Abstract

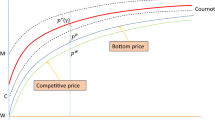

This paper deals with deterministic dynamic pricing and advertising differential games which are stylized models of special durable-good oligopoly markets. We analyze infinite horizon models with constant price and advertising elasticities of demand in the cases of symmetric and asymmetric firms. In particular, we consider general saturation/adoption effects. These effects are modeled as transformations of the sum of the cumulative sales of all competing firms. We specify a necessary and sufficient condition such that a unique Markovian Nash equilibrium for such games exist. For two classes of models we derive solution formulas of the optimal policies and of the value functions, and we show how to compute the evolution of the cumulative sales of each firm. The analysis of these games reveals that the existence of the Nash equilibrium relies on the possibility to separate a component, which is specific for each firm, from a [market] component, which is the same for all firms. The common factor is a function of the decreasing untapped market size. The individual factor of each firm reflects its individual market power and has an impact on equilibrium prices; each such coefficient depends on the price elasticities, unit costs, arrival rates, and discount factors of all competing companies. Formulas for these coefficients reveal how equilibrium prices depend on the number of competing firms, and how the entry or exit of a firm affects the price structure of the oligopoly.

Similar content being viewed by others

Notes

We assume the number of customers is large enough so that it is a valid approximation to treat \(N\), \(x\) and \(y\) as continuous variables.

References

Dockner EJ, Feichtinger G (1986) Dynamic advertising and pricing in an oligopoly: a Nash equilibrium approach. In: Basar T (ed) Proceedings of the Seventh Conference on Economic Dynamics and Control, Springer, Berlin, pp 238–251

Dockner EJ, Jørgensen S, van Long N, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Easingwood CJ, Mahajan V, Muller E (1983) A nonuniform influence innovation diffusion model of new product acceptance. Mark Sci 2(3):273–295

Erickson GM (2009) An oligopoly model of dynamic advertising competition. Eur J Oper Res 197(1):374–388

Erickson GM (2011) A differential game model of the marketing-operations interface. Eur J Oper Res 211(2):394–402

Fruchter GE (1999) The many-player advertising game. Manag Sci 45(11):1609–1611

Fruchter GE, Kalish S (1998) Dynamic promotional budgeting and media allocation. Eur J Oper Res 111(1):15–27

Harris C, Howison S, Sircar R (2010) Games with exhaustible resources. SIAM J Appl Math 70:2556–2581

Helmes K, Schlosser R (2013) Dynamic advertising and pricing with constant demand elasticities. J Econ Dyn Control 37:2814–2832

Helmes K, Schlosser R, Weber M (2013) Optimal advertising and pricing in a class of general new-product adoption models. Eur J Oper Res 229:433–443

Huang J, Leng M, Liang L (2012) Recent developments in dynamic advertising research. Eur J Oper Res 220:591–609

Jørgensen S, Zaccour G (2004) Differential games in marketing. Kluwer Academic Publishers, Boston

Krishnamoorthy A, Prasad A (2010) Optimal pricing and advertising in a durable-good duopoly. Eur J Oper Res 200:486–497

Ledvina A, Sircar R (2011) Dynamic Bertrand oligopoly. Appl Math Optim 63:11–44

Mahajan V, Muller E (1979) Innovation diffusion and new product growth models in marketing. J Mark 43(4):55–68

Mahajan V, Muller E, Bass FM (1990) New product diffusion models in marketing: a review and directions for research. J Mark 54(1):1–26

Mahajan V, Muller E, Wind J (2000) New product diffusion models. Kluwer Academic Publishers, New York

Mansfield E (1961) Technical change and the rate of imitation. Econometrica 29:741–766

Nerlove M, Arrow KJ (1962) Optimal advertising policy under dynamic conditions. Economica 39:129–142

Peres R, Muller E, Mahajan V (2010) Innovation diffusion and new product growth models: a critical review and research directions. Int J Res Mark 27:91–106

Prasad A, Sethi S P (2003) Dynamic optimization of an oligopoly model of advertising. Working paper. UTD School of Management

Schmalensee R (1972) The economics of advertising. North-Holland, Amsterdam

Sethi SP, Prasad A, He X (2008) Optimal advertising and pricing in a new-product adoption model. J Optim Theory Appl 139(2):351–360

Teng J-T, Thompson GL (1984) Optimal pricing and advertising policies for new product oligopoly models. Mark Sci 3(2):148–168

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

see Appendix Tables 5, 6, 7, 8 and 9

1.1 Collection of Formulas

Optimality conditions:

where

Auxilliary parameters:

Characterization of value functions by ODEs: \(\beta =\beta (y)\), \(\psi =\psi (y)\), etc.

Bernoulli differential equation for \(\beta (y)\) (market effect):

Case I. (Special form of (28)): \(z_j=(\gamma -1)\eta _j\alpha _j^{-\gamma }\),

Proofs

Proof of Lemma 1 We shall subdivide the proof into four main parts, (i) reducing the system of equations to the analysis of a particular nonlinear equation, (ii) existence of a solution of this particular equation, (iii) uniqueness, and (iv) dependence on \(n\). Each part will be subdivided into several steps. In Part 1, we show how the analysis of the system of equations can be reduced to the analysis of a particular nonlinear equation in one unknown. The final part, Part 5, exhibits explicit solution formulas of the components \(\alpha _i\), if all cost parameters are zero.\(\square \)

1.2 Part 1: Reducing the system to one equation

If there is a positive vector \(\varvec{\alpha }=(\alpha _i)_{1\leqslant i\leqslant n}\) such that

then simple algebra shows that \(\varvec{\alpha }\) satisfies the system of equations,

where \(Z:=\sum _jz_j\), and \(z_i\) is defined in Lemma 1, see also (31). We define \(n\) real-valued functions \(f_i\) on the positive real line, \(\xi >0\), \(i=1,2,\ldots ,n\),

If \(\varvec{\alpha }\) satisfies (32), then \(f_1(\alpha _1)=f_2(\alpha _2)=\ldots =f_n(\alpha _n)=Z\). Observe, each function \(f_i\) is strictly monotone decreasing, \(f_i(0+)=+\infty \), and \(\lim _{\xi \rightarrow \infty }f_i(\xi )=-r_i\). We denote the unique root of each \(f_i\) by \(\alpha _i^{(0)}\) and we consider the intervals \((0,\alpha _i^{(0)}]\), \(i=1,2,\ldots ,n\); when \(f_i\) is restricted to this interval, the range of \(f_i\) equals \([0,\infty )\). From now on - without loss of generality - we choose the function \(f_1\) to work with. By definition, for any \(\kappa \geqslant 0\), there is a unique \(\xi \) in \((0,\alpha _1^{(0)}]\) such that \(\kappa =f_1(\xi )\), and, for \(i=2,...,n\), there are unique positive numbers \(f_i^{-1}(f_1(\xi ))=:\chi _i(\xi )\) in \((0,\alpha _i^{(0)}]\) such that

By construction, \(\chi _i(\xi )\) are monotone increasing functions on \((0,\alpha _i^{(0)}]\). We are looking for positive vectors \(\varvec{\alpha }=(\alpha _i)_{1\leqslant i\leqslant n}\) which solve system (32). If \(\varvec{\alpha }\) is positive, then \(\mathbf {z}=(z_j)_{1\leqslant j\leqslant n}\) is a positive vector and \(Z=\sum _j(\gamma _j-1)\eta _j(c_j+\alpha _j)^{-\gamma _j}\) is a positive number; moreover, the values \(f_i(\alpha _i)\) are positive as well. Since \(f_i(\xi )\) is nonpositive whenever \(\xi \geqslant \alpha _i^{(0)}\), any component \(\alpha _i\) of a positive solution vector \(\varvec{\alpha }\) needs to be less than \(\alpha _i^{(0)}\) Table 5.

To find the first component \(\alpha _1\) of a solution \(\varvec{\alpha }\), we define a particular nonnegative monotone decreasing function \(G\) on \((0,\alpha _1^{(0)}]\), namely

If \(\alpha _1\) is the first component of a solution of (32), then the equation \(G(\alpha _1)=f_1(\alpha _1)\) has to be satisfied. We shall verify that the equation \(G(\xi )=f_1(\xi )\) has at least one solution \(\xi >0\). In Part 3, see below, we will show that the equation has exactly one solution. If \(\alpha _1\) is known, then all other components of a positive solution vector \(\varvec{\alpha }\) are given by \(\alpha _j=\chi _j(\alpha _1)\), \(2\leqslant j\leqslant n\).

1.3 Part 2: Existence (a necessary and sufficient condition)

To prove existence of a positive value \(\alpha _1\), we shall employ the Intermediate Value Theorem. To be specific, we verify that (a),

i. e. the graph of \(f_1\) lies above the graph of \(G\) in a neighbourhood of zero, and (b), \(G\) dominates \(f_1\) for large values \(\xi \). The last statement is obvious, since

To see that \(f_1\) dominates \(G\) in a neighbourhood of zero we observe that \(\lim _{\xi \rightarrow 0}\chi _j(\xi )=0\), \(j=1,2,\ldots ,n\). This last property follows from the fact that \(\lim _{\xi \rightarrow 0}f_j^{-1}(f_1(\xi ))=0\). The behavior of \(G\) in a neighborhood of zero depends on how many cost coefficients \(c_j\) are positive. If all \(c_j\) are positive, then \(G(0+)\) is finite, while \(f_1(0+)=\infty \). If there is at least one parameter \(c_j\) which is equal to zero, then \(G(0+)=\infty \). To see that \(G\) stays below \(f_1\), we analyze the quotient of both functions \(G\) and \(f_1\). Applying l’Hopital’s rule, we obtain

To streamline the expression on the right hand side of the last equation, we introduce the abbreviation \(\xi _j:=\chi _j(\xi )=f_j^{-1}(f_1(\xi ))\). Taking the derivatives of all functions \(f_j\), simple algebra yields

If \(\xi \) converges to zero, we obtain

Let \(J_0:=\{j|c_j=0, j=1,...,n\}\) and \(H:= \sum _{j\in J_0}(1-1/\gamma _j)\). Next, we consider the following two cases: \(H\geqslant 1\) and \(H<1\). In the first case, the fact that the sum is greater or equal to one, together with (37), implies, \(\xi >0\),

Thus, the (negative) slope of \(G\) is steeper than the (negative) slope of \(f_1\). Since \(G\) dominates \(f_1\) in a neighborhood of \(\alpha _1^{(0)}\), and \(G'(\xi )\leqslant f_1'(\xi )<0\), the difference between \(G\) and \(f_1\) will always be positive on \((0,\alpha _1^{(0)}]\). Hence, if \(H\geqslant 1\), there will never be a solution of (31). On the other hand, (37) implies that the condition of the commons, \(H<1\), is necessary and sufficient for a solution of \(G(\xi )=f_1(\xi )\) to exist. Observe that the strict inequality and (37) imply \(G\) to be dominated by \(f_1\) in a neighborhood of zero. Together with (35), at least one positive solution \(\alpha _1\) exists. Recall, if all unit cost coefficients \(c_j\) are positive, then the condition of the commons is always satisfied.

1.4 Part 3: Uniqueness

Assume the condition of the commons holds true. Part 2 implies that there is at least one solution of the equation

Since the graph of \(f_1\) starts above the graph of \(G\) and ends below it, the number of intersections of the two functions is odd. Should there be more than one solution of (38), then the functions \(G\) and \(f_1\) intersect at least 3 times and, by the Mean Value Theorem, the functions have to have the same slope at two different locations. To see that this last statement contradicts (36), we distinguish between the following two possibilities, (i) all \(c_j\) are zero, and (ii) there is at least one positive \(c_j\). If all \(c_j\) are zero, then \(G'(\xi )/f_1'(\xi )=\sum _{j=1}^n(1-1/\gamma _j)\), and the slopes of \(f\) and \(G\), at any \(\xi \), are never the same if a solution of (38) exists.

Should there be at least one positive cost coefficient, say \(c_l\), then \(G'(\xi )/f_1'(\xi )\) is strictly monotone increasing, and there can be only one location where the slopes are the same. To see that the ratio \(G'/f_1'\) is a strictly monotone increasing function, observe that each denominator of the terms of the right hand side of (36) is decreasing in the variable \(\xi _j=\chi _j(\xi _1)\), and the term involving the variable \(\xi _l\) is strictly decreasing in \(\xi _l\). Moreover, \(\chi _j(\xi _1)\) is monotone increasing in \(\xi _1\). Hence, the ratio \(G'(\xi _1)/f_1'(\xi _1)\) is a strictly increasing function too. Thus, the uniqueness of a positive solution \(\alpha _1\) of (38), as well as the uniqueness of a positive solution vector \(\varvec{\alpha }\) of (31) follows.

1.5 Part 4: Dependence on the number of firms

If there are \(n+1\) equations of the form (10), we shall add one additional function \(f_{n+1}\) to the family of functions \({f_1,...,f_n}\), cf. (33). Notice that in Part I of the existence proof, we are free to choose any element of \({f_1,...,f_{n+1}}\) to be used for the construction of the solution \(\varvec{\alpha }^*(n+1)\); w.l.o.g. we will choose \(f_1\) for both systems of equations. Observe, the function \(G\), see (34), is isotone in the number of equations, i.e., \(G\) based on \(n+1\) terms dominates the sum with only \(n\) terms. Thus, \(\alpha _1(n+1)<\alpha _1(n)\). Since the functions \(\chi _j\), \(j=2,...,n\), are strictly monotone increasing, the claim follows.

1.6 Part 5: Explicit Solution Formulas (all unit costs \(c_j\) are zero)

To conclude, we display the explicit solution of equation (32) if all \(c_j=0\). If all cost coefficients are zero, (32) simplifies, and we get \(Z=f_i(\alpha _i)=\gamma _i \eta _i\alpha _i^{-\gamma _i}-r_i= \frac{\gamma _i}{\gamma _i-1} z_i-r_i\). This system of equations is equivalent to the system

Taking the sum of all \(z_i\), we obtain

Since all \(c_i=0\), using the definition of \(\alpha _i\) in terms of \(z_i\), see above, and using (39) and (40), we can express the unique solution value \(\alpha _i\) in terms of the parameter \(u_i\), \(k_i\), and all \(r_j\), \(\gamma _j\), \(j=1,2,\ldots ,n\):

\(\square \)

Proof of Lemma 2 Elementary calculations show that \(\beta (y)=B(y)^{1-1/\gamma }\) is a solution of the Bernoulli Eq. (14), see Lemma 2. The facts that \(\beta \) and \(B\) are increasing functions are an immediate consequence of formula (13). It remains to show that \(\beta (y)\) is concave on \([0,N]\), if the condition \(\psi '(y)\psi (y)^{\frac{-\varepsilon }{\varepsilon -1}}B(y)<\frac{1-\delta }{a}\) holds true. Since \(\beta '(y)=B(y)^{-\frac{1}{\gamma }}\psi (y)^{\frac{1}{\varepsilon -1}}\psi '(y)\), the second derivative of \(\beta \) is given by \(\beta ''(y)=\frac{-1}{\gamma -1}\,B(y)^{\frac{-1-\gamma }{\gamma }}\psi (y)^{\frac{2}{\varepsilon -1}}+B(y)^{\frac{-1}{\gamma }}\frac{1}{\varepsilon -1}\,\psi (y)^{\frac{2-\varepsilon }{\varepsilon -1}}\psi '(y)\), and the assertion follows. \(\square \)

Proof of Theorem 1 By definition, see Sect. 2.1, \(\dot{y}=-\lambda \), where \(\lambda =\sum _{i=1}^n \lambda _i\). Using the optimality conditions (23) and (24), we obtain

Taking the sum of all \(\lambda _i^*(y)\), we obtain

Since the Bernoulli differential equation (14) can be equivalently written as

elementary transformations yield the formula of \(\lambda \). To see (17), evaluate (42) along an optimal trajectory \(y(t)\). Multiplying (42) by \(\beta '(y(t))\) yields the differential equation

Since \(y(0)=N\), we obtain the formula \(\beta (y(t))=\beta (N)e^{-Zt}\). Since \(B\) is strictly increasing, (17) follows. Since \(-\frac{\dot{y}}{Z}=\frac{\beta (y)}{\beta '(y)}\), cf. (42), integrating the individual rates \(\lambda _i^*(y(t))\) yields the accumulated sales of each company

\(\square \)

Proof of Theorem 3 It follows from the proof of Theorem 1 that, \(1\leqslant i\leqslant n\),

Taking the sum of the individual rates of sales implies

The solution of this elementary differential equation is \(y(t)=e^{-Zt}N\).

When integrating the individual rates \(\lambda _i^*(y)\) we get

\(\square \)

Rights and permissions

About this article

Cite this article

Helmes, K., Schlosser, R. Oligopoly Pricing and Advertising in Isoelastic Adoption Models. Dyn Games Appl 5, 334–360 (2015). https://doi.org/10.1007/s13235-014-0123-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-014-0123-1