Abstract

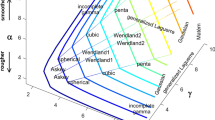

Generalized Hyperbolic distribution (Barndorff-Nielsen 1977) is a variance-mean mixture of a normal distribution with the Generalized Inverse Gaussian distribution. Recently subclasses of these distributions (e.g., the hyperbolic distribution and the Normal Inverse Gaussian distribution) have been applied to construct stochastic processes in turbulence and particularly in finance, where multidimensional problems are of special interest. Parameter estimation for these distributions based on an i.i.d. sample is a difficult task even for a specified one-dimensional subclass (subclass being uniquely defined by λ) and relies on numerical methods. For the hyperbolic subclass (λ = 1), computer program ‘hyp’ (Blæsild and Sørensen 1992) estimates parameters via ML when the dimensionality is less than or equal to three. To the best of the author's knowledge, no successful attempts have been made to fit any given subclass when the dimensionality is greater than three. This article proposes a simple EM-based (Dempster, Laird and Rubin 1977) ML estimation procedure to estimate parameters of the distribution when the subclass is known regardless of the dimensionality. Our method relies on the ability to numerically evaluate modified Bessel functions of the third kind and their logarithms, which is made possible by currently available software. The method is applied to fit the five dimensional Normal Inverse Gaussian distribution to a series of returns on foreign exchange rates.

Similar content being viewed by others

References

Abramowitz M. and Stegun I.A. 1970. Handbook of Mathematical Functions. Dover Publications Inc., New York.

Barndorff-Nielsen O.E. 1977. Exponentially decreasing distributions for the logarithm of the particle size. Proceedings of the Royal Society. London. Series A. Mathematical and Physical Sciences 353: 401-419.

Barndorff-Nielsen O.E., Jensen J.L., and Sørensen M. 1989. Wind shear and hyperbolic distributions. Boundary-Layer Meteorology 49: 417-431.

Barndorff-Nielsen O.E. 1995. Normal inverse gaussian processes and the modelling of stock returns. Research Report 300, Department of Theoretical Statistics, Aarhus University.

Barndorff-Nielsen O.E. 1997. Normal inverse Gaussian distributions and stochastic volatility modelling. Scandinavian Journal of Statistics 24: 1-14.

Barndorff-Nielsen O.E. and Shephard N. 2001. Non-Gaussian Ornstein-Uhlenbeck-based models and some of their uses in financial economics (with discussion). Journal of the Royal Statistical Society, Series B 63: 167-241.

Bibby B.M. and Sørensen M. 1997. A hyperbolic diffusion model for stock prices. Finance & Stochastics 1: 25-41.

Blæsild, P. 1981. The two-dimensional hyperbolic distribution and related distributions, with an application to Johannsen's bean data. Biometrika 68: 251-263.

Blæsild P. and Sørensen M. 1992. “hyp”-a computer program for analyzing data by means of the hyperbolic distribution. Research Report 248, Department of Theoretical Statistics, Aarhus University.

Dempster A.P., Laird N.M., and Rubin D.B. 1977. Maximum likelihood estimation from incomplete data via the EM algorithm (with discussion). Journal of the Royal Statistical Society, Series B 39: 1-37.

Eberlein E. and Keller U. 1995. Hyperbolic distributions in finance. Bernoulli 1: 281-299.

Eberlein E. 2001. Recent advances in more realistic risk management: The hyperbolic model. In: Carol Alexander (Ed.), Mastering Risk Vol. 2: Applications. Prentice Hall, Financial Times, pp. 56-72.

GNU Scientific Library 0.9.3. November 2001. Project homepage: http://sources.redhat.com/gsl/.

Jones P.N. and McLachlan G.J. 1989. Modelling mass-size particle data by finite mixtures. Communications in Statistics: Theory and Methods 18: 2629-2646.

Jørgensen B. 1982. Statistical properties of the generalized inverse Gaussian distribution. Lecture Notes in Statistics, vol. 9, Springer-Verlag, New York.

Lange K.L., Little R.J.A., and Taylor J.M.G. 1989. Robust statistical modeling using the tdistribution. JASA 84: 881-896.

McLachlan G.J. and Krishnan T. 1997. The EM Algorithm and Extensions. John Wiley & Sons, New York.

Nicolato E. and Venardos M.J. 2002. Option pricing in stochastic volatility models of OU type. To appear in Mathematical Finance.

Prause K. 1999. The generalized hyperbolic models: Estimation, financial derivatives and risk measurement. PhD Thesis, Mathematics Faculty, Freiburg University, Freiburg.

Rydberg T.H. 1997. The normal inverse Gaussian Lévy process: Simulation and approximation. Communications in Statistics: Stochastic Models 13: 887-910.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Protassov, R.S. EM-based maximum likelihood parameter estimation for multivariate generalized hyperbolic distributions with fixed λ. Statistics and Computing 14, 67–77 (2004). https://doi.org/10.1023/B:STCO.0000009419.12588.da

Issue Date:

DOI: https://doi.org/10.1023/B:STCO.0000009419.12588.da