Abstract

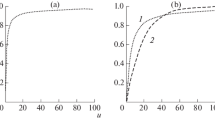

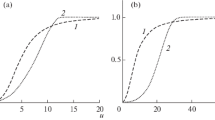

Previous and new results are used to compare two mathematical insurance models with identical insurance company strategies in a financial market, namely, when the entire current surplus or its constant fraction is invested in risky assets (stocks), while the rest of the surplus is invested in a risk-free asset (bank account). Model I is the classical Cramér–Lundberg risk model with an exponential claim size distribution. Model II is a modification of the classical risk model (risk process with stochastic premiums) with exponential distributions of claim and premium sizes. For the survival probability of an insurance company over infinite time (as a function of its initial surplus), there arise singular problems for second-order linear integrodifferential equations (IDEs) defined on a semiinfinite interval and having nonintegrable singularities at zero: model I leads to a singular constrained initial value problem for an IDE with a Volterra integral operator, while II model leads to a more complicated nonlocal constrained problem for an IDE with a non-Volterra integral operator. A brief overview of previous results for these two problems depending on several positive parameters is given, and new results are presented. Additional results are concerned with the formulation, analysis, and numerical study of “degenerate” problems for both models, i.e., problems in which some of the IDE parameters vanish; moreover, passages to the limit with respect to the parameters through which we proceed from the original problems to the degenerate ones are singular for small and/or large argument values. Such problems are of mathematical and practical interest in themselves. Along with insurance models without investment, they describe the case of surplus completely invested in risk-free assets, as well as some noninsurance models of surplus dynamics, for example, charity-type models.

Similar content being viewed by others

References

J. Grandell, Aspects of Risk Theory (Springer-Verlag, Berlin, 1991).

V. Yu. Korolev, V. E. Bening, and S. Ya. Shorgin, Mathematical Foundations of Risk Theory (Fizmatlit, Moscow, 2007) [in Russian].

N. L. Bowers, H. U. Gerber, J. C. Hickman, D. A. Jones, and C. J. Nesbitt, Actuarial Mathematics (Soc. of Actuaries, Itasca, IL, 1986; Yanus-K, Moscow, 2001).

S. Asmussen and H. Albrecher, Ruin Probabilities (World Scientific, Singapore, 2010).

T. A. Belkina, N. B. Konyukhova, and A. O. Kurkina, “Optimal investment problem in dynamic insurance models: II. Cramér–Lundberg model with exponential claim size distribution,” Obozr. Prikl. Promyshl. Mat. (Sekts. Finans. Strakh. Mat.) 17 (1), 3–24 (2010).

T. A. Belkina, N. B. Konyukhova, and S. V. Kurochkin, “Singular initial value problem for linear integrodifferential equation arising in insurance models,” Int. Sci. J. Spectral Evolution Probl. 21 (1), 40–54 (2011).

T. A. Belkina, N. B. Konyukhova, and S. V. Kurochkin, “Singular boundary value problem for the integrodifferential equation in an insurance model with stochastic premiums: Analysis and numerical solution,” Comput. Math. Math. Phys. 52 (10), 1384–1416 (2012).

T. Belkina, N. Konyukhova, and S. Kurochkin, “Singular problems for integro-differential equations in dynamic insurance models,” in Differential and Difference Equations with Applications (Springer, Berlin, 2013), Vol. 47, pp. 27–44.

T. A. Belkina, N. B. Konyukhova, and S. V. Kurochkin, “Singular initial and boundary value problems for integro- differential equations in dynamic insurance models with investment,” Sovrem. Mat. Fundam. Napravl. 53, 5–29 (2014).

T. A. Belkina, “Sufficiency theorems for survival probability in dynamic insurance models with investment,” in Analysis and Modeling of Economic Processes, Ed. by V. Z. Belen’kii (Tsentr. Ekonomiko-Mat. Inst. Ross. Akad. Nauk, Moscow, 2011), Vol. 8, pp. 61–74 (http://wwwcemirssiru/publication/books/).

T. A. Belkina, “Risky investment for insurers and sufficiency theorems for the survival probability,” Markov Processes Related Fields 20, 505–525 (2014).

J. Paulsen and H. K. Gjessing, “Ruin theory with stochastic return on investments,” Adv. Appl. Probab. 29 (4), 965–985 (1997).

A. Frolova, Yu. Kabanov, and S. Pergamenshchikov, “In the insurance business risky investments are dangerous,” Finance Stoch. 6 (2), 227–235 (2002).

S. Pergamenshchikov and O. Zeitouny, “Ruin probability in the presence of risky investments,” Stochastic Process. Appl. 116 (2), 267–278 (2006).

A. V. Boikov, Candidate’s Dissertation in Mathematics and Physics (Steklov Mathematical Inst., Russ. Acad. Sci., Moscow, 2003).

A. Ramos, PhD Thesis (Univ. Carlos III de Madrid, Madrid, 2009) (http://e-archivouc3mes/haudle/ 10016/5631).

L. Bachelier, “Theorie de la speculation,” Ann. Sci. Ecole Norm. Super. 17, 21–86 (1900).

T. A. Belkina, N. B. Konyukhova, and A. O. Kurkina, “Optimal investment problem in dynamic insurance models: I. Investment strategies and ruin probability,” Obozr. Prikl. Promyshl. Mat. (Sekts. Finans. Strakh. Mat.) 16 (6), 961–981 (2009).

R. Bellman, Stability Theory of Differential Equations (McGraw-Hill, New York, 1953; Inostrannaya Literatura, Moscow, 1954).

M. V. Fedoryuk, Asymptotic Analysis: Linear Ordinary Differential Equations (Nauka, Moscow, 1983; Springer, Berlin, 1993).

E. A. Coddington and N. Levinson, Theory of Ordinary Differential Equations (McGraw-Hill, New York, 1955; Inostrannaya Literatura, Moscow, 1958).

W. R. Wasow, Asymptotic Expansions for Ordinary Differential Equations (Wiley, New York, 1965; Mir, Moscow, 1968).

E. Kamke, Differentialgleichungen: Lösungmethoden und Lösungen: I. Gewöhnlishe Differentialgleishungen (Akademie-Verlag, Leipzig, 1959; Nauka, Moscow, 1971).

E. S. Birger and N. B. Lyalikova (Konyukhova), “Discovery of the solutions of certain systems of differential equations with a given condition at infinity I,” USSR Comput. Math. Math. Phys. 5 (6), 1–17 (1965); “On finding the solutions for a given condition at infinity of certain systems of ordinary differential equations II,” 6 (3), 47–57 (1966).

N. B. Konyukhova, “Singular Cauchy problems for systems of ordinary differential equations,” USSR Comput. Math. Math. Phys. 23 (3), 72–82 (1983).

T. A. Belkina, C. Hipp, S. Luo, and M. Taksar, “Optimal constrained investment in the Cramér–Lundberg model,” Scand. Actuarial J., No. 5, 383–404 (2014).

N. B. Konyukhova, “Singular Cauchy problems for singularly perturbed systems of nonlinear ordinary differential equations,” I: Differ. Equations 32 (1), 54–63 (1996), II: Differ. Equations 32 (4), 491–500 (1996).

Higher Transcendental Functions (Bateman Manuscript Project), Ed. by A. Erdelyi (McGraw-Hill, New York, 1953; Nauka, Moscow, 1965).

H. Gingold and S. Rosenblat, “Differential equations with moving singularities,” SIAM J. Math. Anal. 7 (6), 942–957 (1976).

A. V. Boikov, “The Cramér–Lundberg model with stochastic premium process,” Theory Probab. Appl. 47, 489–493 (2003).

N. Zinchenko and A. Andrusiv, “Risk processes with stochastic premiums,” Theory Stoch. Processes 14 (3–4), 189–208 (2008).

G. Temnov, “Risk models with stochastic premium and ruin probability estimation,” J. Math. Sci. 196 (1), 84–96 (2014).

N. V. Azbelev, V. P. Maksimov, and L. F. Rakhmatulina, Introduction to the Theory of Functional Differential Equations (Nauka, Moscow, 1991) [in Russian].

N. B. Konyukhova, “Singular Cauchy problems for some systems of nonlinear functional-differential equations,” Differ. Equations 31 (8), 1286–1293 (1995).

N. B. Konyukhova, “Singular problems for systems of nonlinear functional-differential equations,” Int. Sci. J. Spectral Evolution Probl. 20, 199–214 (2010).

A. A. Abramov, “On the transfer of the condition of boundedness for some systems of ordinary linear differential equations,” USSR Comput. Math. Math. Phys. 1 (4), 875–881 (1962).

A. A. Abramov, K. Balla, and N. B. Konyukhova, “Transfer of boundary conditions from singular points for systems of ordinary differential equations,” in Reports on Applied Mathematics (Vychisl. Tsentr Akad. Nauk SSSR, Moscow, 1981) [in Russian].

A. A. Abramov, N. B. Konyukhova, and K. Balla, “Stable initial manifolds and singular boundary value problems for systems of ordinary differential equations,” Comput. Math. Banach Center Publ. 13, 319–351 (1984).

A. A. Abramov and N. B. Konyukhova, “Transfer of admissible boundary conditions from a singular point for systems of linear ordinary differential equations,” in Reports on Applied Mathematics (Vychisl. Tsentr Akad. Nauk SSSR, Moscow, 1985) [in Russian].

A. A. Abramov and N. B. Konyukhova, “Transfer of admissible boundary conditions from a singular point for systems of linear ordinary differential equations,” Sov. J. Numer. Anal. Math. Model. 1 (4), 245–265 (1986).

A. A. Abramov, V. V. Ditkin, N. B. Konyukhova, B. S. Pariiskii, and V. I. Ul’yanova, “Evaluation of the eigenvalues and eigenfunctions of ordinary differential equations with singularities,” USSR Comput. Math. Math. Phys. 20 (5), 63–81 (1980).

A. A. Abramov, “On the transfer of boundary conditions for systems of ordinary linear differential equations (a variant of the dispersive method),” USSR Comput. Math. Math. Phys. 1 (1), 617–622 (1961).

N. S. Bakhvalov, Numerical Methods: Analysis, Algebra, Ordinary Differential Equations (Nauka, Moscow, 1973; Mir, Moscow, 1977).

V. Kalashnikov and R. Norberg, “Power tailed ruin probabilities in the presence of risky investments,” Stoch. Proc. Appl. 98, 211–228 (2002).

B. Laubis and J.-E. Lin, “Optimal investment allocation in a jump diffusion risk model with investment: A numerical analysis of several examples,” Proceedings of the 43rd Actuarial Research Conference, 2008 (http://wwwsoaorg/news-and-publications/publications/proceedings/arch/arch-2009-isslaspx).

Author information

Authors and Affiliations

Corresponding author

Additional information

Original Russian Text © T.A. Belkina, N.B. Konyukhova, S.V. Kurochkin, 2016, published in Zhurnal Vychislitel’noi Matematiki i Matematicheskoi Fiziki, 2016, Vol. 56, No. 1, pp. 47–98.

Rights and permissions

About this article

Cite this article

Belkina, T.A., Konyukhova, N.B. & Kurochkin, S.V. Dynamical insurance models with investment: Constrained singular problems for integrodifferential equations. Comput. Math. and Math. Phys. 56, 43–92 (2016). https://doi.org/10.1134/S0965542516010073

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S0965542516010073

Keywords

- Cramér–Lundberg-type dynamical insurance models with deterministic and stochastic premiums

- exponential distributions of premium and claim sizes

- investments in risky and risk-free assets

- survival probability of an insurance company as a function of its initial surplus

- second-order linear IDEs on a half-line with Volterra and non-Volterra integral operators

- singular initial value and nonlocal constrained problems

- degenerate problems

- related singular problems for ordinary differential equations

- existence

- uniqueness

- behavior of solutions

- numerical solution algorithms

- numerical results

- comparison of models