Abstract

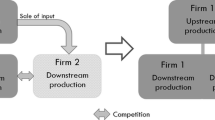

The European Commission has decided to implement a simplified procedure in the context of vertical integration. If the combined market shares of the merging firms is higher than 25% the Commission will investigate the merger thoroughly. Otherwise, the merger is considered harmless. The purpose of this study is to examine the welfare aspects of vertical integration in a simple model and investigate the accuracy of the proposed rule of thumb. Mergers turn out to be harmless from a social point of view when the upstream market is relatively less concentrated compared to the downstream market.

Similar content being viewed by others

References

Dixit, A. 1979. “A Model of Duopoly Suggesting a Theory of Entry Barriers.” Bell Journal of Economics 10: 20-32.

European Commission. 2000. “Commission Notice on a Simplified Procedure for Treatment of Certain Concentrations under Council Regulation (EEC) No 4064/89.” Official Journal of the European Communities (2000/C 217).

European Commission. 1997. “Commission Notice on the Definition of Relevant Market for the Purpose of Community Competition Law.” Official Journal of the European Communities (97/C 372).

Häckner, J. 2001. “Market Delineation and Product Differentiation.” Journal of Industry, Competition and Trade 1: 81-99.

Häckner, J. 2000. “A Note on Price and Quantity Competition in Differentiated Oligopolies.” Journal of Economic Theory 93: 233-239.

Hart, O., and J. Tirole. 1990. “Vertical Integration and Market Foreclosure.” Brookings Papers on Economic Activity, Special Issue: 205-276.

Ordover, J. A., G. Saloner, and S. C. Salop. 1990. “Equilibrium Vertical Foreclosure.” American Economic Review 80: 127-142.

Riordan, M. H. 1998. “Anticompetitive Vertical Integration by a Dominant Firm.” American Economic Review 88: 1232-1248.

Salinger, M. A. 1989. “The Meaning of ‘Upstream’ and ‘Downstream’ and the Implication for Modeling Vertical Mergers.” Journal of Industrial Economics 37: 373-387.

Salinger, M. A. 1988. “Vertical Mergers and Market Foreclosure.” Quarterly Journal of Economics 103: 345-356.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Häckner, J. Vertical Integration and Competition Policy. Journal of Regulatory Economics 24, 213–222 (2003). https://doi.org/10.1023/A:1024790112185

Issue Date:

DOI: https://doi.org/10.1023/A:1024790112185