Abstract

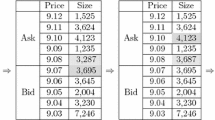

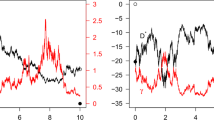

This paper presents a model to describe the dynamic trading process in limit order book. By studying the dynamic pattern of execution probabilities of limit orders with both time and the depth of limit order book, the authors conclude with the following properties: Arrival rates of market buy orders increase as the depth of buy queue in the book increases and decrease as the depth of sell queue increases, and vice versa; similar regularities for the arrival rate of market sell orders; both the arrival rate of market buy order and market sell orders increase as the depth of both sides in the book increases by the same amount. Furthermore, the authors describe more detailed temporary and permanent effects of the market depth on the arrival rates of orders.

Similar content being viewed by others

References

Harris L, Optimal dynamic order submission strategies in some stylized trading problems, Financial Markets, Institutions & Instruments, 1998, 7: 1–76.

Foucault T, Order flow composition and trading costs in a dynamic limit order market, Journal of Financial Markets, 1999, 2: 99–134.

Hollifield B, Miller R, and Sandas P, Empirical analysis of limit order markets, Review of Economic Studies, 2004, 71: 1027–1063.

Hollifield B, Miller R, Sandas P, and Slive J, Estimating the gains from trade in limit-order markets, Journal of Finance, 2006, 61: 2753–2804.

Cohen K, Maier S, Schwartz R, and Whitcomb D, Transaction costs, order placement strategy, and existence of the bid-ask spread, Journal of Political Economy, 1981, 89: 287–305.

Glosten L, Is the electronic open limit order book inevitable?, Journal of Finance, 1994, 49: 1127–1161.

Seppi D, Liquidity provision with limit orders and a strategic specialist, Review of Financial Studies, 1997, 10: 103–150.

Parlour C, Price dynamics in limit order markets, Review of Financial Studies, 1998, 11: 789–816.

Goettler R, Parlour C, and Rajan U, Equilibrium in a dynamic limit order market, Journal of Finance, 2005, 60: 2149–2192.

Goettler R, Parlour C, and Rajan U, Informed traders and limit order markets, Journal of Financial Economics, 2009, 93(1): 67–87.

Foucault T, Kadan O, and Kandel E, The limit order book as a market for liquidity, Review of Financial Studies, 2005, 18: 1171–1217.

Rosu I, Dynamic model of the limit order book, Review of Financial Studies, 2009, 22: 4601–641.

Biais B, Hillon P, and Spatt C, An empirical analysis of the limit order book and the order flow in the Paris bourse, Journal of Finance, 1995, 50: 1655–1689.

Griffiths M, Smith B, Turnball A, and White R, The costs and determinants of order aggressiveness, Journal of Financial Economics, 2000, 56: 65–88.

Ranaldo A, Order aggressiveness in limit order book markets, Journal of Financial Markets, 2004, 7: 53–74.

Dufour A and Engle R, Time and the price impact of a trade, Journal of Finance, 2000, 55: 2467–2498.

Hasbrouck J, Measuring the information content of stock trades, Journal of Finance, 1991a, 46: 179–207.

Hasbrouck J, The summary informativeness of stock trades: An econometric analysis, The Review of Financial Studies, 1991b, 4(3): 571–595.

Furfine C, When is inter-transaction time informative?, Journal of Empirical Finance, 2007, 14: 310–332.

Spierdijk L, An empirical analysis of the role of the trading intensity in information dissemination on the NYSE, Journal of Empirical Finance, 2004, 11: 163–184.

Madhavan A, Richardson M, and Roomans M, Why do security prices change? A transactionlevel analysis of NYSE stocks, Review of Financial Studies, 1997, 10: 1035–1064.

Engle R and Russell J, Autoregressive conditional duration: A new model for irregularly spaced transaction data, Econometrica, 1998, 66: 1127–1162.

Engle R F, The econometrics of Ultra high frequency data, Econometrica, 2000, 68(1): 1–22.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research is supported by the National Natural Science Foundation of China under Grant Nos. 71371024, 71371023 and Fundamental Research Funds for the Central Universities under Grant No. ZZ1319.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Zhang, Q., Liu, S. & Qiu, W. The effects of market depth on the arrival rate of orders. J Syst Sci Complex 27, 1192–1203 (2014). https://doi.org/10.1007/s11424-014-1247-5

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-1247-5