Abstract

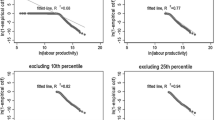

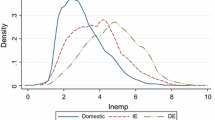

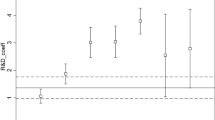

This paper re-examines the link between firm size and exports. The new theories of international trade emphasize firm heterogeneity as the theoretical basis of export behavior. In the context of this heterogeneity, this paper uses the quantile regression methodology to analyze the effects of firm size on firm export propensity (percentage of exported sales). The paper confirms the existence of a positive relationship between firm size and export propensity but finds that the conventional estimates of the elasticity of export propensity with respect to firm size on the average of the export propensities’ distribution underestimate the effect at the bottom of the distribution and overestimate the effect on the rest. Consequently, policies aimed at increasing exports should focus their efforts on increasing the size of those firms with a lower export propensity.

Similar content being viewed by others

Notes

While this result suggests several policy guidelines, I am not proposing a specific policy in the paper. There are, at least, three types of policies that can increase firm size: (i) policies aimed at removing tax and labor distortions; (ii) policies that subsidize merges between firms; and iii) policies that enhance firms’ competition (those that reduce bureaucracy, increase transparency, and so on). However, I do not attempt to analyze these policies in detail in the paper.

Since my measure is not bounded above, I can perform an estimation of the proposed econometric specification. In case there was an upper bound for export propensity, I should have used instead an alternative econometric model.

I also estimate the elasticity of percentage of sales exported with respect to firm size. These estimates appear in the Appendix (Table 8). The results obtained under this measure turn out to be very similar to those obtained with the relative measure of export propensity.

References

Almunia, M., & López-Rodríguez, D. (2014). Heterogeneous responses to effective tax enforcement: Evidence from Spanish firms. MPRA Paper No. 57408.

Altomonte, C., & Aquilante, T. (2012). The EU-EFIGE/Bruegel-unicredit dataset. Bruegel Working Paper, October 2012.

Antràs, P. (2011). El Comportamiento de las Exportaciones Españolas. Apuntes FEDEA.

Bernard, A. B., & Jensen, J. B. (1995). Exporters, jobs, and wages in U.S. manufacturing: 1976–1987. Brookings Papers on Economic Activity, Microeconomics,1995, 67–119.

Bernard, B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives,21, 105–130.

Bernard, B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2012). The empirics of firm heterogeneity and international trade. Annual Review of Economics,4, 283–313.

Bonaccorsi, A. (1992). On the relationship between firm size and export intensity. Journal of International Business Studies,23, 605–635.

Canay, I. A. (2011). A note on quantile regression for panel data models. The Econometrics Journal,14, 368–386.

Díaz-Mora, C., Córcoles, D., & Gandoy, R. (2015). Exit from exporting: Does being a two-way trader matter? Economics the Open-Access, Open-Assessment Ejournal,9, 2015–2020.

Fariñas, J. C., & Martín-Marcos, A. (2007). Exporting and economic performance: Firm-level evidence of Spanish manufacturing. The World Economy,30(4), 618–646.

Galvao, A. F., Jr. (2011). Quantile regression for dynamic panel data with fixed effects. Journal of Econometrics,164(1), 142–157.

García-Santana, M., & Ramos, R. (2013). Distortions and the size distribution of plants: Evidence from cross-country data. Mimeo.

Graham, B. S., Hahn, J., & Powell, J. L. (2009). The incidental parameter problem in a non-differentiable panel data model. Economics Letters,105(2), 181–182.

Greenaway, D., & Kneller, R. (2007). Firm heterogeneity, exporting and foreign direct investment. The Economic Journal,117, F134–F161.

Harding, M., & Lamarche, C. (2009). A quantile regression approach for estimating panel data models using instrumental variables. Economics Letters,104(3), 133–135.

Heckman, J. (1979). Sample selection bias as a specification error. Econometrica,47, 350–354.

Huerta, E., & Salas, V. (2012). La calidad del recurso empresarial en España: Indicios e implicaciones para la competitividad. Papeles de Economía Española,132, 19–37.

Iyer, K. (2010). The determinants of firm-level export intensity in New Zealand agriculture and forestry. Economic Analysis and Policy,40(1), 75–86.

Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis,91(1), 74–89.

Lamarche, C. (2010). Robust penalized quantile regression estimation for panel data. Journal of Econometrics,157(2), 396–408.

Majocchi, A., Bacchiocchi, E., & Mayrhofer, U. (2005). Firm size, business experience and export intensity in SMEs: A longitudinal approach to complex relationships. International Business Review,14, 719–738.

Mañez, J. A., Rochina, M. E., & Sanchís, J. A. (2004). The decision to export: A panel data analysis for Spanish manufacturing. Applied Economics Letters,11, 669–673.

Mañez-Castillejo, J. A., Rochina-Barrachina, M. E., & Sanchís-Llopís, J. A. (2010). Does firm size affect self-selection and learning-by-exporting? The World Economy,33(3), 315–346.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica,71, 1695–1725.

Minondo, A. (2013). Trading firms in the Spanish service sector. Revista de Economía Aplicada,63, 5–28.

Patibandla, M. (1995). Firm size and export behaviour: An Indian case study. Journal of Development Studies,31, 868–882.

Piccardo, C., Bottaso, A., & Benfratello, L. (2014). Innovative capacity and export performance: Exploring heterogeneity along the export intensity distribution (p. 371). WP: Centre for Studies in Economics and Finance.

Pla-Barber, J., & Alegre, J. (2007). Analysing the link between export intensity, innovation and firm size in a science-based industry. International Business Review,16, 275–293.

Ponomareva, M. (2011). Quantile regression for panel data models with fixed effects and small T: Identification and estimation. Working Paper, University of Western Ontario.

Powell, D. (2016). Quantile regression with nonadditive fixed effects. Working Papers RAND Corporation Publications Department.

Powell, D., & Wagner, J. (2014). The exporter productivity premium along the productivity distribution. Evidence from quantile regression with nonadditive firm fixed effects. Review of World Economics,150(4), 763–785.

Redding, S. J. (2011). Theories of heterogeneous firms and trade. Annual Review of Economics,3, 77–105.

Rosen, A. M. (2012). Set identification via quantile restrictions in short panels. Journal of Econometrics,166(1), 127–137.

Vermeulen, P. (2004). Factor content, size, and export propensity at the firm level. Economics Letters,82, 249–252.

Verwaal, E., & Donkers, B. (2002). Firm size and export intensity: Solving an empirical puzzle. Journal of International Business Studies,33, 6013–6613.

Wagner, J. (1995). Exports, firm size, and firm dynamics. Small Business Economics,7, 29–39.

Wagner, J. (2006). Export intensity and plant characteristics: What can we learn from quantile regression? Review of World Economics,142(1), 195–203.

Wagner, J. (2007). Exports and productivity: A survey of the evidence from firm-level data. The World Economy,30, 60–82.

Wagner, J. (2011). From estimation results to stylized facts: Twelve recommendations for empirical research in international activities of heterogeneous firms. De Economist,159, 389–412.

Wolf, J. A., & Pett, T. (2000). Internationalization of small firms: An examination of export competitive patterns, firms size, and export performance. Journal of Small Business Management,38, 34–37.

Yasar, M., Nelson, C. H., & Rejesus, R. (2006). Productivity and exporting status of manufacturing firms: Evidence from quantile regressions. Review of World Economics,142(4), 675–694.

Acknowledgements

I acknowledge financial support from the Spanish Ministry of Science and Innovation under project ECO2011-28501 and the Ministry of Economy and Competitiveness under project ECO2014-53419-R. I would like to thank David Powell for his Stata code for the quantile regression for fixed effects panel data models and Francisco Alcalá, Francisco Candel, Diego Peñarrubia and participants at the XIX Applied Economics Meeting for their helpful comments. Any remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Hernández, P.J. Reassessing the link between firm size and exports. Eurasian Bus Rev 10, 207–223 (2020). https://doi.org/10.1007/s40821-019-00126-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40821-019-00126-9