Abstract

This paper shows that the nationality of firms influences the design of the optimal zoning by a regulator in a duopoly model of spatial price discrimination. For high enough values of the bias of the regulator towards firms, the size of the zone in which firms are allowed to locate is greater when firms are partially foreign-owned than when firms are fully domestic-owned.

Similar content being viewed by others

Notes

For example, Heywood and Ye (2009) study the impact on welfare of foreign competition in a mixed oligopoly under spatial price discrimination. Matsushima and Matsumura (2006) study the spatial location of firms in a mixed oligopoly when there are foreign firms, and Matsumura et al. (2009) investigate whether or not privatization is beneficial from the viewpoint of social welfare in a monopolistic competition model.

See also Colombo (2012) for an analysis of optimal central zoning in a linear town under Cournot competition.

The bias of the regulator measures the relative weights given to consumer surplus and producer surplus in the weighted welfare function.

We consider the linear version of the shipping model analyzed by Hurter and Lederer (1985) and Lederer and Hurter (1986). In some shopping models it is considered that firms may locate outside the city boundaries; for example, Bárcena-Ruiz et al. (2015) show that a regulator highly concerned about firms profits would locate both firms outside the city limits in the unconstrained Hotelling game. Matsumura and Matsushima (2012) show that restricting the locations of the firms to the linear city reduces consumer welfare when firms sign strategic reward contracts with their managers.

See Bárcena-Ruiz and Casado-Izaga (2014) for a proof of this statement.

The proof of this Proposition is similar to that provided by Bárcena-Ruiz and Casado-Izaga (2014) for \(\beta \)=1 and so we omit it. This proof is available from the authors on request.

When we state that the regulator “is more permissive” we compare the size of the areas allowed in both cases.

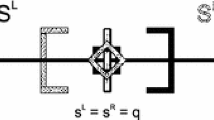

The figure shows the case in which \(\beta <\frac{1}{2}\) because then \(\frac{1 }{1+2\beta }>\frac{1}{2}.\)

References

Bárcena-Ruiz, J.C., Casado-Izaga, F.J.: Zoning under spatial price discrimination. Econ. Inq. 52(2), 659–665 (2014)

Bárcena-Ruiz, J.C., Casado-Izaga, F.J., Hamoudi, H.: Optimal zoning of a mixed duopoly. Ann. Reg. Sci. 52, 141–153 (2014)

Bárcena-Ruiz, J.C., Casado-Izaga, F.J., Hamoudi, H., Rodríguez, I.: Optimal zoning in the unconstrained Hotelling game. Pap. Reg. Sci., forthcoming (2015) doi:10.1111/pirs.12132

Chen, C.-S., Lai, F.-C.: Location choice and optimal zoning under Cournot competition. Reg. Sci. Urban Econ. 38(2), 119–126 (2008)

Colombo, S.: On optimal zoning in a linear town with Cournot competitors. Lett. Spat. Resour. Sci. 5, 113–118 (2012)

Hamoudi, H., Risueño, M.: The effects of zoning in spatial competition. J. Reg. Sci. 52(2), 361–374 (2012)

Heywood, J.S., Ye, G.: Mixed oligopoly and spatial price discrimination with foreign firms”. Reg. Sci. Urban Econ. 39(5), 592–601 (2009)

Hurter, A., Lederer, P.: Spatial duopoly with discriminatory pricing. Reg. Sci. Urban Econ. 15(4), 541–553 (1985)

Lai, F-C. Tsai, J-F.: Duopoly locations and optimal zoning in a small open city. J. Urban Econ. 55(3), 614–626 (2004)

Lederer, P., Hurter, A.: Competition of firms: discriminatory pricing and location. Econometrica 54(3), 623–640 (1986)

Matsumura, T., Matsushima, N.: Locating outside a linear city can benefit consumers. J. Reg. Sci. 52(3), 420–432 (2012)

Matsumura, T., Matsushima, N., Ishibashi, I.: Privatization and entries of foreign enterprises in a differentiated industry. J. Econ. 98, 203–219 (2009)

Matsumura, T., Shimizu, D.: Spatial Cournot competition and economic welfare: a note. Reg. Sci. Urban Econ. 35(6), 658–670 (2005a)

Matsumura, T., Shimizu, D.: Economic welfare in delivered pricing duopoly: Bertrand and Cournot. Econ. Lett. 89(1), 112–119 (2005b)

Matsushima, N., Matsumura, T.: Mixed oligopoly, foreign firms and location choice. Reg. Sci. Urban Econ. 36(6), 753–772 (2006)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank two referees for their helpful comments. Financial support from Ministerio de Ciencia y Tecnología (ECO2012-32299) and the University of the Basque Country (EHU14/05) is gratefully acknowledged.

Appendix

Appendix

Proof of Proposition 1

Equilibrium price policies are described by \(p_{1}^{*}(x_{1},x_{2},x)=p_{2}^{*}(x_{1},x_{2},x)\) = \(max\{f_{1}\left( x_{1},x\right) \), \(f_{2}\left( x_{2},x\right) \}.\) Given a pair of locations \(\left( x_{1},x_{2}\right) \) such that \(x_{1}\leqslant x_{2}\), firms’ total profits, \(\pi =\pi _{1}+\pi _{2}\), are: \(\pi =\int _{\frac{x_{2}-x_{1}}{2} }^{1-x_{1}}txdx+\int _{\frac{x_{2}-x_{1}}{2}}^{x_{2}}txdx- \int _{0}^{x_{1}}txdx-2\int _{0}^{\frac{x_{2}-x_{1}}{2}}txdx- \int _{0}^{1-x_{2}}txdx;\) the first two terms are firms’ revenues and the rest are total transportation costs. So, the weighted welfare is: \(W=\alpha \beta (\pi _{1}+\pi _{2})+(1-\alpha )CS=\) \(\alpha \beta t\left[ \frac{1}{2}(1-x_{1})^{2}-\frac{^{x_{1}2}}{2}-\frac{1}{2 }(1-x_{2})^{2}+\frac{^{x_{2}2}}{2}-\frac{1}{2}(x_{2}-x_{1})^{2}\right] +\) \((1-\alpha )\overline{s}-(1-\alpha )t\left[ \frac{1}{2}(1-x_{1})^{2}+\frac{ ^{x_{2}2}}{2}-\frac{1}{4}(x_{2}-x_{1})^{2}\right] .\) From the first order conditions these two equations are obtained: \(x_{1}=\frac{2(1-\alpha (1+\beta ))-x_{2}(1-\alpha (1+2\beta ))}{1-\alpha (1-2\beta )},\) \(x_{2}= \frac{2\alpha \beta -x_{1}(1-\alpha (1+2\beta ))}{1-\alpha (1-2\beta )}.\) They are valid when \(\alpha >\frac{1}{1+2\beta }.\) The solution is thus: \( x_{1}^{^{*}}=\frac{1}{4}+\frac{1-\alpha (1+\beta )}{4\alpha \beta },\) \( x_{2}^{^{*}}=\frac{3}{4}-\frac{1-\alpha (1+\beta )}{4\alpha \beta },\) when \(\alpha >\frac{1}{1+2\beta },\) and \(x_{1}^{^{*}}=x_{2}{}^{^{*}}= \frac{1}{2}\) when \(\alpha \le \frac{1}{1+2\beta }.\) The second order conditions are met. \(\square \)

Rights and permissions

About this article

Cite this article

Bárcena-Ruiz, J.C., Casado-Izaga, F.J. Foreign-owned firms and zoning under spatial price discrimination. Lett Spat Resour Sci 9, 145–155 (2016). https://doi.org/10.1007/s12076-015-0148-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-015-0148-0