Abstract

The primary purpose of this chapter is to demonstrate how a framework developed from data embodied in surveys of households’ consumer expenditures can be used to calculate complete arrays of own- and cross-price elasticities. The procedure is illustrated for simulated changes of ±10% in the price of telecommunications and for ±50% and −50%/+75% changes in the price of gasoline & motor oil. The engine for the analysis is a matrix of “intra-budget” coefficients that represent the direct relationships amongst the different categories of expenditure in households’ budgets. A strength of the framework is that price changes can be translated immediately into real-income effects, which in turn allows for straightforward separation of income and substitution effects.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

The traditional approach in demand analysis to questions concerning internal relationships of consumption has been in terms of the functional structure of the utility function, how utilities (or, more specifically, marginal utilities) of individual categories of consumption (whether singly or in groups) might be related to utilities of other categories. In great part, the motivation for such enquiries has been adjunctive to estimation, as demand functions derived from utility functions in which separability is postulated are generally much easier to estimate than demand functions derived from utility functions in which separability is absent.

- 2.

Hereafter, Internal Structure.

- 3.

The validity of the whole approach obviously depends upon the matrix of intra-budget coefficients representing stable distributional characteristics of households’ expenditure decisions. Chapter 3 of Internal Structure presents 77a battery of exercises attesting that this assumption can be taken at face value.

- 4.

Unlike in Internal Structure, the present effort utilizes 18 categories of expenditure rather than 14. Food is disaggregated to food consumed at home and food consumed outside of the home, water and telephone are disengaged from housing, and gasoline & oil from transportation.

- 5.

Coefficient estimates are in rows, equations in columns; t-ratios are in parentheses, with 6715 degrees of freedom. The −1s on the diagonal reflect the fact that expenditure in that category is the dependent variable. Definitions of the expenditure categories are given in the Appendix.

- 6.

It might seem that new equilibria are independent of how changes in expenditure come about, but this is not the case, for equilibrium depends upon where and how changes in expenditure occur and at what point (and how) a total-expenditure budget constraint is imposed. In particular, exogenous changes [as should be clear from consideration of Expression (2.5)] leads to new equilibria that are different from the original. With endogenous changes, however, since z is not changed, the system will eventually return to the same equilibrium as before. Chapters 4 and 5 of Internal Structure provide discussion and examples.

- 7.

All calculations are undertaken in SAS.

- 8.

This represents a quarterly total; the implied total annual expenditure is about $54,000.

- 9.

qi Δpi also represents the decrease/increase in real income dictated by Δpi.

- 10.

For reasons that will become clear shortly, these quantities will be referred to as allocation (or reallocation) elasticities.

- 11.

Note that the own-price elasticity is measured from expenditure after the price change (rather than from the base expenditure), since, with no change in quantity demanded, this is what expenditure (as given by qi ∆pi) would be in the absence of a non-zero elasticity. However, a non-zero (negative) elasticity causes some of the revenue [specifically, qi ∆pi − ∆(pi qi)] in effect to “melt” away because of the higher price. For cross-elasticities, on the other hand, since prices of other goods are not changed, calculations are made from base expenditures.

- 12.

At this point, it is useful to step back and contemplate—indeed, even marvel!—at what the procedures behind the formulae in Expressions (2.11) and (2.12) imply and accomplish. For they allow for price elasticities (both own and cross) to be adduced in circumstances in which all price information is subsumed in expenditures. While the estimation of own-price elasticities is straightforward in conventional demand analysis (in situations in which explicit price data are available), estimation of cross-elasticities typically flounders because of large inter-correlations amongst prices (i.e., by multicollinearity). Importantly, the procedure is almost entirely empirical. No assumptions are made regarding behavior, other than that households spend in the way that data are recorded in the BLS surveys, and that their expenditures are bound by a total-expenditure budget constraint. In short, the analysis is almost entirely statistical and mathematical.

- 13.

Potatoes in nineteenth-century Ireland, as studied by Giffen, are the standard example of such a good, hence the term “Giffen” good.

- 14.

- 15.

Several instances of this are encountered in Taylor (2017a).

- 16.

Such can also arise if the relationships amongst the goods are positive, negative, negative instead of negative, positive, positive. Note that relative importance of budget shares will matter as well.

- 17.

- 18.

- 19.

Specifically, wk is calculated as Ay0/Ayk−1. Discussion and details of this as well as other methods of taking the budget constraint into account can be found in Chapter 4 of Internal Structure.

- 20.

Since the focus in the exercises of this paper is primarily on methodology and demonstration, a comparison of the elasticities that have been obtained with those found in the literature is not undertaken. However, for those who might be interested in such, see for telecommunications, amongst others, Crandall and Waverman (1995) and the many studies cited and reviewed in my 1994 book, Telecommunications Demand in Theory and Practice. For gasoline & oil, see Dahl (1982), Epsey (1996), Houthakker et al. (1974), Hughes et al. (2008), Schmalensee and Stoker (1999), Puller and Greening (1999), and Taylor and Houthakker (2010).

- 21.

However, in a 2005 article in The Nation, Sasha Abramsky conjectures that gasoline, in certain circumstances, may indeed be a Giffen good. Similarly, Bopp (1983) suggest the same for kerosene (a low-quality fuel used for heating) and shochu (a Japanese distilled beverage). See also Jensen and Miller (2008) and Kagel et al. (1995).

- 22.

- 23.

From line 9 in Table 2.11.

References

Abramsky, S. 2005. Running on Fumes. The Nation, October 17, pp. 15–19.

Bopp, A. 1983. The Demand for Kerosene: A Modern Giffen Good. Applied Economics 15 (4): 459–467.

Crandall, R.W., and L. Waverman. 1995. Talk Is Cheap: The Promise of Regulatory Reform in North American Telecommunications. Washington, DC: Brookings Institution Press.

Dahl, C. 1982. Do Gasoline Demand Elasticities Vary? Land Economics 58: 374–382.

Epsey, M. 1996. Explaining the Variation in Elasticity Estimates of Gasoline Demand in the United States: A Meta-Analysis. The Energy Journal 17: 49–60.

Houthakker, H.S., P.K. Verleger, and D. Sheehan. 1974. Dynamic Demand Analysis for Gasoline and Electricity. American Journal of Agricultural Economics 56: 412–418.

Hughes, J.E., C.R. Knittel, and D. Sperling. 2008. Evidence of a Shift in the Short-Run Price Elasticity of Gasoline Demand. The Energy Journal 29 (1): 113–134.

Jensen, R., and N. Miller. 2008. Giffen Behavior and Subsistence Consumption. American Economic Review 97 (1): 188–192.

Kagel, J.H., R.C. Battalio, and L. Green. 1995. Economic Choice Theory: An Experimental Analysis of Animal Behavior, 25–28. Cambridge: Cambridge University Press.

Puller, S., and L. Greening. 1999. Household Adjustment to Gasoline Price Change: An Analysis Using 9 Years of US Survey Data. Energy Economics 21: 37–52.

Schmalensee, R., and T.M. Stoker. 1999. Household Gasoline Demand in the United States. Econometrica 67 (3): 645–662.

Taylor, L.D. 1994. Telecommunications Demand in Theory and Practice. Dordrecht: Kluwer Academic Publishers.

Taylor, L.D. 2013. The Internal Structure of U.S. Consumption Expenditures. New York: Springer-Verlag.

Taylor, L.D. 2017a. Notes on Measurement of Consumer Expenditures (With Special Reference to the On-Going BLS Consumer Expenditure Survey. Department of Economics, University of Arizona, Tucson, AZ, myros@att.net.

Taylor, L.D. 2017b. The Internal Structure of Consumption II. Department of Economics, University of Arizona, Tucson, AZ, myros@att.net.

Taylor, L.D., and H.S. Houthakker. 2010. Consumer Demand in the United States: Prices, Income, and Consumer Behavior, 3rd ed. New York: Springer-Verlag.

Acknowledgments

Dedicated to Gary Madden, telecom and IT researcher extraordinaire. I am grateful to Dennis Cory and Timothy Tardiff for comments and criticisms. Problems that might remain are of course my responsibility.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Appendices

Appendices

Appendix 1

Definitions of Expenditures in BLS Survey of Consumer Expenditure: 14 Categories of Expenditure.

Food includes expenditures on food at home referring to expenses for grocery stores and food by the consumer on trips; food away from home accounting for all meals at fast food, take-out, delivery, concession stands, buffet and cafeteria, full-service restaurants, vending machines, and mobile vendors; and other miscellaneous venues.

Alcoholic beverages include beer and ale, wine, whiskey, gin, vodka, rum, and other alcoholic beverages.

Housing includes expenditures on owned dwellings like interest on mortgages, property taxes, and repairs and maintenance; rented dwellings like rent and maintenance, utilities like natural gas and electricity; fuels like fuel oil and coal; public services like water, garbage, and telephone; housekeeping supplies; household textiles; furniture; floor coverings; major and small appliance; and other miscellaneous equipment purchases.

Apparel includes expenditures on men’s and boy’s apparel; women’s and girl’s apparel; apparel for children under 2; footwear; and other apparel products and services.

Transportation includes expenditures for vehicle purchases; vehicle finance charges; gasoline and motor oil; maintenance and repairs; vehicle insurance; public transportation; and vehicle rental, leases, licenses, and other charges.

Health Care includes expenditures on health insurance; medical services like hospital services and physicians’ services; eye and dental care; lab tests and X-rays, convalescent and nursing home care; medical appliances and equipment; and both non-prescription and prescription drugs.

Entertainment includes expenditures on fees and admissions; television, radio, and sound equipment; pets, toys, hobbies, and playground equipment; and other miscellaneous entertainment equipment and services like bicycles, hunting and fishing equipment, boats, photographic equipment and supplies, fireworks, electronic video games, etc.

Personal care products and services includes products for the hair, oral hygiene products, shaving needs, cosmetics and bath products, electric personal care appliances, other personal care products, and personal care services for males and females.

Reading includes subscriptions for newspapers and magazines; books through book clubs; and the purchase of single-copy newspapers, magazines, newsletters, books, and encyclopedias and other reference books.

Education includes tuition; fees; and textbooks, supplies, and equipment for public and private nursery schools, elementary and high schools, colleges and universities, and other schools.

Tobacco products and smoking supplies includes cigarettes, cigars, snuff, loose smoking tobacco, chewing tobacco, and smoking accessories (such as cigarette or cigar holder pipis flint and pipe cleaner).

Miscellaneous includes safety deposit box rental, checking account fees and other bank service charges, credit card memberships, legal fees, accounting fees, funerals, cemetery lots, union dues, occupational expenses, expenses for other properties, and finance charges other than those for mortgages and vehicles.

Cash contributions includes cash contributed to persons or organizations outside the consumer unit, including alimony and child support payments; care of students away from home; and contributions to religious, educational, charitable, or political organizations.

Personal insurance includes expenditures on life insurance; endowments; mortgage insurance; and other premiums for personal liability, accident, and disability, and other non-health insurance other than for homes and vehicles. (Source: U.S. Bureau of Labor Statistics, available at http://www.bls.gov/cex/csxgloss.htm.)

Appendix 2

When the large discrepancy (in absolute value) in the change in expenditures for gasoline & motor oil for all households for the ±50% price changes was first encountered (−$329 vs. $194) in Table 2.7, my reaction was that a coding error almost certainly had to be involved. However, this was not the case, for the difference in fact arises from the manner in which the budget constraint is imposed, specifically, in simulations using Expression (2.3), whether the budget constraint is imposed as in Expression (2.18), or as in:

[where (as before) \(w^{k} = \frac{{y^{0} }}{{y^{k - 1} }}\)], or as in:

where

and where

In the event, it turns out that y* in Expression (2.20) is equal to the solution vector y from Expression (2.5)—as in Table 2.7 for the ±50% price changes. That this is the case can be seen numerically in Tables 2.13A and 2.13B. The numbers appearing in columns 1 and 3 of this show changes in gasoline & motor oil expenditures from the first 10 iterations of Expression (2.18) for a 50% decrease in the gasoil price (column 1) and a 50% increase (column 3). Columns 2 and 4 show the same for simulations using

Convergence values (i.e., −$297.10, −$399.76, etc.) are shown as well.Footnote 22 At the bottom of the table, it is seen that the total expenditure that is associated with values of −$399.76 and $399.76 corresponding to Expression (2.18)—in which the budget constraint of $12, 220 is not imposed—are $9062 and $15,378, respectively, yielding values for w* in Expression (2.22) of 1.3485 (12,220/9062) and 0.7846 (12,220/15,378). When these two factors are applied to the \(\widehat{y}\)s [from Expression (2.21)] in Expression (2.17) to take the budget constraint of $12,220 into account, the result is budget-constrained expenditures for gasoline & motor oil of $274.17 for the 50% price decrease and $786.88 for the 50% price increase.Footnote 23 Subtraction of base expenditures of $603.04 from these quantities then yields the −$328.90 and $193.81 of Expression (2.3) (Table 2.14).

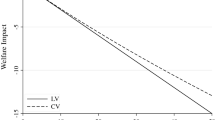

Amongst other things, what this exercise illustrates is that (as discussed in detail in Chapter 4 of Internal Structure) the way in which a budget constraint is imposed in this framework is a matter of choice. This is both a strength and a weakness, a weakness because different methods lead to different results, but a strength in that the method used can be tailored to the question at hand. The method to be used can turn on whether the question of interest involves dynamics or a steady state. Dynamics can then be identified with iterative solutions involving the structural form per Expression (2.3) and a steady state with reduced-form solutions per Expression (2.5). Dynamics, accordingly, can usefully be associated with the sequential effects on expenditures from a price change under the assumption that total expenditure is constant. This allows for the initial effect on the good whose price has changed to be isolated from the effects that arise through feedbacks from other goods. Goods that might appear to be Giffen in the long run can thus be seen to behave normally in the short run. The simulations exercises for both telecommunications and gasoline & motor oil, using Expression (2.18), represented in Table 2.12 and Fig. 2.1 provide illustration.

Rights and permissions

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Taylor, L.D. (2020). A Different Approach to Deriving Price and Income Elasticities: Applications to Telecommunications and Gasoline & Motor Oil. In: Alleman, J., Rappoport, P., Hamoudia, M. (eds) Applied Economics in the Digital Era. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-40601-1_2

Download citation

DOI: https://doi.org/10.1007/978-3-030-40601-1_2

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-40600-4

Online ISBN: 978-3-030-40601-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)