Abstract

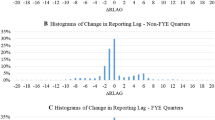

We provide new evidence that the inferior returns to growth stocks relative to value stocks are the result of expectational errors about future earnings performance. Our evidence demonstrates that growth stocks exhibit an asymmetric response to earnings surprises. We show that while growth stocks are at least as likely to announce negative earnings surprises as positive earnings surprises, they exhibit an asymmetrically large negative price response to negative earnings surprises. After controlling for this asymmetric price response, we find no remaining evidence of a return differential between growth and value stocks. We conclude that the inferior return to growth stocks is attributable to overoptimistic expectational errors that are corrected through subsequent negative earnings surprises.

Similar content being viewed by others

References

Abarbanell, J. and R, Lehavy. (2000). “Biased Forecasts or Biased Earnings? The Role of Earnings Management in Explaining Apparent Optimism and Inefficiency in Analysts' Earnings Forecasts.” Unpublished paper, University of North Carolina, Chapel Hill, NC, and University of California, Berkeley, Berkeley, CA.

Barberis, N., A. Shleifer and R. Vishny. (1998). “A Model of Investor Sentiment.” Journal of Financial Economics 49, 307-343.

Bartov, E., D. Givoly and C. Hayn. (2002). “The Rewards to Meeting or Beating Earnings Expectations.” Forthcoming, Journal of Accounting and Economics.

Basu, S. (1977). “Investment Performance of Common Stocks in Relation to Their Price Earnings Ratios: A Test of the Efficient Market Hypothesis.” Journal of Finance 32, 663-682.

Bernard, V. L., J. Thomas and J. Wahlen. (1997). “Accounting-Based Stock Price Anomalies: Separating Market Inefficiencies from Risk.” Contemporary Accounting Research 14, 89-136.

Brown, L. D. (2001). “A Temporal Analysis of Earnings Surprises: Profits Versus Losses.” Journal of Accounting Research 39, 221-241.

Daniel, K., D. Hirshleifer and A. Subrahmanyam. (1998). “Investor Psychology and Security Market Under-and Overreactions.” Journal of Finance 53, 1839-1885.

Dechow, P. M. and R. G. Sloan. (1997). “Returns to Contrarian Investment Strategies: Tests of Naïve Expectations Hypotheses.” Journal of Financial Economics 43, 3-27.

Dreman, D. and M. Berry. (1995). “Overreaction, Underreaction, and the Low-P/E Effect.” Financial Analysts' Journal 51, 21-30.

Fama, E. F. (1998). “Market Efficiency, Long-Term Returns, and Behavioral Finance.” Journal of Financial Economics 49, 283-306.

Fama, E. F. and K. R. French. (1992). “The Cross-Section of Expected Stock Returns.” Journal of Finance 47, 427-465.

Freeman, R. N. and S. Y. Tse. (1992). “A Nonlinear Model of Security Price Responses to Unexpected Earnings.” Journal of Accounting Research 30, 185-209.

Hayn, C., “The Information Content of Losses.” Journal of Accounting and Economics 20, 125-153.

Kasznik, R. and B. Lev. (1995). “To Warn or Not to Warn: Management Disclosures in the Face of an Earnings Surprise.” The Accounting Review 70, 113-134.

Kothari, S. P., J. S. Sabino and T. Zach. (1999). “Implications of Data Restrictions on Performance Measurement and Tests of Rational Pricing.” Unpublished paper, Massachusetts Institute of Technology, Cambridge, MA.

Lakonishok, J., A. Shleifer and R. Vishny. (1994). “Contrarian Investment, Extrapolation, and Risk.” Journal of Finance 49, 1541-1578.

La Porta, R. (1996). “Expectations and the Cross-Section of Stock Returns.” Journal of Finance 51, 1715-1742.

La Porta, R., J. Lakonishok, A. Shleifer and R. Vishny. (1997). “Good News for Value Stocks: Further Evidence of Market Efficiency.” Journal of Finance 52, 859-874.

Matsumoto, D. A. (2002). “Management's Incentives to Avoid Negative Earnings Surprises.” Forthcoming, The Accounting Review.

Skinner, D. J. (1994). “Why Firms Voluntarily Disclose Bad News.” Journal of Accounting Research 32, 38-60.

Skinner, D. J. (1997). “Earnings Disclosures and Stockholder Lawsuits.” Journal of Accounting & Economics 23, 249-282.

Soffer, L. C., S. R. Thiagarajan and B. R. Walther. (2000). “Earnings Preannouncement Strategies.” Review of Accounting Studies 5, 5-26.

Rights and permissions

About this article

Cite this article

Skinner, D.J., Sloan, R.G. Earnings Surprises, Growth Expectations, and Stock Returns or Don't Let an Earnings Torpedo Sink Your Portfolio. Review of Accounting Studies 7, 289–312 (2002). https://doi.org/10.1023/A:1020294523516

Issue Date:

DOI: https://doi.org/10.1023/A:1020294523516