Abstract

Evolutionary game theory predicts that new survival strategies arise from random mutations. Over time, mutants genetically encoded with the superior survival strategy will have more offspring and nonmutants will be driven from the population. This paper argues that the introduction of a mutant technology with strong positive feedback and cascade effects into the market for a network good may result in something like an evolutionarily stable equilibrium that increases social welfare.

Similar content being viewed by others

Notes

An evolutionary strategy s* is stable if for every other strategy s’ ≠ s*, u(s*, s*) ≥ u(s’, s*) and u(s*, s*) = u(s’, s*), such that u(s*, s’) > u(s’, s’). The first part defines a Nash equilibrium. The second part of the definition is necessary to take into account mutations. Suppose that mutant strategy s’ spontaneously appears in a member of a population in which every other member exhibits s*. If u(s*, s*) = u(s’, s*), the mutant strain will not be bred out. Let p represent the proportion of the population with the mutant s’ gene and 1 – p the proportion of the population with the incumbent s* gene. s* is an evolutionary stable strategy if Eu(s) = p[u(s*, s’)] + (1 – p)[u(s*, s*)] > p[u(s’, s’)] + (1 – p)[ u(s’, s*)], in which case the mutant subpopulation will eventually disappear.

Pure private goods are excludable and rivalrous. They are excludable in the sense that the owner can exclude others from enjoying their benefits. They are rivalrous in that consumption by one user rules out the simultaneous consumption by others. Pure private goods do not produce third-party effects (externalities). Consumers and producers enjoy all of the benefits and incur all of the associated costs.

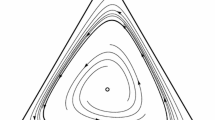

See, for example, Figure 17.3 in Easley and Kleinberg (2010, p. 455).

This mean field approximation is problematic given the complex nature of user motivations, which vary from individual to individual and from market to market. The objective here is to explore the possible implications of network feedback and cascade effects by assuming that the coefficient of expectation is constant. Under certain circumstances, however, it might be more appropriate to express this as a time varying parameter. For example, user expectations may be formed according to the expression β{[x(t – 1) – x(t – 2)]/x(t – 1)} = γ[x(t – 1) – x(t – 2)], where γ = β/[x(t – 1). In this case, the value of β is approached from above as network feedback and cascade effects become more potent. Alternatively, suppose that γ = β/λt, where λ is some positive constant. This suggests that feedback effects may be strong at low levels of market participation, but become increasingly less so as the network market becomes more saturated.

It has been suggested that this description of an adaptive expectations process is not relevant to social networks and fax machines because uncompensated benefits depend only on the specific counterparties using that technology. Instead, the model of adaptive expectations presented is a more appropriate description of “anonymous” networks, such as centralized financial exchanges, in which an increase in the number of participants results in greater market liquidity. This observation is not, strictly speaking, correct. An individual user may join a social networking website or purchase a fax machine not only because personal or business acquaintances have done so, but also because it provides access to a wider circle of potential contacts. Lin and Lu (2011) have argued that enjoyment is the most influential factor in user’s decisions to join social networks, followed by the number of peers in the network, and overall usefulness.

Region VII, for which there are no values of β that solve for Ω, identifies a time path for convergence without oscillations.

The initial conditions assume no network membership in period t = 0 and one-percent network members in period t = 1.

Any complex number of the form α ± iθ (where, in this case, α = β/2, θ = |Ω|0.5/2, and i = −10.5) may be expressed in trigonometric form by the transformation from Cartesian to polar coordinates, i.e. r cos γ = α, r sin γ = θ and r 2 = α 2 + θ 2. Equation (5) is the solution to Eq. (2) after applying De Moivre’s theorem.

The equilibrium share of the population that uses the network good is inversely related to the market-determined price, which is equal to the marginal cost of production. For example, the steady state equilibrium share when c = 0.1 is δ = (1 – c) = 0.9.

Technically speaking, the maximum value of x(t) from Eq. (5) is 1.6, which is not possible given the structure of the model.

For a more complete and detailed comparison of the social welfare implications of equilibria in the markets for pure private and network goods, see Easley and Kleinberg (2010, p. 449–465).

A possible example of this negative cascade is the displacement of instant messaging (IM) by short message service (SMS) known as text messaging. Both technologies are reciprocal networks that provide users with, among other services, real-time, text-messaging capabilities. But, whereas IM users sign into an account provided by AOL, Google, Yahoo, or MSN, text messaging connects users through a cellular phone provider, such as Verizon or Sprint. In 2004, for example, AOL’s Instant Messenger (AIM), which was launched in 1997, had around 36 million users. Three years later, this number peaked at around 63 million users. By 2012, however, the number of AIM users had fallen to just four million. Today, AIM is all but defunct. Another example is MSN Messenger (MSN). Launched in 1999 as a rival to AIM, MSN had 32 million users in 2001. Rebranded in 2006 as Windows Live Messenger, the number of MSN users peaked at around 235 million users in 2008, but declined rapidly thereafter. By 2013 when Microsoft began to phase out this service, the number of users had fallen to around 10 million. Paralleling the precipitous decline in IM was the dramatic increase in SMS. At peak usage of IM in 2006, users sent around 12 million text messages. When Microsoft discontinued IM in 2014, this number had exploded to more than 560 billion text messages. Parenthetically, advancements in this technology once again are transforming this market. SMS is being overtaken by multimedia messaging service (MMS) and IM is making a comeback. WhatsApp, which was acquired by Facebook, is a cross-platform IM application that allows mobile phone users to exchange text, image, video and audio messages. Unlike SMS and MMS, which require a cell phone subscription, however, this application is free.

References

Banerjee, A. (1992). A simple model of herd behavior. Quarterly Journal of Economics, 107(3), 797–817. doi:10.2307/2118364.

Baumol, W. J. (1970). Economic dynamics (3rd ed.). New York: Macmillan Publishing.

Bikhchandani, S., Hirshleifer, D., & Welch, D. (1992). A theory of fads, fashion, custom and cultural change as information cascades. Journal of Political Economy, 100(5), 992–1026. doi:10.1086/261849.

Darwin, C. (1859). On the origin of species by means of natural selection. London: John Murray.

Easley, D., & Kleinberg, J. (2010). Networks, crowds, and markets. New York: Cambridge University Press ISBN: 978-0-521-19533-1.

Economides, N. (1996). The economics of networks. International Journal of Industrial Organization, 14(6), 673–699. doi:10.1016/0167-7187(96)01015-6.

Gandolfo, G. (1971). Mathematical methods and models in economic dynamics. Amsterdam: North-Holland Publishing ISBN: 978-0-720-43053-0.

Granovetter, M. S. (1978). Threshold models of collective behavior. American Journal of Sociology, 83(May), 1420–1443. doi:10.1086/226707.

Hofbauer, J., & Sigmund, K. (1998). Evolutionary games and population dynamics. Cambridge: Cambridge University Press ISBN: 978-0-521-62570-8.

Katz, M. L., & Shapiro, C. (1985). Network externalities, competition, and compatibility. American Economic Review, 75(3), 424–440.

Lin, K.-Y., & Lu, H.-P. (2011). Why people use social networking sites: an empirical study integrating network externalities and motivation theory. Computers in Human Behavior, 27(3), 1152–1161. doi:10.1016/j.chb.2010.12.009.

Schelling, T. C. (1978). Micromotives and macrobehavior. New York: W. W. Norton ISBN: 978-0-393-07568-7.

Shapiro, C., & Varian, H. (1998). Information rules: A strategic guide to the network economy. Boston: Harvard Business School Press. doi:10.1023/A:1007897212472.

Simon, H. A. (1955). A behavioral model of rational choice. Quarterly Journal of Economics, 69(1), 99–118. doi:10.2307/1884852.

Smith, J. M. (1972). On evolution. Edinburgh: Edinburgh University Press ISBN: 978-0-852-24223-0.

Smith, J. M. (1982). Evolution and the theory of games. Cambridge: Cambridge University Press ISBN: 0-521-28884-3.

Smith, J. M., & Price, G. R. (1973). The logic of animal conflict. Nature, 246, 15–18. doi:10.1038/246015a0.

Welch, I. (1992). Sequential sales, learning and cascades. Journal of Finance, 47(2), 695–732. doi:10.1111/j.1540-6261.1992.tb04406.x.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Webster, T.J. Evolutionary Equilibria in Network Markets. Atl Econ J 44, 325–334 (2016). https://doi.org/10.1007/s11293-016-9503-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-016-9503-9