Abstract

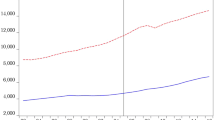

We use monthly data on gross expenditure on luck and skill games in Italy to investigate whether people react to recessions investing in activities based on fortune or ability. Luck game expenditure is volatile and positively correlated with unemployment in economic downturns. Naive consumers tend to consider luck games as a potential source of additional income during recessions. Skill game expenditure is persistent over time and uncorrelated with the unemployment rate, suggesting a more balanced attitude of skill consumers. This study provides evidence on the prevailing behavior and reaction of expert or naïve consumers when facing economic downturns.

Similar content being viewed by others

Notes

European Commission, http://ec.europa.eu/growth/sectors/gambling_it.

Italian gambling regulatory authority (AAMS) data, http://www.aams.gov.it.

Official AAMS monthly series on aggregate spending in gambling started in January 2009 and ended in October 2012. This publication was never resumed.

The 10-year government bond yield reached a peak of 5925 on July 18, then peaked again at 5891 on July 28.

This intuition is supported formally by the existence of a significant intercept shift in the AR(1) model for the logarithm of the confidence index (P-value lower than 0.001).

The correlation between the male unemployment rate and the confidence index throughout the period is negative, but the relationship changes over time. In the pre-crisis period the correlation between the two is weakly positive (0.46) while after July 2011 a neat negative relationship emerges (−0.84).

Non-significant interaction terms have been dropped in a backward selection process.

Granger and Newbold (1974) suggest that a high value for R\(^{2 }\)combined with a low value of the Durbin Watson statistic is an indication of spurious relationship. Following this indication, we found no signals of spurious regression since the statistics are 2.247 for the skill game regression and 2.271 for the luck game regression.

References

Barberis N, Huang M (2008) Stocks as lotteries: the implications of probability weighting for security prices. Am Econ Rev 98:2066–2100

Bastiani L, Gori M, Colasante E, Siciliano V, Capitanucci D, Jarre P, Molinaro S (2013) Complex factors and behaviors in the gambling population of Italy. J Gamb Stud 29:1–13

Blaszczynski A, Nower L (2002) A pathways model of problem and pathological gambling. Addiction 97:487–499

Bordalo P, Gennaioli N, Shleifer A (2013) Salience and asset prices. Am Econ Rev 103:623–628

Callois R (1961) Man, play and games. Thames and Hudson, Great Britain

Camerer CF (2003) Prospect theory in the wild: evidence from the field. In: Camerer C, Loewenstein G, Rabin M (eds) Advances in behavioral economics. Princeton University Press, Princeton

Chantal Y, Vallerand RJ (1996) Skill versus luck: a motivational analysis of gambling involvement. J Gamb Stud 12:407–418

Conlisk J (1993) The utility of gambling. J Risk Uncertain 6:255–275

Deci EL, Ryan RM (1985) Intrinsic motivation and self-determination in human behavior. Plenum Press, New York

De Paola M, Scoppa V (2014) Media exposure and individual choices: evidence from lottery players. Econ Model 38:385–391

Di Cesare A, Grande G, Manna M, Taboga M (2012) Recent Estimates of Sovereign Risk Premia for Euro-Area Countries. Bank of Italy Occasional Papers, No. 128

Eakins J (2016) Household gambling expenditures and the Irish recession. Int Gamb Stud 16:211–230

Epstein RA (1967) The theory of gambling and statistical logic. Academic Press, New York

Eraker B, Ready MJ (2015) Do investors overpay for stocks with lottery-like payoffs? An examination of the returns on OTC stocks. J Financ Econ 115:486–504

Farrell L, Morgenroth E, Walker I (1999) A time series analysis of UK lottery sales: long and short run price elasticities. Oxford B Econ Stat 61:513–526

Farrell L, Walker I (1999) The welfare effects of lotto: evidence from the UK. J Public Econ 72:99–120

Forrest D, Gulley DO, Simmons R (2000) Elasticity of demand for UK National Lottery tickets. Natl Tax J 53:853–863

Forrest D, Simmons R, Chesters N (2002) Buying a dream: alternative models of demand for lotto. Econ Inq 40:485–496

Gandolfo A, De Bonis V (2015) Motivation, personality type and the choice between skill and luck gambling products. J Gamb Bus Econ 9:30–46

Garrett TA, Sobel RS (2004) State lottery revenue: the importance of game characteristics. Public Financ Rev 32:313–330

Gori M, Potente R, Pitino A, Scalese M, Bastiani L, Molinaro S (2015) Relationship between gambling severity and attitudes in adolescents: findings from a population-based study. J Gamb Stud 31:717–740

Granger CW, Newbold P (1974) Spurious regressions in econometrics. J Econ 2:111–120

Gu Z (1999) The Impact of the Asian financial crisis on Asian gaming activities: an examination of Las Vegas strip casino drops. Curr Issues Tour 2(4):354–365

Gulley DO, Scott FA Jr (1993) The demand for wagering on state-operated lotto games. Natl Tax J 42:13–22

Hayatbakhsh MR, Najman JM, Aird R, Bor W, O’Callaghan M, Williams G, Shuttlewood G, Heron Alati RM, (2006) Early Life Course Determinants of Young Adults’ Gambling Behaviour. An Australian Longitudinal Study, Office of Gaming Regulation, Queensland Treasury

Horvath C, Paap R (2012) The effect of recessions on gambling expenditures. J Gamb Stud 28:703–717

Huang JH, Boyer R (2007) Epidemiology of youth gambling problems in Canada: a national prevalence study. Can J Psychiatry 52:657–665

Jackson AC, Wynne H, Dowling NA, Tomnay JE, Thomas SA (2010) Using the CPGI to determine problem gambling prevalence in Australia: measurement issues. Int J Ment Health Addict 8:570–582

Kumar A (2009) Who gambles in the stock market? J Financ 13:1889–1933

Kumar A, Page JK, Spalt OG (2011) Religious beliefs, gambling attitudes, and financial market outcomes. J Financ Econ 102:671–708

Matheson VA (2001) When are state lotteries a good bet (revisited)? Eastern Econ J 27:55–70

Mikesell JL (1994) State lottery sales and economic activity. Natl Tax J 47:165–171

Milne R, Wilson J (2011) Deutsche Bank hedges Italian risk. Financ Times, 26 July 2011

Mizerski R, Mizerski K, Lam D, Lee A (2013) Gamblers’ Habit. J Bus Res 66:1605–11

Olason DT, Hayer T, Brosowski T, Meyer G (2015) Gambling in the mist of economic crisis: results from three national prevalence studies from Iceland. J Gamb Stud 31:759–774

Orford J, Wardle H, Griffiths M (2013) What proportion of gambling is problem gambling? Estimates from the 2010 British Gambling Prevalence Survey. Int Gamb Stud 13:4–18

Perez L, Humphreys B (2013) The “who and why” of lottery: empirical highlights from the seminal economic literature. J Econ Surv 27:915–940

Raab C, Schwer RK (2003) The short- and long-term impact of the Asian financial crisis on Las Vegas Strip baccarat revenues. Hospi Manag 22:37–45

Repetti T, Jung S (2013) Building the first gaming master’s program: an industry perspective. UNLV Gamin Res Rev J 17:63–79

Scalese M, Bastiani L, Salvadori S, Gori M, Lewis I, Jarre P, Molinaro S (2016) Association of problem gambling with type of gambling among Italian general population. J Gamb Stud 32:1017–1026

Schettini KM (2005) State lotteries and consumer behaviour. J Public Econ 89:2269–2299

Scott F, Gulley DO (1995) Testing for efficiency in lotto markets. Econ Inq 33:175–188

Stinchfield R (2003) Reliability, validity, and classification accuracy of a measure of DSM-IV diagnostic criteria for pathological gambling. Am J Psychiatry 160:180–182

Tam MS (1991) Tax on price: a new commodity tax structure for efficiency. Public Financ 46:123–33

Walker MB (1985) Explanations for gambling. In: Caldwell GT, Dickerson MG, Haig B, Sylvan L (eds) Gambling in Australia. Croom Helm, Sydney

Walker MB (1992) The psychology of gambling. Pergamon Press, New York

Wardle H, Moody A, Spence S, Orford J, Volberg R, Dhriti J, Griffiths M, Hussey D, Dobbie F (2011) British Gambling Prevalence Survey 2010. NCSR

Worthington AC, Brown K, Crawford M, Pickernell D (2007) Gambling participation in Australia: findings from the National Household Expenditure Survey. Rev Econ Household 5(2):209–221

Zoli E (2013) Italian sovereign spreads: Their determinants and pass-through to bank funding costs and lending conditions. IMF working paper, No. 13/84

Acknowledgments

We thank two anonymous referees for helpful comments. Financial support from FARB (FFBO127297—University of Bologna) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Table 3.

Rights and permissions

About this article

Cite this article

Capacci, S., Randon, E. & Scorcu, A.E. Are Consumers More Willing to Invest in Luck During Recessions?. Ital Econ J 3, 25–38 (2017). https://doi.org/10.1007/s40797-016-0043-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40797-016-0043-x