Abstract

Fear is often seen as pathological, to be eliminated by expensive emotion-damping pharmaceuticals that have drastic side effects. Such therapies have indiscernible long-term success since they ignore why we have brains. This paper offers a new fundamental theory based on recognising that mental illness is bad decisionmaking—bad risk processing of external stimuli. Whiffs of danger—small risks (tiny chances and challenges)—generate little fears and hopes of whether an act will have a nice or nasty surprise. From enough whiffs of danger with rapid reliable feedback on whether the surprise is nice or nasty, and in adequate variety (sensual, physical, mental, psychological, social, ethical, spiritual) children learn the difference between luck and sensible choice, and adults maintain adequate decisionmaking—the author’s ‘whiffs of danger’ theory. Lack of whiffs constitutes risk starvation and can arise from under-challenge (the risks are too small) or over-challenge (the risks are too big). Boys’ ADHD springs from under-challenge in physical risks—the digital seduction—and over-challenge in mental, psychological, social risks—by faster maturing schoolgirls as teachers quit traditional boy favouritism. Boys’ IQ/maturity over-challenge could be cut by: (1) appropriate pre-school care; (2) single sex schools or in co-ed schools boys’ school entry postponed so one year older than their female classmates; and (3) boys praised for expressions of fears, hopes, not for emotion-damped macho utterances. Under-challenge underlies some panic attacks and epileptic fits, and a high proportion of depressions and dementias. Like schoolboys’ physical under-challenge, these under-challenges are reducible by compensating societal changes.

Similar content being viewed by others

1 Introduction

A ship is safe in the harbour. But that is not what ships are for

John A. Shedd, Salt from My Attic, 1928Footnote 1

The danger of being on the open sea, and in a variety of other circumstances, can bread fear. Many see fear experiences as unhealthy, to be avoided. Having fear experiences is often seen as pathological, yielding bad decisions, mental illness and unhappiness.

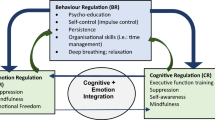

Indeed some people are unhealthily obsessed by fear as in post traumatic stress syndrome (PTSD) and phobias of spiders and other animals and events. These people need to reduce their attention to fear and to experiences of fear in order to enhance their decisionmaking, their health and their happiness. Short and long run success in treating these fear pathologies is with exposure therapies, happening in the environment naturally or by therapy, Amsel et al. (2014). Exposure therapy does not try to coddle the person from experiencing the phenomena that terrifies them.

Although exposure therapy is expressed in the literature in terms of exposure in a “safe’ environment” from the perspective of the therapist, it is not a completely safe environment from the perspective of the sufferer. The therapy involves the sufferer taking the action of being exposed to what the sufferer perceives as a succession of minute risks of a nasty happening from that phenomena. As the person encounters a nice or neutral, not a nasty happening, from the initial exposure the therapist next induces the sufferer to the action of being exposed to more of the phenomenon without the person finding this more than a minute risk. The sufferer’s exposure to the phenomenon is successively increased over time. The sufferer over time develops adequate decisionmaking from exposure to a whole succession of tiny risks—develops an ability to balance the possibility of nice surprises from taking actions as well as the possibility of nasty surprises. The person is no longer a sufferer—has ceased to pathologically fear from a focus on the risk of nasty surprises from actions.

The above is a restatement of how exposure therapy succeeds in Amsel et al. (2014). It is a restatement in terms of decisionmaking under risk. It includes this author’s distinction between the therapist’s perception of what is safe, and the sufferer’s perception of what is a tiny risk, so tiny that the sufferer is willing to take the action. Note that the person needs a whole succession of minute risks to recover from the fear pathology. A single nice surprise from exposure to risk is insufficient. The person cannot know whether this was merely sheer luck.

This paper furnishes a re-conceptualisation of mental illness in general. It thus extends beyond fear pathologies, including to ADHD, depressions, dementias, panic attacks, epileptic fits, as so far explored, and potentially to many other mental illnesses. The re-conceptualisation is needed since the current medical model dominates treatment in terms of chemical rebalancing. But these drugs are expensive, with no long-term demonstrated efficacy, yet serious adverse side effects, and not even demonstrable short-term efficacy above placebos. The stupendous rise in usage of prescription drugs over the last thirty plus years is thus a bubble, meaning production of items of negative value to a nation’s citizens and taxpayers, creating damage to health, personal and national finances. The drugs focus moreover has resulted in corruption of the medical community from researchers, through medical journals, to education of medical practitioners, to physicians prescribing these drugs, and the political process.

Ending the prescription drugs bubble has been attempted for decades by documenting the corruption and by those courageous politicians, unbribed by prescription lobby campaign funds, who manage to implement legislation to curb specific malpractices. But the success from the transparency tactic of valiant skilled writers of articles in scientific journals, books, newspapers, magazines and television documentaries, coupled with piecemeal legislation has been modest. It has not even been enough to curb the dramatic rise in usage of drugs in the treatment of mental illness.

For solid lasting elimination of the bubble, there needs to be a comprehensive reform package addressing simultaneously all major factors contributing to the bubble, and enabling a winning coalition of those benefitting from ending the bubble to instate the needed legislation. The outlines of this package are in Pope (2012a, b, c). One strand of the package is the re-allocation of resources from bubble prescription drugs to interventions that enhance mental health. Such reallocation is facilitated when the medical community, the public and politicians have an overarching framework of what determines mental health to replace their current one of chemical balancing.

That alternative overarching framework is offered in this paper in the form of recognising that adequate mental health is adequate decisionmaking under risk, how such adequacy is attained and maintained. This alternative overarching framework not only re-expresses in decision theoretic terms discoveries already made on how to overcome some mental illnesses, as in exposure therapies for fear pathologies. It opens the way for identifying numerous un-noticed environmental factors that damage mental health, factors that can be reduced or eliminated by changes in the country’s social structure and therapeutic practices.

In this respect, it is not only in overcoming fear pathologies that a person needs many tiny doses of fear and hope. To avoid many other common mental illnesses, a person also needs the sorts of tiny doses of fear along with tiny doses of hope entailed in what the author terms ‘whiffs of danger’ theory of learning and maintaining good decisionmaking, that is good mental health. This is because a contributor to such mental illnesses is a lack of enough of those sorts of tiny fears and hopes by experiencing too little of life’s ups and down to learn adequate decisionmaking and have a balanced perspective on life. The lack generates what the author has termed ‘risk starvation’. Risk starvation can generate inadequate hope in life’s inevitable episodes of adversity, excessive fear.

A whiff is something that is tiny. The author’s whiffs of danger/risk starvation theory does not advocate cavalcades of huge chances and challenges for a person to attain and maintain good decision making, that is good mental health. What it advocates is a person getting enough tiny chances and challenges. Taking on tiny chances and challenges bring an array of nice, neutral and nasty surprises for the laws of large numbers to enable the person to learn when an act is desirable and when it is undesirable. Risk starvation as the term is used in this paper occurs when the person lacks these whiffs of danger, these tiny chances and challenges. The lack can be because that person is over-challenged—too many of the risks are big, not enough tiny ones as when under-protected—or because that person is under-challenged—lacks enough tiny risks as when over-protected.

What are tiny for a particular person depends on many factors, including age. Infants and small children need comfort after nasty surprises, to keep the nasty surprises tiny and so keep them exploring and open to chances and challenges. Also in adulthood, people benefit from a supportive community to soften the nastiness of surprises. But adulthood is not attained, or if attained, not maintained, by coddling—by insulation, from even tiny ups and downs. In such a boring environment, the brain, developed to enhance processing of risk, cannot fulfil that task. It has too little exercise to grow and keep the appropriate neuronal connections, and so has mental ilness.

1.1 Why brains?

To recognise that adequate mental health is a matter of adequate decisionmaking under risk, a starting point is to ask why it is an advantage to have developed the more extensive soft-wiring of higher level animals. Such animals have considerable ability to learn from environmental stimuli and alter their decisions as is the case with vertebrates such as humans, monkey, tortoises, fish—even if all vertebrates, including humans, exhibit certain responses that are more plausibly built-in (hard-wired), not the consequence of environmental learning.

The task of the soft-wired brain is to risk process stimuli through to beneficial decisions. If we lived in a simple world where only a few things repetitively happen, the automatic responses of hard-wired animals might have evolved to yield optimal responses to stimuli. But in our complex world, the capacity to analyse stimuli so as to perceive risks and uncertainties and decide how to respond to them is an advantage.

Just as ships are built sturdily to resist rough dangerous conditions in the open sea, so also soft-wired brains developed to enable animals to better thrive in the risks and uncertainties of life in the wild. In the face of chances and challenges, a healthy brain makes good decisions. Good decisions enhance the animal’s welfare, just as the good ship journeys on through the hazards of the open sea.

1.2 Attainment and maintenance of a good brain

Ships and people however are different in how they attain and in how they maintain their capacities to survive, even thrive, under danger. The ship is inert. A ship passively attains its capacity to survive in dangerous waters—through humans building it. A ship may maintain this capacity throughout long periods facing zero danger in the placid environment of a safe harbour.

People attain their decisionmaking capacity via their own actions—by making decisions, then discovering whether their decisions yielded good or bad results, and later discarding those decisions that yielded too high a proportion of bad results. Soft-wired brains fail to grow well in young years unless they encounter appropriate sets of chances and hopes, and of challenges, risks and fears. Even if they mature satisfactorily, soft-wired brains decay unless they continue to encounter appropriate sets of chances and challenges.

1.3 Paper layout

The paper is designed for the general reader apart from three sections in Part I—Sect. 2.1.2 on probabilities, though this nearly all readers may find useful, as it does not presuppose familiarity with probabilities—and Sects. 2.1.4–2.1.5 where some portions are only relevant to formal decision modelling.

Parts 1 and II explain what is a risk and what is a fear within the context of the author’s SKAT, Stages of Knowledge Ahead Theory of choice under risk. It contrasts these definitions with the contradiction-laden conceptions of risk, of fear and of mental health in standard economic decisionmaking models and also in medical mental health models. Part III presents the case for the author’s whiffs of danger theory of good decisionmaking and mental health, together with its inverse, the author’s risk starvation theory of bad decisionmaking and mental disorders). Part IV recodes some panic attack case histories as more consistently interpreted as caused by fear of missing out on whiffs of danger—suffering risk starvation.

The sequel companion paper applies the author’s whiffs of danger theory to epileptic fits and ADHD, and summarises its earlier detailed application to dementias and depressions, Pope (2009c).

2 SKAT, the Stages of Knowledge Ahead Theory of decisionmaking under risk

2.1 Part 1: Modelling risk and fear

2.1.1 What is a risk?

Risks are often conceived as the possibility of nasty events. In this paper we shall expand the concept of risk in three ways. One is to use the term risk more broadly, to include the possibility of pleasant and neutral events, not merely nasty ones. In this sense we use the term risk in this paper as most people use the term uncertainty. We are not limiting the term risk to the possibility of exclusively nasty outcomes. Economists use the term risk more broadly in this way and it is convenient to do so also in this paper.

The second way in which the term risk is expanded in this paper is to include the normal situation in which a person lacks numerical probabilities of possible risks. Economists often distinguish risk from uncertainty by using risk for cases where possible events have precise numerical probabilities. As these cases are extremely rare, in this paper that risk/uncertainty distinction is ignored.

The third way in which this paper expands the concept of risk is to focus on how risk divides the future into stages. There is a stage of risk when people do not know if they will have a pleasant, neutral or nasty surprise, that is, a stage when people do not know what will happen. This is a stage of limited knowledge ahead. This is the stage of hope and fear—hope of a pleasant surprise, and fear of a nasty one.

There is a more distant stage of the future when people anticipate having that risk resolved—that is, anticipate having got either the pleasant outcome, or the neutral outcome or the nasty outcome. This is a stage of full knowledge ahead, in which there can be no hope and no fear about what that happening will be, since the person by then knows what that particular happening was. There will be however, likely, in this subsequent stage emotions generated by what did not occur and was previously possible. If the nasty previously possible happening did not occur, thankfulness, elation and relief are the typical resultant emotions. If instead the previously possible pleasant happening did not occur, bitterness, disappointment and regret are the typical resultant emotions.

In fact, from the time of encountering stimuli there are a whole series of decisions, arising from evolving stages in which knowledge ahead is anticipated to change from limited knowledge ahead and involving hope and fear, to full knowledge ahead when fear and hope are in the past as the result is known. Each anticipated change in knowledge ahead is a distinct risk. See Fig. 1 where a soft-wired animal, a tortoise, faces a succession of ‘Nows’ that yield a succession of risks, decisions and anticipated changes in knowledge ahead.

In panel 1 the tortoise has resolved its sensual risks and decided it sees a new thing. In panel 2 it has decided that the new thing is either food or not food, but faces the risk of not knowing which. In panel 3, it has decided that it can go to it or stay, but faces the risk of not knowing whether it will decide to go to it. In panel 4 it has decided to start walking, but still faces the risk of whether the new thing will turn out to be food or not. In panel 5 the entire succession of risks and associated hopes and fears is passed: it has the disappointment and physical damage of having discovered it was thorns and not food. This bad experience may induce more caution in deciding to explore and discover in the future. The tortoise thus faced a succession of risks, hopes, fears and surprises.

The essence of risk is an awareness of the possibility of discovery, of learning something different in the future. Let us focus on one of the tortoise’s succession of risks. Let us focus on the one depicted in panel 2 at time 11.52 a.m. At 11.52 a.m. the tortoise’s particular risk is that it might discover that the new thing (a rose) is food, or it might discover that it is not food. The tortoise’s risk at 11.52 a.m. lies in anticipating learning something different in the future. The tortoise’s risk lies in being in a stage of limited knowledge ahead, but anticipating a later stage of full knowledge. The essence of risk is this limited knowledge ahead that is anticipated to change to fuller knowledge ahead, that is fuller knowledge of what the future holds. The tortoise anticipates at 11.52 a.m. that it might have the pleasant surprise of discovering that the rose is food, or the nasty surprise of discovering that the rose is not food.

In panel 5, at 1 p.m., with respect to this particular risk, the tortoise has entered a new stage of its knowledge ahead, a new stage of what the future holds. That particular risk is now gone because the tortoise has full knowledge ahead of whether or not the rose is food. The tortoise has discovered that the rose’s thorns hurt its tender throat—that the rose is not desirable food.

Some readers may wish to skip Sect. 2.1.2 and proceed directly to Sect. 2.1.3.

2.1.2 Probabilities

Of course it is improbable, that even unconsciously, the tortoise employs numerical probabilities in identifying its risks and making decisions. But to connect what this paper tells us about risks with what economists and medical practitioners use as their decisionmaking models, it is enlightening to re-express the above in terms of probabilities measured on a 0–1 scale in decision situations with a limited number of possible outcomes. In such situations, an outcome with a probability of 0 means that the tortoise believes that outcome impossible. An outcome with a probability of 1 means that the tortoise knows that outcome is guaranteed to occur. An outcome with a probability between 0 and 1 means that the tortoise perceives that outcome as possible, but not guaranteed. The closer the outcome’s probability is to 1 the more likely the tortoise reckons that it will occur. A non-degenerate distribution of the probabilities means that there is more than one possible outcome. In panel 2 of Fig. 1, a non-degenerate probability distribution over the two outcomes would mean that the outcomes food and not food each have a probability between 0 and 1—that each might turn out to be the case.

Suppose that the tortoise unconsciously at 11.52 a.m. had put a probability of 0.5 on each of its two conflicting discoveries in panel 2. Then at 11.52 a.m. the tortoise’s probability distribution over the two possible discoveries, food and not food, would be non-degenerate. But an hour plus later when the tortoise will have reached the rose at 1 p.m., these probabilities will have changed. They will no longer be 50/50 chances of the rose being food or not, as by 1 p.m. the tortoise will know the rose is not food: the probability distribution has become degenerate. The probability of the rose being food will by then have changed for the tortoise to 0. The probability of the rose being not food will by then have changed for the tortoise to 1, to a certainty.

The essence of a risk, therefore, namely an anticipated discovery, can be expressed in terms of how probabilities are anticipated to change—evolve. The essence is that the probabilities lie between 0 and 1 during those stages when the risk is present, those in Fig. 1 of panels 2, 3 and 4, and are anticipated to evolve over time. They are anticipated to evolve, to become by the time of 1 p.m. of panel 5, each 0 or 1 in the final discovery stage—the stage when the tortoise anticipates that risk will be dissolved completely. As we shall see in the next section, standard decision models fail to capture the essence of risk. They fail to incorporate the dynamics of how probabilities evolve.

2.1.3 What is a hope? What is a fear?

Hope is focussing on having pleasant possible surprises at a later stage. Hope makes risk enjoyable. Fear is focussing on having possibly nasty surprises at a later stage. A tiny bit of fear is enjoyable also. As Scitovsky (1976, 1981) observes, when people lack tiny doses of fear, they seek to remedy their lack by watching horror movies or taking roller coaster rides and such like activities. Too much fear makes risk unenjoyable. Far too much fear makes risk horrid.

If people know that a pleasant outcome will eventuate, they can feel safe, confident. But they cannot feel hopeful since they do not anticipate any change in knowledge ahead. They already know that the outcome will be pleasant.

Likewise if people know that a nasty outcome will eventuate, they can feel dread, be sad. But they cannot fear since they do not anticipate any change in knowledge ahead. They already know that the nasty outcome is not a mere possibility, but something guaranteed to eventuate.

People can only hope or fear if they anticipate being surprised later. That is, they can only hope and fear if they recognise that they are in a stage now of risk—of limited knowledge ahead. Such was the case for the tortoise in Fig. 1 until 1 p.m. in panel 5. Thus the essence of hope and the essence of fear connect to the essence of risk. Hope and fear are dynamic concepts involving an anticipated change in knowledge ahead. To anticipate a change in knowledge ahead—that is anticipate knowing something different in the future—involves recognising that in the current stage the future is risky. To recognise that the future is risky entails recognising that new things may be learned at a later stage.

In turn this means that hope is not merely focussing on the pleasant possible outcome. It is focussing on the pleasant possible outcome while aware that instead a merely neutral or maybe even a nasty outcome might eventuate. Likewise fear is not merely focussing on the possible nasty outcome. It is focussing on the possible nasty outcome but being aware that instead a neutral or maybe even a pleasant outcome might eventuate.

Some readers may wish to skip Sects. 2.1.4 and 2.1.5 and proceed immediately to Part II.

2.1.4 Resolving the von Neumann and Morgenstern contradiction

As von Neumann and Morgenstern observed, the liking of risk for its own sake arises from the pleasant, neutral and nasty outcomes interacting to give people satisfaction (positive utility). Conversely, the disliking of risk arises from the pleasant, neutral and nasty outcomes interacting to give people dissatisfaction (negative utility). The pleasant, neutral and nasty outcomes are alternative outcomes so cannot occur together—are mutually exclusive. It is a contradiction, said von Neumann and Morgenstern, for outcomes that cannot occur together to interact. Unable to find the ‘higher level’ to resolve what they realised was a pseudo contradiction, they left this task to future researchers, von Neumann and Morgenstern (1947, 1953, 1972, 628–632).Footnote 2

The contradiction remained unresolved for decades, and contributed to economists adopting expected utility theory between 1948 and 1952. For an account of its sudden adoption over these 4 years, and its continued usage, see Pope (1996/7). Expected utility theory excludes liking or disliking risk for its own sake, and thereby excludes risk-based emotions such as hope and fear. These excluded emotions were branded irrational, akin to mistakes of arithmetic, Marschak (1950). In excluding these risk-based emotions, economists inferred that they had a contradiction-free decision procedure in expected utility theory. Paul Samuelson informed this author, for instance, that the identification of the contradiction by von Neumann and Morgenstern in the appendix that they added in their book’s 1947 edition was what persuaded him to quit criticising expected utility theory for being too narrow in omitting risk-based emotions, and to endorse it.

The contradiction was resolved in Pope (1985) using the author’s SKAT, Stages of Knowledge Ahead Theory, presented first in Pope (1983) but not till recently given the acronym SKAT. The pleasant, neutral and nasty outcomes are mutually exclusive at the stage when risk is gone and certainty reigns. In earlier stages, however, when there is risk, there are the possibilities of the surprise being pleasant, neutral or nasty. Anticipating these alternative surprises is the interaction. The interaction of these alternative anticipations of which outcome will later be learned to have occurred is what generates hopes and fears.

2.1.5 Timing contradictions in expected utility theory

Pope (1985) shows that von Neumann and Morgenstern’s pseudo contradiction arose because axiomatised expected utility theory is not in fact contradiction free. Expected utility theory involves the contradiction of missing out on the essence of risk, namely the anticipated change in knowledge ahead. To resolve the pseudo contradiction, decisionmaking under risk must be modelled as epistemically dynamic. Epistemics concern knowledge. An epistemically dynamic model allows for changes in knowledge. To include risk in a model that is free of timing contradictions on what is known at each time point, requires at least two epistemically distinct time periods. It requires one risky period, followed by a later period when it is anticipated that the risk will be gone (or in more complex situations evolved).

The technical error in expected utility theory’s axiomatisations is to have a single epistemic period, meaning a single stage of knowledge of the future. That single stage is the one after the risk will be gone. The technical error means that in expected utility theory, risky choices are mis-defined as probability mixes of sure choices as in Harsanyi (1977). The following outlines why this is an inconsistent definition with timing contradictions.

If the choice is a sure option, there is no risk at the time of choosing it, as the tortoise already knows the outcome. The tortoise’s time of choice (time of deciding whether or not to walk and discover) is noon, the tortoise’s 4th “Now” in Fig. 1. Suppose that the tortoise’s decision to discover were a sure option. Then in the 2nd “Now” of panel 2 that depicts conflicting discoveries food or not food, the conflict is degenerate (pseudo) and so is the discovery trip of an hour (a pseudo discovery trip as the tortoise already knows what the outcome of walking to the rose will be: the probability distribution over the outcomes food and not food is degenerate.

There are two alternative ways for the tortoise to face a sure option at noon. One is that it knows that deciding to walk to the rose will guarantee an outcome that the rose is food. Then by noon the tortoise would have placed a probability of 1 on the food outcome in panel 2, and on the other outcome, not food, the tortoise would have placed a probability of 0. The tortoise would know at noon on deciding to start walking to the new thing that the outcome will be that the rose is food. It is a pseudo discovery trip as the tortoise knows the outcome at the point of choice. The probability distribution over the two outcomes is by definition degenerate with only one outcome possible from making the discovery walk, that with a probability of 1, the outcome will be food.

The second way for the tortoise to face a sure option at noon is that it knows that deciding to walk to the rose will guarantee an outcome that the rose is not food. Then by noon the tortoise would have placed a probability of 0 on food outcome in panel 2, and on the other outcome, not food, the tortoise would have placed a probability of 1. This second way thus reverses in the degenerate probability distribution which outcome has the probability of 1.

Suppose instead that at noon the tortoise has a risky option that deciding to walk to the rose has no guaranteed outcome, but a 50/50 chance of discovering that the rose is food and not food. This means that by noon the tortoise would have placed a probability of 0.5 on the food outcome and a 0.5 probability on the not food outcome and will not know until 1 pm whether the outcome of the discovery trip is food or not food.

Thus the Harsanyi and expected utility theory definition of a risky option as a probability mixture of a sure options embeds the three timing contradictions of the tortoise simultaneously at noon the time of choice perceiving that the outcome is 1) and 2) and 3):

-

1)

guaranteed to be food—a degenerate probability distribution over the two outcomes with 100 % of the distribution weight on the outcome food); and

-

2)

guaranteed to be not food—a degenerate probability distribution over the outcomes, different from 1) as it places 100 % of the distribution weight on the outcome not food; and

-

3)

a risky option whose non-degenerate probability distribution over the outcomes has 50 % of the distribution weight on the outcome food and 50 % on the outcome not food.

But 1), 2) and 3) are mutually exclusive perceptions of the outcome for the tortoise to hold at noon: it is a contradiction to hold all three simultaneously as under the expected utility theory definition of a risky choice. From its simultaneously assuming 1), 2) and 3) that definition embeds two timing contradictions (1) simultaneously assuming that the chooser knows and does not know the outcome; and (2) simultaneously assuming that the chooser knows two different outcomes are guaranteed. This pair of contradictions recurs in all standard rank dependent axiomatic extensions of expected utility theory such as anticipated expected utility theory (Quiggin (1982), smooth preferences theories e.g. Machina (1982) and cumulative prospect theory (Tversky and Kahneman 1992). Via the substitution axiom, as detailed in Pope (2006/7) and Pope and Selten (2010/2011), the contradiction recurs in temporal versions of expected utility theory such as Kreps and Porteus (1978) and Caplin and Leahy (2001).

2.2 Part II: Frameworks for modelling mental health

2.2.1 The static medical framework

Medical models of mental health rarely employ either expected utility theory or extensions of it that formally embed the above contradictions. However they in an analogous fashion miss the essence of risk with its anticipated change in knowledge ahead. This is because medical models are similarly static, and see risks only in terms of nasty outcomes. The nasty outcomes are after the risk is gone and thus by themselves do not capture the essence of risk. Risk is the event in people’s brain of recognising that in their current stage the future is risky but anticipating a discovery—anticipating a surprise, that is, a change in knowledge ahead. As a consequence, the medical model of mental health fails to see how risks, and thus hopes and fears, develop and maintain soft-wired brains, and also fails to see how inadequate exposure to appropriate risks causes mental illnesses. See Fig. 2.

2.2.2 The dynamic SKAT framework

Figure 3 by contrast employs the author’s SKAT, Stages of Knowledge Ahead Theory of decisionmaking under risk and uncertainty. It uses this overarching framework to identify how risks, fears and hopes contribute to mental health and mental illness. Figure 3 recognises that experiencing a risk is a matter of formulating possibilities—and thus is a part of decisionmaking.

There are three new building blocks in Fig. 3 that are missing from the medical framework of Fig. 2.

-

(i)

The process of formulating a set of possibilities, i.e. the mental activity involved in perceiving that there is a risk. In turn the mental process of perceiving risks is part of (ii);

-

(ii)

Making decisions. In turn formulating/perceiving risk is aided by (iii);

-

(iii)

Being in an environment where the person perceives particular sets of risks.

2.2.3 Epistemic stages on experiencing stimuli

In each decisionmaking episode for animals, whether people or tortoises, the first step is sensory—doing adequate risk processing to decode stimuli to determine if they have encountered something new. For the tortoise that in the first panel of Fig. 1 had discerned that it saw a new thing, a rose. In seeking to decode the stimuli, the tortoise formulates risks, sets of alternatives concerning what the stimuli might be, as depicted in Fig. 4.

On decoding stimuli (whether like the tortoise of Fig. 4 decoding them into a rose, or like the US Federal Reserve Board of 2007, decoding sub-prime mortgage default cases into financial fragility), choosers have entered a new epistemic stage. A new epistemic stage means that choosers now know something that they did not know before. Before, the stimuli were a mess of un-interpreted signals. Now the stimuli have an interpretation, a rose in the case of the tortoise, and a sub-prime crisis in the case of the US Federal Reserve Board.

Sequel epistemic stages of decision makers are: (2) formulating alternatives concerning the risk inherent in the now interpreted signal—what could be the pleasant, neutral and nasty surprises ensuing; (3) how they might respond to this particular risk; and (4) which of the alternative ways of responding to choose; and having chosen, (5) a further period of risk until they learn the outcome (result) of their choice.

Within the author’s SKAT, Stages of Knowledge Ahead Theory of risk and uncertainty, Table 1 itemises these stages as depicted for the tortoise in the five panels of Fig. 1. It itemises stages 2–6 with stages 4 and 5 combined.

Table 1 includes as stage 1 the prior stage of the tortoise assessing whether indeed it is seeing something new that is depicted in Fig. 4. Table 1 also includes the sequel stage 7 of evaluating the outcome, i.e. the learning process for future decisions.

The seven epistemic stages of Table 1 can be divided into sub-stages. The epistemic stages will not be invariably strictly sequential in chronological time. The decision maker might for instance, while experiencing fears and hopes since his waiting to learn whether the outcome is a pleasant or nasty surprise, discover another response that has been previously overlooked.) The decision maker might then adopt this response, instead of or in addition to the response, act already chosen.

All the earlier epistemic stages end with the chooser making a decision—an interpretation of the stimuli; a conclusion on what it might imply; an inference on what alternative acts are available as responses; a choice amongst the alternative acts. Only in what is numbered in Table 1 as stage 5 does the epistemic stage end because of an entirely external event, nature delivering either a pleasant, neutral or nasty outcome from the act chosen. Stages 6 and 7 again end via the chooser’s decisions on when to start and when to end evaluating the entire risk episode.

Each epistemic stage involves hopes and fears distinctive to that particular stage. Hopes and fears distinctive to an epistemic stage evaporate once that epistemic stage ends. For instance in Fig. 1, by 1 pm the tortoise has ceased having the specific fear that it will have walked for an hour to the rose in vain as the rose may eventually turn out to be not food. It will have ceased fearing since by then it has been stung. It no longer has this specific fear: it by 1 pm knows that the rose is not food. Earlier, before deciding to walk to the rose, the tortoise had a different specific fear, the fear that it might make the wrong decision. Yet earlier, it had another specific fear, the fear that it could not decode the stimuli.

Under the author’s umbrella framework of SKAT, the Stages of Knowledge Ahead Theory of decisionmaking under risk and uncertainty, an animal anticipates having changes in knowledge ahead after encountering stimuli. Under SKAT the animal’s decision is influenced by its anticipated hopes and anticipated fears and anticipated material effects of going through a sequence of epistemic stages before the entire risk episode is in the past. The extent to which the decision process is conscious, and which aspects of the evolving stages ahead are anticipated, vary with the stimuli, the animal and its entire socio-ecological context.

2.3 Part III: The whiffs of danger theory of mental health

2.3.1 Good decisionmaking

In good decisionmaking procedures stages 1–4 and 7 are performed well. Doing a good evaluation in stage 7 involves having registered whether well-being differed from that anticipated when during the pre-outcome and post-outcome stages 5 and 6 compared to what the animal anticipated in choosing that act after doing its evaluation of its alternatives.

Good mental health is good decisionmaking. Mental disorders are defects in decisionmaking in one or more of the above seven stages. The defects in decisionmaking can arise from people facing only sets of risks that have inappropriate characteristics for good learning. Good learning requires the acquisition of adequate hope in the face of nasty surprises despite choosing well, and adequate fear from experiencing sufficient nasty surprises when choosing badly.

2.3.2 The need for appropriate sets of risks to learn well

A single act chosen (e.g. one involving physical risk) can by luck turn out well or badly. Further, whether it turned out well or badly may have no relevance for discerning whether the animal’s decisionmaking procedure is appropriate for a different sort of act (e.g. one involving a social risk). Learning good decisionmaking thus requires having experienced the following.

-

(a)

More than one sort of risk—requires having experienced different sorts of risks for which soft-wired brains developed, namely sensual, physical, mental, psychological, social, ethical and spiritual.

-

(b)

More than one risk of each given sort—i.e. requires having experienced sets of risks so that laws of large numbers apply reducing the extent to which inherently bad choices by sheer luck turn out well.

To aid in evaluation and learning, it is insufficient for laws of large numbers to yield information years later on whether the outcomes of peoples’ choices were pleasant neutral or nasty. These laws of large numbers need to yield some information rapidly. In turn this means that some risks need to recur with a high frequency and yield fast feedback.

Sometimes the risk inherent in the chosen act turns out badly—yields nasty surprises. For people to have a reasonable likelihood of surviving (and not be killed by the nasty surprises), if the risks are of high frequency, the risks must be modest, not dire. Indeed for people to learn, most of the risks need to be tiny. In the pre-outcome Stage 5, tiny risks give people modest hope that a pleasant surprise will ensue, and a tinge of fear that the nasty surprise will ensue. In the evaluation Stage 7, tiny risks typically result in the animal at best reaping a small pleasant surprise, and at worst a small nasty surprise. Thereby tiny risks typically avoid the animal experiencing paralysing fear during the earlier stages, causing its death, or severe physical injury from being too scared to either drink or eat. Tiny risks also typically avoid the animal being so jolted into ecstasy with pleasant surprises, or into agony with a huge awful surprise, that it is too emotionally affected to evaluate the choice made in each risk episode and so learn when to improve and when to maintain its decisionmaking procedures.

Another essential feature for learning good decisionmaking is that the animal gets uncensored information on the outcomes of its actions, and is not shielded from the full adverse effects of their bad actions. Such shielding happens for instance when parents and spouses cover for alcoholics and other drug addicts. Such substance abusers are, in the terminology of this paper, risk starved because they fail to receive uncensored feedback of adverse effects of bad choices. See Pope (2009a, b, c). Erratic feedback can also occur when law enforcement depends heavily on which individual law enforcer identifies crimes or imposes punishments. Learning what are cause-effect chains, not mere runs of good or bad luck, and thus learning and then maintaining adequate decisionmaking is hampered by such noise in the system as also by bias when the person is indulged by others, not the person who did the act, bearing much of the brunt of bad decisions.

For situations where people experience sets of tiny high frequency risks with rapid feedback uncensored for nasty outcomes, and that cover the varieties of risks for which soft-wired brains developed, this author coins the name ‘whiffs of danger’. For situations in which the animal lacks whiffs, this author coins the name ‘risk starvation’. See Table 2.

Note that a person may experience numerous risks and yet suffer risk starvation, as the term risk starvation is used in this paper and delineated in Table 2. To avoid risk starvation the person must be experiencing sets of risks with all the six characteristics listed in Table 2. The person will suffer risk starvation, for instance, if that person’s risks are insufficiently varied or mainly so minute or ultra rapid that the person is unable to risk process them into effective action and learn from them. The person will suffer risk starvation, also if all its risks are big. Likewise risk starvation ensues if the person has inadequate varieties in the risks.

Risk starvation precludes the chooser from having sufficiently many pleasant, neutral and nasty surprises from his decisions, each fully experienced, and thereby precludes the chooser from learning what are good decisions. This is because risk starvation precludes the chooser from building up from experiences of hopes and fears and material effects:

-

(i)

sufficient hope to avoid falling into depression at the first sizable nasty surprise, and

-

(ii)

sufficient fear to avoid being systematically foolhardy.

Whiffs of danger contribute to:

-

(a)

the development and maintenance of good mental health:

-

(b)

the prevention of many mental disorders; and

-

(c)

reversal of many instances of mental disorders.

For a survey of the evidence of whiffs of danger playing this role in the case of childhood mental development, see Pope (2009c). That review/research paper includes also a fresh look at the concept of stress and a detailed comparison and contrast of the whiffs of danger theory with other non-chemical theories of mental disorders and other non-pharmaceutical therapies for them.

Society plays a key role in whether people get their needed whiffs for developing and maintaining their decisionmaking capacities. This is because it affects whether children and adults in different socio-economic strata have adequate variety in the sorts of risks they receive, in whether the risks are too big or too small for learning, whether they receive unbiased, reliable feedback on their decisions. These matters, including the seminal contributions on society’s role in Hüther (2011), Roth (2001/2003), Pollack (1998), Dustin (2012) and Heckman et al. (2013) are discussed in sequel paper to this one.

The author’s whiffs of danger/risk starvation theory invites a recoding of case studies and epidemiological data on many mental disorders. The recoding can enable reinterpretations and shed light on puzzles.

2.4 Part IV: Re-interpretation of panic and anxiety attacks

This section uses the whiffs of danger theory to re-diagnose the causes of some instances of panic attacks, and thus what is required for curing this mental disorder.

2.4.1 Attacks in a conservative environment against female medical researchers

The case comprised a couple known to this author when living in another country in an extremely conservative university community and whose children are now adults. At a series of luncheons with the couple, the wife sought to interest this author in her first foray into medical research. She had an important set of data and findings. Her husband each time sought to switch the discussion to his also very interesting research. He in addition kept telling her that research is too stressful for her, while she kept reminding him that his research had ever been fraught with stresses. She had, had the nasty surprises of being abandoned by co-scientists in her first foray into research and fired as a mid-level clinician, had acute anxiety attacks (but not a full blown panic attack at that time, and was under a sedation drug therapy. Her husband explained this to me privately and asked that I never again allow the topic of his wife’s research to enter conversation, as it would very likely kill her, such was her over-wrought state. His view was that she needed the quiet life of being simply a housewife to him, no challenge of a new job or of getting her research published. The husband’s diagnosis (shared by her psychiatrist) was the conventional one. The conventional one is that the person suffering anxiety or panic attacks needs to be coddled and protected from risks. But as sequel events reveal, there are grounds for concluding that this conventional diagnosis was the reverse of what could restore the wife’s mental health.

The wife’s anxiety attacks reached a peak on the eve of the couple departing on an international lecture tour. She stated that she could not bear to be merely the accompanying spouse, and found having merely a housewifely role traumatic. On her self-report she had been fired from her job because too independent and it was others who deterred her from her desired new career as a researcher. It was others who declared that this was too stressful for her. I sought to arrange for her to give seminars in some of the universities they would be visiting. She was extremely grateful. On leaving that country, and embarking on developing the whiffs of danger theory, this author emailed the wife as follows. Her anxiety attacks arose from fearing she would be deterred from taking on the exciting challenges she sought. She emailed back that she agreed with this author's above diagnosis of the cause of her panic attacks diagnosis, and gave permission for this author to publish her case history. She further informed this author that after my departure, she had her first full-blown panic attack when she unwillingly went with other housewives on a tourist bus. The full panic attack had made her determined to survive, to stand alone (with God) and not be too fearful to seek out her own whiffs by needing societal and family approval. She reported that she had found a very satisfying writing career and other activities assisting others to see, feel the value of the mystical, spiritual in life as against money, and to help US people out of their pathological fears in the wake of the September 11, 2001 attack on New York.

2.4.2 Attacks in high flyers in cosmopolitan Melbourne

Murray Esler of the Baker Heart Research Institute, Monash University, Australia shared with me the following case studies information of his set of such sufferers that he had gleaned. The sufferers are keen to have an attack induced in his laboratory so as to confirm that the attacks are physical events and not in the imagination of the sufferer. They seek to have their problem taken seriously. All in his set were females, and all high fliers holding exceptional professional posts in organisations. Each was married with numerous children, and complained bitterly at their husbands doing too little to assist in child rearing. The conventional diagnosis is that such women are facing too much stress and too much risk—in this set because flying professional posts entail much stress and risks, including (what to others seem) big risks.

The whiffs of danger theory entices researchers, clinicians and policy makers to take a more subtle look at the characteristics of the sets of risks that these women faced. It offers a diagnosis of the particular risks of which these women were having too many, and of which other sets of risks these women were in fact seeking to get more. The whiffs of danger theory solves a puzzle in the original diagnosis. If the alternative diagnosis discerned by applying the whiffs of danger theory is correct, it avoids these women being given treatment that worsens, rather than cures, their mental disorder.

What is inadequately explained by the conventional diagnosis is that this set of women vehemently complained about having husbands who left them to do virtually all the childcare. It might seem that this can be adequately explained by the conventional diagnosis as follows. The non-contributing husbands increase the risks faced by their wives. This explanation, however, fails to look closely at what these child-rearing risks could be. It fails to contemplate the possibility that the childcare of which they complain, is for these high flyers largely a boring risk-free activity.

The following indicates that this is likely the case. For the upper echelon income strata to which these women belong, childcare in an English-speaking rich country comprises an extensive amount of escorting the children to and from school and other events. In English speaking rich countries women complain bitterly about their boring unchallenging existences from being reduced to that of chauffeurs, yet continue to do so out of social convention. In turn the social convention has arisen as decade after decade the percentage of children abducted or mistreated by adults declines, while decade after decade the fear of parents of such events rises. The upshot is that a few decades ago, children spent much of their free time unsupervised by parents, and took themselves to nearly all scholastic and social events. But today parents, and in this set of panic attack sufferers, mothers protect their children from these tiny risks. In protecting their children by escorting them nearly everywhere, they risk starve the children, and at the same time risk starve themselves. It might be that these panic attack sufferers could drop their panic attacks by becoming less protective parents. It might thus be a win–win situation with no need for the husbands to take on the boring escort roles, and the children being less vulnerable to depressions by having adequate whiffs of danger. It might be that the conventional diagnosis of seeking to have these women quit their high-flying jobs is the reverse of what can restore their mental health.

2.5 Analogies

These women suffered panic attacks after having attained some family and career goals. Under the author’s interpretation of the case studies, these attacks arose from fear of not being able to continue to get enough new challenges that they would keep on being chained to childcare duties that brought risks too tiny to constitute for these women whiffs of danger, not let free to get adequate whiffs from more time in the professional world. The fear in one case was a social environment against Whiles taking a physically different form, it may connect to what O’Connor (1981) identified happens to many men, namely a mid-life crisis and change in career plus lifestyle that occurs around age 40. Within the perspective of the whiffs of danger theory the male mid life 40s crisis is caused by a drop in challenge—after succeeding in what before had seemed risky and challenging, namely acquiring a family, career and house—these men need for new risks, challenges, hopes, fears to avoid their suffering from risk starvation. This is akin to what is needed to enrich the environment of animals in order to reverse cognitive deficits, dementias and depressions, a literature surveyed in Pope (2009a, b, c). The enriched environments are created by augmenting the typical boring mice and rat laboratories with new playthings, and changing the playthings every few days before boredom sets in—before everything is known and there are no longer any tiny fear, no longer any whiffs of danger.

2.6 Companion sequel paper

This applies the whiffs of danger theory to case studies evidence on epileptic fits, and to epidemiological evidence on dementias, depressions and ADHD, Attention Deficit Hyperactivity Disorder. For each disorder it finds evidence of under-challenge rectifiable primarily by societal interventions. It finds also scope for complementarity: adults under-challenged obtaining their needed challenge by furnishing societal contributions. In the case of boys with ADHD, it not only finds physical under-challenge in school classrooms being too still, and inadequate varieties of risks in the new digital age, it finds intellectual over-challenge, risks too big to be whiffs, from the new regime of mothers in the workforce and girls treated equally in the classroom. Boys’ slower maturation and lesser language skills can leave them behind in competing for attention in day care as babes, and in the class room inferior to females till mid puberty. The needed reduction in such risks that are too big for many boys down to healthy tiny whiffs of danger, might be aided by delaying when infant boys are put into day care, and when school age, by single sex schools or by boys remaining in pre-school a year longer, so entering school a year older than girls in the same class. The companion paper in addition delves into the in efficacy and serious adverse side effects of psychiatric drugs, with a detailed analysis of those for ADHD where it is especially shocking as this is drugging children. It traces the role of pharmaceutical influence in generating the biased clinical trials and results misleadingly analysed with inappropriate statistical techniques, as regards the major ongoing multi-centred multi-authored large scale ADHD study, the US NIMH Multimodal Treatment Study, and many other studies.

Notes

I thank Gerd Heinen of the Epilepsy Centre of Berlin-Brandenburg for the quote. He employs the quote to induce more challenge and fear in treating his epileptic patients, as discussed later in this paper.

Von Neumann and Morgenstern used the language of quantum physics and termed this interaction a complementarity.

References

Amsel L, Harbo ST, Halberstam A (2014) There is nothing to fear but the amygdala: applying advances in the neuropsychiatry of fear to public policy. Mind Soc. doi:10.1007/s11299-014-0149-5

Caplin A, Leahy J (2001) Psychological expected utility theory and anticipatory feelings. Q J Econ 116:55–80

Dustin S (2012) Honor thy mother: the devaluation of the womanly in American culture and its consequences for our society. dnmantque@aol.com

Harsanyi JC (1977) Rational behavior and bargaining equilibrium in games and social situations. Cambridge University Press, New York

Heckman J, Pinto R, Savelyev P (2013) Understanding the mechanisms through which an influential early childhood program boosted adult outcomes. Am Econ Rev 103:2052–2086

Hüther G (2011) The neurobiological preconditions for the development of curiosity and creativity. Centre for Psycho-Social Medicine, Department of Psychiatry and Psychotherapy, University of Göttingen, Germany

Kreps DM, Porteus EL (1978) Temporal resolution of uncertainty and dynamic choice theory. Econometrica 46(1):185–200

Machina MJ (1982) ‘Expected utility’ analysis without the independence axiom. Econometrica 50:277–323

Marschak J (1950) Rational behavior, uncertain prospects, and measurable utility. Econometrica 18(2):111–141

O’Connor PA (1981) Understanding the mid-life crisis. Sun Books, Melbourne

Pollack W (1998) Real boys: rescuing our sons from the myth of boyhood. Random House, USA

Pope RE (1983) The pre-outcome period and the utility of gambling. In: Stigum BP, Wenstøp F (eds) Foundations of utility and risk theory with applications. D. Reidel, Dordrecht, pp 37–177

Pope RE (1985) Timing contradictions in von Neumann and Morgenstern’s axioms and in savage’s sure-thing proof. Theory Decis 18:229–261

Pope RE (1996/7) Debates on the utility of chance: a look back to move forward. J Sci Res (Zeitschrift für Wissenschaftsforschung) 11/12:43–92

Pope RE (2006) Multiple periods destroy the axiomatic base of expected utility theory and its standard generalisations. Economics Department Bonn University, Discussion Paper 30, 7 Dec 2006

Pope RE (2009a) The risk starvation theory of alcoholism with a Proposed Questionnaire Test. Mimeo

Pope RE (2009b) Policies to reduce risk starvation causing dementias and depressions. Bonn University Working Paper. Mimeo

Pope RE (2009c) Risk starvation contributes to dementias and depressions: whiffs of danger are the antidote. Int J Psychol Couns 1:154–186

Pope RE (2012a) Parallels in the finance and drug sector bubble. Paper 1 in a sequel of three papers for simultaneous publication in a future issue of health policy

Pope RE (2012b) Desirable reform criteria and no blackmail. Paper 2 in a sequel of three papers for simultaneous publication in a future issue of health policy

Pope RE (2012c) A dual substitution reform package satisfying six desirable criteria. Paper 3 in a sequel of three papers for simultaneous publication in a future issue of health policy

Pope RE, Selten R (2010/2011) Risk in a simple temporal framework for expected utility theory and for SKAT, the Stages of Knowledge Ahead Theory. Risk Decis Anal 2:5–32

Quiggin J (1982) A theory of anticipated utility. J Econ Behav Organ 3:323–343

Roth G (2001/2003) Fühlen, Denken, Handeln. Wie das Gehirn unser Verhalten steuert (Feeling, thinking, action. How the brain steers our behavior) (Frankfurt: Germany: Suhrkamp)

Scitovsky T (1976) The joyless economy: an inquiry into human satisfaction and consumer dissatisfaction. Oxford University Press, Oxford

Scitovsky T (1981) The desire for excitement in modern society. Kyklos 34(1):3–13

Tversky A, Kahneman D (1992) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain 5:297–323

Von Neumann J, Morgenstern O (1944, 1947, 1953, 1972) Theory of games and economic behavior. Princeton University Press, Princeton

Acknowledgments

I thank Beverly McGavin for her email confirmation of the above analysis of her panic attack experiences, and for these to be public, Murray Esler for data on panic attack sufferers, and Pulikesh Naidu for editorial contributions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Pope, R. Attention deficit hyperactivity disorders, panic attacks, epileptic fits, depressions and dementias from missing out on appropriate fears and hopes. Mind Soc 14, 107–127 (2015). https://doi.org/10.1007/s11299-015-0165-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11299-015-0165-0