Abstract

Exposing wind and solar power to the market price signal allows for cost-efficient investment decisions, as it incentivizes investors to account for the marginal value (\(MV^{el}\)) of renewable energy technologies. As shown by Lamont (2008), the \(MV^{el}\) of wind and solar power units depends on their penetration level. More specifically, the \(MV^{el}\) of wind and solar power units is a function of the respective unit’s capacity factor and the covariance between its generation profile and the system marginal costs. The latter component of the \(MV^{el}\) (i.e., the covariance) is found to decline as the wind and solar power penetration increases, displacing dispatchable power plants with higher short-run marginal costs of power production and thus reducing the system marginal costs in all generation hours. This so called ‘system price effect’ is analyzed in more detail in this paper. The analysis complements the work of Lamont (2008) in two regards. First of all, an alternative expression for the \(MV^{el}\) of wind and solar power units is derived, which shows that the \(MV^{el}\) of fluctuating renewable energy technologies depends not only on their own penetration level but also on a variety of other parameters that are specific to the electricity system. Second, based on historical wholesale prices and wind and solar power generation data for Germany, a numerical ‘ceteris paribus’ example for Germany is presented which illustrates that the system price effect is already highly relevant for both wind and solar power generation in Germany.

Zusammenfassung

Nur wenn Investoren das Marktpreissignal und damit den Grenzwert (\(MW_{el}\)) fluktuierender erneuerbarer Energien in ihr Investitionskalkül miteinbeziehen, werden kosteneffiziente Investitionsentscheidungen getroffen. Wie von Lamont (2008) gezeigt, hängt der \(MW_{el}\) der Wind- und Solarkraft von ihrer Durchdringungsrate ab. Im Speziellen gilt, dass der \(MW_{el}\) der Wind- und Solarkraft eine Funktion des technologiespezifischen Kapazitätsfaktors und der Kovarianz zwischen dem technologiespezifischen Erzeugungsprofil und den Systemgrenzkosten ist. Letztere sinken mit steigender Durchdringung der Wind- und Solarkraft, da steuerbare Kraftwerke mit höheren kurzfristigen Grenzkosten verdrängt werden und damit die Systemgrenzkosten in allen Stunden mit Wind- und Solarerzeugung sinken. Dieser Systempreiseffekt ist Untersuchungsgegenstand des vorliegenden Artikels, der die Arbeit von Lamont (2008) in zweierlei Hinsicht ergänzt: Zum einen wird eine alternative Definition des \(MW_{el}\) von Wind- und Solarkraft hergeleitet, mit der gezeigt werden kann, dass der \(MW_{el}\) von fluktuierenden erneuerbaren Energien nicht nur vom eigenen Durchdringungsgrad, sondern von einer Vielzahl weiterer Parameter abhängig ist, die spezifisch für das jeweilige Stromsystem sind. Zum anderen wird basierend auf historischen Strompreis- und Wind- /Solarerzeugungsdaten illustriert, dass der Systempreiseffekt sowohl für Wind als auch für Solarkraft bereits heute von erheblicher Relevanz in Deutschland ist.

Similar content being viewed by others

Notes

In contrast to Lamont (2010), Hirth (2010) and Nicolosi (2010) analyze the annual ‘value factor’ of wind and solar power in Northwestern Europe and Germany, respectively, which can be understood as a proxy/indicator for the \(MV^{el}\) of wind and solar power, as it is defined as the average hourly revenue of wind and solar power generators relative to the time-weighted average wholesale price (base-price) per year. Both papers apply a linear dispatch and investment model and find that the annual value factor of wind and solar power decreases with increasing penetration of these technologies.

Due to the assumption of perfect competition and a price-inelastic electricity demand the cost-minimization approach corresponds to a welfare-maximization approach. Alternatively, the optimality condition for the expansion of fluctuating wind and solar power units could be derived by maximizing profits (assuming perfect competition and a price-inelastic electricity demand).

The term ‘technology- and region-neutral’ indicates that each kWh of renewable electricity produced contributes to achieving the RES-E target irrespective of the technology or the region of its deployment.

Quota obligations in combination with tradable green certificates (TGC) fix the quantity of renewable electricity to be generated. The supply of TGC is ensured by giving producers a certificate for each unit of renewable energy sold. The demand for TGC is induced by transferring the politically implemented RES-E target to distribution companies (electricity suppliers), who are then required to prove that a certain proportion (quota) of the electricity supplied to their final consumers was generated from renewable energy sources.

The assumption that dispatchable generators offer their output at a price equal to their short-run marginal costs of power production reflects the assumption of perfect competition.

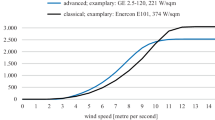

The assumption of a linear function is in line with Bode (2006). However, in reality, the shape of the merit-order curve is rather staircase-shaped. More specifically, with every generator bidding its total capacity at a price equal to its short-run marginal costs of power production, the aggregate supply is a staircase function.

The effects of wind and solar power generation with (almost) no variable generation costs on the wholesale price has been examined by, e.g., Gil et al. (2013), Woo et al. (2010), Jonsson et al. (2014), MacCormack et al. (2007), Munksgaard and Morthorst (2013), Saenz de Miera et al. (2013) or Sensfuß et al. (2008), based on historical as well as simulated data. All papers confirm the decreasing effect of increased wind and solar power generation on the wholesale price (short-term merit-order effect).

The wholsale price function corresponds to the merit-order curve of dispatchable power plants and reflects the short-run marginal costs of power production of the respective electricity system’s dispatchable power plants.

The restriction to the years 2011 and 2012 is due to the fact that solar power generation data from EEX (2006) are only available from 2011 onwards.

Another application of least-squares regressions of the wholesale price on the residual load can, for example, be found in Wagner (2010). Alternative empirical functions from hourly wholesale prices and (residual) load data are, for example, derived by Barlow (2002), Burger et al. (2006) and Elberg and Hagspiel (2013).

We note that production from wind and solar power generation (with marginal production costs of zero) would be offered at a price of zero on the energy exchange if there was no such system. In this case, our approach would only be suitable when additionally assuming that no negative prices are allowed at the energy exchange.

This is primarily due to the application of a linear regression function.

Moreover, in periods of high demand the load levels in neighboring countries can have a significant impact on national electricity prices (McMenamin et al. (2008)).

We note that the correlation between the wind/solar power production factor profile and the wholesale price profile (illustrated in Fig. 4) corresponds to the correlation between the wind/ solar power production factor profile and the residual load profile in the numerical analysis.

The level of decrease in the \(MV^{el}\) of wind/ solar power units differs between the single regions due to differences in the correlation of the regional production factor profiles and the load profile, as illustrated in Table 4 of the Appendix.

Equally, the \(MV^{el}\) of a solar power unit with the average production factor profile is more than 14 % higher than the \(MV^{el}\) of a solar power unit in central Germany at a penetration level of 58 TWh (32.6 thousand €/MW vs. 28.5 thousand €/MW), although the solar power unit with the average wind production factor profile has only 2 % higher FLH than the solar power unit in central Germany (1,072 h vs. 1,055 h).

The CO\(_2\;\) emission constraint reflects a cap- and trade-system for CO\(_2\;\) emission allowances.

The renewable energy constraint reflects a (technology- and region-neutral) quota system for fluctuating rewewable energy generation in combination with tradable green certificates (TGC).

Alternatively, it may be interpreted as the optimal level of a bonus payment given the analogy of quantity- and price-based mechanisms under the assumption of perfect information. However, for reasons of completeness, note that in markets with uncertainties, price-based and quantity-based instruments are no longer equivalent (Weitzman (1974)).

References

Barlow M (2002) A diffusion model for electricity prices. Math Finan 12, 287–298

Bode S (2006) On the impact of renewable energy support schemes on power prices. Hamburg Institute of International Economics (HWWI) Research Paper 4–7

Burger M, Klar B, Mueller A, Schindlmayr G, (2006) A spot market model for pricing derivatives in electricity markets. Quant Finan 4, 109 – 122

EEX (2013a) Expected solar power generation. http://www.transparency.eex.com/en/Statutory%20Publication%20Requirements%20of%20the%20Transmission%20System%20Operators/Power%20generation/Expected%20solar%20power%20generation. Accessed Jan 2014

EEX (2013b) Expected wind power generation. http://www.transparency.eex.com/en/Statutory%20Publication%20Requirements%20of%20the%20Transmission%20System%20Operators/Power%20generation/Expected%20wind%20power%20generation. Accessed Jan 2014

EEX (2013c) Power spot—EPEX spot. http://www.eex.com/en/Download. Accessed Jan 2014

Elberg C, Hagspiel S (2013) Spatial dependencies of wind power and interrelations with spot price dynamics. Institute of Energy Economics at the University of Cologne Working Paper No 13/11

ENSTO-E (2013) Hourly load values for all countries for a specific month. https://www.entsoe.eu/data/data-portal/consumption/. Accessed Jan 2014

EuroWind (2011) Database for hourly wind speeds and solar radiation from 2006–2010 (not public)

Gawel E, Purkus A (2013) Promoting the market and system integration of renewable energies through premium schemes. A case study of the German market premium. Energ Policy 61, 599–609

Gil H A, Gomez-Quiles C, Riquelme J (2012) Large-scale wind power integration and wholesale electricity trading benefits: estimation via an ex post approach. Energ Policy 41, 849–859

Grothe O, Schnieders J (2011) Spatial dependence in wind and optimal wind power allocation: a copula-based analysis. Energ Policy 39, 4742–4754

Hiroux C, Saguan M (2010) Large-scale wind power in European electricity markets: time for revisiting support schemes and market designs? Energ Policy 38, 3135–3145

Hirth L (2013) The market value of variable renewables. The effect of solar wind power variability on their relative price. Energ Econ 38, 218–236

Jägemann C (2014) A note on the inefficiency of technology- and region-specific renewable energy support - The German case. Institute of Energy Economics at the University of Cologne Working Paper No 14/05

Jägemann C, Fürsch M, Hagspiel S, Nagl S (2013) Decarbonizing Europe’s power sector by 2050—analyzing the economic implications of alternative decarbonization pathways. Energ Econ 40, 622–636

Jonsson T, Pinson P, Madsen H (2010) On the market impact of wind energy forecasts. Energ Econ 32, 313–320

Joskow PL (2011) Comparing the costs of intermittent and dispatchable electricity generating technologies. Am Econ Rev 100(3), 238–241

Katzenstein W, Fertig E, Apt J (2010) The variability of interconnected wind plants. Energ Policy 38(8), 4400–4410

Klessmann C, Nabe C, Burges K (2008) Pros and cons of exposing renewables to electricity market risks—a comparison of the market integration approaches in Germany, Spain, and the UK. Energ Policy 36, 3646–3661

Lamont AD (2008) Assessing the long-term system value of intermittent electric generation technologies. Energ Econ 30, 1208–1231

Lijesen M (2007) The real-time price elasticity of electricity. Energ Econ 29, 249–258

Liu S, Jian J, Wang Y, Liang J (2013) A robust optimization approach to wind farm diversification. Int J Elect Power & Energ Syst 53, 409–415

MacCormack J, Hollis A, Zareipour H, Rosehart W (2010) The large-scale integration of wind generation: impacts on price, reliability and dispatchable conventional suppliers. Energ Policy 38, 3837–3846

McMenamin J S, Monforte F A, Fordham C, Fox E, Sebold F D, Quan M (2006) Statistical approaches to electricity price forecasting. Tech. rep., Itron

Munksgaard J, Morthorst PE (2008) Wind power in the Danish liberalised power market. Policy measures, price impact and investor incentives. Energ Policy 36, 3940–3947

Nicolosi M (2012) The economics of renewable electricity market integration. Ph.D. thesis, Institute of Energy Economics at the University of Cologne

Roques F, Hiroux C, Saguanb M (2010) {Optimal wind power deployment in Europe—a portfolio approach. Energ Policy 38(7), Energ Policy 3245-3256

Saenz de Miera G, del Rion Gonzalez P, Vizcaino I (2008) Analysing the impact of renewable electricity support schemes on power prices: the case of wind electricity in Spain}. Energ Policy 36, 3345–3359

Sensfuß F, Ragwitz M, Genoese M (2008) The merit-order effect: a detailed analysis of the price effect of renewable electricity generation on spot market prices in Germany. Energ Policy 36, 3086–3094

Wagner A (2012) Residual demand modeling and application to electricity pricing. Berichte des Fraunhofer ITWM, Nr. 213

Weitzman M (1974) Prices vs quantities. Rev Econ Stud 41, 477–49

Woo C, Horowitz I, Moore J, Pacheco A (2011) The impact of wind generation on the electricity spot-market price level and variance: the Texas experience. Energ Policy 39, 3939–3944

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jägemann, C. An Illustrative Note on the System Price Effect of Wind and Solar Power: The German Case. Z Energiewirtsch 39, 33–47 (2015). https://doi.org/10.1007/s12398-014-0140-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12398-014-0140-1