of government revenue. After discussing the pros and cons of the proposed list of environmental taxes with the Ministry of Environment and Natural Resources (SEMARNAT), SHCP decided to include only two environmental taxes in the fiscal reform plan (alongside many other taxes unrelated to the environment): a carbon tax and a tax on pesticides.

Overall prospects for introducing carbon taxes in Mexico in the early 2010s appeared bleak. For one thing, in 2013, as a non-Annex-1 country, Mexico did not have binding international obligations to mitigate GHG emissions. Additionally, given that the energy matrix in Mexico is highly dependent on fossil fuels and that the country has a large history of subsidizing fuel on distributional and competitiveness grounds, a carbon tax appeared to go against traditional economic interests. Indeed, in 2012, oil was used to meet 53% of the country’s total energy demand, natural gas represented 36%, coal 5%, hydro-electricity 4%, nuclear 1%, and non-hydro renewables 1%. One might have been surprised, therefore, when the Mexican congress passed a tax on GHG emissions at the points of importation and sale of the fuels on 30 October 2013.

Design of the Proposed Carbon Tax

We now describe the process of designing the draft carbon tax before it became law. As mentioned previously, the Mexican carbon tax had both environmental and fiscal objectives. On the one hand, it aimed to induce fuel efficiency and emissions reductions and, inasmuch as it was a unilateral policy measure, at gaining international legitimacy and placing Mexico in a favourable position for climate change and related international environmental negotiations. At the same time, from the point of view of the treasury, the carbon tax had a clear revenue-generating objective.

The team that designed the carbon tax included experts from SEMARNAT and the Mario Molina Center—a not-for-profit think-tank based in Mexico City. The design team decided that, given the technical difficulties and administrative costs, the tax ought to be an indirect one. Specifically, the tax should be levied on fossil fuels and should be proportional to each fuel’s potential to generate carbon dioxide emissions. In order to determine the tax rate, the team considered social-cost-of-carbon estimates and analysed carbon prices in jurisdictions outside of Mexico. At the time, the best-known social-cost-of-carbon estimates ranged from US$20 to US$311 (depending on climate change impact scenarios and discount rates) and 30 countries as well as 18 subnational jurisdictions had either a tax or a cap-and-trade system in place.

The tax design team considered that the social-cost-of-carbon estimates should account for medium- or long-run targets, as even the lowest value in the range was well beyond what was considered politically feasible. The team thus looked at carbon prices in American regional markets, mainly California and the Regional Greenhouse Gas Initiative. The weighted price per ton of carbon dioxide (using market volume as weight) was US$5.70, equivalent at the time to $70.68 Mexican pesos. Intergovernmental Panel on Climate Change default values were used to determine the carbon content of fuels. Table 7.1 shows the proposed tax per volume for different fuels as well as the percentage change in prices.

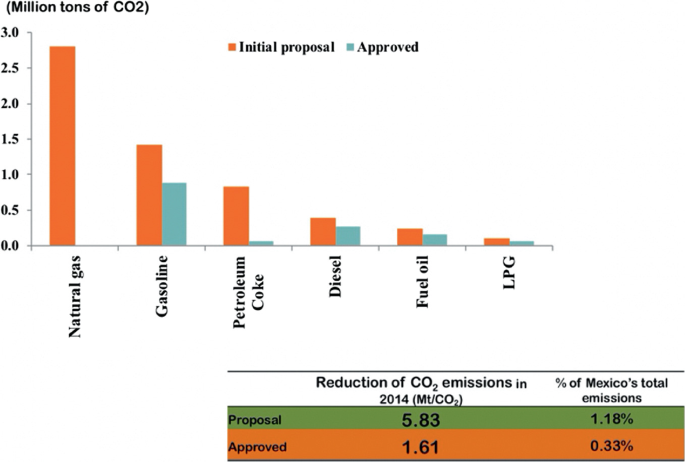

Figures 7.1 and 7.2 display the expected emission reductions (for the year after the tax was introduced) and the expected tax revenue for 2014, respectively. These figures display estimates for both the proposed tax and the tax that ultimately was implemented.

Source Belausteguigoitia (2014)

Expected reduction of emissions for 2014.

Source Belausteguigoitia (2014)

Expected tax revenue for 2014.

The design team also analysed specific political economy aspects of the tax. In particular, the team considered impacts on income distribution, specifically the impact on low income groups, as well as on firms’ costs, and evaluated the support of the general population and environmental NGOs for the tax. With regard to the distributional impact, the team analysed gasoline consumption by income decile and expenditure increases on liquid petroleum gas (LPG) by decile. Figure 7.3 shows percentage consumption of gasoline by decile. The two highest income deciles consume 52% of gasoline, whereas the four lowest income deciles consume 11%. With regard to LPG, the increase in expenditure by the two lowest income deciles was $27 Mexican pesos per month per household, by all accounts a small amount. However, according to the IMF, in most countries, the indirect impact of higher general prices represents one-third to one-half of the burden of increased energy prices on households. Because the estimated distributional impact could be significant, the team considered the potential need of compensating the lowest income deciles.

With regard to the tax’s potential impact on competitiveness, cost increases were analysed for energy-intensive sectors. Carbon dioxide emitting firms suffer a private welfare loss when a carbon tax is implemented. The intended transition to low-carbon processes is not frictionless; it often imposes significant private cost, despite the increase in social welfare. Energy-intensive sectors, such as steel and cement, can be severely affected under carbon pricing schemes.Footnote 5 The team estimated the cost increase as a result of the carbon tax implementation for energy-intensive sectors. Cost increases for cement firms ranged from 0.26 to 0.43%, depending on the fuel used. In the case of steel, the increase was 0.2%. In retrospect, it is clear that the team underestimated the reaction and the lobbying capacity of these sectors. A “second best” option that included some sort of compensation to the most affected sectors could have been contemplated. The fact that Mexico’s most important trading partner, the United States, and its most important competitors did not have a national carbon tax (or a national cap-and-trade system) was also effectively used by business associations that opposed the tax. Finally, as for the general public’s support for the tax, the team considered that the globally diffuse nature of the benefits, and the difficulty of explaining to the public the way in which carbon pricing operates, would result in relatively low public support for the tax. Given that the great majority of environmental NGOs only consider that carbon pricing is environmentally effective if revenues are earmarked for climate change-related actions, the team did not expect NGOs to support the tax.

Political Pressures and Modifications to the Proposed Carbon Tax Bill

Tax reform is a tricky matter. Under many circumstances, decision-makers may have sufficient technical knowledge for designing the optimal tax given a set of goals. Yet, it is not very often that such an optimal tax is actually implemented (Jenkins 2014). Both economic and political factors can play important roles in rendering the possible quite different from the optimal. On the economic side, various types of transaction costs often stand in the way of optimality. Deficient monitoring and enforcement capacity may render first-best solutions infeasible. In the case of carbon taxes, it is notoriously difficult for governments—and even for international bodies—to properly verify baselines and levels of GHG emission reductions. Uncertainty about the various effects of taxes, the amount of expected revenue, price parameters, or market behaviour also make it possible to err in the design.

When it comes to taxes, though, it is the political constraints, pressures and conflicts that loom largest. Economic criteria such as efficiency or optimality—a well as normative criteria such as the “common good”—stand in stark contrast to the interests of specific economic sectors, companies and even individual citizens. From the perspective of business, taxes directly impact profitability and income and they alter the competitive playing field, often benefitting some while harming others. Moreover, taxes are strongly disliked by all—particularly so in low-trust environments where citizens have little faith that tax revenues will be put to good use by their governments.

Dislike of taxes does not, however, automatically translate into effective opposition. The better organized, better connected, and more powerful industries, companies, and persons tend to generate more effective challenges to tax projects that run against their interests. Generally speaking, thus, the feasibility of a tax project hinges in great measure on possibilities for bargaining with, and compensating, powerful actors and veto players. Even when a tax can be forcibly imposed, compliance with it may be affected by the degree to which powerful actors feel adequately treated or compensated.

Yet, not all desirable compensation schemes are feasible. In Mexico, for example, the law forbids earmarking particular tax revenues for specific kinds of expenditures. Moreover, in environments where the legal system is not very effective or corrupt and interpersonal trust is generally low, compensation schemes that promise a future benefit in exchange for a present cost may simply not be credible. In such a context, the feasibility of a tax project may require ex-ante concessions, provisions, and special exceptions to be enshrined in the law itself, often cancelling part of the revenue-generating and environment-protecting potential of the tax project. In other cases, government may simply renege on promises to compensate today’s losers tomorrow, when tomorrow comes.

The Mexican carbon tax was indeed importantly shaped by political constraints. To be sure, some such constraints were evident from the start. As mentioned previously, even before the Mexican carbon tax was sent to congress for approval, it already reflected the design team’s perceptions of political feasibility of the emissions price per ton on which the tax would be based. Other political pressures made themselves felt as the process of writing the initial tax proposal, and then obtaining the votes in congress, unfolded.

The fiscal reform sent by President Peña Nieto to congress for approval consisted of a tax of $70.68 Mexican pesos per ton of carbon dioxide, for each and every one of the taxed fuels, as shown above in Table 7.1. Table 7.2 describes the tax bill that was ultimately approved. In the approved bill, the implicit price of carbon dioxide emissions is lower across the board. More importantly, that price varies markedly across fuel types. Moreover, both natural gas and jet fuel are, for practical purposes, exempt, as their tax rate was set to zero. In the case of airplane fuel, the reason for the exemption stems from the fact that Mexico is bound by the Chicago Convention, which requires the exemption. The rest of the distortions, however, have their origin in the political process.

By the account of people close to the process of design and approval of the carbon tax in Mexico, there were two major political forces behind the differences between the proposed and the approved bills. The first was a broad-based demand of private sector companies that used natural gas in their processes. A noteworthy role was played by privates who had invested in natural gas-based processes and those industries that are intensive in the use of natural gas, who complained that the government was undermining its own economic growth goals by simultaneously reforming the energy sector, while raising taxes on natural gas. Such investors proposed regarding the level of GHG emissions of natural gas as the floor (to be taxed at a zero rate) on the basis of which the tax rates for other, “dirtier,” fuels would be calculated. In the end, the pressure for this change to the tax bill was strong and the change was implemented (see Fig. 7.2).

Private sector players also argued for mechanisms that would make it possible for them to offset some of the tax burden by allowing for partial deductibility of the carbon tax with respect to their overall tax bills, and by making it possible to reduce the carbon tax by offering emission reduction certificates obtained either in Mexico or abroad. The private sector adduced international comparisons to argue for deductibility and for tax offsetting mechanisms. It also emphasized the fact that the United States—by far Mexico’s largest trade partner—did not have a general carbon tax and therefore Mexico’s tax would reduce the ability of Mexican companies to compete in the international market.Footnote 6 Nevertheless, deductibility and the possibility of offsetting emissions by purchasing certificates both ran directly afoul of the government’s revenue-raising goals and were severely restricted.

The second major force was the coal sector. For historical reasons beyond the scope of this chapter, coal mine owners have strong friends across the political spectrum. The coal sector used this power to argue that coal is not always burned (e.g. to generate electricity), but it also has alternative uses with much lower emissions, such as steelmaking. To simplify the administration of the carbon tax, the design team initially wanted to tax coal out of the mine (or at the border) regardless of its future use. Eventually, the bill was modified to accommodate the coal sector’s demand, and it became necessary for the tax authority to audit the ultimate use of coal. For the rest of the fuels, however, the tax remained fully indirect. Additionally, and perhaps more remarkably, the implicit price of carbon dioxide emissions in the calculation of the tax on coal was reduced as a result of political pressure, to a level well below the analogous price for other fuels.

Designers of the bill were strongly opposed to having different tax rates for different fuels, viewing these as distortions of a formerly clean, cost-effective and simple tax scheme. From the environmental economics point of view, the differentiated treatment reduces the environmental effectiveness of the tax and undermines its cost-effectiveness. Just as importantly, the uneven treatment of different fuels could potentially create legal problems for the viability of the carbon tax as a whole. The tax had been justified on the basis of the externalities of GHG emissions, and this justification was inconsistent with differential treatment of fuels per volume of emissions (in fact, this legal issue was utilized as an argument to partially push against the coal sector’s demands). To date, the Mexican carbon tax has not been challenged in the courts, which points to a bargaining outcome in which the main actors’ interests were taken into consideration in the final bill. Nevertheless, changes in markets or technology, or the arrival of new players may change actors’ incentives to promote legal actions against the current carbon tax.

In sum, the government’s imperative to raise revenue was likely the chief motor behind the creation of the carbon tax. Regardless of the initial motive, the design team incorporated experts in the technical aspects of emissions and in environmental economics, and the proposed bill reflected the revenue-raising imperative, anticipated some political constraints, and provided a schedule of economically and environmentally sound incentives to curb carbon dioxide emissions.

Nevertheless, coal mine owners, industrial associations, and the cement and steel industries organized well and had a very active reaction against the tax. Their lobbying capacity resulted in significant changes to the tax bill. The most important were the following: (i) natural gas was for all practical purposes exempted (formally it got a zero percent tax rate); (ii) the indirect price of carbon was significantly lowered and (iii) different tax rates were levied on different fuels, so that some of the dirtiest got very low rates. As shown in Figs. 7.1 and 7.2, the approved tax bill fell quite short of the revenue-raising and emissions-curbing potential of the original bill. Moreover, the inequities it introduced across fuels distorted fuel-usage incentives and created legal risks for the viability of the tax itself.

Political Economy Lessons from the Mexican Carbon Tax

Perhaps the main general lesson is that the feasibility of emissions-reductions policies cannot be understood without regard to the political context. While every country has its idiosyncrasies, we believe the Mexican experience can speak to many other jurisdictions across the globe. Like in Mexico, it is the case everywhere that emissions-reduction policies are by nature difficult due to the external, diffuse, uncertain, and future nature of environmental benefits and the concentration of costs in a few industries, which tend to be politically powerful.

Other aspects of the Mexican experience are perhaps more specific to middle- and low-income countries. In such contexts, institutional weakness, economic inequalities, wealth concentration and low levels of trust render intertemporal bargains and commitments more problematic than in the wealthy parts of the world. It is certainly true in Mexico that large businessmen have a very strong bargaining position vis a vis the government, in part due to the concentration of wealth and ownership, and in part due to the mobility of capital (Elizondo 1994). Those conditions notably constrained the space of feasible carbon taxes in Mexico in ways that departed significantly from those that would have best curbed carbon dioxide emissions.

In fact, environmental concerns were not a top priority for either the government or the private sector. The carbon tax was part of a large package of tax reforms aimed at increasing government revenue. The private sector’s concern mirrored that of the government in seeking to boost its bottom line, in what might be viewed as a zero-sum game. Neither environmental NGOs nor private organizations who stood to benefit from the carbon tax were strong or organized enough to play a major role. From this perspective, the fact that Mexico’s carbon tax came into existence, when reducing emissions was not a top priority of any of the major players—granting that some are sincerely interested in environmental issues—might be viewed as a minor miracle, rather than as the expression of a coherent, long-term vision about environmental policy.

Mexico’s recent history suggests that tax reforms are driven by economic crises, when the government’s need for revenue increases sharply and suddenly. But designing fiscal policy with short-term goals in mind implies that the long-term incentive effects of taxes are no more than a second thought, and those who end up being burdened with taxes are those with the least ability to evade them (Magar et al. 2009; Romero 2015). These issues ought to be important concerns throughout the developing world, even while Mexico seems to stand out among Latin American countries for its low levels of tax collection and a negligible distributional effect of taxes (Mahon 2012; Mahon et al. 2015).

The above considerations underscore the importance of finding compensation schemes that render carbon taxes politically feasible, yet avoid undermining the integrity of the behaviour incentives created by the tax.

Conclusions

In this chapter, we have explained the main constraints that Mexican decision-makers face in implementing an effective policy of carbon emissions reduction based on carbon pricing. It is not a trivial endeavour. Yet, there are specific actions that would increase the likelihood of success of an emissions trading system in Mexico. In the following paragraphs we outline our recommendations for Mexico, based on what we have learned from the previous tax reform. Other countries, especially in the developing world and with economic structures similar to Mexico, should also be able to learn from this experience.

-

1.

Carbon pricing should be an essential component of Mexican mitigation policy. At the same time, Mexico needs fiscal reform and a carbon tax could be a pillar of that reform. According to the International Monetary Fund (IMF), in order for Mexico to have an effective contribution to limiting global warming to 2 °C or less, the carbon tax should follow a path that leads to US$75 per ton of carbon dioxide in 2030. Under that scenario, the prices of coal, natural gas, electricity and gasoline would rise 226, 132, 74 and 18%, respectively. If a cap-and-trade-based policy was chosen, the cap would cause similar price increases.

Decarbonizing the Mexican economy will not only transform production processes, but it will also significantly alter the lives of most people and communities. Such a significant change cannot be driven by the environmental authority (SEMARNAT) on its own. The entire federal government must be involved and the treasury (SHCP) should be the main institutional driver for changes of this magnitude. Total revenue generated by a $75 tax, or by auctioning tradable emission credits, would be equivalent to close to two percent of GDP. The treasury should be interested in considering a carbon tax as an essential element of a new fiscal reform.

However, in “normal” times, as we have discussed in this chapter, a cap-and-trade reform seems unlikely. Yet, atypical times are in the horizon. The current economic crisis that has deepened the government’s need for revenue along with significant pressure from subnational governments for a significant redrafting of their relationship with the central government opens a window of opportunity for a significant fiscal reform that could consider novel instruments that would reduce transaction costs in the bargaining of environmental policies between the government and businessmen.

An important aspect to consider is President López Obrador’s reluctance to consider fuel price increases to consumers (either because of taxes or price liberalization schemes). Goal 5 of the 2020–2024 Energy Programme, titled: “Ensure universal access to energy, so that it is available to all Mexicans for their development,” states that:

Access to energy is essential for the social and economic development of people and their communities. However, in Mexico there is inequality in access to energy, which is mainly derived from the geographical location and the economic situation of the people. For this administration, it is of central interest that all Mexicans have access to energy in its various forms, be it electricity, gasoline, diesel, natural gas, among others, to eliminate restrictions on development.Footnote 7

The struggle between the need for more revenue to stabilize the Government’s financial situation and the president’s commitment not to raise fuel prices will determine whether carbon taxes or auctions of tradable permits will be introduced during President López Obrador’s administration.

-

2.

Apart from the driving force of the treasury, building a broad coalition that supports carbon pricing (in either form) will be needed to overcome political challenges. This was completely overlooked in the 2013 reform. The coalition should include environmental NGOs, green business’ interests and regular people interested in climate change.

Given the Mexican government’s relative weakness for imposing taxes on powerful industries, external pressure and support from international organizations and countries may be a good way to circumvent this constraint. While the current context is not the most auspicious, mainly because of the COVID-19-related world economic crisis, a new, more propitious, world context may soon potentially arise with the Joe Biden Administration in the United States, and innovation significantly lowers the costs of switching to cleaner technologies. In the meantime, Mexico can learn from the carbon pricing experiences of some United States states (e.g. California), Canada, Europe and China.

-

3.

It should be considered that a reform based only on the “common good” or analogous arguments is doomed to fail. For an effective carbon tax or an effective cap-and-trade system to be politically viable, policymakers need to consider allocating part of the revenue to help some economic sectors make the transition, to compensate regressive distributional effects, and to support displaced workers and hard-hit regions. Unfortunately, promises today about future compensation are not always credible.

-

4.

The long-term tax trajectory or, equivalently, the long-term cap trajectory should be clearly established by law to provide the needed certainty for consumers and producers to efficiently adjust to the new conditions. This would also provide the right incentives for industries to comply, significantly reducing transaction costs.

-

5.

Finally, the government should conduct multiple consultations with affected stakeholders and launch a communications campaign that explains the rationale of the policy, provides the facts supporting the case for carbon pricing, and addresses possible misconceptions. Publicizing the effort would also help potential beneficiaries of the reform to construct a focal point for organizing in support of the reform.

Notes

- 1.

- 2.

World Bank (2020).

- 3.

The free-rider problem refers to the incentives that self-interested individuals have to enjoy the benefits of a non-rival good without contributing, given that exclusion is unfeasible.

- 4.

Not to be confused with the current Instituto Nacional Electoral or INE, charged with electoral matters.

- 5.

For an excellent discussion of the impact of carbon pricing on competitiveness see Grubb and Neuhoff (2006).

- 6.

This, and the previously mentioned jet fuel treaty exemption, are two examples of the importance of international political factors in domestic environmental policies.

- 7.

Source: Secretaría de Gobernación (2020). Authors’ translation from the Spanish-language original.

References

Belausteguigoitia JC (2014) Economic analyses to support the environmental fiscal reform. Mario Molina Center. https://www.thepmr.org/system/files/documents/Economic%20Analyses%20to%20Support%20the%20Environmental%20Fiscal%20Reform.pdf. Accessed 3 Sept 2020

Borghesi S, Montini M, Barreca A (2016) The European emission trading system and its followers: comparative analysis and linking perspectives. Springer, New York

Elizondo C (1994) In search of revenue: tax reform in Mexico under the administrations of Echeverria and Salinas. J Lat Am Stud 26:159–190

Grubb M, Neuhoff K (eds) (2006) Emissions trading & competitiveness: allocations, incentives and industrial competitiveness under the EU emissions trading scheme. Earthscan Publications, London

Jenkins JD (2014) Political economy constraints to carbon pricing policies: what are the implications for economic efficiency, environmental efficacy, and climate policy design? Energy Policy 69:467–477

Magar E, Romero V, Timmons J (2009) The political economy of fiscal reforms: Mexico. Background paper IADB

Mahon JH (2012) Tax incidence and tax reforms in Latin America. Woodrow Wilson Center Update on the Americas. Wilson Center

Mahon J, Bergman M, and Arnson CJ (2015) Introduction. In: Mahon J, Bergman M, Arnson CJ (eds) The political economy of progressive tax reforms in Latin America. Woodrow Wilson International Center for Scholars, Washington, pp 1–29

Pigou AC (1932) The economics of welfare. Macmillan, London

Romero V (2015) The political economy of progressive tax reforms in Mexico. In: Mahon J, Bergman M, Arnson CJ (eds) The political economy of progressive tax reforms in Latin America. Woodrow Wilson International Center for Scholars, Washington, pp 161–188

Secretaría de Gobernación (2020) Programa Sectorial de Energía 2020–2024. Diario Oficial de la Federación. https://www.dof.gob.mx/nota_detalle.php?codigo=5596374&fecha=08/07/2020. Accessed 3 Sept 2020.

Stavins RN (2012) Cap-and-trade, carbon taxes, and my neighbor’s lovely lawn. Harvard Kennedy School, Belfer Center, Technology and Policy. https://www.belfercenter.org/publication/cap-and-trade-carbon-taxes-and-my-neighbors-lovely-lawn. Accessed 3 Sept 2020

Tietenberg TH (2006) Emissions trading: principles and practice. Resources for the Future, Washington, DC

Weitzman M (1974) Prices vs quantities. Rev Econ Stud 41(4):291–477

World Bank (2020) Carbon pricing dashboard. https://carbonpricingdashboard.worldbank.org/. Accessed 3 Sept 2020

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Belausteguigoitia, J.C., Romero, V., Simpser, A. (2022). The Political Economy of Carbon Pricing: Lessons from the Mexican Carbon Tax Experience for the Mexican Cap-and-Trade System. In: Lucatello, S. (eds) Towards an Emissions Trading System in Mexico: Rationale, Design and Connections with the Global Climate Agenda. Springer Climate. Springer, Cham. https://doi.org/10.1007/978-3-030-82759-5_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-82759-5_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-82758-8

Online ISBN: 978-3-030-82759-5

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)