Abstract

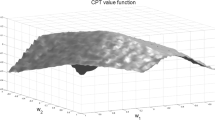

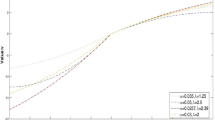

We focus on the interaction between investors and portfolio managers, employing a cumulative prospect theory approach to the investor’s preferences. In an original way, we model trust in the manager and the relative anxiety about investing in a risky asset. Moreover, we investigate how trust and anxiety affect the manager’s fee and the portfolios of cumulative prospect theory investors. The novelty of our contribution relative to previous work is that we rely on cumulative prospect theory(CPT) rather than the classical mean-variance framework. Moreover, our research differs from traditional CPT work through an improved value function that accurately characterizes the reduction in anxiety suffered by the CPT investors from bearing risk when assisted by the portfolio managers’ help relative to when they lack such assistance. Our results differ in several respects from those obtained when using on classical preferences. First, the optimal fees are not symmetric. Specially, the dominant managers obtain higher fees than subordinate managers regardless of changes in risk of risky assets (a risky asset) and changes in the dispersion of trust in the population. Another difference is that these fees are not proportional to expected returns. In particular, the optimal fees increase nonlinearly as risk of risky assets (a risky asset) increases and the dispersion of trust in the population increases.

Similar content being viewed by others

References

Bernard C, Ghossoub M (2009) Static portfolio choice under cumulative prospect theory. MPRA Paper 16502, Munich personal RePEc Archive

Bernard C, He X, Yang J, Zhou X (2015) Optimal insurance design under rank dependent utility. Math Financ 25:154–186

Chevalier J, Ellison G (1997) Risk taking by mutual funds as a response to incentives. J Polit Econ 105:1167–1200

Chevalier J, Ellison G (1999) Career concerns of mutual fund managers. Q J Econ 114:389–432

Deng L (2015) The optimal insurance policy for the general fixed cost of handling an indemnity under rank-dependent expected utility. J Appl Math. doi:10.1155/2015/186061

Deng L, Pirvu TA (2015) Multi-period investment strategies under cumulative prospect theory. Working paper, arXiv:1608.08490

Dhiab B (2015) Demand for insurance under rank dependent expected utility model. Res J Financ Account 6(8):29–36

Gennaioli N, Shleifer A, Vishny R (2015) Money doctors. J Financ 70 (1):91–114

Guerrieri V, Kondor P (2012) Fund managers, career concerns and asset price volatility. Am Econ Rev 102:1986–2017

Hackethal A, Inderst R, Meyer S (2012) Trading on advice. Working paper, University of Frankfurt

He X, Zhou X (2011a) Portfolio choice under cumulative prospect theory: an analytical treatment. Manag Sci 57(2):315–331

He X, Zhou X (2011b) Portfolio choice via quantiles. Math Financ 21 (2):203–231

Inderst R, Ottaviani M (2009) Misselling through agents. Am Econ Rev 99:883–908

Inderst R, Ottaviani M (2012a) Competition through commissions and kickbacks. Am Econ Rev 102:780–809

Inderst R, Ottaviani M (2012b) Financial advice. J Econ Lit 50:494–512

Jin H, Zhou X (2008) Behavioral portfolio selection in continuous time. Math Financ 18(3):385–426

Neummann J, Morgenstern O (1944) Theory of games and economic behavior. Princeton University Press, Princeton

Pirvu TA, Schulze K (2012) Multi-stock portfolio optimization under prospect theory. Math Financ Econ 6:337–362

Shi Y, Cui X, Li D (2014) Discrete-time behavioral portfolio selection under prospect theory. Working paper, available at SSRN 2457762

Tversky A, Kahneman D (1992a) Prospect theory: an analysis of decision under rick. Econometrica 47:262–291

Tversky A, Kahneman D (1992b) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncert 5:297–323

Acknowledgments

The article is supported by National Natural Science Foundation of China (71201051), the State Scholarship Fund (Grant No. 2014BQ11) and Young Talents Training Plan of Hunan Normal University (2014YX04), Philosophical and Social Science Fund of Hunan (No.14YBA264).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 The proof of Proposition 22

Proof

Equation 2.7 identifies

Otherwise, only one manager earns zero profit. This manager could reduce hisfee and also make a positive profit. This condition alone implies that when 𝜃 = 0, the unique equilibriumfeatures \(f_{A}^{*}=f_{B}^{*}=0\). Thus, weonly need to address 𝜃 > 0.

Let

We first consider f A ≥ f B . From Theorem 21, we propose that

and

Set

and

We obtain

and

Write

and

Because

and

f A,1 and f B,1 are the values thatlocally maximize U A and U B , respectively.

Moreover,

and

Therefore, f A,1 and f B,1 are the values thatlocally maximize U A and U B , respectively. Furthermore,

; thus, if manager A is in the dominant position in the financial market, he prefers to charge a higher fee f A than the fee f B of manager B to obtaina larger total profit U A than the total profit U B of manager B. This is the conclusion of Proposition 22. Using helpful software, such as Matlaband Mathmatic, we can obtain the approximately and explicitly optimal solutions of f A and f B

and

We can simplify the results as

and

Let

and

Then,

and

Since 𝜃 ∈ [0, 1], 2(2𝜃 + 1)1/2 − 1 > 0. So, C > 0.

We have that

Hence, when 𝜃 = 0,we can get the minimum of E is 1. Therefore, we have E > 0(𝜃 ∈ [0, 1]).

Now, we can get Eqs. 5.13 and 5.12 .

Symmetrically, when manager B is in a dominant position and manager A isin a subordinate position in the financial market, we obtain analogous results. □

1.2 The proof of Proposition 23

Proof

Given the definition of the rate of fees, we have

and

Because \(W_{i}=v_{i}\xi =k(\frac {a\tau _{i,j}}{\sigma ^{2}}-f_{j})\xi \),we easily obtain the following:

Therefore, we have

\(f_{A}^{*}\)is thus an increasingfunction of σ 2.

Similarly, we have

and

Therefore, \(f_{B}^{*}\)is also anincreasing function of σ 2. □

1.3 The proof of Theorem 26

Proof

We first discuss the total profit of manager A when f A ≥ f B .

If \(V(\bar {k}, \tau _{i,A}, f_{A})\geq V(\bar {k}, \tau _{i,B}, f_{B})\),investor i prefers manager A to manager B.

From

we can demonstrate that

Note that the right-hand side of Eq. 5.18 is not less than 0. For B-trusting investors, theleft-hand side of (5.18) is less than 0. Thus, Eq. 5.18 does not hold. That is, no B-trusting investorswill choose manager A.

For an A-trusting investor, if

an A-trusting investor prefers manager B. Namely, although manager A charges a higher fee thanmanager B, some A-trusting investors have so little trust in manager B that they prefer managerA, regardless of the latter’s higher fee.

Hence, when f A ≥ f B , andnoting that

we canstate that the manager A obtains total profit

where the n-dimension I = (1, 1,..., 1)′.

We can demonstrate that \(1-\theta \geq \frac {\hat {\sigma }^{2}}{a}f_{B}.\) Otherwise, we would have some paradoxical results. Specifically, when \(1-\theta <\frac {\hat {\sigma }^{2}}{a}f_{B}\), if there exits any \(\tau _{i,B}\in [1-\theta, \frac {\hat {\sigma }^{2}}{a}f_{B}]\), this is inconsistent with Eq. 2.6 . If no τ i,B satisfies \(\tau _{i,B}\in [1-\theta, \frac {\hat {\sigma }^{2}}{a}f_{B}]\), namely, any \(\tau _{i,B}\in [\frac {\hat {\sigma }^{2}}{a}f_{B}, 1],\)this contradicts theassumption that τ i,B isuniformly distributed on [1 − 𝜃, 1]. Thus, \(1-\theta \geq \frac {\hat {\sigma }^{2}}{a}f_{B}\)is reasonable.

Moreover, if \(V(\bar {k}, \tau _{i,B}, f_{B})\geq V(\bar {k}, \tau _{i,A}, f_{A})\), namely,

investor i prefers manager B rather to manager A.

Since τ i,A − τ i,B ∈ [−𝜃,𝜃],Eq. 5.19 indicates that

Otherwise, manager A earns zero profit. Manager A could reduce his fee and earn a positive profit.Therefore,

When f A ≥ f B , managerA’s total profit \(U_{f_{A}}(f_{A}, f_{B})\)is rewritten as

Subsequently, we consider f A < f B .

If \(V(\bar {k}, \tau _{i,A}, f_{A})\geq V(\bar {k}, \tau _{i,B}, f_{B})\),investor i prefers manager A to manager B.

From

we can demonstrate that

If investor i is an A-trusting investor, as mentioned above, τ i,A = 1. Thus, τ i,A − τ i,B ≥ 0. Since the right-hand side of Eq. 5.20 is less than 0, Eq. 5.20 always holds. Therefore, all A-trustinginvestors prefer manager A.

For a B-trusting investor and τ i,B = 1,if

the B-trusting investor will choose manager A, as he hopes to pay a lower management fee.

Therefore, when f B > f A , manager A’s total profit is

From Eq. 2.9, we can state that

That is,

Therefore, when f B > f A , manager A’s total profit \(U_{f_{A}}(f_{A}, f_{B})\)is

As in the above results, we obtain manager A’s total profits U A (f A , f B ) by

Similarly, the total profits U B (f A , f B ) of manager B are given by

□

About this article

Cite this article

Deng, L., Liu, Z. One-period pricing strategy of ‘money doctors’ under cumulative prospect theory. Port Econ J 16, 113–144 (2017). https://doi.org/10.1007/s10258-017-0133-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-017-0133-1