Abstract

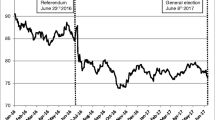

The political turmoil in the UK following the referendum on future membership of the European Union in 2016 provides a natural experiment for studying the effects of political uncertainty on the economy. We find that the subsequent confusion and infighting in British politics has not affected the real economy much—employment is at a historical high and output growth is positive—but there are some signs of slowing investment and house price increases. The stock market has also not been much affected although it did fall after the referendum of 2016. The main effect of the Brexit vote and the subsequent political developments is found in the currency market where news that make a hard Brexit more likely cause the currency to depreciate. We conclude that leaving the European Union without an agreement is likely to make the currency depreciate and the stock market fall while output declines. In contrast, leaving with an agreement that gives continued access to the Single Market would likely make the currency appreciate, the stock market rise and employment and output increase further.

A preliminary version of this paper appeared as a working paper at the Birkbeck Centre of Applied Economics, BCAM 1907, 2019.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

See Antonucci et al. (2017) who attribute the Brexit vote to the declining financial position of the middle class; Arnorsson and Zoega (2019) on the regional characteristics of the Brexit vote (older, less educated, lower income); Colantone and Stanig (2018) on global competition and Brexit; Fidrmuc et al. (2016) on the absence of a relationship between EU regional subsidies and the remain vote; Hobolt (2016) on the divisions in society; and Inglehart and Norris (2016, 2019) on the cultural factors behind the vote. Goodwin and Heath (2016) find that turnout was generally higher in more pro-Leave areas, which implies a greater intensity among those who wanted to leave than those voters who wanted to stay.

- 2.

Dustman and Frattini (2014) analyse the fiscal impact of immigration on the UK economy since 1995. They find that immigrants from the European Economic Areas (EEA) have made a positive fiscal contribution while non-EEA immigrants have made a negative contribution. Since 2000, the contributions have been positive throughout, in particular for immigrants from Europe.

- 3.

See Rodrik (2018) on the difference between left-wing and right-wing populism.

- 4.

- 5.

Dhingra et al. (2016) analyse the economic consequences of the UK leaving the European Union. They find that while these will depend on which policies the UK adopts following Brexit, lower trade due to reduced integration with EU countries will likely cost the UK economy much more than is gained from lower contributions to the EU budget.

- 6.

See Hill (1997) on political risk.

- 7.

See Forte and Portes (2017)

- 8.

FT250 data taken from investing.com

- 9.

Data taken from investing.com

- 10.

See also Corsetti and Müller (2016).

- 11.

- 12.

- 13.

- 14.

They were as follows: Remain: 16,141,241 (48.1%) Leave: 17,410,742 (51.9%).

- 15.

See Biggs (2008).

- 16.

- 17.

- 18.

- 19.

- 20.

- 21.

- 22.

- 23.

- 24.

- 25.

References

Antonucci, L., Horvath, L., Kutiyski, Y., & Krouwel, A. (2017). The malaise of the squeezed middle: Challenging the narrative of the ‘left behind’ Brexiter. Competition and Change, 21(3), 211–229.

Arnorsson, A., & Zoega, G. (2019). On the causes of Brexit. European Journal of Political Economy, 55, 301–323.

Biggs, B. (2008). Wealth, war & wisdom. Hoboken: Wiley.

Carney, M. (2016, June 30). Uncertainty, the economy and policy. Speech by Mark Carney. Retrieved April 29, 2019, from https://www.bankofengland.co.uk/speech/2016/uncertainty-the-economy-and-policy

Colantone, I., & Stanig, P. (2018). Global competition and Brexit. American Political Science Review, 112(2), 201–218. https://doi.org/10.1017/S0003055417000685.

Corsetti, G., & Müller, G. (2016). The pound and the macroeconomic effects of Brexit. Vox EU. Retrieved April 20, from https://voxeu.org/article/pound-and-macroeconomic-effects-brexit

Crafts, N. (2019, January 15). Brexit: Blame it on the banking crisis. Vox EU. Retrieved April 12, 2019, from https://voxeu.org/article/brexit-blame-it-banking-crisis

Davies, R. B., & Studnicka, Z. (2018). The heterogeneous impact of Brexit: Early indications from the FTSE. European Economic Review, 110, 1–17. https://doi.org/10.1016/j.euroecorev.2018.08.003.

Dhingra, S., Ottaviano, G. I. P., Sampson, T., & Reenen, J. (2016). The consequences of Brexit for UK trade and living standards. CEP BREXIT Analysis No. 2.

Dustman, C., & Frattini, T. (2014). The fiscal effects of immigration to the UK. The Economic Journal, 124(580), F593–F643.

Fidrmuc, J., Hulényi, M., & Tunalı, Ç. (2016). Money can’t buy EU love: European funds and the Brexit referendum. CESifo Working Paper Series No. 6107.

Forte, G., & Portes, J. (2017). The economic impact of Brexit-induced reductions in migration. Oxford Review of Economic Policy, 33(1), S31–S44. https://doi.org/10.1093/oxrep/grx008.

Goodwin, M. J., & Heath, O. (2016). The 2016 referendum, Brexit and the left behind: An aggregate level analysis of the result. The Political Quarterly, 87, 323–332. https://doi.org/10.1111/1467-923X.12285.

Hill, C. A. (1997). How investors react to political risk symposium. International Issues in Cross-Border Securitization and Structured Finance, Duke Journal of Comparative & International Law.

Hobolt, S. B. (2016). The Brexit vote: A divided nation, a divided continent. Journal of European Public Policy, 23(9), 1259–1277. https://doi.org/10.1080/13501763.2016.1225785.

House of Commons Library. (2019). https://commonslibrary.parliament.uk/tag/nigel-walker/.

Inglehart, R., & Norris, P. (2016). Trump, Brexit and the rise of populism: Economic have-nots and cultural backlash. HKS Working Paper No. RWP16-026. https://doi.org/10.2139/ssrn.2818659

Inglehart, R., & Norris, P. (2019). Cultural backlash: Trump, Brexit, and authoritarian populism. Cambridge: Cambridge University Press.

Knight, F. H. (1921). Risk, uncertainty, and profit. Boston and New York: Houghton Mifflin Company.

Mudde, C. (2004). The populist zeitgeist. Government and Opposition, 39(4), 541–563. https://doi.org/10.1111/j.1477-7053.2004.00135.x.

Mudde, C. (2017). Populism: A very short introduction (2nd ed.). New York: Oxford University Press.

Müller, J.-W. (2015). Parsing populism: Who is and who is not a populist these days? Juncture, 2(22), 80–89. https://doi.org/10.1111/j.2050-5876.2015.00842.x.

Müller, J.-W. (2016). What is populism. Philadelphia: University of Pennsylvania Press.

Rodrik, D. (2018). Populism and the economics of globalization. Journal of International Business Policy, 1(1–2), 12–33. https://doi.org/10.1057/s42214-018-0001-4.

Wright, B. (2016, June 28). Why we should be looking at the FTSE 250 and not the FTSE 100 to gauge the impact of Brexit. The Telegraph. Retrieved May 2, 2019, from https://www.telegraph.co.uk/business/2016/06/27/why-we-should-be-looking-at-the-ftse-250-and-not-the-ftse-100-to/

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

The pound-dollar exchange rate, 1971–2019 (Source: Authors’ calculations and investing.com)

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Engilbertsson, S., Zoega, G. (2020). The Effect of Brexit on the UK Economy (So Far). In: Paganetto, L. (eds) Capitalism, Global Change and Sustainable Development. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-46143-0_8

Download citation

DOI: https://doi.org/10.1007/978-3-030-46143-0_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-46142-3

Online ISBN: 978-3-030-46143-0

eBook Packages: Economics and FinanceEconomics and Finance (R0)