Abstract

In this paper, we develop an integrated inventory model in a single-vendor single-buyer supply chain under an unknown demand distribution at the buyer. It is assumed that each lot delivered to the buyer contains a random fraction of defective items, and lead time can be reduced at an extra crashing cost. We also consider that the unmet demand at the buyer during the stockout period is partially backordered. A model is formulated to minimize the total expected relevant costs of the system considering an exact expression of the service level constraint to ensure that a certain percentage of customer orders are filled by the buyer. Closed-form expressions are derived for the optimal order quantity and safety factor for given lead time and shipment frequency, and then an algorithm is proposed to find the global optimal solution. Finally, a numerical example is presented to illustrate the solution procedure and sensitivity analysis is carried out to analyze the proposed model.

Similar content being viewed by others

References

Banerjee A (1986) A joint economic-lot-size model for purchaser and vendor. Decis Sci 17(3):292–311

Bookbinder J, Lordahl A (1989) Estimation of inventory reorder levels using the bootstrap statistical procedure. IIE Trans 21(4):302–312

Cárdenas-Barrón LE (2000) Observation on: economic production quantity model for items with imperfect quality [International Journal of Production Economics 64 (2000) 59–64]. Int J Prod Econ 67(2):201

Chu P, Yang KL, Chen PS (2005) Improved inventory models with service level and lead time. Comput Oper Res 32(2):285–296

Chung KJ (2008) A necessary and sufficient condition for the existence of the optimal solution of a single-vendor single-buyer integrated production-inventory model with process unreliability consideration. Int J Prod Econ 113(1):269–274

Gallego G, Moon I (1993) The distribution free newsboy problem: review and extensions. J Oper Res Soc 44(8):825–834

Glock CH (2012) The joint economic lot size problem: a review. Int J Prod Econ 135(2):671–686

Goyal SK, Cárdenas-Barrón LE (2002) Note on: economic production quantity model for items with imperfect quality—a practical approach. Int J Prod Econ 77(1):85–87

Ho CH (2009) A minimax distribution free procedure for an integrated inventory model with defective goods and stochastic lead time demand. Int J Inf Manag Sci 20:161–171

Huang CK (2004) An optimal policy for a single-vendor single-buyer integrated production-inventory problem with process unreliability consideration. Int J Prod Econ 91(1):91–98

Jha JK, Shanker K (2009) Two-echelon supply chain inventory model with controllable lead time and service level constraint. Comput Ind Eng 57(3):1096–1104

Joglekar PN (1988) Comments on “a quantity discount pricing model to increase vendor profits”. Manag Sci 34(11):1391–1398

Kelle B, Transchel S, Minner S (2009) Buyer–supplier coorperation and negotiation support with random yield consideration. Int J Prod Econ 118(1):152–159

Lee WC, Wu JW, Hsu JW (2006) Computational algorithm for inventory model with a service level constraint, lead time demand with the mixture of distributions and controllable negative exponential backorder rate. Appl Math Comput 175(2):1125–1138

Li Y, Xu X, Ye F (2011) Supply chain coordination model with controllable lead time and service level constraint. Comput Ind Eng 61(3):858–864

Liao CJ, Shyu CH (1991) An analytical determination of lead time with normal demand. Int J Oper Prod Manag 11(9):72–78

Lin YJ (2008) Minimax distribution free procedure with backorder price discount. Int J Prod Econ 111(1):118–128

Lin SW, Wou YW, Julian P (2011) Note on minimax distribution free procedure for integrated inventory model with defective goods and stochastic lead time demand. Appl Math Model 35(5):2087–2093

Liu X, Çetinkaya S (2011) The supplier–buyer integrated production-inventory model with random yield. Int J Prod Res 49(13):4043–4061

Maddah B, Jaber MY (2008) Economic order quantity for items with imperfect quality: revisited. Int J Prod Econ 112(2):808–815

McClain JO, Thomas LJ, Mazzola JP (1992) Operations management: production of goods and services. Prentice Hall, Englewood Cliffs

Montgomery DC, Bazaraa MS, Keswani A (1973) Inventory models with a mixture of backorders and lost sales. Nav Res Logist 20(2):255–263

Moon I, Choi S (1994) The distribution free continuous review inventory system with a service level constraint. Comput Ind Eng 27(1–4):209–212

Moon I, Choi S (1998) A note on lead time and distributional assumptions in continuous review inventory models. Comput Oper Res 25(11):1007–1012

Moon I, Shin E, Sarkar B (2014) Min–max distribution free continuous-review model with a service level constraint and variable lead time. Appl Math Comput 229:310–315

Nahmias S (2001) Production and operations analysis. McGraw-Hill Irwin, New York

Ouyang LY, Wu KS (1997) Mixture inventory model involving variable lead time with a service level constraint. Comput Oper Res 24(9):875–882

Ouyang LY, Chen CK, Chang HC (1999) Lead time and ordering cost reductions in continuous review inventory systems with partial backorders. J Oper Res Soc 50(12):1272–1279

Ouyang LY, Wu KS, Ho CH (2004) Integrated vendor-buyer cooperative models with stochastic demand in controllable lead time. Int J Prod Econ 92(3):255–266

Ouyang LY, Wu KS, Ho CH (2006) The single-vendor single-buyer integrated inventory problem with quality improvement and lead time reduction-minimax distribution-free approach. Asia-Pac J Oper Res 23(3):407–424

Ouyang LY, Wu KS, Ho CH (2007) An integrated vendor–buyer inventory model with quality improvement and lead time reduction. Int J Prod Econ 108(1–2):349–358

Pan JCH, Yang JS (2002) A study of an integrated inventory with controllable lead time. Int J Prod Res 40(5):1263–1273

Papachristos S, Konstantaras I (2006) Economic ordering quantity models for items with imperfect quality. Int J Prod Econ 100(1):148–154

Salameh MK, Jaber MY (2000) Economic production quantity model for items with imperfect quality. Int J Prod Econ 64(1–3):59–64

Sarkar B, Chaudhuri K, Moon I (2015) Manufacturing setup cost reduction and quality improvement for the distribution free continuous-review inventory model with a service level constraint. J Manuf Syst 34:74–82

Scarf HE (1958) A min–max solution of an inventory problem. In: Arrow KJ, Karlin S, Scarf HE (eds) Studies in mathematical theory of inventory & production. Stanford University Press, Stanford, pp 201–209

Silver EA (1976) Establishing the order quantity when the amount received is uncertain. INFOR 14(1):32–39

Silver EA, Pyke DF, Peterson R (1998) Inventory management and production planning and scheduling, 3rd edn. Wiley, New York

Tajbakhsh MM (2010) On the distribution free continuous-review inventory model with a service level constraint. Comput Ind Eng 59(4):1022–1024

Tersine RJ, Hummingbird EA (1995) Lead-time reduction: the search for competitive advantage. Int J Oper Prod Manag 15(2):8–18

Tung CT, Deng PS (2013) Improved solution for inventory model with defective goods. Appl Math Model 37(7):5574–5579

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 Derivation of the expected average inventory at the vendor

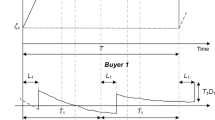

The average inventory at the vendor is given by the difference between the accumulated inventory at the vendor and the accumulated inventory (including defective items) at the buyer per unit time (please see Fig. 1).

Putting \(p_{1} + p_{2} + \ldots + p_{m - 1} = m\mu - p_{m}\) in the above expression and rearranging the terms, we have

Let \(Z = p_{1} + 2p_{2} + 3p_{3} + \ldots + \left( {m - 1} \right)p_{m - 1} + mp_{m} ,\) then the expected average inventory at the vendor can be given by

Now, \(E\left( Z \right) = E\left( {\sum\nolimits_{i = 1}^{m} {ip_{i} } } \right) = \sum\nolimits_{i = 1}^{m} {E\left( {ip_{i} } \right)} = \sum\nolimits_{i = 1}^{m} {iE\left( {p_{i} } \right)} .\)

Since \(E\left( {p_{i} } \right) = \mu\), therefore \(E\left( Z \right) = \mu \sum\nolimits_{i = 1}^{m} {i = \frac{{m\left( {m + 1} \right)}}{2}\mu } .\)

Putting \(E\left( Z \right) = m\left( {m + 1} \right)\mu /2\) into Eq. (31) and on simplification, we get

1.2 Derivation of the expected average inventory at the buyer

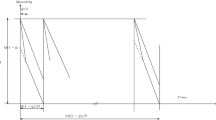

The expected shortages at the end of the buyer’s cycle is given by \(E\left( {X - r} \right)^{ + }\). Since the demand during stockout period at the buyer is partially backordered with backorder ratio β, then the expected number of backorders per cycle and the expected lost sales per cycle can be given by \(\beta E\left( {X - r} \right)^{ + }\) and \(\left( {1 - \beta } \right)E\left( {X - r} \right)^{ + }\), respectively. To find the expression for the holding cost per unit time of the buyer, the average inventory at the buyer is established adapting the approaches of Montgomery et al. (1973) and Liu and Çetinkaya (2011). The buyer receives m shipments in each production cycle of the vendor and the number of non-defective items in each shipment is a random variable, and so the replenishment cycles of the buyer are not identical. Thus, the average inventory at the buyer is found based on the vendor’s production cycle rather than the buyer’s replenishment cycle. The expected net inventory level of non-defective items just before arrival of the ith shipment is \(r - DL + \left( {1 - \beta } \right)E\left( {X - r} \right)^{ + }\) and the expected net inventory level of non-defective items immediately after arrival of the ith shipment is \(Qp_{i} + r - DL + \left( {1 - \beta } \right)E\left( {X - r} \right)^{ + }\). Assuming a linear decrease of the buyer’s inventory level during each replenishment cycle, the expected average inventory at the buyer based on the vendor’s production cycle can be obtained by

Putting \(r - DL = k\sigma \sqrt L\) from Assumption (2) into Eq. (33), we get

Since \(E\left( {p_{i} } \right) = \mu\) and we know that \(Var\left( {p_{i} } \right) = E\left( {p_{i}^{2} } \right) - \left[ {E\left( {p_{i} } \right)} \right]^{2} , \;{\text{i}} . {\text{e}} .\; \delta^{2} = E\left( {p_{i}^{2} } \right) - \mu^{2}\). Substituting \(E\left( {p_{i} } \right) = \mu\) and \(E\left( {p_{i}^{2} } \right) = \mu^{2} + \delta^{2}\) into Eq. (34) and on simplification, we get the expected average inventory at the buyer as

Appendix 2

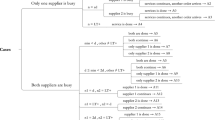

We consider the situation when the buyer and the vendor are not willing to cooperate and they make their optimal decisions independently. The buyer determines the optimal order quantity, safety factor and lead time by minimizing the total expected cost in Eq. (9) and satisfying the SLC in Eq. (17). Based on the optimal decision of the buyer, the vendor decides the optimal number of shipments per production cycle for which the total expected cost of the vendor in Eq. (4) is minimum.

To solve the buyer’s problem, we temporarily ignore the SLC in Eq. (17) and minimize the total expected cost of the buyer in Eq. (9). Similar to the solution procedure as discussed in Sect. 5, it can be shown that for fixed Q and k, \(TEC_{b} \left( {Q,k,L} \right)\) is a concave function in \(L \in \left[ {L_{i} , L_{i - 1} } \right]\), and so the minimum value of \(TEC_{b} \left( {Q,k,L} \right)\) occurs at the end points of the interval \(L \in \left[ {L_{i} , L_{i - 1} } \right]\). Furthermore, we can show that for fixed \(L \in \left[ {L_{i} , L_{i - 1} } \right]\), \(TEC_{b} \left( {Q,k,L} \right)\) is a monotonically increasing function in \(k \in \left[ {0,\infty } \right)\) and is a convex function in Q. Thus, for fixed \(L \in \left[ {L_{i} , L_{i - 1} } \right]\), if the SLC is ignored, the minimum value of \(TEC_{b} \left( {Q,k,L} \right)\) will occur at \(k = 0\) and Q that satisfies the condition \(\partial TEC_{b} \left( {Q,k,L} \right)/\partial Q = 0\), that is

Now, if the SLC in Eq. (17) is satisfied for k = 0 and Q as in Eq. (36), then k = 0 and Q in Eq. (36) is the optimal solution for fixed \(L \in \left[ {L_{i} , L_{i - 1} } \right]\). Otherwise, the SLC becomes active, and the solution procedure similar to that in Sect. 5can be applied to derive the optimal solution for Q and k. Thus, for fixed \(L \in \left[ {L_{i} , L_{i - 1} } \right]\), if the SLC is active, the optimal value of Q and k can be obtained using Eqs. (37) and (38), respectively.

and

Now, Steps 2–3 of the algorithm presented at the end of Sect. 5 is modified as below to find the global optimal decision of the buyer.

-

Step 1: For each \(L_{i} , i = 0, 1, 2, \ldots ,n\), perform (1.1) to (1.3).

-

(1.1)

Calculate Q i using Eq. (36).

-

(1.2)

If Q i calculated in (1.1) satisfies the SLC given by Eq. (17) for \(k_{i} = 0\), then set \(k_{i} = 0\) and go to (1.3). Otherwise, calculate Q i using Eq. (37) and then k i using Eq. (38).

-

(1.3)

Calculate the corresponding \(TEC_{b} \left( {Q_{i} ,k_{i} ,L_{i} } \right)\) using Eq. (9).

-

(1.1)

-

Step 2: Find \(\mathop {\hbox{min} }\nolimits_{i = 0,1, \ldots ,n} TEC_{b} \left( {Q_{i} ,k_{i} ,L_{i} } \right)\). Let \(TEC_{b} \left( {Q_{b}^{*} ,k_{b}^{*} ,L_{b}^{*} } \right) = \mathop {\hbox{min} }\nolimits_{i = 0,1, \ldots ,n} TEC_{b} \left( {Q_{i} ,k_{i} ,L_{i} } \right)\), then \(\left( {Q_{b}^{*} ,k_{b}^{*} ,L_{b}^{*} } \right)\) is the optimal solution for the buyer.

Next, the total expected cost of the vendor given by Eq. (4) is minimized for the given optimal order quantity \((Q_{b}^{*} )\) of the buyer. Now, for fixed order quantity of the buyer, \(TEC_{v} \left( {Q,m} \right)\) is a convex function in m, because \(\partial^{2} TEC_{v} \left( {Q_{b}^{*} ,m} \right)/\partial m^{2} = 2SD/\left( {m^{3} \mu Q_{b}^{*} } \right) > 0\). Since the optimal production lot size of the vendor is an integer multiple of the buyer’s order quantity, and so an integer positive value of \(m = m_{v}^{*}\) that satisfies the following condition is selected as an optimal number of shipments in a production cycle.

Rights and permissions

About this article

Cite this article

Gutgutia, A., Jha, J.K. A closed-form solution for the distribution free continuous review integrated inventory model. Oper Res Int J 18, 159–186 (2018). https://doi.org/10.1007/s12351-016-0258-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-016-0258-5