Collection

Special Issue: International Financial Management and Valuation

- Submission status

- Closed

Certainly, international financial management and valuation is a special discipline in the broader field of finance. According to our analysis of the annual meetings of the European Finance Association, such topics are of persistent relevance, especially with respect to issues of foreign exchange management and asset pricing.

Our limited review of the textbook literature on international financial management has shown that international parity conditions, in particular the uncovered interest rate parity, the unbiasedness forward-rate hypothesis and the efficient markets version of the relative purchasing power parity continue to be the prevalent paradigms since the breakdown of the Bretton Woods system 50 years ago. An enormous amount of empirical research has shown that no exchange rate forecasting method is infallible and that some empirical anomalies still challenge economic theory, at least for some forecasting horizons, exchange rates and periods. However, empirical research also indicates that no pervasive trading strategies to “beat the market” can be devised after considering transaction costs and risk. The assumption of sufficient market integration appears to be the prevalent assumption in most textbooks on international financial management. Cross-border valuation of businesses or projects in less developed countries, where a high degree of segmentation must be considered, remains both a theoretical and practical challenge.

In a similar way, the topics presented in this special issue on international financial management show clearly that this is an area of ongoing research with high demand for practical applications. Schüler presents a comprehensive model for cross-border valuation, while Bartram, Lohre, Poe, and Ranganathan deliver a tour de force through the empirical research on relevant investment factors for different asset classes across the globe from the perspective of an institutional investor. Hammer, Janssen, and Schwetzler as well as Bobenhausen and Salzmann show how information asymmetries in cross-border situations influence the value of the investment target in private transactions or in public offerings. All these contributions give valuable theoretical and empirical insights for investment and financing decisions that management or investors need to consider in an international context. It shows that fruitful developments relating to academic research and its practical application are and will remain a key feature of this field of financial economics.

Editors

-

Wolfgang Breuer

Department of Finance, RWTH Aachen University, Aachen, Germany

-

Santiago Ruiz de Vargas

Advisory Services, NOERR AG WPG StBG, Munich, Germany

Articles (5 in this collection)

-

-

Navigating the factor zoo around the world: an institutional investor perspective

Authors (first, second and last of 4)

- Söhnke M. Bartram

- Harald Lohre

- Ananthalakshmi Ranganathan

- Content type: Original Paper

- Open Access

- Published: 26 April 2021

- Pages: 655 - 703

-

Discount, transparency and announcements effects of equity rights offerings: international evidence

Authors

- Nils-Christian Bobenhausen

- Astrid Juliane Salzmann

- Content type: Original Paper

- Open Access

- Published: 08 January 2021

- Pages: 733 - 758

-

Cross-border buyout pricing

Authors

- Benjamin Hammer

- Nils Janssen

- Bernhard Schwetzler

- Content type: Original Paper

- Open Access

- Published: 23 December 2020

- Pages: 705 - 731

-

Cross-border DCF valuation: discounting cash flows in foreign currency

Authors

- Andreas Schüler

- Content type: Original Paper

- Open Access

- Published: 01 October 2020

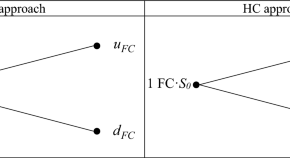

- Pages: 617 - 654