Abstract

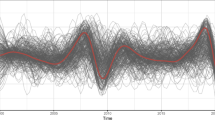

Time series generated by a complex hierarchical system exhibit various types of dynamics at different time scales. A financial time series is an example of such a multiscale structure with time scales ranging from minutes to several years. In this paper we decompose the volatility of financial indices into five intrinsic components and we show that it has a heterogeneous scale structure. The small-scale components have a stochastic nature and they are independent 99% of the time, becoming synchronized during financial crashes and enhancing the heavy tails of the volatility distribution. The deterministic behavior of the large-scale components is related to the nonstationarity of the financial markets evolution. Our decomposition of the financial volatility is a superstatistical model more complex than those usually limited to a superposition of two independent statistics at well-separated time scales.

Similar content being viewed by others

References

L.F. Costa, O.N. Oliveira, G. Travieso, F.A. Rodrigues, P.R.V. Boas, L. Antiqueira, M.P. Viana, L.E.C. da Rocha, Adv. Phys. 60, 329 (2011)

A.L. Barabási, E. Ravasz, Z. Oltvai, in Statistical Mechanics of Complex Networks, edited by R. Pastoras-Satorras, M. Rubi, A. Diaz-Guilera (Springer, Berlin, 2003)

M.M. Dacorogna, R. Gençay, U.A. Müller, R.B. Olsen, O.V. Pictet, An Introduction to High-Frequency Finance (Academic Press, San Diego, 2001)

R.S. Tsay, Analysis of Financial Time Series (Wiley, Hoboken, 2010)

C. Beck, E.G.D. Cohen, Physica A 322, 267 (2003)

C. Beck, Philos. Trans. R. Soc. A 369, 453 (2011)

D.N. Sob’yanin, Phys. Rev. E 84, 051128 (2011)

C. Beck, Braz. J. Phys. 39, 357 (2009)

C. Beck, Phys. Rev. Lett. 98, 064502 (2007)

J. Gao, Y. Cao, W. Tung, J. Hu, Multiscale Analysis of Complex Time Series (Wiley, Hoboken, 2007)

D.B. Percival, A.T. Walden, Wavelet Methods for Time Series Analysis (Cambridge University Press, Cambridge, 2000)

N.E. Huang, Z. Shen, S.R. Long, M.C. Wu, H.H. Shih, Q. Zheng, N.C. Yen, C.C. Tung, H.H. Liu, Proc. R. Soc. London A 454, 903 (1998)

R. Cont, Quant. Financ. 1, 223 (2001)

S.J. Taylor, Asset Price Dynamics, Volatility, and Prediction (Princeton University Press, Princeton, 2007)

E. Van der Straeten, C. Beck, Phys. Rev. E 80, 036108 (2009)

A. Gerig, J. Vicente, M.A. Fuentes, Phys. Rev. E 80, 065102 (2009)

C. Vamoş, M. Crăciun, Phys. Rev. E 81, 051125 (2010)

C. Vamoş, M. Crăciun, Eur. Phys. J. B 86, 166 (2013)

Y. Liu, P. Gopikrishnan, P. Cizeau, M. Meyer, C.-K. Peng, H.E. Stanley, Phys. Rev. E 60, 1390 (1999)

C. Vamoş, M. Crăciun, Automatic Trend Estimation (Springer, Dordrecht, 2012)

P. Chaudhuri, J.S. Marron, J. Am. Stat. Assoc. 94, 807 (1999)

C. Vamoş, Phys. Rev. E 75, 036705 (2007)

J.A. Schumpeter, Business Cycles. A Theoretical, Historical and Statistical Analysis of the Capitalist Process (McGraw-Hill, New York, 1939)

P.J. Brockwell, R.A. Davies, Time Series: Theory and Methods (Springer-Verlag, New York, 1996)

S. Van Bellegem, in Wiley Handbook in Financial Engineering and Econometrics: Volatility Models and Their Applications, edited by L. Bauwens, C. Hafner, S. Laurent (Wiley, New York, 2011)

R.F. Engle, J.G. Rangel, Rev. Financ. Stud. 21, 1187 (2008)

J. Voit, The Statistical Mechanics of Financial Markets (Springer, Berlin, 2005)

S.I. Resnick, Heavy tails Phenomena. Probabilistic and Statistical Modeling (Springer, New York, 2007)

C.C. Heyde, S.G. Kou, Oper. Res. Lett. 32, 399 (2004)

J.P. Onnela, A. Chakraborti, K. Kaski, J. Kertész, A. Kanto, Phys. Rev. E 68, 056110 (2003)

M. McDonald, O. Suleman, S. Williams, S. Howison, N.F. Johnson, Phys. Rev. E 77, 046110 (2008)

T.K.D. Peron, F.A. Rodrigues, Europhys. Lett. 96, 48004 (2011)

A. Arenas, A. Díaz-Guilera, J. Kurths, Y. Moreno, C. Zhou, Phys. Rep. 469, 93 (2008)

M.E.J. Newman, Contemp. Phys. 46, 323 (2005)

S. Gheorghiu, M.-O. Coppens, Proc. Natl. Acad. Sci. 101, 15852 (2004)

P. Gopikrishnan, V. Plerou, L.A.N. Amaral, M. Meyer, H.E. Stanley, Phys. Rev. E 60, 5305 (1999)

V. Plerou, P. Gopikrishnan, L.A.N. Amaral, M. Meyer, H.E. Stanley, Phys. Rev. E 60, 6519 (1999)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vamoş, C., Crăciun, M. Intrinsic superstatistical components of financial time series. Eur. Phys. J. B 87, 301 (2014). https://doi.org/10.1140/epjb/e2014-50596-y

Received:

Revised:

Published:

DOI: https://doi.org/10.1140/epjb/e2014-50596-y