Abstract

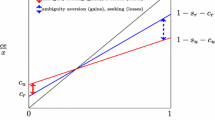

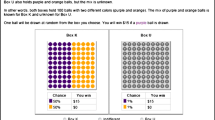

The Ellsberg Paradox documented the aversion to ambiguity in the probability of winning a prize. Using an original sample of 266 business owners and managers facing risks from climate change, this paper documents the presence of departures from rationality in both directions. Both ambiguity-seeking behavior and ambiguity-averse behavior are evident. People exhibit ‘fear’ effects of ambiguity for small probabilities of suffering a loss and ‘hope’ effects for large probabilities. Estimates of the crossover point from ambiguity aversion (fear) to ambiguity seeking (hope) place this value between 0.3 and 0.7 for the risk per decade lotteries considered, with empirical estimates indicating a crossover mean risk of about 0.5. Attitudes toward the degree of ambiguity also reverse at the crossover point.

Similar content being viewed by others

REFERENCES

Becker, S.W. and Brownson, F.O. (1964), What price ambiguity? On the role of ambiguity in decision-making, Journal of Political Economy 72: 65-73.

Camerer, C.F. and Kunreuther, H. (1989), Experimental markets for insurance, Journal of Risk and Uncertainty 2: 265-300.

Camerer, C.F. and Weber, M. (1992), Recent developments in modeling preferences: uncertainty and ambiguity, Journal of Risk and Uncertainty 5: 325-370.

Curley, S.P. and Yates, F.J. (1985), The center and range of the probability interval as factors affecting ambiguity preferences, Organizational Behavior and Human Decision Processes 36: 272-287.

Einhorn, H.J. and Hogarth, R.M. (1986), Decision making under ambiguity, Journal of Business 59: S225-S250.

Ellsberg, D. (1961), Risk, ambiguity, and the savage axioms, Quarterly Journal of Economics 75: 643-669.

Gärdenfors, P. and Sahlin, N.E. (1982), Unreliable probabilities, risk taking, and decision making, Syntheses 53: 361-386.

Heath, C. and Tversky, A. (1991), Preferences and belief: ambiguity and competence in choice under uncertainty, Journal of Risk and Uncertainty 4: 5-28.

Hogarth, R.M. and Einhorn, H.J. (1990), Venture theory: a model of decision weights, Management Science 36: 780-803.

Hogarth, R.M. and Kunreuther, H.C. (1985), Ambiguity and insurance decisions, American Economic Review Papers and Proceedings 75(2): 386-390.

Kahn, B.E. and Sarin, R.K. (1987), Modeling ambiguity in decisions under uncertainty. UCLA Center for Marketing Studies working paper no. 163.

Kahn, B.E. and Sarin, R.K. (1988), Modeling ambiguity in decisions under uncertainty, Journal of Consumer Research 15: 265-72.

Larson, Jr., J.R. (1980), Exploring the external validity of a subjectively weighted utility model of decision making, Organizational Behavior and Human Performance 26: 293-304.

Slovic, P. and Tversky, A. (1974), Who accepts Savage's Axiom?, Behavioral Science 19: 368-73.

Viscusi, W.K. and Magat, W.A. (1992). Bayesian decisions with ambiguous belief aversion, Journal of Risk and Uncertainty 5: 371-387.

Viscusi, W.K., Magat, W.A. and Huber, J. (1991), Pricing environmental health risks: survey assessments of risk-risk and risk-dollar trade-offs for chronic bronchitis, Journal of Environmental Economics and Management 21: 35-51.

Yates, J.F. and Zukowski, L.G. (1976), Characterization of ambiguity in decision making, Behavioral Science 21: 19-25.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Viscusi, W.K., Chesson, H. Hopes and Fears: the Conflicting Effects of Risk Ambiguity. Theory and Decision 47, 157–184 (1999). https://doi.org/10.1023/A:1005173013606

Issue Date:

DOI: https://doi.org/10.1023/A:1005173013606