Abstract

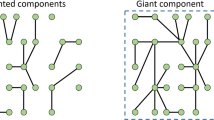

Solomon and Golo (Account Econ Law 3(3):167–260, 2013) have recently proposed an autocatalytic (self-reinforcing) feedback model which couples a macroscopic system parameter (the interest rate), a microscopic parameter that measures the distribution of the states of the individual agents (the number of firms in financial difficulty) and a peer-to-peer network effect (contagion across supply chain financing). In this model, each financial agent is characterized by its resilience to the interest rate. Above a certain rate the interest due on the firm’s financial costs exceeds its earnings and the firm becomes susceptible to failure (ponzi). For the interest rate levels under a certain threshold level, the firm loans are smaller then its earnings and the firm becomes ‘hedge.’ In this paper, we fit the historical data (2002–2009) on interest rate data into our model, in order to predict the number of the ponzi firms. We compare the prediction with the data taken from a large panel of Italian firms over a period of 9 years. We then use trade credit linkages to discuss the connection between the ponzi density and the network percolation. We find that the ‘top-down’–‘bottom-up’ positive feedback loop accounts for most of the Minsky crisis accelerator dynamics. The peer-to-peer ponzi companies contagion becomes significant only in the last stage of the crisis when the ponzi density is above a critical value. Moreover the ponzi contagion is limited only to the companies that were not dynamic enough to substitute their distressed clients with new ones. In this respect the data support a view in which the success of the economy depends on substituting the static ‘supply-network’ picture with an interacting dynamic agents one.

Similar content being viewed by others

Notes

We present a discrete iterative process where at each iteration either the quantity of loans or the interest rate adjust for loan supply costs. Following this, lowering the interest rate will decrease demand, while raising the interest rate will lower demand. This is similar to Walras groping process. The quantity of loans are accommodative and initially nominal interest rates are sticky but will adjust in accordance with the cost of lending. This is similar Marshallian process, see for instance Humphrey (1992). Our combined Marshall–Walras process is described in detail in Solomon and Golo (2013). The mathematics of such iterative processes is studied in detail in the monograph (Galor 2007). For a continuous time treatment see Alessandro (2011).

Without an immediate cash flow from the “next generation”, the suppliers could not afford to continue in business.

References

Alessandro V (2011) A perspective on Minsky moments: revisiting the core of the financial instability hypothesis. Rev Polit Econ 23(1):49–67

Cantono S, Solomon S (2010) When the collective acts on its components: economic crisis autocatalytic percolation. J Phys 12(7):075038

Galor O (2007) Discrete dynamical systems. Springer, Berlin

Golo N, Kelman G, Bree DS, Usher L, Lamieri M, Solomon S (2015) Many-to-one contagion of economic growth rate across trade credit network of firms. arXiv preprint arXiv:1506.01734

Hicks J (1980–1981), IS-LM: an explanation. J Post Keynes Econ 3:139–155

Humphrey TM (1992) Marshallian cross diagrams and their uses before Alfred Marshall. Economic Review, Federal Reserve Bank of Richmond, pp 3–23

Kindleberger CP, Aliber R (2005) Manias, panics, and crashes: a history of financial crises, 5th edn. Wiley, New York. ISBN 0-471-46714-6

Kindler A, Solomon S, Stauffer D (2013) Peer-to-peer and mass communication effect on opinion shifts. Phys A Stat Mech Appl 392(4):785–796

Levy H, Levy M, Solomon S (2000) Microscopic simulation of financial markets: from investor behavior to market phenomena. Academic Press, New York

Lovelock J (2000) Gaia: a new look at life on earth. Oxford University Press, Oxford

Mankiw NG (2006) The macroeconomist as scientist and engineer, p 19. Retrieved 2011-12-30

Minsky HP (1975) Financial resources in a fragile financial environment. Challenge, pp 6–13

Minsky HP (1975) John Maynard Keynes. Columbia University Press, New York

Minsky H (1984) Can, “it” happen again? Essays on instability and finance. ME Sharpe, Armonk, NY

Reinhart C, Rogoff K (2014) This time is different: a panoramic view of eight centuries of financial crises. Ann Econ Finance 15(2). Cambridge: Harvard University: 1065–1188. All Figures, Tables and Data Abstract April 2008 shorter version 2014 Annals Version

Shiller RJ (2005) Irrational exuberance. Random House Digital, Inc, Princeton, NJ

Solomon S, Golo N (2013) Minsky financial instability, interscale feedback, percolation and Marshall–Walras disequilibrium. Account Econ Law 3(3):167–260

Whalen CJ (2008) The credit crunch: a Minsky moment. Stud Note Econ 13(1):3–21

Acknowledgments

We thank the Institute for New Economic Thinking (INET), as this work has been performed with their support under Grant ID INO1100017. We thank The Annual Workshop on Economic Science with Heterogeneous Interacting Agents (WEHIA) 2012 and 2013 organizers for comments on our preliminary results and for allowing us to present them here.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Golo, N., Brée, D.S., Kelman, G. et al. Too dynamic to fail: empirical support for an autocatalytic model of Minsky’s financial instability hypothesis. J Econ Interact Coord 11, 247–271 (2016). https://doi.org/10.1007/s11403-015-0163-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-015-0163-7