Abstract

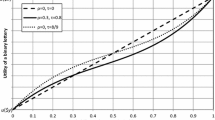

We provide an economic interpretation of the practice consisting in incorporating risk measures as constraints in an expected prospect maximization problem. For what we call the infimum of expectations class of risk measures, we show that if the decision maker (DM) maximizes the expectation of a random prospect under constraint that the risk measure is bounded above, he then behaves as a “generalized expected utility maximizer” in the following sense. The DM exhibits ambiguity with respect to a family of utility functions defined on a larger set of decisions than the original one; he adopts pessimism and performs first a minimization of expected utility over this family, then performs a maximization over a new decisions set. This economic behaviour is called “maxmin under risk” and studied by Maccheroni (Econ Theory 19:823–831, 2002). As an application, we make the link between an expected prospect maximization problem, subject to conditional value-at-risk being less than a threshold value, and a non-expected utility economic formulation involving “loss aversion”-type utility functions.

Similar content being viewed by others

References

Artzner P., Delbaen F., Eber J.-M., Heath D. (1999) Coherent measures of risk. Mathematical Finance 9: 203–228

Barbu V., Precupanu T. (1986) Convexity and optimization in Banach spaces. D. Reidel Publishing Company, Bucharest

Ben-Tal A., Teboulle M. (1986) Expected utility, penalty functions and duality in stochastic nonlinear programming. Management Science 32(11): 1445–1446

Ben-Tal A., Teboulle M. (2007) An old-new concept of convex risk measures: The optimized certainty equivalent. Mathematical Finance 17(3): 449–476

Dentcheva, D., & Ruszczynski, A. (2006). Portfolio optimization with stochastic dominance constraints. Journal of Banking & Finance, 30, 433–451.

Eichhorn, A., & Römisch, W. (2006). Mean-risk optimization models for electricity portfolio management. In Proceedings of probabilistic methods applied to power systems, Stockholm, Sweden, PMAPS 2006.

Gilboa I., Schmeidler D. (1989) Maxmin expected utility with non-unique prior. Journal of Mathematical Economics 18(2): 141–153

Gollier C. (2001) The economics of risk and time. MIT Press, Cambridge

Kahneman D., Tversky A. (1979) Prospect theory: An analysis of decision under risk. Econometrica 47(2): 263–292

Maccheroni F. (2002) Maxmin under risk. Economic Theory 19: 823–831

Markowitz H. (1952) Portfolio selection. Journal of Finance 7: 77–91

Markowitz H. (1959) Portfolio selection: Efficient diversification of investments. Wiley, New York

Muller A., Stoyan D. (2002) Comparison methods for stochastic models and risk. Wiley, New York

Ogryczak W., Ruszczynski A. (1999) From stochastic dominance to mean-risk model: Semideviations as risk measures. Eur J Oper Res 116: 217–231

Rockafellar R. T., Uryasev S. (2000) Optimization of conditional value-at-risk. Journal of Risk 2: 21–41

Tversky A., Kahneman D. (1991) Loss aversion in riskless choice: A reference-dependent model. The Quarterly Journal of Economics 106(4): 1039–1061

Tversky A., Kahneman D. (1992) Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5(4): 297–323

von Neuman J., Morgenstern O. (1947) Theory of games and economic behaviour (2nd ed.). Princeton University Press, Princeton

Wakker P. P. (2010) Prospect theory: For risk and ambiguity. Cambridge University Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Seck, B., Andrieu, L. & De Lara, M. Parametric multi-attribute utility functions for optimal profit under risk constraints. Theory Decis 72, 257–271 (2012). https://doi.org/10.1007/s11238-011-9255-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-011-9255-6

Keywords

- Risk measures

- Utility functions

- Non-expected utility theory

- Maxmin

- Conditional value-at-risk

- Loss aversion