Abstract

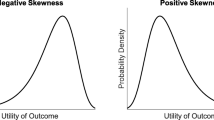

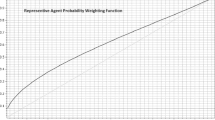

We generalize the Allais common consequence effect by describing three common consequence effect conditions and characterizing their implications for the probability weighting function in rank-dependent expected utility. The three conditions—horizontal, vertical, and diagonal shifts within the probability triangle—are necessary and sufficient for different curvature properties of the probability weighting function. The first two conditions, shifts in probability mass from the lowest to middle outcomes and middle to highest outcomes respectively, are alternative conditions for concavity and convexity of the weighting function. The third condition, decreasing Pratt-Arrow absolute concavity, is consistent with recently proposed weighting functions. The three conditions collectively characterize where indifference curves fan out and where they fan in. The common consequence conditions indicate that for nonlinear weighting functions in the context of rank-dependent expected utility, there must exist a region where indifference curves fan out in one direction and fan in the other direction.

Similar content being viewed by others

References

Allais, Maurice. (1953). “Le comportement de l'homme rationnel devant le risque: Critique le Postulats et Axiomes de L'École Américaine,” Econometrica, 21, 503-546.

Allais, Maurice. (1979). “The so-called Allais Paradox and rational decision under uncertainty,” in Expected Utility Hypotheses and the Allais Paradox, ed. by Maurice Allais and Ole Hagen. Dordrecht, Holland: Reidel, 437-481.

Birnbaum, Michael H. and William R. McIntosh. (1996). “Violations of branch independence in choices between gambles.” Organizational Behavior and Human Decision Processes 67, 91-110.

Birnbaum, Michael H. and Alfredo Chavez. (1997). “Tests of Theories of Decision Making: Violations of Branch Independence and Distribution Independence,” violations of branch independence in choices between gambles.” Organizational Behavior and Human Decision Processes 71, 161-194.

Buschena, David and David Zilberman. (1998). “Predictive Value of Incentives, Decision Difficulty, and Expected Utility Theory for Risky Choices,” Department of Agricultural Economics and Economics Staff Paper, 95-1, Montana State University.

Camerer, Colin F. (1989). “An Experimental Test of Several Generalized Utility Theories,” Journal of Risk and Uncertainty 2, 61-104.

Camerer, Colin F. (1992). “Recent Tests of Generalizations of Expected Utility Theory.” In Utility: Theories, Measurement, and Applications, ed. by Ward Edwards. Norwell, MA: Kluwer, 207-251.

Camerer, Colin F. (1995). “Individual Decision Making.” In The Handbook of Experimental Economics, ed. by John H. Kagel and Alvin E. Roth. Princeton, NJ: Princeton University Press, 587-703.

Camerer, Colin F. and Teck-hua Ho. (1994). “Violations of the Betweenness Axiom and Nonlinearity in Probability,” Journal of Risk and Uncertainty 8, 167-196.

Chew Soo Hong and William Waller. (1986). “Empirical tests of weighted utility theory,” Journal of Mathematical Psychology 30, 55–72.

Conlisk, John. (1989). “Three Variants on the Allais Example,” American Economic Review 79, 392-407.

Gonzalez, Richard and George Wu. (1998). “On the Form of the Probability Weighting Function,” unpublished paper.

Hardy, George H., John E. Littlewood, and George Pólya. (1952). Inequalities, Second Edition, Cambridge, England: Cambridge University Press.

Harless, David W. (1992). “Predictions about Indifference Curves Inside the Unit Triangle: A Test of Variants of Expected Utility,” Journal of Economic Behavior and Organization 18, 391-414.

Harless, David W. and Colin F. Camerer. (1994). “The Predictive Utility of Generalized Expected Utility Theories,” Econometrica 62, 1251-1290.

Hey, John and Chris Orme. (1994). “Investigating generalizations of expected utility theory using experimental data,” Econometrica 62, 1291-1326.

Kahneman, Daniel and Amos Tversky. (1979). “Prospect Theory: An Analysis of Decision under Risk,” Econometrica 47, 263-291.

Karmarkar, Uday S. (1978). “Subjective Weighted Utility: A Descriptive Extension of the Expected Utility Model,” Organizational Behavior and Human Performance 21, 61-72.

Lattimore, Pamela K., Joanna K. Baker, and Ann D. Witte. (1992). “The influence of probability on risky choice: A parametric examination,” Journal of Economic Behavior and Organization 17, 377-400.

Luce, R. Duncan and Peter C. Fishburn. (1991). “Rank-and Sign-Dependent Linear Utility Models for Finite First-Order Gambles,” Journal of Risk and Uncertainty 4, 29-59.

MacCrimmon, Kenneth R. and Stig Larsson. (1979). “Utility Theory: axioms versus ´paradoxes',” in Expected Utility Hypotheses and the Allais Paradox, ed. by Maurice Allais and Ole Hagen. Dordrecht, Holland: Reidel, 333-409.

Machina, Mark J. (1982). “Expected Utility' Analysis without the Independence Axiom,” Econometrica 50, 277-323.

Machina, Mark J. (1987). “Choice under Uncertainty: Problems Solved and Unsolved,” Journal of Economic Perspectives 1, 121-154.

Neilson, William S. (1992). “A mixed fan hypothesis and its implications for behavior towards risk,” Journal of Economic Behavior and Organization 19, 197-211.

Pratt, John W. (1964). “Risk Aversion in the Small and in the Large,” Econometrica 32, 122-136.

Prelec, Drazen. (1990). “A 'Pseudo-endowment' Effect, and its implications for some recent nonexpected utility models,” Journal of Risk and Uncertainty 3, 247-259.

Prelec, Drazen. (1998). “The probability weighting function,” Econometrica, forthcoming.

Quiggin, John. (1982). “A Theory of Anticipated Utility,” Journal of Economic Behavior and Organization 3, 323-343.

Quiggin, John. (1993). “Testing Between Alternative Models of Choice Under Uncertainty-Comment,” Journal of Risk and Uncertainty 6, 161-164.

Quiggin, John and Peter P. Wakker. (1994). “The axiomatic basis of anticipated utility theory: A clarification,” Journal of Economic Theory 64, 486-499.

Roell, Ailsa. (1987). “Risk aversion in Quiggin and Yaari's Rank-order Model of Choice under uncertainty,” Economic Journal 97, 143-159.

Segal, Uzi. (1987). “Some Remarks on Quiggin's Anticipated Utility,” Journal of Economic Behavior and Organization 8, 145-154.

Segal, Uzi. (1989). “Anticipated Utility: A Measure Representation Approach,” Annals of Operations Research 19, 359-373.

Segal, Uzi and A. Spivak. (1988). “Non-expected utility risk premiums: The cases of probability ambiguity and outcome uncertainty,” Journal of Risk and Uncertainty 1, 333-347.

Sopher, Barry and Gary Gigliotti. (1993). “A Test of Generalized Expected Utility Theory,” Theory and Decision 35, 75-106.

Starmer, Chris. (1992). “Testing New Theories of Choice under Uncertainty Using the Common Consequence Effect,” Review of Economic Studies 59, 813-830.

Starmer, Chris and Robert Sugden. (1989). “Violations of the Independence Axiom in Common Ratio Problems: An Experimental Test of Some Competing Hypotheses,” Annals of Operations Research 19, 79-101.

Tversky, Amos and Craig R. Fox. (1995). “Weighing Risk and Uncertainty,” Psychological Review 102, 269-283.

Tversky, Amos and Daniel Kahneman. (1992). “Advances in Prospect Theory: Cumulative Representation of Uncertainty,” Journal of Risk and Uncertainty 5, 297-323.

Tversky, Amos and Peter P. Wakker. (1995). “Risk Attitudes and Decision Weights,” Econometrica 63, 1255-1280.

Wakker, Peter P. and Amos Tversky. (1993). “An Axiomatization of Cumulative Prospect Theory,” Journal of Risk and Uncertainty 7, 147-176.

Wu, George. (1994). “An Empirical Test of Ordinal Independence,” Journal of Risk and Uncertainty 9, 39-60.

Wu, George and Richard Gonzalez. (1996). “Curvature of the Probability Weighting Function,” Management Science 42, 1676-90.

Wu, George and Richard Gonzalez. (1997). “Nonlinear Event Weights in Decision Making under Uncertainty,” unpublished paper.

Yaari, Menahem E. (1987). “The Dual Theory of Choice Under Risk,” Econometrica 55, 95-115.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Wu, G., Gonzalez, R. Common Consequence Conditions in Decision Making under Risk. Journal of Risk and Uncertainty 16, 115–139 (1998). https://doi.org/10.1023/A:1007714509322

Issue Date:

DOI: https://doi.org/10.1023/A:1007714509322