Abstract

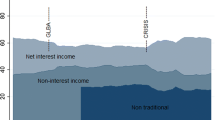

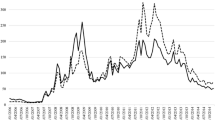

This paper investigates risk shifting in commercial banks in the emerging market of Vietnam, where banks fund domestic asset portfolios almost exclusively from deposits and with limited issuance of securities. We investigate the relationship between these banks’ income diversification strategies and their overall level of risk during the recent period of deregulation and global financial crisis. Our results show that those commercial banks that have shifted to non-interest income activities in fact face higher levels of risk. This finding is at odds with theories that argue that diversification is a strategy for risk reduction and has broader implications for domestic system stability. The analysis provides a framework for evaluating these issues in other emerging markets.

Similar content being viewed by others

References

Acharya, V.V., Hasan, I., and Saunders, A. (2006) Should banks be diversified? Evidence from individual bank loan portfolios. The Journal of Business 79(3): 1355–1412.

Acquaah, M. (2015) Determinants of corporate listings on stock markets in Sub-Saharan Africa: Evidence from Ghana. Emerging Markets Review 22: 154–175.

Ahmed, A.D. (2016) Integration of financial markets, financial development and growth: Is Africa different? Journal of International Financial Markets Institutions and Money 42: 43–59.

Andreasen, E., and Valenzuela, P. (2016) Financial openness, domestic financial development and credit ratings. Finance Research Letters 16: 11–18.

Anzoategui, D., Pería, M.S.M., and Melecky, M. (2012) Bank competition in Russia: An examination at different levels of aggregation. Emerging Markets Review 13(1): 42–57.

Athanasoglou, P.P., Brissimis, S.N., and Delis, M.D. (2008) Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money 18(2): 121–136.

Baele, L., De Jonghe, O., and Vennet, R.V. (2007a) Does the stock market value bank diversification? Journal of Banking & Finance 31(7): 1999–2023.

Baele, L., Jonghe, O.D., and Vennet, R.V. (2007b) Does the stock market value bank diversification? Journal of Banking & Finance 31: 1999–2023.

Battaglia, F., and Gallo, A. (2015) Risk governance and Asian bank performance: An empirical investigation over the financial crisis. Emerging Markets Review 25: 53–68.

Beale, N., Rand, D.G., Battey, H., Croxson, K., May, R.M., and Nowak, M.A. (2011) Individual versus systemic risk and the Regulator’s Dilemma. Proceedings of the National Academy of Sciences of the United States of America 108(31): 12647–12652.

Boyd, J., Chang, C., and Smith, D. (1998) Moral hazard under commercial and universal banking. Journal of Money, Credit and Banking 30(3): 426–468.

Boyd, J., Hanweck, G. and Pithyachariyakul, P. (1980) Bank holding company diversification. In: Proceedings from a conference on bank structure and competition, may. Federal Reserve Bank of Chicago: (pp. 105–120).

Cai, K., and Zhu, H. (2015) Cultural distance and foreign IPO underpricing variations. Journal of Multinational Financial Management 29: 99–114.

Carlson, M. (2004) Are branch banks better survivors? Evidence from the depression era Economic Inquiry 42(1): 111–126.

Castro, F., Kalatzis, A.E.G., and Martins-Filho, C. (2015) Financing in an emerging economy: Does financial development or financial structure matter? Emerging Markets Review 23: 96–123.

Ciarlone, A., and Miceli, V. (2016) Escaping financial crises? Macro evidence from sovereign wealth funds’ investment behaviour. Emerging Markets Review 27: 169–196.

Claessens, S., and Laeven, L. (2004) What drives bank competition? Some international evidence. Journal of Money, Credit and Banking 36: 563–583.

De Jonghe, O. (2010) Back to the basics in banking? A micro-analysis of banking system stability. Journal of Financial Intermediation 19(3): 387–417.

Demirgüç-Kunt, A., and Huizinga, H. (2010) Bank activity and funding strategies: The impact on risk and returns. Journal of Financial Economics 98(3): 626–650.

Dewandaru, G., Rizvi, S.A.R., Bacha, O.I., and Masih, M. (2014) What factors explain stock market retardation in Islamic Countries. Emerging Markets Review 19: 106–127.

DeYoung, R., and Roland, K. (2001) Product mix and earnings volatility at commercial banks: Evidence from a degree of total leverage model. Journal of Financial Intermediation 10: 54–84.

Doumpos, M., Gaganis, C. and Pasiouras, F. (2016) Bank diversification and overall financial strength: International evidence. Financial Markets, Institutions & Instruments 25: 169–213.

Elsas, R., Hackethal, A., and Holzhäuser, M. (2010) The anatomy of bank diversification. Journal of Banking & Finance 34(6): 1274–1287.

Elyasiani, E., and Wang, Y. (2012) Bank holding company diversification and production efficiency. Applied Financial Economics 22(17): 1409–1428.

Fan, J.P.H., Gillan, S.L., and Yu, X. (2013) Property rights, R&D spillovers, and corporate accounting transparency in China. Emerging Markets Review 15: 34–56.

Froot, K.A., Scharfstein, D.S., and Stein, J.C. (1993) Risk management: Coordinating corporate investment and financing policies. The Journal of Finance 48(5): 1629–1658.

Froot, K.A., and Stein, J.C. (1998) Risk management, capital budgeting, and capital structure policy for financial institutions: An integrated approach. Journal of Financial Economics 47(1): 55–82.

Gallo, J., Apilado, V., and Kolari, J. (1996) Commercial bank mutual fund activities: Implications for bank risk and profitability. Banking and Finance 20: 1775–1791.

García-Herrero, A., and Vázquez, F. (2013) International diversification gains and home bias in banking. Journal of Banking & Finance 37(7): 2560–2571.

Gimet, C., and Lagoarde-Segot, T. (2012) Financial sector development and access to finance: Does size say it all? Emerging Markets Review 13(3): 316–337.

Goetz, M.R., Laeven, L., and Levine, R. (2016) Does the geographic expansion of banks reduce risk? Journal of Financial Economics 120(2): 346–362.

Grassa, R. (2012) Islamic banks’ income structure and risk: Evidence from gcc countries. Accounting Research Journal 25(3): 227–241.

Gulamhussen, M.A., Pinheiro, C., and Pozzolo, A.F. (2014) International diversification and risk of multinational banks: Evidence from the pre-crisis period. Journal of Financial Stability 13: 30–43.

Guyot, A., Lagoarde-Segot, T., and Neaime, S. (2014) Foreign shocks and international cost of equity destabilization: Evidence from the MENA region. Emerging Markets Review 18: 101–122.

Hou, X., Wang, Q., and Li, C. (2015) Role of off-balance sheet operations on bank scale economies: Evidence from China’s banking sector. Emerging Markets Review 22: 140–153.

John, K., John, T.A., and Saunders, A. (1994) Universal banking and firm risktaking. Journal of Banking & Finance 18(2): 307–323.

Köhler, M. (2015) Which banks are more risky? The impact of business models on bank stability. Journal of Financial Stability 16: 195–212.

Kwan, S. (1998), Securities activities by commercial banking firms’ section 20 subsidiaries: Risk, return and diversification benefits. In: Economic research, Federal Reserve Bank of San Francisco.

Kwast, M. (1989) The impact of underwriting and dealing on bank returns and risks. Journal of Banking & Finance 13: 101–125.

Landskroner, Y., Ruthenberg, D., and Zaken, D. (2005) Diversification and performance in banking: The israeli case. Journal of Financial Services Research 27(1): 27–49.

Lepetit, L., Nys, E., Rous, P., and Tarazi, A. (2008) Bank income structure and risk: An empirical analysis of european banks. Journal of Banking & Finance 32(8): 1452–1467.

Liu, H., Molyneux, P., and Nguyen, L.H. (2012) Competition and risk in south east Asian commercial banking. Applied Economics 44(28): 3627–3644.

Luintel, K.B., Khan, M., Leon-Gonzalez, R., and Li, G. (2016) Financial development, structure and growth: New data, method and results. Journal of International Financial Markets Institutions and Money 43: 95–112.

Mercieca, S., Schaeck, K., and Wolfe, S. (2007) Small european banks: Benefits from diversification? Journal of Banking & Finance 31(7): 1975–1998.

Meslier, C., Tacneng, R., and Tarazi, A. (2014) Is bank income diversification beneficial? Evidence from an emerging economy. Journal of International Financial Markets Institutions and Money 31(1): 97–126.

Miletkov, M., and Wintoki, M.B. (2012) Financial development and the evolution of property rights and legal institutions. Emerging Markets Review 13(4): 650–673.

Minghua, C., Jeon, B.N., Wang, R., and Ji, W. (2015) Corruption and bank risk-taking: Evidence from emerging economies. Emerging Markets Review 24: 122–148.

Mirzaei, A., and Moore, T. (2014) What are the driving forces of bank competition across different income groups of countries? Journal of International Financial Markets Institutions and Money 32(1): 38–71.

Nguyen, J. (2012) The relationship between net interest margin and noninterest income using a system estimation approach. Journal of Banking & Finance 36(9): 2429–2437.

Nguyen, T.P.T., Nghiem, S.H., Roca, E., and Sharma, P. (2016a) Bank reforms and efficiency in Vietnamese banks: evidence based on SFA and DEA. Applied Economics 48(30): 2822–2835.

Nguyen, M., Perera, S., and Skully, M. (2016b) Bank market power, ownership, regional presence and revenue diversification: Evidence from Africa. Emerging Markets Review 27: 36–62.

Nguyen, P.A., and Simioni, M. (2015) Productivity and efficiency of Vietnamese banking system: new evidence using Färe-Primont index analysis. Applied Economics 47(41): 4395–4407.

Nguyen, M., Skully, M., and Perera, S. (2012) Market power, revenue diversification and bank stability: Evidence from selected South Asian countries. Journal of International Financial Markets Institutions and Money 22(4): 897–912.

Nyasha, S., and Odhiambo, N.M. (2015) Economic growth and market-based financial systems: A review. Studies in Economics and Finance 32(2): 235–255.

Pennathur, A.K., Subrahmanyam, V., and Vishwasrao, S. (2012) Income diversification and risk: Does ownership matter? An empirical examination of Indian banks. Journal of Banking and Finance 36(8): 2203–2215.

Phiri, A. (2015) Asymmetric cointegration and causality effects between financial development and economic growth in South Africa. Studies in Economics and Finance 32(4): 464–484.

Pradhana, R.P., Arvinb, M.B., and Norman, N.R. (2015) Insurance development and the finance-growth nexus: Evidence from 34 OECD countries. Journal of Multinational Financial Management 31: 1–22.

Puri, M. (1996) Conflicts of interest, intermediation, and the pricing of underwritten securities. Mimeo, Graduate School of Business. Stanford University, Mars

Rajan, R. (1991) Conflict of interest and the separation of commercial and investment banking, Working Paper. University of Chicago

Rossi, S.P.S., Schwaiger, M.S., and Winkler, G. (2009) How loan portfolio diversification affects risk, efficiency and capitalization: A managerial behavior model for austrian banks. Journal of Banking & Finance 33(12): 2218–2226.

Saeed, A., and Sameer, M. (2015) Financial constraints, bank concentration and SMEs: evidence from Pakistan. Studies in Economics and Finance 32(4): 503–524.

Saghi-Zedek, N. (2016) Product diversification and bank performance: Does ownership structure matter? Journal of Banking & Finance 71: 154–167.

Sanya, S., and Wolfe, S. (2011) Can banks in emerging economies benefit from revenue diversification? Journal of Financial Services Research 40(1–2): 79–101.

Saunders, A., and Walter, I. (1994) Universal Banking in the United States: What Could We Gain? What Could We Lose?. Oxford : Oxford University Press.

Sawada, M. (2013) How does the stock market value bank diversification? Empirical evidence from japanese banks. Pacific-Basin Finance Journal 25: 40–61.

Sehrawat, M., and Giri, A.K. (2015) Financial development and economic growth: Empirical evidence from India. Studies in Economics and Finance 32(3): 340–356.

Seven, U., and Coskun, Y. (2016) Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerging Markets Review 26: 34–63.

Shim, J. (2013) Bank capital buffer and portfolio risk: The influence of business cycle and revenue diversification. Journal of Banking & Finance 37(3): 761–772.

Slijkerman, J.F., Schoenmaker, D., and de Vries, C.G. (2013) Systemic risk and diversification across european banks and insurers. Journal of Banking & Finance 37(3): 773–785.

Stewart, C., Matousek, R., and Nguyen, T.N. (2016) Efficiency in the Vietnamese banking system: A DEA double bootstrap approach. Research in International Business and Finance 36: 96–111.

Stiroh, K. (2004) Diversification in banking: Is non-interest income the answer? Journal of Money, Credit and Banking 36(5): 853–882.

Stiroh, K.J., and Rumble, A. (2006) The dark side of diversification: The case of us financial holding companies. Journal of Banking & Finance 30(8): 2131–2161.

Tsai, Y.-S., Lin, C.-C., and Chen, H.-Y. (2015) Optimal diversification, bank value maximization and default probability. Applied Economics 47(24): 2488–2499.

van Oordt, M.R.C. (2014) Securitization and the dark side of diversification. Journal of Financial Intermediation 23(2), 214–231.

Vithessonthi, C. (2014) The effect of financial market development on bank risk: Evidence from Southeast Asian countries. International Review of Financial Analysis 35: 249–260.

Vithessonthi, C., and Kumarasinghe, S. (2016) Financial development, international trade integration, and stock market integration: Evidence from Asia. Journal of Multinational Financial Management 35: 79–92.

Vu, H., and Nahm, D. (2013) The determinants of profit efficiency of banks in Vietnam. Journal of the Asia Pacific Economy 18(4): 615–631.

Wang, J., and Zhou, H. (2015) Competition of trading volume among markets: Evidence from stocks with multiple cross-listing destinations. Journal of Multinational Financial Management 31: 23–62.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Batten, J.A., Vo, X.V. Bank risk shifting and diversification in an emerging market. Risk Manag 18, 217–235 (2016). https://doi.org/10.1057/s41283-016-0008-2

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41283-016-0008-2