Abstract

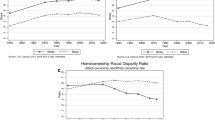

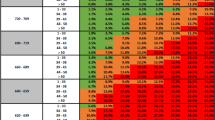

Utilizing a sample of loan originations, the distribution of the market served by the Federal Housing Administration (FHA) and conventional lenders is modeled through this current cycle. Results indicate that FHA market shares in the early years of the observation period (2003 through 2006) are concentrated in zip codes with higher economic risk characteristics and obtained by high risk borrowers. FHA is forced to accept lower quality loans as competition from more nimble private lenders with lower access hurdles and more rapid processing expanded into markets traditionally served by FHA. Unexpectedly, the analysis also reveals that the distribution of FHA loans fails to exhibit a targeted racial bias toward neighborhoods with African American Concentration.

Similar content being viewed by others

Notes

That same month (June 2010), FHA mortgages accounted for over 47 % of the new home purchase activity. The pace has fallen since that peak to roughly 15 % of the total and 25 % of new house purchases.

Numerous papers have choice models and neighborhood controls, but this is the first time neighborhood risk factors and temporal variations are explored in the distribution of FHA loans (see Linneman and Wachter 1989; Gabriel and Rosenthal 1991; Goodman and Nichols 1997; Hendershott et al. 1997; Hendershott and Thibodeau 1997; and Pennington-Cross and Nichols 2000).

The AUS provides a score of the overall credit worthiness of the application and recommends the level of underwriting and documentation for FHA insurance eligibility.

In a similar fashion to borrowers, former subprime lenders are migrating into the pool of FHA qualified lenders.

The stated goals now include community development, but this expansion still retains the foundation of access, and the retention to homeownership as a means to achieve policy goals.

Cannon et al. (2006) find that zip codes are not randomly assigned, but rather follow neighborhood topographic and arterial boundaries with more precision than the often used census assigned boundaries.

One additional externality not addressed in this analysis is the matter of state regulations on foreclosure filings by financial institutions. The modeling is restricted to a single state thereby eliminating state level variation caused by differences in legislation (see Pence 2006).

Some level of selection bias exists in this measure; however, an alternative zip code level house price index is not publicly available. The Fannie Mae House Price Index does drill down to the zip code level, but was not provided for this analysis.

Observation of data from 2009 supports significant deterioration in the loan risk characteristics of FHA borrowers.

It should be acknowledged that the variable LTV_RATIO does not include unobserved second loans on the house, a common limitation of loan level data.

It is recognized that the calendar year cutoff is arbitrary, but short of a theoretical or empirical basis for an alternative, it is deemed a reasonable approach to avoiding issues of censoring in the data if analyzed over time.

References

Ambrose, B. W., & Pennington-Cross, A. (2000). Local economic risk factors and the primary and secondary mortgage market. Regional Science and Urban Economics, 30(6), 683–701.

Aragon, D., Caplin, A.,Chopra, S., Leahy, J., Lecun, Y., Scoffier, M., et al. (2010). Reassessing FHA risk. NBER Working Paper No. 15802.

Archer, W. R., & Smith, B. C. (2010). Residential mortgage default: The roles of house price volatility, euphoria and the borrower’s put option. Journal of Real Estate Finance and Economics, 1–24.

Calem, P. S., Gillen, K., & Wachter, S. M. (2004a). The neighborhood distribution of subprime mortgage lending. Journal of Real Estate Finance and Economics, 29(4), 393–410.

Calem, P., Gillen, K., & Wachter, S. M. (2004b). The neighborhood patterns of subprime lending: evidence from disparate cities. Housing Policy Debate, 15(3), 603–20.

Cannon, S. E., Miller, N. G., & Pandher, G. S. (2006). Risk and return in the U.S. Housing Market: a cross-sectional asset-pricing approach. Real Estate Economics, 34(4), 519–552.

Cameron, A. C., & Trivedi, P. K. (1998). Regression analysis of count data. Cambridge: Cambridge University Press.

Donovan, S. (2011). Supporting affordability and accessibility through housing finance reform, U.S. Department of Housing and Urban Development’s blog from the Secretary.

Federal Housing Administration (2009). FHA Annual Management Report for Fiscal Year 2008.

Federal Housing Administration (2011). FHA Housing Single-family Outlook. May.

Gabriel, S. A., & Rosenthal, S. S. (1991). Credit rationing, race, and the mortgage market. Journal of Urban Economics, 29(3), 371–379.

Goodman, J. L., & Nichols, J. B. (1997). Does FHA Increase Home Ownership or just Accelerate it? Journal of Housing Economics, 6(2), 184–202.

Goodman, A. C., & Smith, B. R. (2010). Housing foreclosures: theory works so does policy. Journal of Housing Economics, 19(4), 280–294.

Hendershott, P. H., & Thibodeau, T. G. (1997). Wealth accumulation and housing choices of young households: an exploratory investigation. Journal of Housing Research, 8(2), 137–154.

Hendershott, P. H., LaFayette, W. C., & Haurin, D. R. (1997). Debt usage and mortgage choice: the FHA conventional decision. Journal of Urban Economics, 41(2), 202–217.

Karikari, J. A., Voicu, I., & Fang, I. (2011). FHA vs. Subprime mortgage originations: is FHA the answer to subprime lending? Journal of Real Estate Finance and Economics, 43(4), 441–458.

Linneman, P., & Wachter, S. M. (1989). The impacts of borrowing constraints on homeownership. Real Estate Economics, 17(4), 380–402.

Long, S. J. (1997). Regression models for categorical and limited dependent variables. Thousand Oaks: Sage.

Monroe, A. (2001). How the Federal Housing Administration affects the housing market, working paper with the Harvard University Department of Economics.

Mortgage Bankers Association (2006). National Delinquency Survey.

Nichols, J. B., Pennington-Cross, A., & Yezer, A. (2005). Borrower self-selection, underwriting costs, and subprime mortgage credit supply. Journal of Real Estate Finance and Economics, 30(20), 197–219.

Pence, K. M. (2006). Foreclosing on opportunity: state laws and mortgage credit. The Review of Economics and Statistics, 88(1), 177–182.

Pennington-Cross, A., & Nichols, J. B. (2000). Credit history and the FHA-conventional choice. Real Estate Economics, 28(2), 307–336.

Smith, B. C. (2010). Turmoil in the residential mortgage market, a review and compilation of research and policy. Journal of Housing Research, 19(1), 65–87.

Smith, B. C. (2011). Mortgage reform and the countercyclical role of the Federal Housing Administration’s mortgage mutual insurance fund. Economic Quarterly, 97(1), 95–110.

United States Department of Housing and Urban Development (2010). FHA-Insured Single-Family Mortgage Originations and Market Share Report, 2010-Q3.

United States Department of Housing and Urban Development (2007). The Federal Housing Administration, http://www.hud.gov/offices/hsg/fhahistory.cfm.

United States Government Accountability Office (2007). Federal Housing Administration: Decline in the agency’s market share was associated with product and process developments of other mortgage market participants. GAO-07-645.

Weicher, J. C. (1995). Comment on Kerry D. Vandell’s, “FHA restructuring proposals: alternatives and implications. Journal of Housing Research, 6(2), 417–437.

Author information

Authors and Affiliations

Corresponding author

Additional information

Valuable comments have been provided by John Karikari and Anthony Pennington-Cross and participants of the International Atlantic Economic Conference in Washington, DC, October 22, 2011. Access to the data used in the analysis was obtained through agreement with LPS Analytics and the Richmond Federal Reserve Bank. All errors and omissions are the author’s responsibility.

Rights and permissions

About this article

Cite this article

Smith, B.C. Lending Through the Cycle: The Federal Housing Administration’s Evolving Risk in the Primary Market. Atl Econ J 40, 253–271 (2012). https://doi.org/10.1007/s11293-012-9327-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-012-9327-1