Abstract

We investigate the cross-sectional distribution of house prices in the Greater Tokyo Area for the period 1986–2009. We find that size-adjusted house prices follow a lognormal distribution except for the period of the housing bubble and its collapse in Tokyo, for which the price distribution has a substantially heavier upper tail than that of a lognormal distribution. We also find that, during the bubble era, sharp price movements were concentrated in particular areas, and this spatial heterogeneity is the source of the fat upper tail. These findings suggest that, during a bubble, prices increase markedly for certain properties but to a much lesser extent for other properties, leading to an increase in price inequality across properties. In other words, the defining property of real estate bubbles is not the rapid price hike itself but an increase in price dispersion. We argue that the shape of cross-sectional house price distributions may contain information useful for the detection of housing bubbles.

Similar content being viewed by others

Notes

Cochrane (2005) argues that an important feature of the tech stock bubble in the late 1990s is that it was concentrated in stocks related to internet business. Cochrane (2005, p. 191) observes that “if there was a ‘bubble,’ or some behavioral overenthusiasm for stocks, it was concentrated on Nasdaq stocks, and Nasdaq tech and internet stocks in particular.”

Some of the recent studies, including Ferreira and Gyourko (2012, 2017), Sinai (2013), and Zhang and Yi (2018), focus on the higher moments of the house price distribution in the context of boom–bust cycles in housing markets. For example, Ferreira and Gyourko (2012, 2017) highlight the presence of substantial regional heterogeneity in housing prices in the recent US boom–bust cycle, stating that “the recent US housing boom cannot be interpreted as a single, national event, as different markets began to boom across a decade-long period from the mid-1990s to the mid-2000s, some of them multiple times” (Ferreira and Gyourko 2017, p. 1). However, these studies do not examine changes in the shape of the cross-sectional house price distribution over boom–bust cycles.

Anomaly detection techniques can be categorized into supervised and unsupervised detection techniques depending on whether they rely on a training dataset that has labeled instances for normal as well as anomalous classes (see, for example, Chandola et al. 2009). The procedure adopted in the early warning studies can be regarded as supervised anomaly detection, as they label some observations of, for example, the credit/GDP ratio as anomalies using information on crisis dates. In contrast, our procedure is essentially unsupervised anomaly detection since we do not label observations as normal or anomalous. See Chandola et al. (2009) for more on the distinction between supervised and unsupervised anomaly detection.

More details on the dataset used in the paper are provided in the next section.

We also see a secular increase in price dispersion since 1993. We are not quite sure why this is the case, but recent studies, including those by Van Nieuwerburgh and Weill (2010) and Gyourko et al. (2013) find some evidence that the rise in house price dispersion across regions in the United States is related to the change in income distribution across regions. For example, Van Nieuwerburgh and Weill (2010) find that the cross-sectional coefficient of variation of house prices across 330 metropolitan statistical areas in the United States increased from 0.15 in 1975 to 0.53 in 2007. Through a counterfactual simulation, they show that this increase in the dispersion of house prices is accounted for mostly by the increase in income inequality.

See Okina et al. (2001) for more details on each of these factors.

See Hoshi and Kashyap (2000) on banks’ lending behavior during the bubble and its burst.

In Japan, land is taxed at three stages: inheritance tax, registration and license tax, and/or real estate acquisition tax are applied when land is acquired; fixed property tax, urban planning tax, and/or special land-holding tax are applied while land is held; and corporation tax, income tax, and/or inhabitant tax are applied to capital gains when land is transferred.

The dataset contains full information about the evolution of the posted price for a housing unit from the week when it was first listed until the final week when it was removed because of a successful transaction. In this study, we only use the price in the final week since this can be safely regarded as sufficiently close to the contract price. The number of listings shown in the text does not include those prices listed before the final week.

A similar idea has been adopted in recent studies applying assignment models to the housing markets including Landvoigt et al. (2015), Piazzesi and Schneider (2016), Määttänen and Terviö (2014), and Rios-Rull and Sanchez-Marcos (2008). In these models, equilibrium prices are determined so that households with high (low) demand for housing services are assigned to high (low) quality houses. These studies show that the distribution of equilibrium prices across houses is determined by the distribution of quality across houses and the distribution of characteristics across households. Rosen (1974) and Landvoigt et al. (2015) show that the assumption of no costless unbundling implies limits to arbitrage in housing markets.

Note that the subscript for time is dropped here to simplify the exposition.

See Gabaix (2009) for an extensive survey of empirical and theoretical studies on power laws in various economic contexts such as income and wealth, the size of cities and firms, and stock market returns.

Note that we cannot obtain estimates for \(\zeta _{t}\) from Fig. 3. The CDFs in Fig. 3 are for normalized prices, which are defined by \([P_{it}\exp (-\mu _{t})]^{1/\sigma _{t}}\), where \(\mu _{t}\) and \(\sigma _{t}\) are the mean and the standard deviation in year t. Therefore, the slope of each CDF in Fig. 3 is given by \(\sigma _{t}\zeta _{t}\) (rather than \(\zeta _{t}\)), if the original price follows the power law distribution given by (6). Many examples of power law distributions have been provided. For example, the net worth of Americans follows a power law distribution with an exponent of 1.1; the frequency of the use of words follows such a distribution with an exponent of 1.2; the population of US cities has an exponent of 1.3; the number of hits on websites has an exponent of 1.4; the magnitude of earthquakes has an exponent of 2.8; and price movements in financial markets have an exponent of 3 (or lower). The exponents for the house price distributions estimated here are greater than most of these figures, implying that the tail parts of the house price distributions are less fat than those in the other examples of power law distributions.

To see why the tails of the house size distribution are less fat than the tails of the price distribution, consider a simple example in which household A has 100 times as much wealth as household B, so that A spends 100 times as much money on a house as B. What does A’s house look like? Does it have a bathroom that is 100 times larger than the one in B’s house? Alternatively, does it have 100 bathrooms? Needless to say, neither is true, because even a person of A’s wealth would have little use for such a gigantic bathroom (or so many bathrooms). Instead, it is more likely that the size of A’s house (and, therefore, the size and/or number of its bathroom) is only, say, 10 times greater and, consequently, the unit area price of A’s house is 10 times higher than B’s. This is similar to the finding by Bils and Klenow (2001) that richer households not only consume more goods but also higher quality and, therefore, more expensive goods.

The price–size relationship described by Eq. (9) provides an answer to the question regarding the choice of functional form for hedonic price equations, which has been extensively discussed in previous studies such as Cropper et al. (1988). The novelty of our approach is that we derive this functional form not from economic theory but from the statistical fact that house prices and sizes follow a power law and an exponential distribution, respectively.

Note that the price per square meter, \(\exp (aS+b)/S\) takes its minimum value when S is equal to 1 / a. Given the estimate of a, this implies that the price per square meter takes its minimum value when \(S=1/0.013\approx 75\), which is consistent with what we see in the lower two panels of Fig. 6.

This dataset contains land prices for about 30,000 sites across Japan. The price of each site is assessed by the Land Appraisal Committee once a year and made available to the public. The dataset contains information about various attributes of a particular piece of land, including its address, size, shape, and types of land use (residential, commercial, or industrial). In this paper, we focus on land for residential use that is smaller than \(300\,\text {m}^{2}\) and located in the Greater Tokyo Area. The number of observations ranges from 2000 to 5000 per year.

Note that 1\(^{\circ }\) is approximately 100 km.

In conducting these regressions, we use only pixels with more than twenty transactions in a year. The number of pixels used in the regressions is about 300 for each year.

It should be noted that the estimated CDF does not fully converge to a lognormal even in the case of the smallest pixels. It may be the case that the CDF becomes much closer still to a lognormal distribution if we were able to reduce the pixel size even further. Unfortunately, we cannot do so because of the limited number of observations.

References

Anundsen, A. K., Gerdrup, K., Hansen, F., & Kragh-Sorensen, K. (2016). Bubbles and crises: The role of house prices and credit. Journal of Applied Econometrics, 31(7), 1291–1311.

Bils, M., & Klenow, P. J. (2001). Quantifying quality growth. American Economic Review, 91(4), 1006–1030.

Blackwell, C. (2018). Power laws in real estate prices? Some evidence. The Quarterly Review of Economics and Finance, 69, 90–98.

Borio, C., & Lowe, P. (2002). Assessing the risk of banking crises. BIS Quarterly Review, 7(1), 43–54.

Chandola, V., Banerjee, A., & Kumar, V. (2009). Anomaly detection: A survey. ACM Computing Surveys, 41(3), 15.

Cochrane, J. H. (2005). Stocks as money: Convenience yield and the tech-stock bubble. In W. C. Hunter, G. G. Kaufman, & M. Pomerleano (Eds.), Asset price bubbles: The implications for monetary, regulatory, and international policies (pp. 175–203). Cambridge: MIT Press.

Cropper, M. L., Deck, L. B., & McConnell, K. E. (1988). On the choice of functional form for hedonic price functions. Review of Economics and Statistics, 70(4), 668–675.

Del Castillo, J., & Puig, P. (1999). The best test of exponentiality against singly truncated normal alternatives. Journal of the American Statistical Association, 94, 529–532.

Diewert, W. E., de Haan, J., & Hendriks, R. (2011). The decomposition of a house price index into land and structures components: A hedonic regression approach. The Valuation Journal, 6(1), 58–105.

Drehmann, M., & Juselius, M. (2014). Evaluating early warning indicators of banking crises: Satisfying policy requirements. International Journal of Forecasting, 30(3), 759–780.

Feller, W. (1968). An introduction to probability theory and its applications (3rd ed., Vol. 1). New York: Wiley.

Ferreira, F., & Gyourko, J. (2012). Heterogeneity in neighborhood-level price growth in the United States, 1993–2009. American Economic Review, 102(3), 134–40.

Ferreira, F., & Gyourko, J. (2017). Anatomy of the beginning of the housing boom: US neighborhoods and metropolitan areas, 1993-2009, November 2017.

Gabaix, X. (2009). Power laws in economics and finance. Annual Review of Economics, 1(1), 255–294.

Glaeser, E. L., Gottlieb, J. D., & Tobio, K. (2012). Housing booms and city centers. American Economic Review, 102(3), 127–33.

Greene, W. (2003). Econometric analysis (5th ed.). Upper Saddle River, NJ: Prentice Hall.

Gyourko, J., Mayer, C., & Sinai, T. (2013). Superstar cities. American Economic Journal: Economic Policy, 5(4), 167–99.

Himmelberg, C., Mayer, C., & Sinai, T. (2005). Assessing high house prices: Bubbles, fundamentals, and misperceptions. Journal of Economic Perspectives, 19, 67–92.

Hoshi, T., & Kashyap, A. (2000). The Japanese banking crisis: Where did it come from and how will it end? NBER Macroeconomics Annual 1999 (Vol. 14, pp. 129–212). Cambridge: MIT.

Kaminsky, G. L., & Reinhart, C. M. (1999). The twin crises: The causes of banking and balance-of-payments problems. American Economic Review, 89(3), 473–500.

Kiyotaki, N., & Moore, J. (1997). Credit cycles. Journal of Political Economy, 105(2), 211–248.

Landvoigt, T., Piazzesi, M., & Schneider, M. (2015). The housing market(s) of San Diego. American Economic Review, 105(4), 1371–1407.

Määttänen, N., & Terviö, M. (2014). Income distribution and housing prices: An assignment model approach. Journal of Economic Theory, 151, 381–410.

Malevergne, Y., Pisarenko, V., & Sornette, D. (2011). Testing the pareto against the lognormal distributions with the uniformly most powerful unbiased test applied to the distribution of cities. Physical Review E, 83(3), 036111.

Mankiw, N. G., & Weil, D. N. (1989). The baby boom, the baby bust, and the housing market. Regional Science and Urban Economics, 19(2), 235–258.

Martin, A., & Ventura, J. (2018). The macroeconomics of rational bubbles: A user’s guide. Annual Review of Economics, 10, 505–539.

McMillen, D. P. (2008). Changes in the distribution of house prices over time: Structural characteristics, neighborhood, or coefficients? Journal of Urban Economics, 64(3), 573–589.

Nishimura, K. (2011). Population ageing, macroeconomic crisis and policy challenges, Prepared for the Panel “The General Theory and the Policy Reponses to Macroeconomic Crisis” at the 75th Anniversary Conference of Keynes’ General Theory. University of Cambridge, Cambridge, June 19–21, 2011.

Okina, K., Shirakawa, M., & Shiratsuka, S. (2001). The asset price bubble and monetary policy: Japan’s experience in the late 1980s and the lessons. Monetary and Economic Studies (Special Edition), 19(2), 395–450.

Piazzesi, M., & Schneider, M. (2016). Housing and macroeconomics. In J. B. Taylor & H. Uhlig (Eds.), Handbook of macroeconomics (Vol. 2, pp. 1547–1640). Amsterdam: Elsevier.

Rios-Rull, J. V., & Sanchez-Marcos, V. (2008). An aggregate economy with different size houses. Journal of the European Economic Association, 6(2–3), 705–714.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Shimizu, C., Nishimura, K. G., & Watanabe, T. (2010). Housing prices in Tokyo: A comparison of hedonic and repeat-sales measures. Journal of Economics and Statistics, 230(6), 792–813.

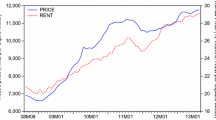

Shimizu, C., & Watanabe, T. (2010). Housing bubbles in Japan and the United States. Public Policy Review, 6(3), 431–472.

Shimizu, C., & Watanabe T. (2013). Sticky housing rents and monetary policy: The Japanese experience. Paper presented at the KDI Workshop on “Real Estate Driven Systemic Risk: Country Cases and Their Policy Implications”, December 13–14, 2012, Seoul.

Sinai, T. (2013). House price moments in boom-bust cycles. In E. L. Glaeser & T. Sinai (Eds.), Housing and the financial crisis (pp. 19–68). Chicago: University of Chicago Press.

Takáts, E. (2012). Aging and house prices. Journal of Housing Economics, 21(2), 131–141.

Van Nieuwerburgh, S., & Weill, P. O. (2010). Why has house price dispersion gone up? Review of Economic Studies, 77(4), 1567–1606.

Zhang, L., & Yi, Y. (2018). What contributes to the rising house prices in Beijing? A decomposition approach. Journal of Housing Economics, 41, 72–84.

Acknowledgements

This paper is based on the invited lecture titled “House Price Dispersion in Boom–Bust Cycles” given by Tsutomu Watanabe at 2019 JEA Spring Meeting. We would like to thank Kosuke Aoki, Gautam Goswami, Donald Haurin, Christian Hilber, Kiyohiko G. Nishimura, Etsuro Shioji, Misako Takayasu, Kenji Yamanishi, Hiroshi Yoshikawa, and participants at the JEA meeting for helpful comments and suggestions. We also thank an anonymous reviewer for insightful comments and suggestions. An earlier version of this paper has been circulated under the title “On the Evolution of the House Price Distribution.” This research forms part of the project on “Central Bank Communication Design” funded by a JSPS Grant-in-Aid for Scientific Research (No. 18H05217) and has further been supported by the program titled “Joint Usage/Research Center for Interdisciplinary Large-scale Information Infrastructures” as well as the program titled “High Performance Computing Infrastructure”.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ohnishi, T., Mizuno, T. & Watanabe, T. House price dispersion in boom–bust cycles: evidence from Tokyo. JER 71, 511–539 (2020). https://doi.org/10.1007/s42973-019-00019-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42973-019-00019-6

Keywords

- Housing bubbles

- Anomaly detection

- Lognormal distributions

- Power-law tail

- Hedonic models

- Market segmentation

- Submarkets