Abstract

This paper documents the channels through which commodity price volatility can affect resource intensive industries’ investment decisions, production levels and profitability. Over the very long run, the Canadian forestry sector was not immune from the negative effects of commodity price volatility. However, the long run averages mask dynamic and asymmetric patterns in the sector’s responses to price volatility. The supply of investment funds from formal-external sources was suppressed during episodes of high and rising commodity price volatility, but insensitive to low and falling volatility. These effects weakened as the economy matured. The accumulation of reproducible and natural capital was affected by commodity price volatility through an investment supply channel that was also asymmetric, but in this case, the effect was strongest during low and falling volatility. These results show how a maturing economy with diversified investment opportunities can become increasingly immune from the negative effects of commodity price volatility.

Similar content being viewed by others

Notes

Other countries that could be considered part of this group include the Scandinavian nations, Russia, Argentina and Brazil.

This view is consistent with the presence of a "pecking order" in the supply of investment funds (Myers 2001).

Because Canadian forestry firms have never been large enough to dictate prices on international markets, prices and price volatility may be assumed to be exogenous.

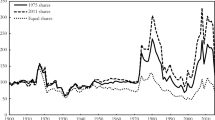

Although few product-specific price series are available over the long run, we can see that between 1900 and 1950 lumber prices were more than 25 % more volatile than the aggregate forestry WPI and "raw and partly manufactured" wood product prices were nearly 10 % more volatile.

The OLS estimate of the correlation between Canadian forestry sector value added as a share of GDP and real GDP per capita growth is −0.0232 (robust standard error = 0.028). The estimate of the correlation between the volatility of Canadian forestry prices relative to the volatility of the GDP deflator and real GDP per capita growth is −0.0003 (robust standard error = 0.006).

Dynamic renewable resource extraction models are described in Neher (1990), and Hartwick and Olewiler (1998). Pindyck (1984) shows how the structure of these models can be adapted to include uncertainty. Sadorsky (2001), Sadorsky and Henriques (2001), and El-Sharif et al. (2005) employ multi-factor CAPMs to model resource firms' investment supply functions. The online appendix provides a detailed description of the underlying structural model.

Results from the estimation of a fully-reduced form system of first order conditions are reported in Appendix Table A2.1.

This approach embodies an admittedly ad hoc dimension to some of the equation specifications—particularly the profit equation. Results from the estimation of alternate equation specifications are reported in Appendix Tables A2.2, A2.3 and A2.4.

Natural capital does not appear as an explanatory variable in the profit equation because resource rents are derived from the return to in situ timber assets. Results from the estimation of other profit function specifications are reported in Appendix Table A2.1 and A2.3.

The productivity parameter in Eq. (2) has been smoothed using a Hodrick-Prescott filter. Exogeneity of the productivity parameter has been confirmed with a Hausman test. Results from the estimation of production functions that use alternate productivity measures and more flexible characterizations of technological change are reported in Appendix Tables A2.1 and A2.4. It remains an interesting research question to determine whether price volatility affects patterns in technological change.

Up to five lags (i = 0–5) have been considered. 1 lag is used in Eq. (3), but for the human and natural capital accumulation functions longer lags (i = 2 or 3) fit the data better. Results from the estimation of the system with alternate lag lengths are reported in Appendix Table A2.5.

In an efficient equity market, anticipated changes in profitability should be fully reflected in equity prices. This implies that changes in equity market performance will be related to deviations from expected profitability rather than aggregate changes in the profits, and these deviations may be related to changes in price volatility. Although there are many ways to model deviations from expectations, I assume that investors on the TSE expected changes in forestry profits to be determined by last years' profits, conditional on observed price volatility. This implies that all of the annual change in forest profits may be considered unanticipated.

Phillips-Perron unit root tests confirm stationarity in the model's normalized log-differenced variables. Results from the estimation of the system with all variables measured in levels are reported in Appendix Table A2.6.

Source and construction details for all series are provided in the online appendix.

The opportunity cost of labour is assumed to be total employment multiplied by average annual labour income earned in non-resource intensive manufacturing. The opportunity cost of capital is assumed to be the nominal value of net fixed capital times a user cost for capital.

Results from using alternate measures of natural capital are reported in Appendix Table A2.7.

Better measures of human capital would be preferred, but for early years even information on employees' gender and age is only available at census dates.

No dividend or total return information is available for Canadian forestry firms through most of my period of study. For years before and after the TSE forest sector index is reported, a weighted average of annual high-low quotations for individual firms is used. Results from the estimation of the system using alternate CAPM specifications are reported in Appendix Table A2.8.

Results from the estimation of the of the system using alternate opportunity cost measures in the accumulation functions are reported in Appendix Table A2.9.

After 1956 a TSE 300 composite index is available. From 1935 to 1956 a full market composite index is used. From 1914 to 1935 the market index is adjusted to account for changes in the mining index. Rosenbluth's (2005) reconstructed composite index, adjusted to account for changes in the mining index, is used from 1900 to 1914.

Results from the estimation of the system using alternate price volatility measures are reported in Appendix Table A2.10.

Stata commend: ireg3. Results from the estimation of the system using alternate estimation strategies are reported in Appendix Table A2.11, Panel A and B.

The price volatility shock imposed in Counterfactual # 1 increases the long run average relative price volatility by 0.96. To put this figure into context, the average relative volatility of forestry prices increased by 0.82 between 1965–1975, 0.99 between 1915–1925, and 1.37 between 1985–1995.

The effect of the shock dissipates, meaning the period-over-period change in each variable drops to less than 0.1 %, for all endogenous variables within ten periods.

Cook’s distance and covariance ratio tests for outlying observations confirm the statistical importance of the years during each "crisis" period.

Results from the estimation of the system using alternate crisis dates, and after splitting the sample between episodes of crisis and calm, are reported in Appendix Table A2.12.

Statistically insignificant parameter estimates on the interaction terms in the input accumulation functions indicate that, although these relationships were asymmetric, they were stable over the 1900–2005 period.

Because the investment supply responses during episodes crisis and calm were both declining sharply over time—the interaction terms during crisis and calm are statistically indistinguishable—I only report parameter estimates under the assumption of symmetric investment supply responses in Table 4.

References

Acemoglu D, Robinson J (2012) Why nations fail: the origins of power, prosperity and poverty. Profile Books, London

Allen RC (2009) The British industrial revolution in global perspective. Cambridge University Press, New York

Allen RC, Keay I (2004) Saving the whales: lessons from the extinction of the Eastern Arctic Bowhead Whale. J Econ Hist 64:400–432

Auty R (1990) Resource based industrialization: sowing the oil in eight exporting countries. Clarendon Press, Oxford

Auty R (2001) Resource abundance and economic development. Oxford University Press, New York

Bhattacharyya S, Williamson J (2009) Commodity price shocks and the Australian economy since federation. National Bureau of Economic Research working paper no. 14694, NBER, Cambridge

Blattman C, Hwang J, Williamson J (2007) Winners and losers in the commodity lottery: the impact of terms of trade growth and volatility in the periphery, 1870–1939. J Dev Econ 82:156–179

Bliss M (1987) Northern enterprise: five centuries of Canadian business. McClelland and Stewart, Toronto

Boyce J, Emery JC (2011) Is a negative correlation between resource abundance and growth sufficient evidence that there is a ‘resource curse’? Resour Policy 36:1–13

Chen Y, Rogoff K (2003) Commodity currencies. J Int Econ 60:133–160

Clay K (2011) Natural resource and economic outcomes. In: Rhode P, Rosenbloom J, Weiman D (eds) Economic evolution and revolution in historical time. Stanford University Press, Stanford

Clay K, Weckenman A (2014) Resources and curses: evidence from the United States, 1880–2000. Paper prepared for 2015 Allied Social Sciences Association annual meeting

Dick T (1982) Canadian Newsprint, 1913–1930: national policies and the North American economy. J Econ Hist 42:659–687

Drummond I (1987) Progress without planning: the economic history of Ontario from confederation to the Second World War. University of Toronto Press, Toronto

Drushka K (1995) H.R.: a biography of H.R. MacMillan. Harbour Publishing, Madeira Park

El-Sharif I, Brown D, Burton B, Nixon B, Russell A (2005) Evidence on the nature and extent of the relationship between oil prices and equity values in the UK. Energy Econ 27:819–830

Greasley D, Madsen J (2010) Curse and boon: natural resources and long-run growth in currently rich economies. Econ Record 86:311–328

Gylfason T, Herbbertsson T, Zoega G (1999) A mixed blessing: natural resources and economic growth. Macroecon Dyn 3:204–225

Hartwick J, Olewiler N (1998) The economics of natural resource use, 2nd edn. Addison-Wesley, Toronto

Hausman R, Rigobon R (2003) An alternative interpretation of the resource curse: theory and policy implications. National Bureau of Economic Research working paper no. 9424. NBER, Cambridge

Innis HA (1930) The fur trade in Canada: an introduction to Canadian economic history. University of Toronto Press, Toronto

Jacks D, O’Rourke K, Williamson J (2010) Commodity price volatility and world market integration since 1700. Rev Econ Stat 93:800–813

Keay I (2007) The engine or the caboose? Resource industries and twentieth century Canadian economic performance. J Econ Hist 67:1–32

Keay I, Redish A (2004) The micro-economic effects of financial market structure: evidence from 20th century North American steel firms. Explor Econ Hist 41:377–403

Koren M, Tenreyro S (2007) Volatility and development. Q J Econ 122:243–287

Lederman D, Maloney W (2007) Trade Structure and Growth. In: Lederman D, Maloney W (eds) Natural resources: neither curse nor destiny. Stanford University Press and The World Bank, Washington

Lower A (1933) The trade in square timber. Contrib Can Econ 6:40–61

Magee G (1996) Patenting and the supply of inventive ideas in colonial Australia: evidence from Victorian patent data. Aust Econ Hist Rev 36:30–58

Manzano O, Rigobon R (2007) Resource curse or debt overhang? In: Lederman D, Maloney W (eds) Natural resources: neither curse nor destiny. Stanford University Press and The World Bank, Washington

Marchak P (1983) Green gold: the forest industry in British Columbia. University of British Columbia Press, Vancouver

Mehlum H, Moene K, Torvik R (2006) Institutions and the resource curse. Econ J 116:1–20

Myers S (2001) Capital structure. J Econ Perspect 15:81–102

Neher P (1990) Natural resource economics: conservation and exploitation. Cambridge University Press, New York

Nelles H (1974) The politics of development: forests, mines and hydro-electric power in Ontario, 1849–1941. Macmillan, Toronto

Pearce P (1990) Introduction to forestry economics. University of British Columbia Press, Vancouver

Pindyck R (1984) Uncertainty in the theory of renewable resource markets. Rev Econ Stud 51:289–303

Rosenbluth G (2005) Reconstruction of the Toronto stock exchange composite market index. http://www.arts.ubc.ca/econsochist. Accessed 20 Apr 2005

Rudin R (1982) Montreal banks and urban development in Quebec, 1840–1914. In: Stelter G, Artibise A (eds) Shaping the urban landscape: aspects of the Canadian city. Carleton University Press, Ottawa

Sachs J, Warner A (1997) Sources of slow growth in African economies. J Afr Econ 6:335–376

Sachs J, Warner A (1999) The big push, natural resource booms and growth. J Dev Econ 59:43–76

Sachs J, Warner A (2001) The curse of natural resources. Eur Econ Rev 45:827–838

Sadorsky P (2001) Risk factors in stock returns of Canadian oil and gas companies. Energy Econ 23:17–28

Sadorsky P, Henriques I (2001) Multifactor risk and the stock returns of Canadian paper and forest products companies. For Policy Econ 3:199–208

Statistics Canada (1993) Environmental perspectives, studies and statistics. Statistics Canada, Ottawa

Stijns J-P (2005) Natural resource abundance and economic growth revisited. Resour Policy 30:107–130

Taylor G, Baskerville P (1994) A concise history of business in Canada. Oxford University Press, Toronto

Urquhart M (1993) Gross national product of Canada, 1870-1926: the derivation of the estimates. McGill-Queen’s Press, Montreal

Van der Ploeg F, Poelhekke S (2009) Volatility and the natural resource curse. Oxf Econ Pap 61:727–760

Watkins MH (1963) A staple theory of economic growth. Can J Econ Polit Sci 29:141–158

Wright G (1990) The origins of American industrial success, 1879–1940. Am Econ Rev 80:651–668

Wright G, Czelusta J (2004) Why economies slow: the myth of the resource curse. Challenge 47:6–38

Zhang D (2007) The softwood lumber war: politics, economics, and the long US-Canadian trade dispute. Resour Futur, Washington

Acknowledgments

I would like to thank André Bernier, Herb Emery, Richard Hornbeck, David Jacks, Frank Lewis, Gregor Smith, and Jeffrey Williamson for taking time to comment on earlier versions of this paper. I would also like to thank seminar participants at UC-Davis, Yale, University of Calgary, and University of Alberta, and the editor and referees at Cliometrica. Financial assistance provided by SSHRC grant # 410-2007-0323 and the Corporate Policy and Portfolio Coordination Branch of Natural Resources Canada is gratefully acknowledged. All remaining errors and omissions remain the responsibility of the author.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Keay, I. Immunity from the resource curse? The long run impact of commodity price volatility: evidence from Canada, 1900–2005. Cliometrica 9, 333–358 (2015). https://doi.org/10.1007/s11698-014-0118-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-014-0118-6