Abstract

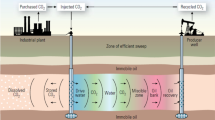

The main goal of any improved oil recovery (IOR) is to displace the remaining oil in a reservoir; it is achieved by improving the volumetric efficiency and enhancing the oil displacement. Carbon dioxide is considered to have high potential to improve the production efficiency of the reservoir. This process is gaining a lot of relevance these days as one of the best IOR techniques because when CO2 dissolves in heavy oil, it reduces the oil viscosity, increases the oil swelling, improves the gravity segregation of oil and the internal drive energy. Consequently, this improves the oil recovery from the reservoir. Oil recovery using CO2 is a win/win technique because it enhances the oil recovery and can be used as a CO2 storage option in reservoirs to reduce the greenhouse gas levels in the atmosphere. In the present study, the reservoir simulation is used to predict the reservoir’s behavior using different production scenarios. A reservoir model is constructed using Eclipse and is used to optimize the well. The objective of this study is to enhance understanding of improved oil recovery for a typical reservoir located offshore on Australian continental shelf. The second part of this study focuses on carrying out an economic analysis of the best IOR scenario, with the maximum oil recovery, by analyzing key variables, such as oil prices, capital costs, operation and maintenance costs, CO2 prices and taxes. The results obtained indicated that proper well optimization performed in high oil saturation areas using sensitivity analysis and optimizing the values of injection and production increases the oil recovery and maximum sweep of the reservoir. The economic analysis carried out on the chosen optimum scenario 4 was found to be very economical with total savings of $173 M.

Similar content being viewed by others

Introduction

Improved oil recovery (IOR) is an approach that allows the recovery of oil from a depleted and high-viscosity oil field. According to a report from (NETL (March 2010) in 2006, IOR projects alone produced around 650,000 barrels of oil per day. IOR operations account for almost 9 Million metric tonnes of carbon, which is equivalent to 80 percent of industrial CO2 every year. Twenty percent of CO2 used for IOR operation comes from natural gas processing plants and the majority of CO2 comes from underground.

Improved oil recovery processes using gas, is also known as capillary number increasing processes. This method is called miscible flooding. Gas drive is the use of energy that arises from the expansion of gas in a reservoir to drive the oil out to a well bore. There are two types of gas drives, namely condensing gas drives in which there is a mass transfer of intermediate hydrocarbon from the solvent to crude, and vaporizing gas drives in which mass transfer occurs from the crude to the solvent. CO2, nitrogen and flue gas fall into this category. These methods are based on the principles of increasing capillary number, which means reducing the interfacial tension between the water and oil thus lowering the mobility ratio (Lake and Walsh 2008).

The screening process for the selection of IOR involves gathering the reservoir data and comparing this with the screening criteria for various IOR methods. After narrowing the choices, the evaluation of results is moved to the laboratory to investigate rock and fluid properties. Engineers and geo-scientists use the available data to create reservoir models to simulate the effects of different IOR methods to choose the optimal one. Pilot testing is performed to prove the applicability of gas for a certain reservoir and also to find out the field and operational problems which may arise. This testing reduces uncertainty and risk and most importantly, it helps to produce plans for large-scale field development. This is very important as laboratory tests and studies may not provide sufficient results. Because the pilot testing is normally operated in a different way to the field-wide application, it is sometimes difficult to project the information to the field as a whole. In this model, the final drilling and completion activities, as well as the surface and transport facilities are determined (Mungan 1982).

One of the most important aspects in planning a proper detailed plan for characterizing a reservoir is to identify the primary factors which will have a profound impact on the CO2 flooding. The scoping factors decide whether the CO2 flooding project will be economically and technically successful or should it be abandoned, if there is no financial gain. Most important reservoir attributes which might cause technical and economical failure and engineer should look into before starting a CO2 project are: thermodynamic minimum miscibility pressure and the average reservoir pressure, oil saturation to water flooding, reservoir heterogeneity, gravity effects, the ability to inject and produce fluids at economical rates and approximate operating plus investments costs associated with the process (Jarrell et al. 2002).

The Implementation of a CO2 IOR project involves the installation of a CO2 recycling plant, laying CO2 transportation pipelines, drilling and reworking of wells and the purchase cost of CO2. Operators need to consider the total CO2 costs, in other words the cost of CO2 purchase and the CO2 recycle cost, which can amount to around 25 to 50 precent of the cost of oil per barrel. In addition, the other costs involved are CO2 supply/injection, price of oil and infrastructure costs associated with the cost of carbon tax emissions (NETL March 2010).

The selection of a suitable IOR depends on careful selection of the reservoir and its characteristics. Once these questions are addressed then based on sound technical analysis, a detailed reservoir model is developed and economic analysis is conducted (Romero-Zerón 2012). Uncertainty in management is also a critical factor in reservoir simulation (Schlumberger 2013). A sound economical recommendations can only be made after a detailed reservoir analysis is carried out.

This hypothetical study is based on a typical reservoir located offshore on the Australian continental shelf using CO2 as an injection medium. Improved oil recovery scenarios were generated in the Eclipse reservoir simulation software and the scenario with the maximum oil recovery at the end of reservoir life was chosen for an economic analysis of that particular optimum scenario.

In the second part of the present study, carbon dioxide is chosen as the medium for improved oil recovery. A detailed economic analysis on the chosen scenario is also conducted on key variables, such as, oil prices, price of injectant (CO2), capital expenditures and operating costs.

Methodology

Methodology followed in the present study is shown in the steps below.

Model development

This step depends on the process that needs to be studied. There are many reservoir models available within eclipse, such as miscible oil, black oil, thermal and compositional models and the nature of analysis and scope of the study determines which models need to be used. In the present study, black oil reservoir model is used because of its wide application in the petroleum industry and also because it is far less demanding than a compositional simulator.

For the construction of a model, the following steps were followed:

-

Quality controlling of the geologic model for errors and problems.

-

Scaling up the model.

-

Simulation of the model for output.

-

Intersection of the reservoir wells with the model and output simulation well data

-

Output the production data in the form of simulations and link to wells.

The reservoir model, which simulates a heterogeneous reservoir, is divided into 2,400 cells of multiple layers. The black oil simulator is chosen for this. The grid size in the present model is (x, y, z) (20 × 15 × 8). The model is simulated with Cartesian grid corner point geometry having one reservoir with an aquifer. The numerical model for aquifer is defined in the grid section. The reservoir fluid contains three phases namely gas, oil and water. The oil consists of live oil with a dissolved gas. The API tracking is used to track the oil gravities and an algorithm does the numerical diffusivity control. The residual oil in gas saturation is 0.1503 and residual oil in water saturation is 0.19103. The average depth of the reservoir is 7,539 feet and average pressure is 3,721.2 psia. The grid block size depth in X, Y and Z direction are 1,273, 1,332 and 70 feet. The data inputs for the reservoir modeling are composed of fluid and rock properties such as porosity, pressure and permeability. The inputs in Eclipse office 100 are classified in the sections of case definition, grid section, PVT section, SCAL, initialization and schedule section (Schlumberger 2012).

Reservoir model simulation

Reservoir simulation is the study of fluid flow in a hydrocarbon reservoir under production conditions. This simulation predicts the behavior of the reservoir in different production scenarios and helps to understand the reservoir’s geologic properties. It is important to simulate a reservoir for asset valuation to determine the recoverable reserves accurately and also for the asset management for determination of the best possible perforation method, well patterns, number of wells to drill, and injection rates. Uncertainty management is also a critical factor, where it is important to estimate the financial risk of exploration and early life cycles fields (Schlumberger 2013)

The reservoir simulation used in the present study included the following steps:

-

1.

Dividing the reservoir into several different cells.

-

2.

Providing basic data for each cell.

-

3.

Positioning wells within the cell.

-

4.

Specifying the well production rates as a function of time.

-

5.

Solving each cell simultaneously, so the number of cells in the simulation model is directly related to the time required to solve the time step.

-

6.

Specifying historical production rates.

-

7.

History matching.

-

a.

Pressure matching.

-

b.

Production matching.

-

a.

-

8.

Sensitivity studies to be done at any stage of the modeling process (appropriate)

-

9.

Predicting the future under varying operating strategies.

Production profile development

After running the simulation, the field pressure and total field oil production plots were generated for the first three scenarios as shown in Figs. 1, 2. The x-axis in Fig. 1 represents the number of years of simulation period whereas the y-axis represents the pressure in psia. Similarly, in Fig. 2, y-axis represents the total revenue in Million dollars.

Primary depletion

To perform the natural depletion method, the gas and water injection wells are kept shut by changing the injection well control parameters. This action can also be performed for well completion and specification data in the schedule section to meet the requirements of the injection. The action facility in the eclipse can also be used to set some limit on rate, pressure or time, after which injection starts or paused/stopped automatically, at the specified limit. The action can be repeated for finite as well as infinite times in the life of the subject well. However, “ACTION” facility enables that if natural production of the oil wells falls below some specified limit, all injection wells automatically start injecting.

The reservoir oil is produced from 10 wells namely (L1, L2, L3, LU1, LU2, U1, U2, U3, U4, and U5). Water is injected around the edges of the reservoir through eight wells namely (I1, I2, I3, I4, I5, I6, I7, I8) and the gas at the center using the well GI (the names of the water injection wells start with the letter “I” to make the recognition easier). Table 3 and Table 4 summarizes base cases for the injection and production well control parameters. Therefore, to perform primary depletion, the wells for the injection control parameters are kept shut in the schedule section of eclipse by performing following commands:

Injection well control (I): Open/shut flag = Shut

Injection well control (GI): Open/shut flag = Shut

As shown in Fig. 1, the average pressure for primary depletion was 3,800 psia in 2010 and it started to decrease continuously till 2017 to 3000 psia, at which the production ceases. Therefore, the primary depletion phase lasted for 7 years of the total reservoir’s life. Figure 2 shows the total field oil production, which is 1.02 Million tonne at the end of the primary production period.

Figure 3 illustrates oil saturation matrix at the beginning of primary depletion, which shows that the oil saturation is very high on the left side of the reservoir block. Figure 4 shows the oil saturation matrix at the end of primary depletion period. In this figure, the orange zone at the left side of the block indicates considerable reduction of oil saturation, but there is still original oil in place (OOIP) left inside the reservoir, which can be improved by gas injection technique.

Scenario 1

For scenario 1, the water and gas injection wells are opened in the Schedule section, by changing the injection well control parameters shown in Table 4. This parameter remains the same for the first three scenarios and well location is changed to gain more sweep efficiency and ultimately recovery performs well optimization.

Injection well control (I): Open/Shut flag = Auto

Injection well control (GI): Open/Shut flag = Open

Well completion and specification parameters for oil wells are mentioned in Table 2. This is base scenario for these wells. The well oil production limits are set at 20,000 STB/day as shown in Table 3. The maximum gas to oil ratio for scenario 1 was found to be 1.21 MSCF/STB. It is obvious from Fig. 1, that the injection of gas raises the sector’s reservoirs pressure by 400 psia in 2016, as compared to reservoir pressure of natural depletion period and this pressure further sustains till 2019 and additional oil is recovered. Higher injection rates cause higher average sector pressures. The oil production from these wells lasted from 2010 to 2019 as shown in Fig. 2. From Fig. 2, it is obvious that reservoir’s life extends by 2 years and improved oil recovery produces an additional 1.23 M tonnes at the end of oil recovery period.

From the oil saturation at the end of scenario 1, it is found that there are few blocks surrounding the production wells U3, U4 and U5, where the oil saturation is still high, therefore in the next scenario, the position of these oil production wells is shifted to achieve the maximum sweep.

Scenario 2

From the oil saturation matrix of scenario 1, it was found that there are still some unswept regions in the areas near the oil production wells, which indicates that there is need to optimize the location of oil wells U3, U4 and U5, located in the maximum oil saturation zone. The locations of these wells are changed (as shown below) to obtain the maximum sweep efficiency and oil recovery from the given sector by changing the base line data given in Table 2 and performing following commands:

Well COMPLETION AND SPECIFICATION

WELL U3: x grid = 9, y grid = 14

WELL U4: x grid = 5, y grid = 9

WELL U5: y grid = 8, y grid = 3

The oil production from these wells lasted 2010 to 2018. The results from this scenario is summarized in Fig. 2. After changing the position of these wells, the GOR increases to 1.23 MSCF/STB, this decreases the field pressure to 50 psia as compared to scenario 1, shown in Fig. 1. This is unproductive for the reservoir, as the natural energy for the reservoir reduces. This effect can also be seen in the field oil production plot, in Fig. 2. The field oil production reduces to 500,000 STB as compared to scenario 1 and consequently the oil recovery period lasted for 8 years for this scenario as compared to 9 years for scenario 1. The oil saturation matrix at the end of recovery period showed that there are still unswept wells U4, U3, U1 and U2. The comparison of the present scenario with the previous scenario showed that there was an abrupt change in the GOR. When GOR increases the field pressure reduces, this greatly affected the field oil production.

Scenario 3

In this scenario, the positions of oil production wells U3, U4 and U5 were kept same as of scenario 2 and the positions of oil production wells L1, L3 and LU2 (as shown below), located on the right side of the sector in the high oil saturation areas were optimized to obtain the maximum sweep efficiency and oil recovery from the given sector. Following commands were performed:

Well COMPLETION AND SPECIFICATION

WELL L1: x grid = 12, y grid = 12

WELL L3: x grid = 16, y grid = 11

WELL LU2: x grid = 15, y grid = 12

The results obtained from this scenario showed a very good sweep efficiency and oil recovery by optimization of well location in the high oil saturation areas. Figure 1 shows the pressure plot for this scenario. After well optimization, the field pressure drop in 2017 was 3,400 psia, as compared to the previous scenario, where the pressure dropped in 2016. There was also a reduction in GOR by 0.08 MSCF/STB as well. This reduction in GOR increased the reservoir pressure and it greatly affected the oil recovery as shown in Fig. 2. The oil recovery is improved by 500,000 STB at the end of the period as compared to scenario 1. This indicates very good displacement efficiency.

Optimization of BHP and THP on scenario 3: scenario 4

This section emphasizes on optimizing the values of production and injection parameters of the optimum scenario by improving the oil recovery factor and maximum sweep for the reservoir. Tubing wellhead pressure (THP) and bottom-hole pressure (BHP) are used to control the drawdown of reservoir. BHP corresponds, where operator has installed control valves (subsurface), otherwise well head pressure (WHP) is used as a control mode. BHP is denoted by pwf (flowing bottom-hole pressure) or pws (shut in pressure). According to Darcy law the lesser the BHP, the higher the drawdown and the more will be the oil recovery. The same principle is applied to THP as well, however, if the THP decreases and BHP increases, this indicates liquid load up in the well. Therefore, in the scenarios 4, these two controlling factors are optimized. Table 3 and Table 4 provide details on injection well control parameters. It can be seen that the well control parameter (I) is controlled by the tubing head pressure (THP) and well control (GI) is controlled by the reservoirs rate.

Optimization of BHP

In this sub section, BHP of the wells was changed to a minimum BHP (500 psia), for all the production well parameters from the base values but the same values of THP for the injection and production well control parameters were used. It was found that the field pressure and GOR did not change as compared to scenario 3. The field pressure and field gas oil ratio also remained the same and did not affect the total field oil production and field pressure. Decreasing the BHP had no effect on the oil production on this scenario which means that the base values of BHP are correct.

In this step, the BHP values for all the production wells were increased to 2,400 psia from the base value of BHP (2,000 psia) and base values of THP for injection and production well control parameters shown in Table 3 and Table 4 were used. It is found that these changes increased the field pressure only by 60 psia from 2014 onwards as compared to scenario 3. The field GOR almost remains the same at 1.12 MSCF/STB, therefore this scenario did not provide a good solution of the problem as the total field oil production also reduced to 200,000 STB. There is also an abrupt change in the average field gas production rate of 120,000 STB/day, therefore the base value of BHP 2,000 is considered and in the next scenarios THP is used as a control mode for injection and production well control parameters. This scenario proves that very high BHP from the base values of production well control parameters results in low oil recovery and ultimately low sweep, causing an increase in field pressure and field gas production rate.

Optimization of THP

To optimize the THP, the base value of BHP used is the optimum value for the given well locations. The THP values for the injection and production well control parameters in Table 3 and Table 4 are changed to get an overall increase in oil recovery and drawdown from the reservoir. The following changes are made.

WCONPROD (WELL U, L, U1, U2, LU1)

THP: 70 Psia

WCONINJE-INJECTION WELL CONTROL (I)

THP: 900 Psia

Figure 5 is a testimonial of the fact that by reducing THP too low increases the drawdown from the reservoir and ultimately increases the flow rates as well; since, in this case, the field gas production rates increase to 120,000 STB/day. The field pressure also dropped by 50 psia as compared to scenario 3 because of an increase in drawdown from the reservoir. This resulted in a very low oil production from the reservoir and the oil production dropped to 400,000 STB as compared to scenario 3.

This is the optimization result of scenario 3 referred here as scenario 4 here on. In the next scenario, the values mentioned below for THP are used.

WCONPROD (WELL U, L, U1, U2, LU1)

THP: 100 Psia

WCONINJE-INJECTION WELL CONTROL (I)

THP: 1,200 Psia

Analysis of scenario 4

As illustrated in Fig. 7, the values of the THP have an effect on the overall oil recovery. The drawdown from the reservoir becomes stable and the production rates fall back to the original value of 100,000 STB/day for the oil and gas production rates as shown in Fig. 6. The field gas oil ratio is found to be 1.16 MSCF/STB and field pressure drop is 20 psia in 2017 as compared to scenario 3. This greatly affected the field oil production rate and the oil production increased by 200,000 STB as shown in Fig. 7 as compared to scenario 3 in Fig. 2.

As shown in Fig. 8, this scenario provides the maximum oil recovery by optimizing well location and also performing sensitivity analysis on BHP and THP values. This scenario is further considered as a source for improved oil recovery using CO2 as injection gas. In subsequent section, economic analysis of IOR is presented.

Economic analysis

The objective of the present economic analysis is to provide a mechanism to evaluate the cash flow and gain during the production life of the reservoir using CO2. This study is based on certain assumptions summarized below.

The main assumptions related to costs in the present study are:

-

Price of CO2 and oil is considered constant throughout the study period.

-

10 % depreciation rate is considered.

-

7.33 Barrels of oil is considered equal to one tonne.

-

18.9 Mscf of gas is considered as one tonne of injected CO2.

Oil recovery estimation is based on the reservoir parameters of pore volume, oil saturation, past recovery techniques etc. The estimation of price depends on the cash inflows and cash outflows. Cash inflows depend on the oil production generation while cash outflows are generated by the operation, investments, maintenance, field development expenditures and other costs. A detailed IOR cost model is developed by the study of financial assumptions. These include capital costs relating the costs incurred by the compressor, pipe line, wells and capture facility plant. The model includes operation and maintenance (O&M) costs of the lifting fluids for recycling the reproduced gas plus general and administrative costs. The model also accounts for the operation costs involved with CO2 operation, royalties, severances and ad valorem taxes.

Operation costs

CO2 transportation and capture cost

The transportation cost varies from project to project, but according to the literature review and by National enhanced oil recovery initiative (NEORI) participant survey, cost for the transportation involved with IOR is in the range of $5 to $20 per tonne, with an average cost of $10 per tonne (NEORI 2012). This price is also confirmed by the study carried out in China for the assessment of CO2 IOR in Caoshe oil field in Subei basin which is $0.6/Mscf (Shaoran 2007). The capture costs of CO2 vary with the source with an average price for CO2 capture operation to be $20/tonne. Another study carried out on Caoshe oil field for the economic analysis of CO2 enhanced oil recovery and storage, calculated the cost in the range of $15–40/tonne, with an average price of $20/tonne (Shaoran 2007).

Operation and maintenance cost of CO2 recycling

According to a study carried out on Permian oil basins, the operation and maintenance for CO2 recycling are indexed as $0.13/Mscf or $2.45/tonne (Melzer 2006).

Lifting costs: The lifting costs, which include liquid lifting, transportation and reinjection are calculated on the total liquid production costs and are priced as $0.25 per barrel or $1.832 per tonne (Melzer 2006).

General administrative costs

These are added as 20 % of the lifting costs and operation and maintenance costs for CO2 recycling (Melzer 2006).

CO2 IOR tax incentive

Oil produced from an approved IOR project is eligible for a special IOR tax rate. According to NEORI, the representative price for IOR incentive is from $5/tonne for an industrial-low cost tranche to $37/tonne for industrial high cost and power plant tranche, with an average price taken as $20/tonne (NEORI 2012).

Allocation of taxes

According to a study carried out by CO2 IOR from Permian oil basins, developed by the advanced resources, allocates the taxes for royalties, Severance taxes and Ad Valorum taxes as 12.5, 2.3 and 2.1 %, respectively (Shaoran 2007). The same values for the allocation of taxes are considered for the present project.

Capital costs

Cost of CO2 capture facility

There are different methods for capturing CO2 from flue gases. One of the methods is a chemical absorption method. A company in china carried out a pilot test to capture 3,000 tonnes of CO2 per year from a power station in Beijing, their capturing costs were in the region of $2.94 Million. According to assumptions, 1 tonne of CO2 equals to 18.9 Mscf. Therefore, 18,000 tonnes of CO2 injected per year would cost approximately $17 Million (Shaoran 2007).

Pipe line costs

Petro China estimated the costs associated with pipelines for the Caoshe oil field to be approximately $0.018 Million/km, by taking an approximate distance of 100 km from the oil field to the city for the present project, the cost of the pipe line is $1.8 Million (Shaoran 2007).

Compressor cost

Two compressors are normally required for the project. The cost of compressor is approximately $1.18 M. Normally the installation and transportation cost covers 40 % of the total cost of the compressors. Therefore, the total cost of the compressor would be $1.65 M (Shaoran 2007).

Cost of new wells

The cost of well drilling is around $147.1/m, the well depth required for the wells is between 2,000 and 3,000 m. Since there are 19 wells, the cost of these wells is approximately $7 M for an approximate depth of 2,500 m (Shaoran 2007).

Results

The IOR cost design ties as close as possible to the data for the scoping analysis of IOR on a typical reservoir located offshore in Australian continental shelf (the data for the economic analysis are used from CO2 storage project in Caoshe oil field, Subei basin (China), National enhanced oil recovery initiative (NEORI) and Permian oil basins developed by advanced resources) to make use of the cost model. Apart from comparison purposes within the petroleum industry, the data are also used to assess the economic impacts of specific policies and plans. These costs included the CO2 equipment costs, cost of new wells, compressor cost, pipe line costs, CO2 transportation and CO2 capture costs and capital costs. The model is based on the improved oil recovery calculations; the total oil produced is calculated by subtracting the maximum oil produced from the chosen scenario, by the oil produced from the primary oil recovery. Similarly, the total CO2 injection values constitute only from scenario 4, as there was no CO2 injection for the primary depletion phase. Total CO2 production is found by subtracting the CO2 produced for IOR and primary depletion. Total water production calculation is also important for the costs associated with the lifting costs, as pumps are required to lift oil and water from the production well to the facility. Gross revenue is generated using the price of oil as $95/tonne. Federal and state governments enjoy total net revenue of $36 M, which is deducted from the gross revenues. Capital costs involved the capture facility, pipeline, compressor and cost of wells, these costs constituted $28 M. The purchased CO2 constitutes the price of capture operation, compression and transportation and was found to be $5 Million at the end of oil recovery period as shown in Table 1. This is also known as the total CO2 price. The total operation and maintenance costs consisted of lifting operation, general administrative and maintenance costs for CO2 recycling were $12 M as shown in Table 1. $20/tonne was allocated as a special IOR tax rate for the amount of CO2 injected. This amount was added to the gross revenues at the end of IOR period, which is $226 M as shown in Table 1.

The total project costs for the carbon dioxide IOR was $68 Million for the first year, these expenses constituted total net revenue, total capital costs, total CO2 price and total operation and maintenance costs. 10 % tax was deducted from the first year for a period of 9 years for the rest of reservoirs production life. Total amount of oil recovered by IOR was 2.34 M tonnes. The table below shows the results obtained from the cost model.

Discussion

At the beginning of the project, due to high capital costs for IOR, the project losses were $68 M, as shown in Fig. 10. When the improved oil recovery started from 2011 onwards and also because of the removal of high end capital costs, the total profits for the project started increasing on the yearly basis as shown in Fig. 10.

A key component of the IOR field is the compressor, as it requires a larger amount of energy and capital investments, including the high end capital costs for the capture facility. The CO2 capture cost depends on the technology used and is likely to remain static overtime, but the costs fall rapidly when the technology matures. Secondly, the cost of pipelines and transportation costs can also be reduced if the capture plant is located within the close distance of the IOR site.

When evaluating a proposal, one has to look at the cash flows in relationship to today’s dollars. The difference of the cash inflows and cash outflows (total investment on a project) is known as the Net Present Value. The NPV is calculated with a 10 % discount factor for each year; the total present value of the cash inflows generated for the period of 9 years is subtracted from the first year to give the final NPV. A positive NPV indicates that the project is profitable and a negative value indicates that the project is not profitable and the value is discarded. It was observed that higher oil price with 10 % discount provide maximum profit.

Project profits

The reservoir production life lasted from 2010 to 2019. Figures 9 and 10 illustrate that the CO2 IOR project started generating revenues after 0.6 years from production period. Based on the cost model generated in the present study, this is also the payback period, as the profit only accounts for the oil produced by the improved oil recovery alone.

Conclusions

-

1.

Among different scenarios investigated, best performance in oil recovery is produced by Gas injection scenario because of its miscibility effects. This observation is consistent with other studies, i.e., Gozalpour reported approximately one tonne of CO2 injected can produce 2.5–3.3 STB of oil (Gozalpour et al. 2005). Present study results show 13.7 STB of oil production per tonne of CO2.

-

2.

Proper well optimization in high oil saturation areas of the reservoir increases the oil recovery and maximum sweep as GOR and reservoir pressure improves. By performing sensitivity analysis and optimizing the injection and production parameters, it is observed that THP and BHP produce more drawdown from the reservoir. Consequently, the field production rates, gas oil ratio and field pressure improves sweep efficiency.

-

3.

The economic analysis carried out was found to be very economical, which was $173 M. There were high project costs at the beginning of the project due to high capital costs for the operation, but when the IOR operation started, gross revenues ($) were generated, which considerably reduced the total capital/operation and maintenance costs. Project economics improved with high oil prices, improved oil recovery technology, low cost of gas injection, improvement of the tax structure (low royalty, severance and Ad Valorum tax rates). The financial feasibility of the IOR also depends on the policies adopted for considering the cost values of the gas associated with the IOR. The economics of these projects will improve during the passage of time.

-

4.

Furthermore, for CO2 IOR offshore projects, improvements were required to overcome the challenges related to insufficient reservoir characterization, large well spacing, equipment needed to handle CO2 and the life span of offshore structures.

Future Challenges

-

1.

Proper reservoir characterization is a main challenge for Gas injections IOR and improper reservoir characteristics causes poor sweep. Reservoirs with very low permeability or very high are also a poor candidate for CO2 flooding. CO2 injection losses are also experienced with reservoirs with high concentration of vertical fractures (Gozalpour et al. 2005).

-

2.

The principle of IOR can be applied to the offshore fields but the distance between the offshore wells is often greater than the onshore wells. This extends the time for IOR initialization and produces unmeaningful results. This complicates the process and limits the IOR techniques that may be applicable. Well spacing is an important factor which can optimize CO2 IOR, the greater distance between the wells reduced the sweep efficiency (Nelms and Burke 2004). This in turn can affect the project economics and/or decrease or increase the CO2 IOR.

-

3.

Furthermore, for the offshore IOR operations, the risks of IOR and safe CO2 storage due to possible insufficient reservoir characterization need to be evaluated. The questions which need to be answered are: (1) how long the CO2 IOR project can be operated in the offshore field and (2) can CO2 be injected for storage after stopping the IOR operation (Gozalpour et al. 2005)

-

4.

The CO2 IOR offshore, provides some challenges, this include, insufficient reservoir characterization, large well spacing, equipment needed to handle CO2 and the life span of offshore structures.

-

5.

The IOR experience has shown that the performance of CO2 IOR is good if low cost gas source is used. Typical recovery factors are in the range of 50–60 % of OOIP (Original oil in place), therefore, there are very few economic barriers related to onshore IOR projects. There are challenges related to offshore CO2 IOR projects, as there are added costs involved for CO2 separation, transportation, costs related to adapting platforms and well completions to handle CO2 (Gozalpour et al. 2005)

-

6.

Another economic barrier related to CO2 IOR for offshore fields is the problem arising due to high levels of corrosion. It is possible to replace some parts of the offshore platform when corrosion occurs, but the cost of doing so is very high even if inhibitors are used to protect some parts of the system, while the other parts which are corroded still have to be replaced.

References

Gozalpour F, Ren S, Tohidi B (2005) CO2 EOR and storage in oil reservoir. Oil Gas Sci Technol 60(3):537–546

Jarrell PM, Fox C, Stein M, Webb S (2002) Practical aspects of CO2 flooding. Society of petroleum Engineers, Texas

Lake LW, Walsh MP (2008) Enhanced oil recovery (EOR) field data literature search, vol 116. Department of petroleum and geosystems engineering, Austin

Melzer S (2006) Basin orientated strategies for CO2 enhanced oil recovery: permian basin

Mungan N (1982) “Carbon dioxide flooding-applications”. J Can Petrol Technol 21(6)

Nelms RL, Burke RB (2004). Evaluation of oil reservoir characteristics to access north dakota carbon dioxide miscible flooding potential. In: 12th Williston basin horizontal well and petroleum conference, Minot

NEORI (2012) Carbon dioxide enhanced oil recovery: a critical domestic energy, economic and environmental opportunity. Houston, 31

NETL (March 2010). “Carbon dioxide enhanced oil recovery (untrapped domestic energy supply and long term carbon storage solution)”. Retrieved 09th Oct 2012, from http://www.netl.doe.gov/

Romero-Zerón L (2012) Advances in enhanced oil recovery processes, introduction to enhanced oil recovery (eor) processes and bioremediation of oil-contaminated sites, InTech, 318

Schlumberger (2012). Eclipse 100. Australia, Schlumberger: Eclipse reservoir simulation software

Schlumberger (2013). Retrieved 29 Mar 2013, from http://www.slb.com/services/technical_challenges/enhanced_oil_recovery.aspx

Shaoran R (2007) Assessment of carbon dioxide, enhanced oil recovery and storage potential in Caoshe Oilfield, Subei Basin, p 40

Acknowledgments

I would like to express my sincere appreciation and thanks to Schlumberger Australia for providing ECLIPSE reservoir simulation software, it would have been impossible to undertake this thesis without their help. I would also like to thank Mr.Warrick Burgees (Systems Manager—IT services) for his amazing IT support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Ghani, A., Khan, F. & Garaniya, V. Improved oil recovery using CO2 as an injection medium: a detailed analysis. J Petrol Explor Prod Technol 5, 241–254 (2015). https://doi.org/10.1007/s13202-014-0131-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13202-014-0131-0