Abstract

The literature shows that openness to trade improves long-term growth but also that it may increase exposure to high output volatility. In this vein, our paper investigates whether exporting and export diversification at the firm level have an effect on the output volatility of firms. We use large representative firm-level databases from Estonia, Hungary, Romania, Slovakia and Slovenia over the last boom–bust cycle in 2004–2012. The results confirm that exporting is related to higher volatility at the firm level. There is also evidence that this effect increased during the Great Recession due to the large negative shocks in export markets. We find that export diversification mitigates volatility only in some cases. Exporting more products or serving more markets does not necessarily result in higher stability of firm sales.

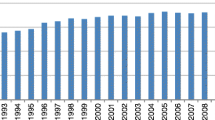

Source: World Bank, World Development Indicators

Source: Authors’ calculations from CompNet and customs data

Similar content being viewed by others

Notes

See Koren and Tenreyro (2007) for the list of sectors with more volatility from global sectoral shocks.

More recently, Giovanni et al. (2017) also highlight the importance of the contribution of the largest firms to aggregate fluctuations. In the case of France, co-movements can be traced to the top 100 firms.

Kurz and Senses (2016) who look at employment volatility find that non-traders are more volatile than exporters, while they find importers to be the most volatile. The both exporter and importing firms, the biggest firms, have similar volatility to exporters only. However, to relate to their research would require knowledge on the correlation between employment and sales volatility. Similarly, Nguyen and Schaur (2012) find that exporters and importers channel volatility in foreign markets to the domestic market, while they find the effect from importing to be even larger than from exporting. These findings suggest that import is an important source of domestic volatility. Unfortunately, import data is not at our disposal in all the sample countries and will not be in the focus of this paper.

Recently, Girma et al. (2016) connect higher exports and sales via foreign affiliates of Japanese firms to higher volatility of stock returns.

In addition, we control for import share. Firm-level import information is not at our disposal for all of our sample countries. Results (available on request) for Estonia and Slovakia show significant mitigating effect of import share on output volatility, while inference with respect to export share or diversification remaines unchanged. These findings seem at odds with the volatility increasing effects of imports found by Kurz and Senses (2016) for employment and by Nguyen and Schaur (2012) for domestic sales. Following the argument of Kurz and Senses (2016) discussing the ambigouity of the effect of import, our negative result can arise from intermediate inputs diversified trhough imports as in Koren and Tenreyro (2013).

Agency of the Republic of Slovenia for Public Legal Records and Related Services.

The Harmonised System of the World Customs Organization.

The average firm in the sample is in the medium size category following the European definition where a medium sized firm has between 50 and 250 employees.

In addition to specifications presented in Tables 4 and 5 and in Appendix 3, an alternative specification has been tested with industry dummies. If the volatility and the adverse impact of the Great Recession on volatility were industry specific, the relationship between exporting and volatility would diminish after introduction of these controls. Introducing industry dummies does not change the results qualitatively.

The following country groups have been applied: EU15, New EU member states, North America, South-Eastern European economies in transition, Commonwealth of Independent States and Georgia, North Africa, Central Africa, East Africa, Southern Africa, West Africa, East Asia, South Asia, Western Asia, Caribbean, Mexico and Central America, South America, Oceania, and Japan.

The export share can also be subject to endogeneity, e.g. Buch et al. (2009) and Vannoorenberghe (2012) use tariffs and geographical location to instrument export share. Given that these papers find IV and OLS results to be fairly similar; and that the relationship between exporting and volatility is rather consistent in this paper, we focus on testing the exogeneity of concentration.

These products are aerospace; computers, office machinery; electronics-communications; pharmaceuticals; scientific instruments; motor vehicles; electrical machinery; chemicals; other transport equipment and non-electrical (http://www.oecd.org/sti/ind/48350231.pdf).

We thank Luca David Opromolla for this suggestion.

In addition, we assume that firm-specific shocks to A and K are not correlated with each other or with the demand shock \(\rho \left( {\gamma_{d} , \gamma_{A} } \right) = 0,\;\rho \left( {\gamma_{d} , \gamma_{K} } \right) = 0, \rho \left( {\gamma_{A} , \gamma_{K} } \right) = 0\), while the demand shocks of production markets can be correlated, but are not perfectly correlated \(- 1 < \left| {\rho \left( {\gamma_{p} , \gamma_{{p_{m}^{ *} }} } \right)} \right| < 1\) for every foreign market m and \(- 1 < \left| {\rho \left( {\gamma_{{p_{j}^{ *} }} , \gamma_{{p_{m}^{ *} }} } \right)} \right| < 1\) for every foreign market m ≠ j.

References

Amador, J., Cabral, S., & Maria, J., R. (2011). A simple cross-country index of trade specialization. Open Economies Review, 22, 447–461.

Amador, J., & Opromolla, L. D. (2012). Product and destination mix in export markets. Review of World Economics, 149(1), 23–53.

Arkolakis, C., & Muendler, M.-A. (2013). Exporters and their products: A collection of empirical regularities. CESifo Economic Studies, 59(2), 223–248.

Autor, D. H., Dorn, D., & Hanson, G. H. (2013). The china syndrome: Local labor market effects of import competition in the United States. American Economic Review, 103(6), 2121–2168.

Bakker, B. B., & Gulde, A.-M. (2010). The credit boom in the EU new member states: Bad luck or bad policies? (IMF Working Papers) (pp. 1–45).

Becker, B. J., & Wu, M.-J. (2007). The synthesis of regression slopes in meta-analysis. Statistical Science, 22(3), 414–429.

Benatti, N. (2014). Initial quality report of the CompNet WS2 data. ECB Directorate General Statistics.

Berman, N., Berthou, A., & Héricourt, J. (2015). Export dynamics and sales at home. Journal of International Economics, 96(2), 298–310.

Bernard, A. B., Bradford Jensen, J., Redding, S. J., & Schott, P. K. (2012). The empirics of firm heterogeneity and international trade. Annual Review of Economics, 4(1), 283–313.

Bernard, A. B., Redding, S. J., & Schott, P. K. (2010). Multiple-product firms and product switching. American Economic Review, 100(1), 70–97.

Bernard, A. B., Redding, S. J., & Schott, P. K. (2011). Multiproduct firms and trade liberalization. The Quarterly Journal of Economics, 126(3), 1271–1318.

Buch, C. M., Döpke, J., & Strotmann, H. (2009). Does export openness increase firm-level output volatility? World Economy, 32(4), 531–551.

Comin, D., & Philippon, T. (2005). The rise in firm-level volatility: Causes and consequences. National Bureau of Economic Research, Inc. (NBER Working Paper 11388).

De Backer, K., & Miroudot, S. (2014). Mapping global value chains. European Central Bank. (Working Paper Series 1677).

di Giovanni, J., & Levchenko, A. A. (2009). Trade openness and volatility. The Review of Economics and Statistics, 91(3), 558–585.

di Giovanni, J., & Levchenko, A. A. (2010). Putting the parts together: Trade, vertical linkages, and business cycle comovement. American Economic Journal: Macroeconomics, 2(2), 95–124.

di Giovanni, J., & Levchenko, A. A. (2012). Country size, international trade, and aggregate fluctuations in granular economies. Journal of Political Economy, 120(6), 1083–1132.

di Giovanni, J., Levchenko, A. A., & Mejean, I. (2014). Firms, destinations, and aggregate fluctuations. Econometrica, 82(4), 1303–1340.

di Giovanni, J., Levchenko, A. A., & Mejean, I. (2017). Large firms and international business cycle comovement. American Economic Review, 107(5), 598–602.

Eckel, C., Iacovone, L., Javorcik, B., & Peter Neary, J. (2016). Testing the core-competency model of multi-product exporters. Review of International Economics, 24(4), 699–716.

Esposito, F. (2016). Risk diversification and international trade. Society for Economic Dynamics. (2016 Meeting Papers, Vol. 302).

Fort, T. C., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). How firms respond to business cycles: The role of firm age and firm size. IMF Economic Review, 61(3), 520–559.

Gervais, A. (2017). Uncertainty, risk aversion and international trade. https://doi.org/10.2139/ssrn.2711276.

Girma, S., Lancheros, S., & Riaño, A. (2016). Global engagement and returns volatility. Oxford Bulletin of Economics and Statistics, 78(6), 814–833.

Koren, M., & Tenreyro, S. (2007). Volatility and development. The Quarterly Journal of Economics, 122(1), 243–287.

Koren, M., & Tenreyro, S. (2013). Technological diversification. American Economic Review, 103(1), 378–414.

Kurz, C., & Senses, M. Z. (2016). Importing, exporting, and firm-level employment volatility. Journal of International Economics, 98(January), 160–175.

Lopez-Garcia, P., & di Mauro, F. (2015). Assessing European competitiveness: The new CompNet microbased database. European Central Bank. (Working Paper Series 1764).

Maggioni, D., Turco, A. L. O., & Gallegati, M. (2014). Does export complexity matter for firms’ output volatility? Universita’ Politecnica delle Marche (I), Dipartimento di Scienze Economiche e Sociali. (Working Papers. 407).

Manova, K., & Zhang, Z. (2012). Multi-product firms and product quality. National Bureau of Economic Research, Inc. (NBER Working Papers. 18637).

Navaretti, G. B., Checchi, D., & Turrini, A. (2003). Adjusting labor demand: Multinational versus national firms: A cross-European analysis. Journal of the European Economic Association, 1(2–3), 708–719.

Nguyen, D. X., & Schaur, G. (2012). Import and export linkages transmit volatility across markets. Manuscript. www.econ.ku.dk/nguyen/papers/NguyenSchaur2012.pdf.

Riaño, A. (2011). Exports, investment and firm-level sales volatility. Review of World Economics, 147(4), 643–663.

Vannoorenberghe, G. (2012). Firm-level volatility and exports. Journal of International Economics, 86(1), 57–67.

Vannoorenberghe, G., Wang, Z., & Zhihong, Yu. (2016). Volatility and diversification of exports: Firm-level theory and evidence. European Economic Review, 89, 216–247.

Wagner, J. (2012). International trade and firm performance: A survey of empirical studies since 2006. Review of World Economics (Weltwirtschaftliches Archiv), 148(2), 235–267.

Acknowledgements

The authors are grateful to Holger Görg an two anonymous referees and to Elena Bobeika, Luca David Opromolla, Karsten Staehr, Priit Vahter, the participants at presentations held in Bratislava, Frankfurt, Tallinn,Brno, and at the ETSG conference in Paris for their insightful comments; to Robin Hazlehurst for his excellent language editing; and for the financial support from Estonian Research Council Grant IUT20-49.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of neither the Bank of Estonia, the Eurosystem nor the National Bank of Romania, the National Bank of Slovakia, the Bank of Slovenia or the European Commission.

Appendices

Appendix 1: Theoretical model of export diversification and output volatility

Firm i produces output Y it using the Cobb–Douglas production function with constant returns to scale and with domestic labour L it with share \(\alpha\) and domestic capital K it as inputs. Producers’ technology, A it is subject to firm-specifics shocks. Firm sells a time-invariant share, 1 − λ i of output domestically for price p t and exports the rest. The firm can sell to one or more foreign markets m for \(p_{mt}^{*}\) price, with the sum of foreign market shares, \(\mathop \sum \nolimits_{m = 1}^{M} \lambda_{mi}^{*}\), totalling λ i . Exporting cost per unit of product for each destination market, c mt . Firms’ maximisation in the equilibrium yields:

Where denoting the labour supply and demand elasticities with \(\eta^{\text{S}}\) and \(\eta^{\text{D}} :\;d_{it} = \left[ {p_{t} (1 - \lambda_{i} ) + \mathop \sum \nolimits_{m = 1}^{M} \left( {p_{mt}^{*} - c_{m} } \right)\lambda_{mi}^{*} } \right]\), \(\beta_{0} = \alpha \left[ {\eta^{D} \eta^{S} /\left( {\eta^{D} + \eta^{S} } \right)} \right]ln\alpha\), \(\beta_{1} = 1 + \alpha \left[ {\eta^{D} \eta^{S} /\left( {\eta^{D} + \eta^{S} } \right)} \right]\), \(\beta_{2} = \alpha \left[ {\eta^{D} \eta^{S} /\left( {\eta^{D} + \eta^{S} } \right)} \right]\), \(\beta_{3} = 1 - \alpha\). Variables with bars denote equilibrium values and time subscripts suppressed.

We assume the firm faces random technology, demand and capital cost shocks, \(\gamma_{A} ,\;\gamma_{d} \; {\text{and}}\;\gamma_{K}\) respectively. The variables can be then defined as \(= \bar{A}e^{{\gamma_{A} }} ,d = \bar{d}e^{{\gamma_{d} }} = \bar{d}e^{{\gamma_{p} \left( {1 - \lambda } \right) + \mathop \sum \limits_{m} \gamma_{{p_{m}^{*} }} \lambda_{m}^{*} }}\), and \(K = \bar{K}e^{{\gamma_{K} }}\), where the demand shock depends on the domestic and foreign demand shocks.Footnote 17 Deriving the expressions of output with random shocks over the equilibrium output, we obtain the following expression for the variance of the output growth.

If a firm is producing for one market only, be it domestic or foreign, the variance of output depends on three components: variance of productivity shocks, variance of demand shocks in the market, and variance of shocks to capital. If a firm is producing not for one but for M markets, then the output volatility equation is composed of \(\left( {{\text{M}}^{2} + 2} \right)\) components, which are two variances representing the technology and capital cost shocks, M variances to the demand shocks, and \(\frac{{{\text{M}}\left( {{\text{M}} - 1} \right)}}{2}\) double covariances between the demand shocks for all the markets. Due to the complexity of relations, entry to an additional market could either decrease output volatility because of the diversification effect in the covariance terms, or increase the output volatility because of the high variance or covariance of demand shocks of a firm in additional markets.

Appendix 2: Diversification of products exported and destination markets in 2008 and 2012

See Fig. 3.

Diversification of products exported (left panel) and destination markets (right panel), manufacturing, 2008 and 2012. Note: The figures are inspired by the presentation by Arkolakis and Muendler (2013) of exporter scope distribution.

Appendix 3: Estimates of concentration and volatility over different time spans, 2004–2012

See Table 11.

Appendix 4: Estimates of concentration and volatility over different time spans, alternative measure of concentration, 2004–2012

See Table 12.

Appendix 5: Estimates of concentration and volatility over different time spans, volatility over 6 years, 2004–2012

See Table 13.

About this article

Cite this article

Čede, U., Chiriacescu, B., Harasztosi, P. et al. Export characteristics and output volatility: comparative firm-level evidence for CEE countries. Rev World Econ 154, 347–376 (2018). https://doi.org/10.1007/s10290-018-0312-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-018-0312-x