Abstract

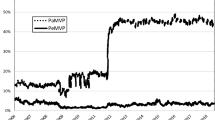

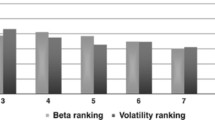

This article aims at comparing two major equity index construction methodologies, the capitalization-weighted and the equally weighted approaches. Focusing on the constituents of the DJ Euro Stoxx index from January 2002 to December 2011, it provides further evidence to add to the established literature on this topic, of the higher risk-adjusted returns achieved by equally weighted portfolios in comparison with cap-weighted indexes. The novelty of our study is that we test these findings on the Euro stock market by using four reweighting frequencies (monthly, quarterly, semiannually and annually) with the aim of identifying that which is most able to maximize the benefits of the contrarian strategy implicit in the equally weighted approach. Moreover, it is demonstrated that the excess returns are not driven solely by a ‘size effect’ that usually explains the difference in performance of the two methodologies. Finally, we confirm our results by performing a Fama-French (1992) three-factor regression analysis and also by using a portfolio approach based on the market capitalization of the index constituents. To evaluate the implementation of the EW strategy, from an operational perspective, we estimate the related transaction costs and show that trading costs are not able to affect the main results.

Similar content being viewed by others

Notes

See Swinkels (2004) for a survey on momentum investing.

European data are also used by Hemminki and Puttonen (2008) in their study on the benefits of fundamental indexation.

According to the statistics provided by Blackrock, in 2011, the market share of the IShares products in Europe, within the category of ETFs, was 70 per cent. Moreover, in December 2011, the assets under management by the IShares in Europe were €105.9 billion.

The DJ EuroStoxx and the DJ EuroStoxx 50 are composed only of stocks denominated in euro. This restriction allows a comparison of the two index construction methodologies without having to consider the trend of the exchange rates (primarily the EUR/GBP).

A negotiation fee equal to 10 bps for stock trading is relatively high for institutional investors. Our conservative assumption allows considering the possible additional transaction costs arising from the bid-ask spread characterizing smaller cap stocks.

References

Amec, N., Goltz, F. and Martellini, L. (2011) Improved beta? Journal of Indexes 14 (1): 10–19.

Arnott, R.D., Hsu, J.C. and Moore, P. (2005) Fundamental indexation. Financial Analysts Journal 61 (2): 83–99.

Bailey, J.V. (1992) Are manager universes acceptable performance benchmarks? The Journal of Portfolio Management 18 (3): 9–13.

Chow, T., Hsu, J., Kalesnik, V. and Little, B. (2011) A survey of alternative equity strategies. Financial Analysts Journal 67 (5): 37–57.

Choueifaty, Y. and Coignard, Y. (2008) Toward maximum diversification. The Journal of Portfolio Management 34 (4): 40–51.

Clarke, R., De Silva, H. and Thorley, S. (2006) Minimum-variance portfolios in the U.S. equity market. The Journal of Portfolio Management 33 (1): 10–24.

Dash, S. and Loggie, K. (2008) Equal Weight Indexing Five Years Later. S&P’s Research Report.

Dash, S. and Zeng, L. (2010) Equal Weight Indexing Seven Years Later. S&P’s Research Report.

Fama, E. and French, K. (1992) The cross-section of expected return. Journal of Finance 47 (2): 427–465.

Hauger, R.A. and Baker, N.L. (1991) The efficient market inefficiency of capitalization-weighted stock portfolios. The Journal of Portfolio Management 17 (3): 35–40.

Hemminki, J. and Puttonen, V. (2008) Fundamental indexation in Europe. Journal of Asset Management 8 (6): 401–405.

Hsu, J.C. (2006) Cap-weighted portfolios are sub-optimal portfolios. Journal of Investment Management 4 (3): 1–10.

Jegadeesh, N. and Titman, S. (1993) Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance 48 (1): 65–91.

Keim, D.B. (1983) Size-related anomalies and stock return seasonality: Further empirical evidence. Journal of Financial Economics 12 (1): 13–32.

Perold, A.F. (2007) Fundamentally flawed indexing. Financial Analysts Journal 63 (6): 31–37.

Schwert, G.W. (1983) Size and stock returns, and other empirical regularities. Journal of Financial Economics 12 (1): 3–12.

Sharpe, W.F. (1964) Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19 (3): 425–442.

Swinkels, L. (2004) Momentum investing: A survey. Journal of Asset Management 5 (2): 120–143.

Velvadapu, P. (2011) The evolution of equal weighting. Journal of Indexes 14 (1): 20–29.

Author information

Authors and Affiliations

Corresponding author

Additional information

Disclaimer STOXX Limited (‘STOXX’) is the source of Dow Jones EuroStoxx Index and the Dow Jones EuroStoxx 50 Index and STOXX or its third-party data providers are the source of the data comprised therein. STOXX has authorized the publication of a limited amount of index data in the doctoral of Enrica Bolognesi, Giuseppe Torluccio and Andrea Zuccheri published in the Journal of Asset Management. Any dissemination or further distribution of such information is prohibited. Neither STOXX nor its third-party data providers have been involved in any way in the creation of any reported information and they neither warrant nor assume any liability whatsoever – including without limitation the accuracy, adequateness, correctness, completeness, timeliness and fitness for any purpose – with respect to any reported information.

Although the article is the result of a joint effort, Section ‘Data and Methodology’ was provided by Enrica Bolognesi; Section ‘Conclusions’ was provided by G. Torluccio; Sections ‘Introduction’ and ‘Empirical Results’ was provided by Andrea Zuccheri.

Rights and permissions

About this article

Cite this article

Bolognesi, E., Torluccio, G. & Zuccheri, A. A comparison between capitalization-weighted and equally weighted indexes in the European equity market. J Asset Manag 14, 14–26 (2013). https://doi.org/10.1057/jam.2013.1

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2013.1