Abstract

A copula-based approach for pricing crack spread options is described. Crack spread options are currently priced assuming joint normal distributions of returns and linear dependence. Statistical evidence indicates that these assumptions are at odds with the empirical data. Furthermore, the unique features of energy commodities, such as mean reversion and seasonality, are ignored in standard models. We develop two copula-based crack spread option models using a simulation approach that address these gaps. Our results indicate that the Gumbel copula and standard models (binomial, and Kirk and Aron (1995)) mis-price a crack spread option and that the Clayton model is more appropriate. We contribute to the energy derivatives literature by illustrating the application of copula models to the pricing of a heating oil–crude oil “crack” spread option.

Similar content being viewed by others

Notes

Throughout the article we use the generic term “crack spread option” although the model specifically refers to a heating oil–crude oil crack spread option (NYMEX trading symbol CH). The copula approach is similar for pricing a gasoline oil–crude oil “crack” spread option (NYMEX trading symbol CG).

We would like to acknowledge Bob Biolsi of the CME Group for providing us with insight into how the settlement prices are determined.

More generally, the marginal distributions and joint distribution of the random variables must be elliptical distributions (such as multivariate normal, multivariate t-distribution, logistic distribution, and Laplace distributions).

We wish to sincerely thank the anonymous referees for suggesting the Laurence and Wang (2009) article which has helped improve an earlier version of this article considerably.

In the daily NYMEX crude oil and heating oil futures price data (519 parallel observations) over the period February 3, 2003, to March 3, 2005, we find no evidence of seasonality for both price series. The chi-square test statistic values are 6.84 (p-value = 0.81) for crude oil and 14.52 (p-value = 0.21) for heating oil respectively.

Dornier and Queruel (2000) include an additional term in order to consider seasonality in a mean-reverting model.

While we only need the payoff at maturity to price the European-type crack spread option discussed in this paper, we generate the full random paths for the assets as an illustration since the copula simulation technique can be used for pricing other path dependent options (e.g., American type) in the energy sector.

The options data include the following items: “symbol,” “trading date,” “contract month,” “open interest,” “Call (c)/Put (p),” “strike price,” “High,” “Low,” “Last,” “Settlement Price (Actual Price),” and “Total Volume.”

References

Alexander C (2005) Correlation in crude oil and natural gas markets. In Managing energy price risk: the new challenges and solutions. Risk Books, London, pp 573–604

Benth FE, Kettler PC (2006) Dynamic copula models for the spark spread. Pure Math 14:1–31

Biglova A, Kanamura T, Rachev ST, Stoyanov SV (2008) Modeling, risk assessment and portfolio optimization of energy futures. Invest Manag Financ Innovat 5(1):17–31

Black F (1976) The pricing of commodity contracts. J Financ Econ 3:167–179

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Boyle PP (1988) A lattice framework for pricing options with two state variables. J Financ Quant Anal 23:1–12

Boyle PP, Lai Y, Tan KS (2004) Pricing options using lattice rules. NA Actuar J 9(3):50–76

Carmona R, Durrleman V (2003) Pricing and hedging spread option. SIAM Rev 45(4):627–685

Cherubini U, Luciano E (2002) Bivariate option pricing with copulas. Appl Math Financ 9:69–85

Cherubini U, Luciano E, Vecchiato W (2004) Copula methods in finance. Wiley, West Sussex

Clayton DG (1978) A model for association in bivariate life tables and its applications in epidemiological studies of familial tendency in chronic disease incidence. Biometrika 65:141–151

Dias MAG (2004) Valuation of exploration and production assets: an overview of real options models. J Pet Sci Eng 44:93–114

Dixit AK, Pindyck RS (1994) Investment under uncertainty. Princeton University Press, Princeton

Dornier F, Queruel M (2000) Caution to the wind. Energ Power Risk Manag Aug 30–32

Dunis CL, Laws J, Evans B (2006) Modelling and trading the gasoline crack spread: a non-linear story. Deriv Use Trading Regul 12(1–2):126–145

Frank MJ (1979) On the simultaneous associativity of F(x, y) and x + y –F(x, y). Aequationes Math 19:194–226

Frees EW, Valdez E (1998) Understanding relationships using copulas. NA Actuar J 2(1):1–25

Genest C (1987) Frank’s family of bivariate distributions. Biometrika 74:549–555

Genest C, Rivest L (1993) Statistical inference procedures for bivariate archimedean copulas. J Am Stat Assoc 88:1034–1043

Girma PB, Paulson AS (1998) Seasonality in petroleum futures spreads. J Futures Mark 18(5):581–598

Girma PB, Paulson AS (1999) Risk arbitrage opportunities in petroleum futures spreads. J Futures Mark 19(8):931–955

Grégoire V, Genest C, Gendron M (2008) Using copulas to model price dependence in energy markets. Energy Risk March 58–64

Gumbel EJ (1960) Distributions des valeurs extremes en plusiers dimensions. Publ Inst Stat Univ Paris 9:171–173

Haigh MS, Holt MT (2002) Crack spread hedging: accounting for time-varying volatility spillovers in the energy futures markets. J Appl Econ 17(3):269–289

Kamrad B, Ritchken P (1991) Multinomial approximating model for options with k-state variables. Manag Sci 37(12):1640–1652

Kirk E, Aron J (1995) Correlation in energy markets. In Managing energy price risk. Risk Books, London

Laurence P, Wang T (2009) Sharp distribution free lower bounds for spread options and the corresponding optimal subreplicating portfolios. Insur Math Econ 44:35–47

Lee AJ (1993) Generating random binary deviates having fixed marginal distributions and specified degrees of association. Am Stat 47:209–215

Margrabe W (1978) The value of an option to exchange one asset for another. J Financ 33:177–186

Marshall AW, Olkin I (1988) Families of multivariate distributions. J Am Stat Assoc 83:834–841

Nelsen RB (1999) An introduction to copulas. Springer, New York

Paddock JL, Siegel DR, Smith JL (1988) Option valuation of claims on real assets: the case of offshore petroleum leases. Quar J Econ 479–508

Pickles E, Smith JL (1993) Petroleum property valuation: a binomial lattice implementation of option pricing theory. Energ J 14(2):1–26

Pindyck RS (1999) The long-run evolution of energy prices. Energ J 20(2):1–27

Rachev ST, Menn C, Fabozzi FJ (2005) Fat-tailed and skewed asset return distributions-implications for risk management, portfolio selection and option pricing. Wiley, New York

Ross SM (1999) An introduction to mathematical finance. Cambridge University Press

Schwartz ES (1997) The stochastic behavior of commodity prices: implications for valuation and hedging. J Financ 52(3):923–973

Sklar A (1959) Functions de repartition a n dimensions et leurs merges. Publ Inst Stat Univ Paris 8:229–231

van den Goorbergh WWJ, Genest C, Weker BJM (2005) Bivariate option pricing using dynamic copula models. Insur Math Econ 37:101–114

Acknowledgements

We also wish to acknowledge valuable comments from participants at the Institute of Industrial Engineers Research Conference, Nashville, Tennessee, May, 2007 and Institute of Industrial Engineers Research Conference, Orlando, Florida, May, 2006. Dr. Herath acknowledges research funding from the Social Sciences and Humanities Research Council (SSHRC) of Canada.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

1.1 Survey of Frank, Clayton, and Gumbel copulas

Three one parameter bivariate Archimedean copulas are given in Table 4. Nelsen (1999: 94–97) tabulates 22 one-parameter Archimedean copula families. The parameter θ in each case measures the degree of dependence and controls the dependence between the two variables. For instance, when θ→0 there is no dependence and if θ→∞ there is perfect dependence. The dependence parameter θ which characterizes each family of Archimedean copulas can be related to Kendall’s Tau. This property is used to empirically determine the applicable copula form.

1.2 Empirically identifying a copula form

The first step in modeling and simulation is identifying the appropriate copula form. Genest and Rivest (1993) provide the following procedure (fit test) to identify an Archimedean copula. The method assumes that a random sample of bivariate data (X i , Y i ) for i = 1,2.....,n is available. Assume that the joint distribution function H has an associated Archimedean copula \( {C_{\theta }} \), and then the fit allows us to select the appropriate generator φ. The procedure involves verifying how closely different copulas fit the data by comparing the closeness of the copula (parametric version) with the empirical (non-parametric) version. The steps are:

-

Step 1

Estimate from the data the Kendall’s correlation using the non-parametric or distribution free measure:

-

Step 2

Identify an intermediate variable Z i = F (X i , Y i ) with a distribution function \( K(z) = \Pr \left( {{Z_i} \leqslant z} \right) \). Construct an empirical (non parametric) estimate of this distribution as follows:

The empirical version of the distribution function K(z) is K E (z) = proportion of Z i ≤ z

-

Step 3

Construct the parametric estimate of K (z). The relationship between this distribution function and the generator is given by \( K(z) = z - \frac{{\varphi (z)}}{{\varphi \prime (z)}} \), where φ′(z) is the derivative of the generator and 0 ≤ z ≤ 1. We provide below the specific form of K(z) for the three Archimedean copulas surveyed in this paper.

-

(i)

$$ {\text{Frank Copula}}\quad \quad \quad \quad K(z) = \frac{{\theta z - \left[ {1 - \exp \left( {\theta z} \right)} \right]\ln \left[ {\frac{{\exp \left( { - \theta z} \right) - 1}}{{\exp \left( { - \theta } \right)}}} \right]}}{\theta } $$(A1)

-

(ii)

$$ {\text{Clayton Copula}}\quad \quad \quad \quad K(z) = \frac{{z\left( {1 + \theta - {z^{\theta }}} \right)}}{\theta } $$(A2)

-

(iii)

$$ {\text{Gumbel Copula}}\quad \quad \quad \quad K(z) = \frac{{z\left( {\theta - \ln z} \right)}}{\theta } $$(A3)

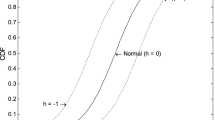

Repeat Step 3 for several different families of copulas, i.e., several choices of generator functions, φ(.). By visually examining the graph of K(z) versus K E (z) or using statistical measures such as minimum square error analysis, one can choose the best copula. This copula can be used in modeling dependence and simulation.

1.3 Copula simulation procedures for the Clayton and Gumbel families

In order to simulate outcomes from the bivariate distribution of asset prices, we use the procedures developed by Genest (1987) and Lee (1993) for the Clayton copula:

1.3.1 Algorithm A.3.1 Generating bivariate outcomes from the Clayton family

-

Step 1

Generate independent (0, 1) uniform random numbers u 1 and u 2

-

Step 2

Set \( {X_1} = {F^{{ - 1}}}\left( {u{}_1} \right) \)

-

Step 3

Compute \( u_2^{*} = {\left[ {1 + u_1^{{ - \theta }}\left( {u_2^{{ - \theta /1 + \theta }} - 1} \right)} \right]^{{ - 1/\theta }}} \)

-

Step 4

\( {X_2} = {G^{{ - 1}}}\left( {u_2^{*}} \right) \)

The above algorithm is computationally expensive for simulating bivariate data from the Gumbel distribution (see discussion in Frees and Valdez 1998). An alternate algorithm suggested by Marshall and Olkin (1988) for the construction of compound copulas can be used instead. The algorithm is as follows:

For the Gumbel copula, the generator and Laplace transform are given in Equation (c) Column C, Appendix Table 4. The inverse generator is equal to the Laplace transform of a positive stable variate \( \gamma \sim {\text{St}}\left( {{\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }},1,\Theta, 0} \right) \) where \( \Theta = {\left( {\cos \left( {\frac{\prod }{{2\theta }}} \right)} \right)^{\theta }} \) and θ > 0.

1.3.2 Algorithm A.3.2 Generating bivariate outcomes from the Gumbel family

-

Step 1

Simulate a positive Stable variate \( \gamma \sim {\text{St}}\left( {\widehat{\alpha },1,\Theta, 0} \right) \)

-

Step 2

Simulate two independent uniform [0,1] random numbers u 1 and u 2

-

Step 3

Set \( {X_1} = {F^{{ - 1}}}\left( {u_1^{*}} \right) \) and \( {X_2} = {G^{{ - 1}}}\left( {u_2^{*}} \right) \) where \( u_i^{*} = \phi \left( {\frac{1}{\gamma }\ln {u_i}} \right) \) and \( \varphi (t) = \exp \left( { - {t^{{\frac{1}{\theta }}}}} \right) \) for \( i \in \left[ {1,2} \right] \)

Cherubini et al. (2004) suggest the following procedure to simulate a positive random variable \( \gamma \sim {\text{St}}\left( {\widehat{\alpha },1,\Theta, \delta } \right) \):

-

Step 1 (a)

Simulate a uniform random variable \( \upsilon = U\left( {\frac{{ - \prod }}{2},\frac{\prod }{2}} \right) \)

-

Step 1 (b)

Independently draw an exponential random variable (ε) with mean = 1

-

Step 1 (c)

\( {\theta_0} = \arctan \left( {\tan \left( {\frac{{\prod {\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}}}{2}} \right)} \right)/{\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }} \) and compute

$$ z = \frac{{\sin {\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}\left( {{\theta_0} + \upsilon } \right)}}{{{{\left( {\cos {\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}{\theta_0}\cos \upsilon } \right)}^{{\frac{1}{{{\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}}}}}}}}{\left[ {\frac{{\cos \left( {{\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}{\theta_0} + \left( {{\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }} - 1} \right)\upsilon } \right)}}{\varepsilon }} \right]^{{\frac{{\left( {1 - {\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}} \right)}}{{{\overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{\alpha }}}}}}} $$ -

Step 1 (d)

\( \gamma = \Theta z + \delta \)

Appendix B

2.1 Current approaches to pricing crack spread options

Spread options are options whose payoffs depend on the difference between two or even three assets. The payoff of a two asset spread option at maturity for a call is

where K is the strike price of the option, S i is the price of the underlying asset i. When K = 0, the spread option is equivalent to an exchange option (see Margrabe 1978). There is no closed-form solution for spread options with correlated asset prices and a non-zero strike price (see Boyle et al. (2004) and Carmona and Durrleman (2003) for discussions of pricing spread options with non-zero strike prices).

2.2 Kirk and Aron (1995) model

The Kirk and Aron (1995) crack spread option model is based on the Black (1976) futures contract model. It is a European-style spread option on futures contracts modified by equating the futures price to a general asset price S i , with strike price K, volatility of the respective assets σ i , the correlation (linear dependence) between the two assets ρ and the risk-free rate r. The Kirk and Aron (1995) formula to price the crack spread is as follows:

where

\( {d_1} = \frac{{\ln \left( {{S_A}} \right) + \left( {r + {\sigma^2}/2} \right)\left( {T - t} \right)}}{{\sigma \sqrt {{T - t}} }} \) and \( {d_2} = {d_1} - \sigma \sqrt {{T - t}} \)

The Kirk and Aron (1995) formula is an approximate model since there is no closed-form solution to a spread option on correlated assets with a non-zero exercise price.

2.3 Binomial lattice approach

To price a crack spread option, we can use the binomial lattice approach for two correlated assets (see Kamrad and Ritchken 1991; Boyle 1988; Pickles and Smith 1993). Define the asset pair \( \left\{ {{S_1}(t),{S_2}(t)} \right\} \)over time t as having a bivariate lognormal density. Let the drift rate be μ i where σ i is the instantaneous standard deviation of the i th asset and r is the risk-free rate. Define the instantaneous linear correlation between two assets as ρ. In the two assets binomial tree, each node has four branches and the risk-neutral probabilities for each branch is given by:

The value for the up and down movements for each asset i = 1,2 is given by \( {\widehat{u}_i} = {e^{{{\sigma_i}\Delta t}}} \) and \( {\widehat{d}_i} = {e^{{ - {\sigma_i}\Delta t}}} \).

2.4 Non-copula Monte Carlo simulation approach

Monte Carlo simulation can be used to price spread options including crack spread options. If the volatility of the assets and their correlation are assumed to be deterministic, then one could estimate the joint distribution of the underlying assets which can be used directly in the simulation. For example, if the marginal distribution of the log-returns of each asset is assumed to be normal, then in the simulation, one can sample directly from a joint normal distribution (or joint lognormal if returns instead of log-returns are used). In this case, payoff values can be simulated from the terminal distribution. For a European-type spread option, it is not necessary to simulate the entire price path. The non-copula Monte Carlo simulation approach, however, is also based on the same two weak assumptions (i.e., normal distribution of log-returns and linear dependence) as the Kirk and Aron (1995) model and the binomial approach.

Rights and permissions

About this article

Cite this article

Herath, H.S.B., Kumar, P. & Amershi, A.H. Crack spread option pricing with copulas. J Econ Finan 37, 100–121 (2013). https://doi.org/10.1007/s12197-011-9171-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-011-9171-1