Abstract

In this paper we evaluate the forecasting performance of employment expectations for employment growth in 15 European states. Our data cover the period from the first quarter 1998 to the fourth quarter 2014. With in-sample analyses and pseudo out-of-sample exercises, we find that for most of the European states considered, the survey-based indicator model outperforms common benchmark models. It is therefore a powerful tool for generating more accurate employment forecasts. We observe the best results for one quarter ahead predictions that are primarily the aim of the survey question. However, employment expectations also work well for longer forecast horizons in some countries.

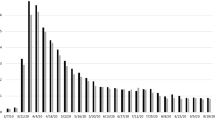

Source: European Commission, Eurostat, author’s calculations and illustrations

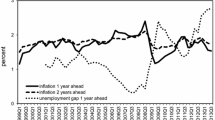

Source: European Commission, Eurostat, author’s calculations and illustrations

Similar content being viewed by others

Notes

The data are periodically updated and available at http://www.cesifo-group.de/ifoHome/facts/Time-series-and-Diagrams/Zeitreihen/Reihen-Beschaeftigungsbarometer.html.

A description and new press releases can be found at http://www.kof.ethz.ch/en/surveys.

The aim of the European Commission is to keep the sample representative for each month. To ensure this, sample updates are necessary on occasion due to, e.g., start-ups or bankruptcies. However, the samples for the business survey are very stable in each state. Additional details on the sample composition can be found in European Commission (2007).

The code of the corresponding time series is: namq_10_a10_e. All the data can be downloaded free of charge under http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home. The data used in this paper were downloaded on May 15, 2015. To keep our analysis as up-to-date as possible, we use employment figures based on the new European System of National and Regional Accounts 2010 (ESA 2010).

Advanced services comprise the sectors information and communication, financial services, real estate, scientific and administrative services, public administration as well as arts and other service activities. For more details on the specific sectors, see Eurostat (2008).

Table 4 in the Appendix shows the typical descriptive results for all considered series.

The same holds for the series EEXP_tm.

The results of the unit root tests for MEMP and EEXP_tm can be found in Table 5 in the Appendix. For these two variables, the stationarity tests yield relatively similar results as for EMP and EEXP_av

So it is by no means a test on causality between two variables or on the exogeneity of a series.

Whenever breaks in the time series are present, the rolling window approach is preferable. An expanding window is suitable when there are no breaks in the series or the whole cyclicality of the series should be captured. The recursive approach then leads to more precise estimates of the parameters (Weber and Zika 2013).

Turning to EEXP_tm, the third month of each quarter as representative serves as a leading indicator as well. Especially for Italy, the third month has explanatory power for EMP as well as for MEMP. Detailed in-sample results for EEXP_tm can be found in Table 6 in the Appendix.

The results from the expanding window are presented in Table 7 in the Appendix.

The ISM is defined as \(y_{t+h} = {\overline{y}}\), representing the sample average of the estimation window. The Random Walk prediction is simply the last known value of the target variable \(y_{t+h} = y_{t-1}\).

One would argue that adding an indicator and therefore getting a better in-sample fit for the data has to result in a better out-of-sample performance. This may not be the case (see Chatfield 1995). Overfitting the model or parameter instabilities (see Rossi and Sekhposyan 2011) are some explanations why in-sample and out-of-sample performance may differ.

The results for longer forecast horizons are available upon request.

In order to keep the number of results clear and to save space, we only present the Fluctuation test results for EMP and EEXP_av. All the other results and pictures are available upon request.

References

Abberger, K. (2007a). Forecasting quarter-on-quarter changes of German GDP with monthly business tendency survey results. Ifo Working Paper No. 40.

Abberger, K. (2007b). Qualitative business surveys and the assessment of employment—A case study for Germany. International Journal of Forecasting, 23(2), 249–258.

Ang, A., Bekaert, G., & Wei, M. (2007). Do macro variables, asset markets, or surveys forecast inflation better? Journal of Monetary Economics, 54(4), 1163–1212.

Chatfield, C. (1995). Model uncertainty, data mining and statistical inference. Journal of the Royal Statistical Society, Series A, 158(3), 419–466.

Clark, T. E., & West, K. D. (2007). Approximately normal tests for equal predicitve accuracy in nested models. Journal of Econometrics, 138(1), 291–311.

Claveria, O., Pons, E., & Ramos, R. (2007). Business and consumer expectations and macroeconomic forecasts. International Journal of Forecasting, 23(1), 47–69.

Croux, C., Dekimpe, M. G., & Lemmens, A. (2005). On the predictive content of production surveys: A pan-European study. International Journal of Forecasting, 21(2), 363–375.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive accuracy. Journal of Business and Economic Statistics, 13(3), 253–263.

dos Santos, R. H. (2003). The use of qualitative data for short term analysis. Banco de Portugal Economic Bulletin, 9(3), 101–118.

EBRD (2013). Transition report 2013. European Bank for Reconstruction and Development, ISBN 9781898802402.

European Commission (2007). The Joint Harmonised EU Programme of Business and Consumer Surveys—User Guide. Directorate General for Economic and Financial Affairs. http://ec.europa.eu/economy_finance/db_indicators/surveys/documents/userguide_en.pdf.

Eurostat (2008). NACE Rev. 2—Statistical classification of economic activities in the European Community. Eurostat Methodologies and Working Papers, ISSN 1977-0375.

Fritsche, U., & Stephan, S. (2002). Leading indicators of German business cycles. Journal of Economics and Statistics, 222(3), 289–315.

Gayer, C. (2005). Forecast evaluation of European commission survey indicators. Journal of Business Cycle Measurement and Analysis, 2005(2), 157–183.

Giacomini, R., & Rossi, B. (2010). Forecast comparisons in unstable environments. Journal of Applied Econometrics, 25(4), 595–620.

Graff, M., Mannino, M., & Siegenthaler, M. (2012). A real time evaluation of employment forecasts in Switzerland. KOF Working Papers No. 320.

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37(3), 424–438.

Hanssens, M., & Vanden Abeele, P. M. (1987). A time-series study of the formation and predictive performance of EEC production survey expectations. Journal of Business & Economic Statistics, 5(4), 507–519.

Hansson, J., Jansson, P., & Löf, M. (2005). Business survey data: Do they help in forecasting GDP growth? International Journal of Forecasting, 21(2), 377–389.

Hartle, D. (1958). Predictions derived from the employment forecast survey. The Canadian Journal of Economics and Political Science, 24(3), 373–390.

Hutter, C., & Weber, E. (2015). Constructing a new leading indicator for unemployment from a survey among German employment agencies. Applied Economics, 47(3), 3540–3558.

Lehmann, R. (2015). Survey-based indicators vs. hard data: What improves export forecasts in Europe? Ifo Working Paper No. 196.

Lütkepohl, H. (2005). New introduction to multiple time series analysis. Berlin: Springer.

Martinsen, K., Ravazzolo, F., & Wulfsberg, F. (2014). Forecasting macroeconomic variables using disaggregate survey data. International Journal of Forecasting, 30(1), 65–77.

Ng, S., & Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica, 69(6), 1519–1554.

Österholm, P. (2010). Improving unemployment rate forecasts using survey data. Finnish Economic Papers, 23(1), 16–26.

Robinzonov, N., & Wohlrabe, K. (2010). Freedom of choice in macroeconomic forecasting. CESifo Economic Studies, 56(2), 192–220.

Rossi, B., & Sekhposyan, T. (2011). Understanding models’ forecasting performance. Journal of Econometrics, 164(1), 158–172.

Seiler, C. (2014). On the robustness of balance statistics with respect to nonresponse. OECD Journal: Journal of Business Cycle Measurement and Analysis, 2014(2), 45–62.

Siliverstovs, B. (2013). Do business tendency surveys help in forecasting employment? A real-time evidence for Switzerland. OECD Journal: Journal of Business Cycle Measurement and Analysis, 2013(2), 1–20.

Weber, E. & Zika, G. (2015). Labour market forecasting: is disaggregation useful? Applied Economics, 48(23), 2183–2198.

Acknowledgments

Our special thanks goes to two anonymous referees, Alfred Garloff and Marcel Thum for their careful reading of our manuscript. We are grateful to Wolfgang Nagl, Michael Weber and seminar participants at the Technische Universität Dresden for helpful comments and suggestions; and to Lisa Giani Contini for editing this text. We also thank the participants at the meeting of the Regional Research Network from the Institute for Employment Research in November 2013. Comments from the 1st CGDE Doctoral Workshop are also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lehmann, R., Weyh, A. Forecasting Employment in Europe: Are Survey Results Helpful?. J Bus Cycle Res 12, 81–117 (2016). https://doi.org/10.1007/s41549-016-0002-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-016-0002-5