Abstract

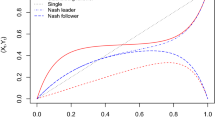

In this paper, we develop optimal trading strategies for a risk averse investor by minimizing the expected cost and the risk of execution. Here we consider a law of motion for price which uses a convex combination of temporary and permanent market impact. In the special case of unconstrained problem for a risk neutral investor, we obtain a closed form solution for optimal trading strategies by using dynamic programming. For a general problem, we use a quadratic programming approach to get approximate dynamic optimal trading strategies. Further, numerical examples of optimal execution strategies are provided for illustration purposes.

Similar content being viewed by others

References

Almgren R., Chriss N.: Optimal execution of portfolio transactions. J. Risk. 3, 5–39 (2000)

Almgren, R.: Optimal execution with nonlinear impact functions and trading-enhanced risk applied mathematical finance. 1, 1–18 (2003)

AitSahlia F., Sheu Y.C., Pardalos P.M.: Optimal execution of time-constrained portfolio transactions. In: Konthoghiorges, E.J., Rustem, B., Winker, P. (eds) Computational Methods in Financial Engineering, pp. 95–102. Springer, Berlin (2008)

Bank P., Baum D.: Hedging and portfolio optimization in financial markets with a large trader. Math. Finance. 14, 1–18 (2004)

Bertsimas D., Lo A.: Optimal control of execution costs. J. Financial Markets 1, 1–50 (1998)

Bertsimas D., Hummel P., Lo A.: Optimal Control of Execution Costs for Portfolios. MIT, USA (1999)

Evstigneev, I.V., Hens, T., Hoppe, K.R.S.: Market Selection of Financial Trading Strategies: Global Stability Mathematical Finance, vol. 12, pp. 329–339 (2002)

Huberman G., Stanzl W.: Optimal liquidity trading. Rev. Finance 9, 165–200 (2005)

Kissell R., Malamut R.: Algorithmic decision-making framework. J. Trading 1, 12–21 (2006)

Kissel R., Glantz M.: Optimal Trading Strategies. Amacom, Inc., New York (2003)

Knopov P., Pardalos P.M.: Simulation and Optimization Methods in Risk and Reliability Theory. Nova Science Publishers, New York (2009)

Perold A.F.: The implementation shortfall: paper versus reality. J. Portfolio Manag. 14, 4–9 (1998)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Khemchandani, R., Gupta, N., Chaudhary, A. et al. Optimal execution with weighted impact functions: a quadratic programming approach. Optim Lett 7, 575–592 (2013). https://doi.org/10.1007/s11590-012-0441-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-012-0441-4