Abstract

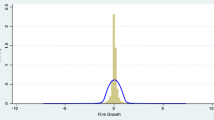

Using conditional quantile regressions for a panel of listed firms from euro-area countries in the 2005–2011 period, we explore the role of banking concentration in firm growth between micro and larger firms; pre-crisis and post-crisis years; periphery and core countries. The results provide evidence on the differentiated role of banking concentration in firms exhibiting different growth rates, depending at the same time on firm size, firm location and the financial crisis.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Applying also VIF tests confirms the absence of any multicollinearity problems.

- 2.

- 3.

Following the definition of firm size groups provided.

- 4.

It should be noted that a similarity hypothesis between the CR*Dummy and CR*(1-Dummy) coefficients was rejected in all cases by an F test at 0.05.

References

Allen, F., & Gale, D. (2004). Competition and financial stability. Journal of Money, Credit, and Banking, 36(3), 453–480.

Audretsch, D. B., & Mahmood, T. (1995). New firm survival: New results using a hazard function. The Review of Economics and Statistics, 77(1), 97–103.

Beck, T., & Demirgüç-Kunt, A. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance, 30(11), 2931–2943.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2006). Bank concentration, competition, and crises: First results. Journal of Banking & Finance, 30(5), 1581–1603.

Black, S. E., & Strahan, P. E. (2002). Entrepreneurship and bank credit availability. The Journal of Finance, 57(6), 2807–2833.

Bonaccorsi di Patti, E., & Dell’Ariccia, G. (2004). Bank competition and firm creation. Journal of Money, Credit, and Banking, 36(2), 225–251.

Boyd, J. H., & De Nicolo, G. (2005). The theory of bank risk taking and competition revisited. The Journal of Finance, 60(3), 1329–1343.

Capasso, M., Cefis, E., & Frenken, K. (2013). On the existence of persistently outperforming firms. Industrial and Corporate Change, 23(4), 997–1036.

Carbo-Valverde, S., Rodriguez-Fernandez, F., & Udell, G. F. (2009). Bank market power and SME financing constraints. Review of Finance, 13(2), 309–340.

Cefis, E., & Marsili, O. (2005). A matter of life and death: Innovation and firm survival. Industrial and Corporate Change, 14(6), 1167–1192.

Cetorelli, N., & Strahan, P. E. (2006). Finance as a barrier to entry: Bank competition and industry structure in local US markets. The Journal of Finance, 61(1), 437–461.

Claessens, S., & Laeven, L. (2004). What drives bank competition? Some international evidence. Journal of Money, Credit, and Banking, 36(3), 563–583.

Fielding, D., & Rewilak, J. (2015). Credit booms, financial fragility and banking crises. Economics Letters, 136, 233–236.

Fotopoulos, G., & Louri, H. (2000). Determinants of hazard confronting new entry: Does financial structure matter? Review of Industrial Organization, 17(3), 285–300.

Hao, L., & Naiman, D. Q. (2007). Quantile regression. (No. 149). Sage.

Henrekson, M., & Johansson, D. (2010). Gazelles as job creators: A survey and interpretation of the evidence. Small Business Economics, 35(2), 227–244.

Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1), 74–89.

Laeven, L., & Valencia, F. (2013). The real effects of financial sector interventions during crises. Journal of Money, Credit and Banking, 45(1), 147–177.

Petersen, M. A., & Rajan, R. G. (1995). The effect of credit market competition on lending relationships. The Quarterly Journal of Economics, 110(2), 407–443.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. The American Economic Review, 88(3), 559–586.

Ratti, R. A., Lee, S., & Seol, Y. (2008). Bank concentration and financial constraints on firm-level investment in Europe. Journal of Banking & Finance, 32(12), 2684–2694.

Rice, T., & Strahan, P. E. (2010). Does credit competition affect small-firm finance? The Journal of Finance, 65(3), 861–889.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33(2), 141–149.

Acknowledgement

We would like to thank the reviewers for insightful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Switzerland AG

About this paper

Cite this paper

Dimelis, S., Giotopoulos, I., Louri, H. (2018). Banking Concentration and Firm Growth: The Impact of Size, Location and Financial Crisis. In: Tsounis, N., Vlachvei, A. (eds) Advances in Time Series Data Methods in Applied Economic Research. ICOAE 2018. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-02194-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-02194-8_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-02193-1

Online ISBN: 978-3-030-02194-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)