Abstract

India is the largest producer of food grains, dairy commodities and horticultural crops and largest exporter of rice, beef and cotton. But the country, at the micro-level, still struggles with extensive and deep-rooted problems with food security. The Planning Commission notes that 22% of the 1.2 billion Indians are still living in poverty. This chapter assesses the impact of off-farm income and labour allocation (both casual and permanent off-farm work), and decisions on food security of smallholder households in India. Promoting food distribution schemes and female education would bring about further reduction of food insecurity among rural households. We found that off-farm activities and off-farm business income reduce food insecurity of rural Indian households. Spouse’s casual off-farm work status had a negative impact on household’s food insecurity—increased food security; operator’s casual off-farm work status had a positive impact on household’s food insecurity—increased food insecurity. However, food insecurity of households increased if both operator and spouse worked casually off the farm.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

Traditionally, farmers in developing countries were involved in farming full-time and rarely opted for non-farm work. However, with significant growth in the rural economy in many developing countries, the rural non-farm sector has experienced a substantial increase in the share of rural employment. Additionally, variability in climate, riskiness in farm income, credit market constraints and shortage of hired labour have also led to income diversification strategies (farm and off-farm) by farmers, both in the developed and developing countries (Ruben and Berg 2001; Ellis 2000; Mishra and Goodwin 1997). As a result, smallholder farmers have changed their labour allocations, both on and off the farm. Additionally, it can be argued that off-farm work could increase the educational outcomes and productivity of other family membersFootnote 1 (Yang 1997). Finally, the literature reveals the significance of off-farm income in increasing food security for rural households. For example, Owusu et al. (2011) concluded that non-farm work positively influenced the food security status of farm households in the northern region of Ghana. In another study, Barrett et al. (2001) conclude that off-farm work could be a possible pathway out of the vicious circle of poverty for rural households.

However, the literature falls short of differentiating the type of off-farm job (casual/part-time or permanent/full-timeFootnote 2). Specifically, the literature fails to discuss the impacts of types of off-farm income and labour allocation decisions, by the operator and spouse, on food security in smallholder households in developing countries. Therefore, the objective of this chapter is to assess the impact of off-farm income and labour allocation, both casual and permanent, on the food security of smallholder households in India. Additionally, we attempt to understand the dynamics of the above impacts when either the operator or the spouse—or both—is involved in off-farm activities. Our study further contributes to the literature by using panel data which have an advantage over cross-sectional data. We use wider, nationally representative household-level data than previously reported. Finally, we compare the mean impact from the panel data with heterogeneous impact from quantile panel regressions.

The chapter is organised as follows. Section 2 discusses off-farm work and food security in India, with a special focus on the status of off-farm work—permanent and/or casual. This section also reviews the literature on the existing role of operator–spouse relationship on food security. Section 3 presents the data used in the empirical analysis. Section 4 outlines the conceptual framework and empirical procedure. Section 5 discusses empirical results, followed by concluding remarks.

2 Food Security and Off-Farm Work in India

India, located in South Asia, is a fast-growing country. Its population is growing by 2% a year (current population of 1.24 billion). However, 69% of Indians live in rural areas and 58% of these rural households are agricultural households—directly dependent on agriculture for their employment and livelihood (NSSO 2104). The agricultural sector’s contribution to gross domestic product (GDP) fell from 43 to 14% over the period 1970–2011. Rapid growth in non-agricultural sectors (service and manufacturing sectors) has led to the migration of labour out of agriculture. Nonetheless, agriculture is an important sector of the economy, accounting for around 14% of GDP and 11% of the country’s exports. About 56% of the land mass is agricultural land, and only 43% is net cultivated area; only about 45% of cropped area is reported to be irrigated. The net cultivated area increased significantly, by about 18%, from 119 million hectares in 1950–51 to about 140 million hectares in 1970–71. Since then, net cultivated area has remained stable at around 140 million hectares; only 3.5% of the area is under permanent crops. However, the average holding size is about 1.3 ha, and about 85% of farms fall into this category (known as smallholders).

Although India is the largest producer of food grains, dairy commodities and horticultural crops, and the largest exporter of rice, beef and cotton, the country, at the micro-level, still struggles with extensive and deep-rooted problems with food security. The Planning Commission notes that 22% of the 1.2 billion Indians are still living in poverty (Planning Commission 2014). Furthermore, the per capita income of Indians is about 15% that of the world overall, and one in three children is malnourished. In response to the 2007–2008 global food crisis, the Indian government enacted the National Food Security Mission (NFSM) which resulted in a significant increase in food grain production. All indicators show that the NFSM has helped to attain India’s food security at the national level. However, at the micro-level, the situation is characterised by extensive malnutrition and stunting among the population. As a result, the government enacted the National Food Security Act (NFSA) in 2013. The NFSA 2013 is seen as a vital step in alleviating the issue of widespread poverty and malnutrition. But the majority of poor households either reside in rural areas or are dependent on agriculture. Therefore, any policy measures designed to lift the poor out of poverty may include advancements in the agricultural sector.

The Indian rural labour market is mainly characterised by two types of work status: regular (or permanent) and casual work, defined on the basis of payment method. For example, permanent work is where wages are paid at monthly or regular intervals, sometimes accompanied by payments in advance or bonuses/gifts during the harvest season. On the other hand, casual work is where wage payments are made either daily or on a piecemeal basis; casual labourers could be hired in groups (Pal 1996). Finally, women in rural areas are generally excluded from regular (or permanent) jobs and tend to hold more casual jobs. The choice of work status depends on wage and another non-wage criteria, including credit constraints and home production time, especially for women. Given poor working conditions and long working hours on the farm, casual jobs are preferred to farm work. Casual work is very common in the farming sector. However, the opposite is true in the case of the rural non-farm sectorFootnote 3. In the rural non-farm sector, both casual and permanent jobs coexist, but permanent jobs are relatively scarce. Permanent jobs are generally held by the rich and educated class (upper caste), while poor and uneducated workers are engaged in casual non-farm jobs (Lanjouw and Shariff 2004). On the other hand, readily available, casual non-farm jobs can also increase agricultural wages, leading to an increase in the incomes of rural poor who are dependent on farming activities. For example, the successful implementation of public works programmes such as the Employment Guarantee Scheme and Jawahar Rozgar Yojana (employment generation scheme) has led to an increase in demand for casual labour in the non-farm sector, leaving a shortage of hired labour in the agricultural sector (Berg et al. 2012; Kareemulla et al. 2010; Bhargava 2014). The rural non-farm sector has become a dominant source of employment and income for smallholder households in India, consequently affecting the food security of smallholder households.

It should be recalled that women in rural areas tend to work as casual labourers. The majority of women in rural areas work as a cultivator or a casual labourer on other land (Lanjouw and Murgai 2009). If that is the case, then income-generating farm and off-farm activities may have implications for the food security of smallholder households. It is widely known that, compared to men, women spend a higher proportion of their income on food, child health, educationFootnote 4 and other consumption items (Quisumbing et al. 1995; Thomas 1991). Quisumbing et al. (1995) further state that, relative to men, women’s incomes are comparatively less in amount and more in frequency. Women spend the majority of their income on daily consumption, while men spend more on durable or expensive goods. In another study, Thomas (1991) found that, compared to paternal income, maternal income had 4–8 times greater impact on family health. This also holds true for child survival probabilities, which are 20 times higher. In this study, we argue that a wage shock (casual or permanent wages) would affect the food security of smallholder households. For example, a shock in the casual wage of the casual worker, in the rural non-farm sector, is likely to have a significant impact on the food security, compared to a shock in the regular wage of the permanent worker. Similarly, the impact of a drop in casual and permanent wages differs depending on the gender of the head of the rural smallholder household. Finally, the working status (casual or permanent off-farm work) of women/spouses could have a substantial impact on the food security of smallholder households. Our study covers the impact of the work status of either operator or spouse, or both, on the food security status of the household.

3 Data

Data for this study are drawn from two rounds of Indian Human Development Survey (IHDS) held in 2004/05 and 2011/12, respectively. IHDS is a nationally representative survey of about 41,554 households and 215,754 individuals, in 1503 villages and 971 urban areas of India. In the second round, around 83% of the household were re-interviewed; around 2134 new households were also interviewed in the second round. Information about split households was also considered. The survey included information regarding household income, consumption and standard of living; for individuals, it included information on employment, morbidity and education.

In this study, we considered a panel of 17,142 rural households that were interviewed in both rounds. Only rural households were chosen for this study, because we are interested in analysing the impact of work status (casual and permanent) on the food security of smallholder households. In this study, the share of food expenditure is the sum of food expenditure over total expenditure. Food expenditure is the sum of expenditures on various food items, including food at restaurants, consumed in the last 30 days, and total expenditure is the total monthly household expenditureFootnote 5 which includes health, rent, communication, transport, education, clothing and footwear. The share of food expenditure over total household expenditure in our study is considered as an indicator of food insecurity status (Smith and Subadoro 2007). Returning to our measure of food insecurity, an increase in the share of food expenditure over total expenditure would make the household more food insecure. This is because, if the household experiences a negative income shock, then it would be accompanied by a reduction in food consumption, making the household more food insecure (Smith and Subadoro 2007). The opposite is also true.

The socio-demographic explanatory variables include age of household head and spouse, years of education of both household head and spouse, size of household, number of older persons (≥64 years) living in the household, number of children (≤14 years) living in the family, whether the household receives subsidised food (below poverty line—BPL cardholder), and wealth indexFootnote 6. Along with these, shares of farm income, off-farm income, and off-farm business incomeFootnote 7 are included in the model. To further analyse the dynamics within the household, a casual and permanent form of off-farm work is also considered. Casual work is defined as work that is undertaken daily, casual piecemeal work, or any contract lasting less than a year while permanent work is defined as work under a regular term or longer contract. Finally, smallholder households where the operator, spouse or both are involved in casual and permanent off-farm work are considered in this study.

4 Descriptive Statistics

Table 1 shows a considerable change in the scenario for Indian rural households in recent years. The share of food expenditures fell considerably, from 57% in 2004/05 to 49% in 2011/12. Average food expenditures representing a lower proportion of total expenditures may indicate that significant populations in rural areas are becoming less food insecure. The average age of operator and spouse was around 45 and 40 years, respectively, in 2005. The average level of education (in years) is higher for the operator. The size of household averaged around five members in both years. The number of older members (≥64 years) living in the household, on average, was significantly lower in both years. On average, every rural household had at least one child aged under 14. This highlights the fact that rural India is significantly young. Farm income contributed, on average, around 16–18% in both years, while non-farm income, was on average a major contributor to household income.

It should be recalled that off-farm income, a key variable in our study, is defined as income from non-farm activities other than farming income (own farm). Off-farm income may also include income from work performed on other farms and/or work performed in other rural non-farm sectors, such as construction, manufacturing or the services sector. Table 1 reveals that off-farm income, as a share of total smallholder household income, has been steady—around 50% in both survey years (2004/05 and 2011/12). Smallholders in India could also derive income by engaging in non-farm business income. Off-farm businesses include a seed company, a farm implement dealership, storage facilities and produce stands. Table 1 shows that business income was around 8–9% of total household income in the survey years. Interestingly, Table 1 reveals that the share of people living below the poverty line (BPL cardholders)Footnote 8 has increased from 40% in 2004/05 to 48% in 2011/12. This increase in the share of BPL cardholders may be attributed to increased awareness by rural households of social security programmes such as the public distribution system (PDS) for basic food items.

Another set of variables germane to our study is the work status of the operator and spouse. For example, Table 1 shows that the share of the workforce (operators or spouses) employed permanently in off-farm jobs is significantly low. In all, 6.0–6.5% of rural households have reported either the operator or spouse working off the farm permanently. Additionally, data from 2004/05 and 2011/12 in Table 1 show a declining trend in operators’ engagement in permanent jobs in the off-farm labour market. However, Table 1 shows that the share of spouses working permanently in the non-farm sector has increased moderately, from 0.3% in 2004/05 to 0.6% in 2011/12. On the other hand, the share of spouses involved in casual off-farm jobs has increased significantly, from 2.9% in 2004/05 to 4.8% in 2011/12.

Our study also includes variables where both operator and spouse were engaged in permanent off-farm jobs and/or where both were engaged in casual off-farm jobs. Such time allocation decisions may be important because differing work status (casual or permanent) may have different implications on the income, capacity to withstand production/consumption shocks and food security status of smallholder households. Table 1 reveals that around 24–25% of smallholder households have both operator and spouse engaged in casual off-farm jobs; about 0.50–0.60% of smallholder households report both working in permanent off-farm jobs. Finally, less than 1% of the smallholder households report either operator with permanent off-farm job and spouse with casual off-farm job, or vice versa.

Let us now compare the sources of income for smallholder households, by the households’ food insecurity (FIS) classFootnote 9 (see Smith and Subandaro 2007), for 2004/05 and 2011/12 (Table 2). In 2005, households in the least FIS class derived about 16% of their total income from farming, while the income from farming for households in the highest FIS class was around 20% (column 5, Table 2). However, by 2011/12 the share of farm income in total income for these classes decreased to 14% and 16%, respectively. Findings here highlight the riskiness in farm income associated with variability in output and/or prices in the farming sector. Interestingly, the share of off-farm income in total household income is consistent across all FIS classes. For example, regardless of FIS class, off-farm income contributed about 48–51% towards total household income in 2004/05 and 2011/12. This is consistent with the fact that off-farm income is stable and has little or no variability. Table 2 reveals a considerable difference in the share of business income to total income. For instance, the least FIS class received about 13% of their total income from off-farm business ownership. However, for the highest FIS class, off-farm business income was about 6% of total income. A similar trend is also observed in 2011/12 (Table 2, lower panel).

A consistent trend across all FIS classes is sources of income diversification (Table 2). We observe a higher reliance on off-farm income and income from off-farm businesses. Along with this, we also observe a significant share of household income from other sources, including remittance, property income and other public benefits (Table 2). Table 2, lower panel, shows that in 2011/12 the least FIS class derived almost 2 5% of their total income from other sources. Additionally, regardless of FIS class, the share of other income in total income has increased over time (2004/05–2011/12). This finding underscores the importance of other sources of income in overcoming food insecurity in rural India. Table 2 also shows that over time, the proportion of rural households in the high and highest FIS classes has fallen considerably—30 to 25% in the high FIS class and 35–20% in the highest FIS class. This is a positive trend, which also corroborates with the poverty level in rural India, as estimated by the Planning Commission of India, for the respective years.Footnote 10 In the next section, we present the methodology that estimates the effect of off-farm income and labour allocation decisions by operators and spouses on food insecurity, using both panel analysis and quantile regression with fixed effects.

5 Methodology

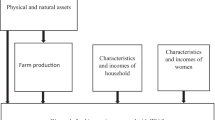

In order to estimate the effect of off-farm income and labour allocation for both operator and spouse on food insecurity, we use mean effects and heterogeneous effects modelling.

5.1 Estimation of Mean Impact

The mean impact of off-farm income and labour allocation decisions on food insecurity is estimated using the following model:

where \(\beta\) and \(\delta\) are the coefficients to be estimated, \(\alpha_{ij}\) is a set of time-constant unobservable household variables, \(\vartheta_{jt}\) is a set of time-variant unobservable village variables, \(\theta_{t}\) is a year dummy (=0 for 2004/05 and =1 for 2011/12) and \(\varepsilon_{it}\) is a set of time-variant unobservable household variables. The dependent variable \((Y_{ijt} )\) is the share of food expenditure in total consumption expenditures or FIS. \(E_{ijt}\) is a vector of main variables of interest and \(X_{ijt}\) is other explanatory variables. We control for age and education of both operator and spouse, wealth index, BPL cardholders, household size, number of older members (≥64 years) in the household and children (≤14 years) in the household. Additionally, \(\theta_{t}\), year dummy is included to account for all temporal variation in the region between 2004/05 and 2011/12. The standard errors are clustered at the village level, and robust errors were reported. Fixed effect regression was used to reduce the bias produced by a non-random assignment of households into off-farm employment. This model was chosen as this would clear away all time-invariant observable and unobservable household characteristics. Additionally, this takes care of any possible endogeneity due to unobserved time-invariant heterogeneity.

5.2 Estimation of Heterogeneous Impact

In the next step, we want to estimate the heterogeneous impact of off-farm income and labour allocation decisions of operator and spouse on food insecurity, using quantile regression. Quantile regression estimates treatment effects at different quantiles of the outcome distribution. This has an advantage over ordinary least squares, where the impact is estimated at the mean. In order to take advantage of panel data, we run a fixed effects panel quantile regression. Here the following model is considered:

\(Y_{it} = U_{it}^{*} (1 + D_{it} )\quad {\text{where}}\;U_{it}^{*} \sim U(0,1)\) and a structural quantile function (SQF) for the variable of interest is estimated:

The SQF defines the quantile of the latent outcome variable, \(D_{it}\), which represents FIS—share of food expenditure in total expenditures, and ranges from 0 to 1. The quantiles were further classified into four classes, based on their magnitude of FIS as defined above (Smith and Subadoro 2007; COCA 2006; U.S. Department of Labor 2006). The estimated percentage change in the share of food expenditures, resulting in the change in FIS class, due to off-farm income and labour allocation is represented by \(\beta_{l}\). This is estimated over time at the \(l{\text{th}}\) quantile of the share of food expenditures. \(\alpha_{ht}\) is the fixed effect based on age of household head (HH) and spouse, years of education of both HH and spouse, household size, number of older persons (≥64 years), number of children (≤14 years), BPL cardholders (Yes/No) and wealth index.

We follow the procedure proposed by Powell (2013). According to him, the additive fixed effect framework used by Canay (2011) allows the parameters to vary based on the part of the disturbance term, while it excludes the other part assuming that it is fixed across time. But the motivation for the use of quantile treatment effects (QTEs) is to allow the parameters of interest to change based on the non-separable disturbance term \(U_{it}^{*}\) and not \(U_{it}\) which is assumed in additive fixed effects model. Moreover, in some cases when researchers are interested in estimating QTEs for the outcome variable, \(Y_{it}\), they assume that they are not identified cross-sectionally. This method allows the parameters to be interpreted as in the cross-sectional quantile case.

6 Result and Discussion

Table 3 presents the parameter estimates from the fixed effects panel regression and panel quantile regression. In terms of sources of income and their impact on the food insecurity, results in Table 3 (column 2) reveal that the share of farm income (SFI) has a positive and significant impact on FIS, while off-farm income and business income did not have any significant effect on FIS. Household size has a positive impact on FIS while wealth has a significant negative effect on FIS. We should bear in mind that households with more members would tend to spend more on food items, and wealthier households would spend more on non-food items. Findings are consistent with theory. To control for overall variations over time, we included a time dummy (=1 if year 2011/12). The significant and negative effect of the time dummy variable indicates that, all other things being equal, FIS for rural households in India has fallen by about 6% between 2004/05 and 2011/12. This finding may suggest that rural households in India have become more food secure. Due to the limited variation over time, most of the estimated coefficients explaining household characteristics are not significant. Secondly, the results from the quantile fixed effects show the heterogeneous impact of off-farm income and labour allocation decisions of operator/spouse on FIS. Due to the space limitation, we only present selected quantiles across FIS classes; households with more than 65% of food expenditures in total expenditures are considered as highly FIS.

The age of the HH has a negative impact on FIS, while the spouse’s age has a positive impact on FIS. These variables are significant at the 20th, 30th, 40th, 80th and 90th quantile. The educational attainment of the operator has a negative effect on FIS for 60th and higher quantiles. On the other hand, the educational level of spouses has a negative and significant effect on FIS for all quantiles. It is not only the direction of impact which is significant; the magnitude also reveals that spouse’s education has a greater impact on reducing FIS (i.e. lowers the share of food expenditures in total spending) compared to operator’s educational attainment. In other words, an additional year in spouse’s education reduces FIS by 0.3% points (Table 3), across most quantiles. On the other hand, an additional year in operator’s education decreases FIS by 0.1% points (Table 3) for 60th and higher quantiles. Findings here underscore the importance of educating women. This finding is consistent with that of Quisumbing et al. (1995). Policies designed to subsidise the education of girls and women can perhaps result in better jobs in the rural non-farm sector and could improve rural households’ FIS status.

The number of older persons in a rural household has a negative and significant impact on FIS (Table 3) for all quantiles. On the other hand, the number of children in a rural household has a positive and significant impact on FIS (i.e. increase in food share expenditures), at all quantiles. A possible explanation is that compared to younger members, older people generally spend less on food items but more on health care. The coefficient on household size is positive and statistically significant for all quantile estimates, implying that larger families have higher food expenditures and hence more FIS. For example, an additional household member increases FIS in a household by about 0.1–0.6% points for all food expenditure quantiles, and the impact seems to be higher for the medium and high FIS classes (0.4–0.6% points).

Wealth has a significant negative impact on FIS. Specifically, for the high and highest FIS classes, columns 8–12 of Table 3 indicate that a one-unit increase in wealth index reduces FIS by about 3–4% points. The magnitude of the impact of wealth reveals that wealth could be a major factor in reducing FIS in rural Indian households. The share of BPL cardholders has a negative and significant effect on FIS and is consistent across all classes and quantiles. These findings are consistent with our expectations. It should be noted that BPL cardholders receive food entitlements from the government under various schemes, including the PDS and National Food Security Act (NFSA), and these programmes cover expenditure on staples such as rice, wheat, sugar and pulses. BPL cardholders are protected from any price shocks, which therefore make them less food insecure. All other things being equal, a unit increase in BPL membership would decrease FIS by 0.5–0.7% points for the highest FIS class (columns 11–12, Table 3).

We will now illustrate the effect of off-farm income and labour allocation decisions by operators and spouses, variables of interest to this paper. The share of farming income has a positive and significant impact on FIS. These findings suggest that farming income that is variable in nature may increase FIS. Surprisingly, the share of farming income has relatively less impact on the highest FIS class (columns 11–12, Table 3) than on the least FIS class (columns 2–3, Table 3). This could be due to small landholdings owned by the highest FIS class. A unit increase in the share of farming income the FIS of the highest class by about 4% points; for the least FIS class, by about 9% points.

On the other hand, off-farm income has a negative and significant effect on FIS, implying that off-farm income reduces FIS for the medium class to the highest class. A unit increase in off-farm income share reduces FIS by 0.8–1.7% points, respectively, for the medium class to the highest class. This illustrates the importance of off-farm income in reducing the FIS of rural Indian households. This finding reiterates the contribution of rural non-farm income to stabilise household incomes and their consumption bundle. Perhaps off-farm income serves as a buffer in case of production and food shocks experienced by rural households. Similarly, business income has a negative and significant effect on FIS for the medium to highest classes. A unit increase in business income share reduces FIS by 1.3–2.5% points for the medium to the highest class. The above findings underscore the importance of income diversification in achieving FIS for rural Indian households.

Let us turn our attention to the labour allocation decision of operators and spouses, and its impact on FIS. A spouse’s engagement in permanent off-farm work has a significant positive effect on FIS for the high and highest classes (the 40th, 60th and 80th quantiles). For other classes, the impact was heterogeneous. The lack of significance could also be explained by the low proportion of rural spouses engaged in permanent jobs off the farm. However, operators engaged in permanent off-farm work have significantly lower FIS. With respect to casual work, findings in the table show the opposite effect. For example, a spouse’s engagement in casual off-farm work tends to reduce FIS and hence makes rural households less food insecure; the impact is significant across all classes or quantiles. This result was consistent with the findings of Quisumbing et al. (1995) and Thomas (1991). Specifically, a unit increase in spouse’s involvement in casual off-farm work reduces FIS by 2.8–0.03% points. In the case of the operator, the impact on FIS was positive and significant for most of the classes.

Another interesting variable is operator and spouse engagement in casual off-farm work. In this case, casual off-farm work by both makes rural households more food insecure, especially in the medium and highest classes (columns 5–7 and 11–12, Table 3). For example, a unit increase in casual work by both operator and spouse increases FIS by 0.05–0.09% points for the medium class, and by 1.1–1.4% points for the highest FIS class. This is not surprising, because most of the poor households engaged in casual off-farm work and, given the low pay and poor working conditions for casual work, it would have a positive impact on FIS. Finally, the time dummy variable has a negative and significant coefficient, suggesting that over time (2004/05–2011/12), FIS has fallen consistently across all classes. Findings here shows that rural Indian households may be becoming more food secure. This result corroborates the estimates of the Planning Commission of India (2014).

7 Conclusion

India is mostly an agrarian economy, with almost 69% of Indians living in rural areas; 58% of rural households are directly dependent on agriculture for their employment and livelihood (NSSO 2104). According to the Planning Commission of India (2014), a significant number of rural households are still living below the poverty line and therefore may be food insecure. Furthermore, there have been increasing cases of malnutrition among children in rural households. Therefore, there is a need to assess and implement policies pertaining to enhancement of incomes and reduction in the food insecurity status of rural households. In this chapter, we evaluate the impact of off-farm income and labour allocation decisions, by operators and spouses, on the food security status of rural Indian households. We found that off-farm activities and off-farm business income reduce the food insecurity of rural households. But surprisingly, an increase in own-farm activities led to an increase in food insecurity. Therefore, promotion of off-farm activities and off-farm business, such as a sole proprietorship or small business, may help to enhance food security among rural Indian households.

We also analysed the impact on the food security of the casual and permanent off-farm work status of operators and spouses. We found that where spouses worked casually off the farm, their households were food secure, while where operators worked casually off the farm, their households were food insecure. However, if both operator and spouse worked casually off the farm, their households were food insecure. We also found evidence that a spouse’s education plays a greater role, relative to the operator, in reducing food insecurity. Therefore, policymakers should promote education, especially targeting female members of the family. Our study also found that BPL cardholders were less likely to be food insecure, perhaps an indication that government policies are working with their intended targets. Therefore, broad and efficient implementation of policies such as the PDS and Antyodaya Yojana (subsidised food scheme) could be encouraged. In other words, expansion of these programmes of free provision of essential food items, to a significant proportion of the population living below the poverty line, would most likely reduce instances of food insecurity. Hence, targeting would enhance the effectiveness of these public policies.

Notes

- 1.

Recall that off-farm work has been carried out by an educated member of the smallholder household and in turn, other members of the family either start going to school or receive better information and farming experience.

- 2.

- 3.

The rural non-farm sector is defined as economic activities in rural areas other than agriculture, livestock, fishing and hunting (Lanjouw and Lanjouw 2001).

- 4.

In a recent study Afridi et al. (2015) concluded that the mother’s participation in the labour force would improve the educational outcomes of the child.

- 5.

Only few expenses were reported for a reference period of 365 days; these were then converted to monthly expenses by dividing by 12.

- 6.

Wealth index derived by using principal component analysis of various common assets owned by the households. This included ownership of house, bicycle, scooter/motorcycle, television, cooler, electric fan, telephone, mobile phones, refrigerator, car, air conditioner, washing machine, computer, laptop, credit card and microwave oven.

- 7.

Farmers may have off-farm businesses (such as a seed, tractor or implement company, tea stall or restaurant) that provide income to the household.

- 8.

Defined as rural households living below poverty line (INR 447 and INR 816 per capita per month in 2004/05 and 2011/12 respectively).

- 9.

Based on Smith and Subandaro (2007), we identify four FIS classes. The class is based on the share of food expenditure as a proportion of total household expenditure. Least food insecure (FIS) class: <=50%; medium FIS class: >=50%– <=65%; high FIS class: >=65%–<75%; highest FIS class: >=75%.

- 10.

The poverty ratio for rural India was 41.8% in 2004/05, falling to 25.7% in 2011/12 (Planning Commission of India 2014).

References

Afridi, F., Mukhopadhyay, A., & Sahoo, S. (2015). Female labor force participation and child education in India: evidence from the National Rural Employment Guarantee Scheme. IZA Journal of Labor & Development, 1–27.

Barrett, C., Reardon, T., & Webb, P. (2001). Non-farm income diversification and household livelihood strategies in rural Africa: Concepts, dynamics and policy implications. Food Policy, 315–331.

Berg, E., Bhattacharya, S., Durgam, R., & Ramachandran, M. (2012). Can rural public works affect agricultural wages? Evidence from India. CSAE Working Paper.

Bhargava, A. (2014). The impact of India’s rural employment guarantees on demand for agricultural technology. IFPRI Discussion Paper, 01381.

Canay, I. A. (2011). A simple approach to quantile regression for panel data models. The Econometrics Journal, 14(3), 368–386.

COCA (Canada’s Office of Consumer Affairs). (2006). The consumer trends report. Canada’s Office of Consumer Affairs, Ottawa, Ontario.

Ellis, F. (2000). The determinants of rural livelihood diversification in developing countries. Journal of Agricultural Economics, 289–302.

Goodwin, B. K., & Mishra, A. (2004). Farming efficiency and the determinants of multiple jobs holding by farm operators. American Journal of Agricultural Economics, 722–729.

Kareemulla, K., Kumar, S., Reddy, K., Rao, C., & Venkateswarlu, B. (2010). The impact of NREGS on rural livelihoods and agricultural capital formation. Indian Journal of Agricultural Economics, 524–539.

Kimhi, A. (1994). Quasi maximum likelihood estimation of multivariate probit models: Estimating farm couples’ labor participation. American Journal of Agricultural Economics, 76, 828–835.

Lanjouw, J., & Lanjouw, P. (2001). The rural non-farm sector: Issues and evidence from developing countries. Agricultural Economics, 1–23.

Lanjouw, P., & Murgai, R. (2009). Poverty decline, agricultural wages and non-farm employment in rural India: 1983–2004. Agricultural Economics, 243–263.

Lanjouw, P., & Shariff, A. (2004). Rural nonfarm employment in India: Access, incomes, and poverty impact. NCAER.

Mishra, A., & Goodwin, B. K. (1997). Farm income variability and supply of off-farm labor. American Journal of Agricultural Economics, 880–887.

National Sample Survey Office (NSSO). (2104). Key indicators of situation agricultural households in India (January–December 2013), Vol. 33 of 70th Round. New Delhi: National Sample Survey Office, Ministry of Statistics and Programme Implementation, Government of India, New Delhi, India.

Owusu, V., Abdulai, A., & Abdul-Rahman, S. (2011). Non-farm work and food security among farm households in northern Ghana. Food Policy, 108–118.

Pal, S. (1996). Casual and regular contracts: Workers’ self-selection in the rural labor markets in India. The Journal of Development Studies, 99–116.

Planning Commission. (2014). Report of the expert group to review the methodology for measurement of poverty. The government of Indian, New Delhi.

Powell, D. (2013). A new framework for estimation of quantile treatment effects. RAND Working Paper, WR-824-1.

Quisumbing, A., Brown, L., Feldstein, H., Haddad, L., & Pena, C. (1995). Women: The key to food security. Washinton, D.C: Food Policy Report, The International Food Policy Research Institute.

Ruben, R., & Berg, M. V. (2001). Non-farm employment and poverty alleviation of rural farm households in Honduras. World Development, 549–560.

Smith, L., & Subandoro, A. (2007). Measuring food security using household expenditure surveys, Food security in practice, IFPRI, p. 147.

Thomas, D. (1991). Gender differences in household resource allocation. Population and Human Resources Department. Living Standards Measurement Study.

U.S. Department of Labor. (2006). Consumer expenditures in 2004. U.S. Bureau of Labor Statistics Report 992, Washington, D.C.

Yang, D. T. (1997). Education and off-farm work. Economic development and cultural change, 613–632.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Dsouza, A., Mishra, A.K., Sonoda, T. (2020). Impact of Casual and Permanent Off-Farm Activities on Food Security: The Case of India. In: Gomez y Paloma, S., Riesgo, L., Louhichi, K. (eds) The Role of Smallholder Farms in Food and Nutrition Security. Springer, Cham. https://doi.org/10.1007/978-3-030-42148-9_10

Download citation

DOI: https://doi.org/10.1007/978-3-030-42148-9_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-42147-2

Online ISBN: 978-3-030-42148-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)