Abstract

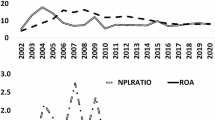

As an essential and exciting topic in financial management, MCDM has been widely used in evaluating financial performance to improve the suitability and reliability of financial indicators with respect to the impacts of both qualitative and quantitative information. This chapter aims to present a hybrid MCDM approach to evaluate the Vietnamese banking sector's performance under COVID-19 impacts. The proposed method utilizes The Criteria Importance Through Intercriteria Correlation (CRITIC) technique to determine objective weights of financial ratios. Decision-Making Trial and Evaluation Laboratory (DEMATEL) method is employed to obtain the cause-effect relationship and the subjective weights based on experts’ judgments. Bank alternatives’ ranking is estimated using the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS) approach. The empirical data of 23 Vietnamese commercial banks gathered from 2019-Q3/2020 is illustrated. The results of this chapter show that the COVID-19 pandemic has significant effects on the quality of assets, the liquidity of banks, and the growth rate. When the economy slows down, banks face the challenge of keeping up with demand and raising additional resources to balance the situation. For better intelligent risk management systems, faster digital transformation is needed for the Vietnamese banking system. Furthermore, the proposed method offers useful insights and is applicable to many businesses, proving helpful in dealing with complex criteria problems for stakeholders.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Mosser, P.C.: Central bank responses to COVID-19. Bus. Econ. 55(4), 191–201 (2020)

Zhang, D., Hu, M., Ji, Q.: Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 36, 101528 (2020)

World Bank: The global economic outlook during the COVID-19 pandemic: a changed world. The World Bank (2020) .

Dang, T.T., Wang, C.N., Hiep, N.,Nguyen, N.A.T.: Bank performance evaluation using data envelopment analysis: a case study in Vietnam. In: Contemoorary issues in banking and finance sustainability, fintech and uncertainties university (2020)

Tran, T.-T., et al.: Influencing Factors of the International Payment Service Quality at Joint Stock Commercial Bank for Investment and Development of Vietnam. J. Asian Financ. Econ. Bus. 7(10), 241–254 (2020)

Wang, C.N., Luu, Q.C., Nguyen, T.K.L., Der Day, J.: Assessing bank performance using dynamic SBM model. Mathematics (2019)

Wu, D.D., Olson, D.L.: Pandemic Risk Management in Operations and Finance: Modeling the Impact of COVID-19 (2020)

Nguyen, P.H., Tsai, J.F., Kumar, V.A.G., Hu, Y.C.: Stock investment of agriculture companies in the Vietnam stock exchange market: An AHP integrated with GRA-TOPSIS-MOORA approaches. J. Asian Financ. Econ. Bus. 7(7), 113–121 (2020)

Rodrigues, L., Rodrigues, L.: Economic-financial performance of the Brazilian sugarcane energy industry: An empirical evaluation using financial ratio, cluster and discriminant analysis. Biomass Bioenergy 108(November), 289–296 (2018)

Gudiel Pineda, P.J., Liou, J.J.H., Hsu, C.C., Chuang, Y.C.: An integrated MCDM model for improving airline operational and financial performance. J. Air Transp. Manag. 68, 103–117 (2018)

Haris, M., HongXing, Y., Tariq, G., Malik, A.: An evaluation of performance of public sector financial institutions: Evidence from Pakistan. Int. J. Bus. Perform. Manag. 20(2), 145–163 (2019)

Sharma, A., Jadi, D.M., Ward, D.: Evaluating financial performance of insurance companies using rating transition matrices. J. Econ. Asymmetr. 18(May), e00102 (2018)

Slavica, T.V.: A. Finance, banking and insurance, 1–256 (2017)

Beheshtinia, M.A., Omidi, S.: A hybrid MCDM approach for performance evaluation in the banking industry. Kybernetes 46(8), 1386–1407 (2017)

Gasbarro, D., Sadguna, I.G.M., Zumwalt, J.K.: The changing relationship between CAMEL ratings and bank soundness during the Indonesian banking crisis. Rev. Quant. Financ. Account. 19(3), 247–260 (2002)

Roman, A., Şargu, A.C.: Analysing the Financial Soundness of the Commercial Banks in Romania: An Approach based on the Camels Framework. Proc. Econ. Financ. 6(13), 703–712 (2013)

Benjamin, S.J., Bin Mohamed, Z., Marathamuthu, S.: DuPont analysis and dividend policy: empirical evidence from Malaysia Abstract (2016)

Rashid, A., Jabeen, S.: Analyzing performance determinants: conventional versus Islamic Banks in Pakistan. Borsa Istanbul Rev. (2016)

Bucevska, V., Hadzi Misheva, B.: The determinants of profitability in the banking industry: empirical research on selected Balkan Countries. East. Europ. Econ. 55(2), 146–167 (2017)

Pekkaya, M., Demir, F.E.: Determining the priorities of CAMELS dimensions based on bank performance. Contrib. Econ.:445–463 (2018)

Bunea, O.I., Corbos, R.A., Popescu, R.I.: Influence of some financial indicators on return on equity ratio in the Romanian energy sector—a competitive approach using a DuPont-based analysis. Energy 189, 116251 (2019)

Chang, C.T., Ouyang, L.Y., Teng, J.T., Lai, K.K., Cárdenas-Barrón, L.E.: Manufacturer’s pricing and lot-sizing decisions for perishable goods under various payment terms by a discounted cash flow analysis Int. J. Prod. Econ. 218, 83-95 (2019)

Le, T.D., Ngo, T.: The determinants of bank profitability: A cross-country analysis. Cent. Bank Rev. 20(2), 65–73 (2020)

Carras, M.A., Knowler, D., Pearce, C.M., Hamer, A., Chopin, T., Weaire, T.: A discounted cash-flow analysis of salmon monoculture and Integrated Multi-Trophic Aquaculture in eastern Canada. Aquac. Econ. Manag. 24(1), 43–63 (2020)

Wu, H.Y.: Constructing a strategy map for banking institutions with key performance indicators of the balanced scorecard. Eval. Program Plann. 35(3), 303–320 (2012)

Park, J.H., Shea, C.H., Wright, D.L.: Reduced-frequency concurrent and terminal feedback: a test of the guidance hypothesis. J. Mot. Behav. (2000)

Schalock, R.L., Bonham, G.S.: Measuring outcomes and managing for results. Eval. Program Plann. 26(3), 229–235 (2003)

Sridharan, S., Go, S., Zinzow, H., Gray, A., Barrett, M.G.: Analysis of strategic plans to assess planning for sustainability of comprehensive community initiatives. Eval. Program Plann. 30(1), 105–113 (2007)

Liu, J.S., Lu, L.Y.Y., Lu, W.M., Lin, B.J.Y.: A survey of DEA applications. Omega (United Kingdom) (2013)

Cooper, W.W., Seiford, L.M., Zhu, J.: Data envelopment analysis: history, models, and interpretations. Int. Ser. Oper. Res. Manag. Sci. (2011)

Gregoriou, G.N.: Quantitative models for performance evaluation and benchmarking: data envelopment analysis with spreadsheets. J. Wealth Manag. 17(4), 114–115 (2015)

Paradi, J.C., Zhu, H.: A survey on bank branch efficiency and performance research with data envelopment analysis. Omega (United Kingdom) (2013)

Wang, K., Huang, W., Wu, J., Liu, Y.N.: Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega (United Kingdom) (2014)

Wanke, P., Barros, C.: Two-stage DEA: An application to major Brazilian banks. Expert Syst. Appl. (2014)

Othman, F.M., Mohd-Zamil, N.A., Rasid, S.Z.A., Vakilbashi, A., Mokhber, M.: Data envelopment analysis: a tool of measuring efficiency in banking sector,” Int. J. Econ. Financ. (2016)

Akkoç, S., Vatansever, K.: Fuzzy performance evaluation with AHP and topsis methods: evidence from Turkish Banking Sector after the global financial crisis. Eurasian J. Bus. Econ. 6(11), 53–74 (2013)

Nguyen, P.: A Fuzzy Analytic Hierarchy Process ( FAHP ) Based on SERVQUAL for Hotel Service Quality Management : Evidence from Vietnam *. J. Asian Financ. Econ. Bus. 8(2), 1101–1109 (2021)

Nguyen, P.-H., Tsai, J.-F., Nguyen, T.-T., Nguyen, T.-G., Vu, D.-D.: A Grey MCDM Based on DEMATEL Model for Real Estate Evaluation and Selection Problems: A Numerical Example. J. Asian Financ. Econ. Bus. 7(11), 549–556 (2020)

Nguyen, P.H., Tsai, J.F., Nguyen, H.P., Nguyen, V.T., Dao, T.K.: Assessing the Unemployment Problem Using A Grey MCDM Model under COVID-19 Impacts: A Case Analysis from Vietnam. J. Asian Financ. Econ. Bus. 7(12), 53–62 (2020)

Nguyen, P.H., Tsai, J.F., Nguyen, V.T., Vu, D.D., Dao, T.K.: A Decision Support Model for Financial Performance Evaluation of Listed Companies in The Vietnamese Retailing Industry. J. Asian Financ. Econ. Bus. 7(12), 1005–1015 (2020)

Dinçer, H., Yüksel, S.: Comparative Evaluation of BSC-Based New Service Development Competencies in Turkish Banking Sector with the Integrated Fuzzy Hybrid MCDM Using Content Analysis. Int. J. Fuzzy Syst. 20(8), 2497–2516 (2018)

Zhao, Q., Tsai, P.H., Wang, J.L.: Improving financial service innovation strategies for enhancing China’s banking industry competitive advantage during the fintech revolution: A hybrid MCDM model. Sustain. 11(5), 1–29 (2019)

Wu, H.Y., Tzeng, G.H., Chen, Y.H.: A fuzzy MCDM approach for evaluating banking performance based on balanced scorecard. Expert Syst. Appl. (2009)

Nassereddine, M., Eskandari, H.: An integrated MCDM approach to evaluate public transportation systems in Tehran. Transp. Res. Part A Policy Pract. 106(April), 427–439 (2017)

Pak, J.Y., Thai, V.V., Yeo, G.T.: Fuzzy MCDM Approach for Evaluating Intangible Resources Affecting Port Service Quality. Asian J. Shipp. Logist. 31(4), 459–468 (2015)

Akdag, H., Kalayci, T., Karagöz, S., Zülfikar, H., Giz, D.: The evaluation of hospital service quality by fuzzy MCDM. Appl. Soft Comput. J. 23, 239–248 (2014)

Zoraghi, N., Amiri, M., Talebi, G., Zowghi, M.: A fuzzy MCDM model with objective and subjective weights for evaluating service quality in hotel industries. J. Ind. Eng. Int. 9(1), 1–13 (2013)

Tsaura, S.H., Chang, T.Y., Yen, C.H.: The evaluation of airline service quality by fuzzy MCDM. Tour. Manag. 23(2), 107–115 (2002)

Tseng, M.L.: Using hybrid MCDM to evaluate the service quality expectation in linguistic preference. Appl. Soft Comput. J. 11(8), 4551–4562 (2011)

Si, S.L., You, X.Y., Liu, H.C., Zhang, P.: DEMATEL Technique: A Systematic Review of the State-of-the-Art Literature on Methodologies and Applications. Math. Probl. Eng. 1, 2018 (2018)

Hsu, C.W., Kuo, T.C., Chen, S.H., Hu, A.H.: Using DEMATEL to develop a carbon management model of supplier selection in green supply chain management. J. Clean. Prod. (2013)

Asan, U., Kadaifci, C., Bozdag, E., Soyer, A., Serdarasan, S.: A new approach to DEMATEL based on interval-valued hesitant fuzzy sets. Appl. Soft Comput. J. (2018)

Govindan, K., Chaudhuri, A.: Interrelationships of risks faced by third party logistics service providers: a DEMATEL based approach. Transp. Res. Part E Logist. Transp. Rev. (2016)

Malviya, R.K., Kant, R.: Hybrid decision making approach to predict and measure the success possibility of green supply chain management implementation. J. Clean. Prod. (2016)

Patil, S.K., Kant, R.: A hybrid approach based on fuzzy DEMATEL and FMCDM to predict success of knowledge management adoption in supply chain. Appl. Soft Comput. J. (2014)

Rostamzadeh, R., Ghorabaee, M.K., Govindan, K., Esmaeili, A., Nobar, H.B.K.: Evaluation of sustainable supply chain risk management using an integrated fuzzy TOPSIS- CRITIC approach. J. Clean. Prod. (2018)

Abdel-Basset, M., Mohamed, R.: A novel plithogenic TOPSIS- CRITIC model for sustainable supply chain risk management. J. Clean. Prod. (2020).

Keshavarz Ghorabaee, M., Amiri, M., Kazimieras Zavadskas, E., Antuchevičienė, J.: Assessment of third-party logistics providers using a CRITIC–WASPAS approach with interval type-2 fuzzy sets. Transport (2017)

Criteria, T., Through, I., Correlation, I.: CRITIC Method, pp 5–7 (1995)

Gabus, A., Fontela, E.: World problems an invitation to further thought within the framework of DEMATEL. Battelle Geneva Res. Cent., 1–8 (1972)

Kimbonguila, A., Matos, L., Petit, J., Scher, J., Nzikou, J.M.: Effect of physical treatment on the physicochemical, rheological and functional properties of Yam Meal of the cultivar ‘Ngumvu’ from dioscorea Alata L. of Congo. Int. J. Recent Sci. Res. (2019)

Mamadiyarov, Z., Azlarova, A.: Covid 19 visits to banking institutions—yesterday , today and tomorrow (2021)

Abbasi, S., Nazemi, A.: Presenting and evaluating the banks rating model using topsis technique. Int. J. Nonlinear Anal. Appl. 11, 195–209 (2020)

Önder, E., Hepsen, A.: Combining time series analysis and multi criteria decision making techniques for forecasting financial performance of banks in Turkey. Int. J. Latest Trends Financ. Econ. Sci. (2013)

Heffernan, T., Pawlak, M.: Crisis futures: The affects and temporalities of economic collapse in Iceland. Hist. Anthropol. Chur. 31(3), 314–330 (2020)

Sarı, T.: Performance evaluation of Turkish banks with TOPSIS and stepwise regression (2020)

Tanasković, S., Jandrić, M.: Macroeconomic and institutional determinants of non-performing loans. J. Cent. Bank. Theory Pract. (2015)

Makri, V., Tsagkanos, A., Bellas, A.: Determinants of non-performing loans: the case of Eurozone. Panoeconomicus (2014)

Lipson, M.L., Mortal, S., Schill, M.J.: On the scope and drivers of the asset growth effect. J. Financ. Quant. Anal., 1651–1682 (2011)

Juárez, F.: The growth of companies as a function of total assets. WSEAS Trans. Bus. Econ. 15, 301–310 (2018)

Jo, H., Han, I., Lee, H.: Bankruptcy prediction using case-based reasoning, neural networks, and discriminant analysis. Expert Syst. Appl. 13(2), 97–108 (1997)

Watson, J.: Comparing the performance of male-and female-controlled businesses: relating outputs to inputs. Entrep. theory Pract. 26(3), 91–100 (2002)

Fernández de Lis, S., Martínez Pagés, J., Saurina Salas, J.: Credit growth, problem loans and credit risk provisioning in Spain. Banco de España. Servicio de Estudios (2000)

De Lis, F.S., Pagés, J.M., Saurina, J.: Credit growth, problem loans and credit risk provisioning in Spain. BIS Pap. 1, 331–353 (2001)

Hati, S.R.H., Wibowo, S.S., Safira, A.: The antecedents of Muslim customers’ intention to invest in an Islamic bank’s term deposits: evidence from a Muslim majority country. J. Islam. Mark. (2020)

Yulianto, A., Solikhah, B.: The internal factors of Indonesian Sharia banking to predict the mudharabah deposits. Rev. Integr. Bus. Econ. Res. 5(1), 210 (2016)

Duguma, G.J., Han, J.: Effect of deposit mobilization on the financial sustainability of rural saving and credit cooperatives: evidence from Ethiopia. Sustainability 10(10), 3387 (2018)

Tuyishime, R., Memba, F., Mbera, Z.: The effects of deposits mobilization on financial performance in commercial banks in Rwanda: a case of equity bank Rwanda limited. Int. J. small Bus. Entrep. Res. 3(6), 44–71 (2015)

Li, L., Zhang, Y.: Are there diversification benefits of increasing noninterest income in the Chinese banking industry? J. Empir. Financ. 24, 151–165 (2013)

Maudos, J., Solís, L.: The determinants of net interest income in the Mexican banking system: an integrated model. J. Bank. Financ. 33(10), 1920–1931 (2009)

Vozková, K., Teplý, P.: An analysis of bank fee and commission income in the EU and in the Czech Republic in a low interest rate environment. Sci. Pap. Univ. Pardubice. Ser. D, Fac. Econ. Adm. 28(2) (2020)

Köhler, M.: An analysis of non-traditional activities at German savings banks: Does the type of fee and commission income matter? (2018)

UYÊN, T. T. Ú.: The impact of initial public offering on profit before tax on asset in vietnamese enterprises–from the perspective of management accounting. J. Econ. Dev. 50–57 (2019)

Steffens, P., Davidsson, P., Fitzsimmons, J.: Performance configurations over time: implications for growth–and profit–oriented strategies. Entrep. Theory Pract. 33(1), 125–148 (2009)

Nariswari, T.N., Nugraha, N.M.: Profit growth: impact of net profit margin, gross profit margin and total assests turnover. Int. J. Financ. Bank. Stud. 9(4), 87–96 (2020)

Scherer, F.M.: Corporate inventive output, profits, and growth. J. Polit. Econ. 73(3), 290–297 (1965)

Cebenoyan, A.S., Strahan, P.E.: Risk management, capital structure and lending at banks. J. Bank. Financ. (2004)

Messai, A.S., Jouini, F.: Micro and macro determinants of non-performing loans. Int. J. Econ. Financ. (2013)

Nissim, D., Penman, S.H.: Ratio analysis and equity valuation: from research to practice. Rev. Account. Stud. (2001)

Heikal, M., Khaddafi, M., Ummah, A.: Influence analysis of return on assets (ROA), return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current ratio (CR), against corporate profit growth in automotive in indonesia stock exchange. Int. J. Acad. Res. Bus. Soc. Sci. (2014)

Mawaddah, N.: Faktor-Faktor Yang Mempengaruhi Profitabilitas Bank Syariah. ETIKONOMI (2015)

Busch, R., Memmel, C.: Banks’ net interest margin and the level of interest rates. Credit Cap. Mark. (2017)

Rosly, S.A., Abu Bakar, M.A.: Performance of Islamic and mainstream banks in Malaysia. Int. J. Soc. Econ. (2003)

Robin, I., Salim, R., Bloch, H.: Financial performance of commercial banks in the post-reform era: further evidence from Bangladesh. Econ. Anal. Policy (2018)

Petria, N., Capraru, B., Ihnatov, I.: Determinants of banks’ profitability: evidence from EU 27 banking systems. Proc. Econ. Financ. (2015)

Hirtle, B.J., Stiroh, K.J.: The return to retail and the performance of US banks. J. Bank. Financ. (2007)

Lo, C.W., Leow, C.S.: Islamic banking in Malaysia: a sustainable growth of the consumer market. Int. J. Trade Econ. Financ. (2014)

Zhang, H.: Share price performance following actual share repurchases. J. Bank. Financ. (2005)

Agostino, M., Drago, D., Silipo, D.B.: The value relevance of IFRS in the European banking industry. Rev. Quant. Financ. Account. (2011)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 Institute of Technology PETRONAS Sdn Bhd

About this chapter

Cite this chapter

Nguyen, PH., Tsai, JF., Hu, YC., Ajay Kumar, G.V. (2022). A Hybrid Method of MCDM for Evaluating Financial Performance of Vietnamese Commercial Banks Under COVID-19 Impacts. In: Abdul Karim, S.A. (eds) Shifting Economic, Financial and Banking Paradigm. Studies in Systems, Decision and Control, vol 382. Springer, Cham. https://doi.org/10.1007/978-3-030-79610-5_2

Download citation

DOI: https://doi.org/10.1007/978-3-030-79610-5_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-79609-9

Online ISBN: 978-3-030-79610-5

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)