Abstract

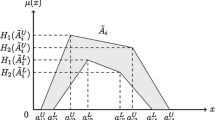

The aim of this paper was to develop methods for addressing the problem of project portfolio selection and present some approaches for evaluating investment portfolio. We proposed two methods for this problem. The first method is based on gray systems and proposed a gray linear programming model. In this regard, first the effective criteria for performance evaluation of project portfolios with literature survey are identified. Then the importance of each is measured with Shannon entropy. For ranking the considered sample, we use gray systems theory. Finally, part investment in each portfolio is determined by the gray linear programming model. The second method is based on the fuzzy ranking method.In this section, 100,000 portfolios are produced by a computer program that each involves 20 different projects the amount of whose investment is between 0 and 100 % . Revenue uncertainty of each portfolio is randomly selected. Then use the ranking index that allows decision maker to compare various portfolios and select the best of them. In both methods, we try to use real options theory concepts as a modern and efficient economic evaluation tool for optimal portfolio selection problem. Applicable examples are used to show the convenience and suitability of the proposed methods.

Similar content being viewed by others

References

Mintzberg H., Ahlstrand B., Lampel J.: Strategy Safari: A guided tour through the wilds of strategic management. Free Press, New York (1998)

HamelG. Prahalad C.K.: Strategy as Stretch And Leverage. Harv. Bus. Rev. 71, 73–84 (1993)

Kendall, G.I.; Rollins, S.C.: Advanced project portfolio management and the PMO, multiplying ROI at warp speed. J. Ross Publishing, Inc., Boca Raton (2003)

Ghasemzadeh F., Archer N., Iyogun P.: A zero-one model for project portfolio selection and scheduling. J. Oper. Res. Soc. 50, 745–755 (1999)

Sommer, R.J.: Portfolio management for projects: a new paradigm. In: Dye, L.D.; Pennypacker, J.S. (eds.) Project portfolio management: selecting and prioritizing projects for competitive advantage, pp. 55–60. Center for Business Practices, West Chester (1999)

Rǎdulescu Z., Rǎdulescu M.: Project portfolio selection models and decision support. National Institute for Research & Development in Informatics, Romania (2001)

Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. (eds.) Portfolio management for new products. Basic Books, New York (2001)

Yelin, K.C.: Linking strategy and project portfolio management. In: Levine, H.A. (ed.) Project portfolio management: a practical guide to selecting projects, managing portfolios and maximizing benefit, pp. 137–145. Pfeiffer Wiley, USA (2005)

Better M., Glover F.: Selecting project portfolios by optimizing simulations. Eng. Econ. 51, 81–97 (2006)

Standard for Portfolio Management: PMI, Newtwon Square (2006)

Mousavi S.M., Tavakkoli-Moghaddam R., Heydar M., Ebrahimnejad S.: Multi-criteria decision making for plant location selection: an integrated Delphi–AHP–PROMETHEE methodology. Arab. J. Sci. Eng. 38, 1255–1268 (2013)

Morris P., Jamieson A.: Translating Corporate Strategy Into Project Strategy: Realizing Corporate Strategy Through Project Management. PMI, USA (2004)

Dey P.K.: Integrated project evaluation and selection using multiple-attribute decision-making technique. Int. J. Prod. Econ. 103, 90–103 (2006)

Evans, D.; Souder, W.; Pinto, J.: Methods of selecting and evaluating projects, pp. 119–137. Project management institute project management handbook. Jossey-Bass, San Francisco, CA (1998)

Meredith, J.R.; Mantel, S.: Administração de Projetos, Uma Abordagem Gerencial, 4aedição. Editora LTC (2000)

Taylor J.: A survival guide for project manager. AMACOM, Broadway (2006)

Baker N., Freeland J.: Recent advances in R&D benefit measurement and project selection methods. Manag. Sci. 21, 1164–1175 (1975)

Baker N.R.: R&D project selection. IEEE Trans. Eng. Manag. 21, 465–471 (1974)

Liberatore M.J., Titus G.J.: The practice of management science in R&D project management. Manag. Sci. 29, 962–974 (1983)

Hall D.L., Nauda A.: An interactive approach for selecting IR&D projects. IEEE Trans. Eng. Manag. 37, 126–133 (1990)

Martino J.P.: Research and development project selection. Wiley, New York (1995)

Heidenberger K., Stummer C.: Research and development project selection and resource allocation—a review of quantitative modelling approaches. Int. J. Manag. Rev. 1, 197–224 (1999)

Chien C.-F.: A portfolio-evaluation framework for selecting R&D projects. R&D Manag. 32, 359–368 (2002)

Myers S.: Determinants of corporate borrowing. J. Financ. Econ. 5, 147–175 (1977)

Avison D., Lau F., Neilsen P.A., Myers M.: Action research. Commun. ACM. 42, 94–97 (1999)

Al-Otaibi M., Mukhopadhyay A.: Options for managing water resources in Kuwait. Arab. J. Sci. Eng. 30, 55 (2005)

Taskin S., Dursun B., Alboyaci B.: Performance assessment of a combined solar and wind system. Arab. J. Sci. Eng. 34, 217–227 (2009)

Salah K.: Two analytical models for evaluating performance of Gigabit Ethernet hosts. Arab. J. Sci. Eng. 31, 245–264 (2006)

Mousavi, S.M.; Torabi, S.A.; Tavakkoli-Moghaddam, R.: A hierarchical group decision-making approach for new product selection in a fuzzy environment. Arab. J. Sci. Eng. 38, 3233-3248 (2013)

Leslie, K.; Michaels, M.: The real power of real options.McKinsey Q. 3,5–22 (1997)

Pereira O., Junior D.: The R&D project selection problem with fuzzy coefficients. Fuzzy Sets Syst. 26, 299–316 (1988)

Zdeněk Z.: Generalised soft binomial American real option pricing model (fuzzy–stochastic approach). Eur. J. Oper. Res. 207, 1096–1103 (2010)

Zmeškal Z.: Application of the fuzzy–stochastic methodology to appraising the firm value as a European call option. Eur. J. Oper. Res. 135, 303–310 (2001)

Zmeškal Z.: Value at risk methodology under soft conditions approach (fuzzy-stochastic approach). Eur. J. Oper. Res. 161, 337–347 (2005)

Coffin M.A., Taylor B.W.: R&D project selection and scheduling with a filtered beam search approach. IIE Trans. 18, 167–176 (1996)

Fang, Y.; Lai, K.K.; Wang, S.Y.: A fuzzy mixed projects and securities portfolio selection model. Springer, Berlin (2005)

Inuiguchi M., Ramík J.: Possibilistic linear programming: a brief review of fuzzy mathematical programming and a comparison with stochastic programming in portfolio selection problem. Fuzzy Sets Syst. 111, 3–28 (2000)

Bas E., Kahraman C.: Fuzzy capital rationing model. J. Comput. Appl. Math. 224, 628–645 (2009)

Kuchta D.: Fuzzy capital budgeting. Fuzzy SetsSyst. 111, 367–385 (2000)

Yoshida, Y.: Optimal stopping in fuzzy stochastic processes and its application to option pricing in financial engineering. Soft Methods in Probability, Statistics and Data Analysis Physica-Verlag, pp. 244–251. Springer, Heidelberg (2002)

Yoshida Y.: A discrete-time model of American put option in an uncertain environment. Eur. J. Oper. Res. 151, 153–166 (2003)

Yoshida Y., Yasuda M., Nakagami J.-I., Kurano M.: A discrete-time American put option model with fuzziness of stock prices. Fuzzy Optim. Decis. Mak. 4, 191–207 (2005)

Muzzioli S., Reynaerts H.: The solution of fuzzy linear systems by non-linear programming: a financial application. Eur. J. Oper. Res. 177, 1218–1231 (2007)

Muzzioli S., Torricelli C.: A multiperiod binomial model for pricing options in a vague world. J. Econ. Dyn. Control. 28, 861–887 (2004)

Collan, M.; Fullér, R.; Mezei, J.: A fuzzy pay-off method for real option valuation. J. Appl. Math. Decis. Sci. 2009 (2009). doi:10.1155/2009/238196

Karsak, E.E.: A generalized fuzzy optimization framework for R&D project selection using real options valuation. ICCSA 2006, Computational Science and its Applications, pp. 918–927 (2006)

Hassanzadeh F., Collan M., Modarres M.: A technical note on “A fuzzy set approach for R&D portfolio selection using a real options valuation model” by Wang and Hwang (2007). Omega. 39, 464–465 (2011)

Hassanzadeh F., Collan M., Modarres M.: A practical R&D selection model using fuzzy pay-off method. Int. J. Adv. Manuf. Technol. 58, 227–236 (2012)

Hassanzadeh, F.; Modarres, M.; Saffari, M. (eds.): A robust optimization approach to R&D portfolio selection. Springer, Berlin (2009)

Roshanaei, V.; Vahdani, B.; Mousavi, S.M.; Mousakhani, M.; Zhang, G.: CAD/CAM system selection: a multi-component hybrid fuzzy MCDM model. Arab. J. Sci. Eng. 1–16 (2013)

Deng J.L.: Gray systems. China Ocean Press, Beijing (1988)

Liu S.F., Lin Y.: Gray information. Springer, London (2006)

Nagai M., Yamaguchi D.: Elements on Gray system theory and its applications (in Japanese). Kyoritsu-Shuppan, Tokyo (2004)

Wen, K.L. Gray systems: modeling and prediction, Tucson, Yang’s Scientific Research Institute (2004)

Zadeh L.A.: Fuzzy sets. Inf. Control. 8, 338–353 (1965)

Deng J.L.: Control problems of Gray sytems. Syst. Control Lett. 1, 288–294 (1982)

Pawlak, Z.: Rough sets. Int. J. Comput. Inf. Sci. 11, 341–356 (1982)

Lin, Y.; Liu, S.F.: A historical introduction to Gray systems theory. IEEE Int. Conf. Syst. Man Cybern. 2403–2408, (2004)

Deng, J.: Introduction to Gray system theory. J. Gray Syst. 1, 1–24 (1989)

Zadeh, L.A.: Fuzzy sets as a basis for a theory of possibility. Fuzzy sets Syst. 1, 3–28 (1978)

Spott, M.: A theory of possibility distributions. Fuzzy Sets Syst. 102, 135–155 (1999)

Dubois, D.; Nguyen, H.T.; Prade, H.: Possibility theory, probability and fuzzy sets: misunderstandings, bridges and gaps, fundamentals of fuzzy sets. The handbook of Fuzzy Sets Series. Kluwer Academic Publishers, Dordrecht (1999)

Dubois, D.; Ostasiewicz, W.; Prade, H. (eds.): Fuzzy sets: history and basic notions. Kluwer Academic Publishers, Dordrecht (2000)

Deschrijver G., Kerre E.E.: On the relationship between some extensions of fuzzy set theory. Fuzzy Sets Syst. 133, 227–235 (2003)

Huang Y., Huang C.: The integration and application of fuzzy and Gray modeling methods. Fuzzy Sets and Syst. 78, 107–119 (1996)

Cheng, F.J.; Hui, S.; Chen, Y.: Reservoir operation using Gray fuzzy stochastic dynamic programming. Hydrol Process. 16, 2395–2408 (2002)

Gray numbers and their operations. Gray information, pp. 23–43. Springer, London (2006)

Bǎdescu, A.V.; Smeureanu, I.; Asimit, A.V.: Portfolio Assets Selection Through Gray Numbers Implementation (2010)

Liu, S.; Guo, T.; Dang, Y.: Gray system theory and its application, vol. 270. The Science Press of China (2000)

Mendel J., John R.I.: Type-2 fuzzy sets made simple. IEEE Trans. Fuzzy Syst. 10, 117–127 (2002)

John R.I.: Type 2 Fuzzy sets: an appraisal of theory and applications. Int. J. Uncertain. Fuzziness Knowl Based Syst. 6, 563–576 (1998)

Sambuc, R.: Fonctions Phi-floues. Applicationà l’aide au diagnostic en pathologie thyrodienne. Université de Marseille (1975)

Yang, H.Q.; Yao, H.; Jones, J.D.: Calculating functions of fuzzy numbers. Fuzzy Sets Syst. 55, 273–283 (1993)

Deng, J.L.: The introduction of Gray system. Journal Gray Syst. 1, 1–24 (1982)

Liu, S.; Lin, Y.: Gray systems: theory and applications (Understanding Complex Systems). Springer, Berlin (2011)

Mujumdar, P.P.; Karmakar, S.: Gray fuzzy multiobjective optimization. Fuzzy multi-criteria decision making: theory and applications with recent developments, pp. 453–481. Department of civil engineering, Institute of science (2008)

Amenc, N.; Sourd, V.L.: Portfolio theory and performance analysis. Wiley, USA (2005)

Kyläheiko, K.; Sandström, J.; Virkkunen, V.: Dynamic capability view in terms of real options. Int. J. Prod. Econ. 80, 65–83 (2002)

Markowitz, H.: Portfolio selection. J. Financ. 7 (1952)

Bermudez, J.D.; Segura, J.V.; Vercher, E.: A fuzzy ranking startegy for portfolio selection applied to the spanish stock market. IEEE Fuzzy Syst. Conf. IEEE Int. (2007)

Leon, T.; Liern, V.; Marco, P.; Segura, J.V.: A downside risk approach for the portfolio selection problem with fuzzy returns. Fuzzy Econ. Rev. 9 (2004)

Gear, A.E.; Lockett, A.G.; Pearson, A.W.: Analysis of some portfolio selection models for R&D. IEEE Trans. Eng. Manag. 2, 66–76 (1971)

Souder, W.E.; Mandakovic, T.: R&D project selection models. Res. Manag. 29(4), 36–42 (1986)

Weber, R.; Werners, B.; Zimmermann, H.-J.: Planning models for research and development. Eur. J. Oper. Res. 48(2), 175–188 (1990)

Bohanec, M. et al.: Knowledge-based portfolio analysis for project evaluation. Inf. Manag. 28(5), 293–302 (1995)

Ernst, H.: Patent portfolios for strategic R&D planning. J. Eng. Technol. Manag. 15(4), 279–308 (1998)

Ghasemzadeh, F.; Norman, P.A.: Project portfolio selection through decision support. Decis. Support Syst. 29(1), 73–88 (2000)

Deng, X-T.; Zhong-Fei, L.;Shou-Yang, W.: A minimax portfolio selection strategy with equilibrium. Eur. J. Oper. Res. 166(1), 278–292 (2005)

Sanna, U.; Cirillo, A.; Nannina, S.: A fuzzy number ranking in project selection for cultural heritage sites. J. Cult. Herit. 9(3), 311–316 (2008)

Wei, C-C.; Houn-Wen, C.: A new approach for selecting portfolio of new product development projects. Expert. Syst. Appl. 38(1), 429–434 (2011)

Oh, J.; Jeongsam, Y.; Sungjoo, Lee.: Managing uncertainty to improve decision-making in NPD portfolio management with a fuzzy expert system. Expert. Syst. Appl. 39(10), 9868–9885 (2012)

Özkır, V.; Tufan, D.: A fuzzy assessment framework to select among transportation investment projects in Turkey. Expert. Syst. Appl. 39(1), 74–80 (2012)

Gupta, P.; et al.: Multiobjective credibilistic portfolio selection model with fuzzy chance-constraints. Inform Sci 229, 1–17 (2013)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Arasteh, A., Aliahmadi, A. & Omran, M.M. Application of Gray Systems and Fuzzy Sets in Combination with Real Options Theory in Project Portfolio Management. Arab J Sci Eng 39, 6489–6506 (2014). https://doi.org/10.1007/s13369-014-1155-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13369-014-1155-y