Abstract

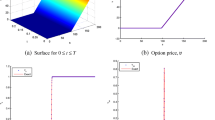

There is a need for very fast option pricers when the financial objects are modeled by complex systems of stochastic differential equations. Here the authors investigate option pricers based on mixed Monte-Carlo partial differential solvers for stochastic volatility models such as Heston’s. It is found that orders of magnitude in speed are gained on full Monte-Carlo algorithms by solving all equations but one by a Monte-Carlo method, and pricing the underlying asset by a partial differential equation with random coefficients, derived by Itô calculus. This strategy is investigated for vanilla options, barrier options and American options with stochastic volatilities and jumps optionally.

Similar content being viewed by others

References

Achdou, Y. and Pironneau, O., Numerical Methods for Option Pricing, SIAM series, Philadelphia, USA, 2005.

Amin, K. and Khanna, A., Convergence of American option values from discrete- to continuous-time financial models, Mathematical Finance, 4, 1994, 289–304.

Barth, A., Schwab, C. and Zollinger, N., Multi-level Monte Carlo finite element method for elliptic PDEs with stochastic coefficients, Num. Math., 119(1), 2011, 123–161.

Bates, D. S., Jumps and stochastic volatility: Exchange rate processes implicit Deutsche mark options, Review Financial Stud., 9(1), 1996, 69–107.

Black, F. and Scholes, M., The pricing of options and coorporate liabilities, J. Political Econ., 81, 1973, 637–659.

Boyle, P., Options: A Monte Carlo approach, Journal of Financial Economics, 4, 1977, 323–338.

Carr, P. and Madan, D., Option valuation using the fast Fourier transform, Journal of Computational Finance, 2(4), 1999, 61–73.

Dupire, B., Pricing with a smile, Risk, 1994, 18–20.

George, P. L. and Borouchaki, H., Delaunay triangulation and meshing, Hermès, Editions Paris, 1998; Application to Finite Elements, Translated from the original, P. J. Frey and S. A. Canann (eds.), French, 1997.

Glasserman, P., Monte-Carlo Methods in Financial Engineering, Stochastic Modeling and Applied Probability, Vol. 53, Springer-Verlag, New York, 2004.

Hecht, F., Pironneau, O., Le Yaric, A., et al., freefem++ documentation. http://www.freefem.org

Heston, S., A closed form solution for options with stochastic volatility with application to bond and currency options, Review with Financial Studies, 6(2), 1993, 327–343.

Lewis, A., A simple option formula for general jump-diffusion and other exponential Lévy processes, 2001. http://www.optioncity.net

Loeper, G. and Pironneau, O., A mixed PDE/Monte-Carlo method for stochastic volatility models, C. R. Acad. Sci. Paris, Ser. I, 347, 2009, 559–563.

Merton, R. C., Option pricing when underlying stock returns are discontinuous, J. Financ. Econ., 3, 1976, 125–144.

Pironneau, O., Dupire Identities for Complex Options, Comptes Rendus de l’Académie des Sciences, to appear.

Li, X. S., Demmel, J. W. and Gilbert, J. R., The superLU library. http://crd.lbl.gov/xiaoye/SuperLU

Wilmott, P., Howison, S. and Dewynne, J., The Mathematics of Financial Derivatives, Cambridge University Press, Cambridge, 1995.

Author information

Authors and Affiliations

Corresponding author

Additional information

In honor of the scientific heritage of Jacques-Louis Lions

Rights and permissions

About this article

Cite this article

Lipp, T., Loeper, G. & Pironneau, O. Mixing monte-carlo and partial differential equations for pricing options. Chin. Ann. Math. Ser. B 34, 255–276 (2013). https://doi.org/10.1007/s11401-013-0763-2

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11401-013-0763-2