Abstract

This paper aimed at investigating the relationship between the features of local knowledge bases and the creation of innovative start-ups in Italy. The knowledge spillover theory of entrepreneurship has here been combined with the recombinant knowledge hypothesis in order to derive a theoretical framework that could emphasize the heterogeneous nature of knowledge and identify some key dimensions. The empirical analysis has been focused on the patterns of new firm formation in Italian NUTS 3 regions using data on the creation of innovative start-ups that have followed the implementation of a new Italian regulation. The results of the analysis confirm that not only does the size of the knowledge stock play a key role in shaping the creation of innovative start-ups, but also the characteristics of such knowledge, in terms of variety and similarity.

Similar content being viewed by others

1 Introduction

The need to target policy intervention toward innovative start-ups is widely acknowledged by both policy makers and academic scholars as a key measure to achieve sustainable economic growth in the EU as well as overseas. Entrepreneurship, i.e., the process by which new enterprises are founded and become viable, is in fact essential for employment growth and job creation, wage growth and wealth creation. It is therefore recognized as the key engine of economic activities, both for stagnant economies to recover and for emerging ones to sustain growth. In this context, at the end of 2012, a new regulation, which provides specific measures to foster the creation and development of innovative start-ups, was approved in Italy. As a result, by the end of 2013, more than 1500 innovative start-ups had registered with the Italian Chamber of Commerce.

A wide body of the literature has emphasized the key role of start-ups in bringing about innovations and introducing new technologies onto the market. Their role is even more relevant when radical technologies are at stake (Aghion and Howitt 1992; Wennekers and Thurik 1999; Carree and Thurik 2006; Audretsch et al. 2006). In this context, efforts to systematically link entrepreneurship to economic development at the regional level have shown that new firm formation is a determinant of regional growth, cross-regional differences and regional employment dynamics (Feldman 2005; Fritsch and Schindele 2011; Dejardin and Fritsch 2011). Moreover, starting from the observation that entrepreneurial activity is geographically clustered, both theoretical and empirical analyses have been conducted in an attempt to identify the characteristics and attributes of the local socioeconomic systems that may have an impact on new firm formation (Fritsch 1997; Reynolds et al. 1994; Carlton 1983; Bartik 1985; Audretsch and Fritsch 1994; Feldman 2001; Lee et al. (2004). A more recent strand of the literature has pointed out the importance of local knowledge spillovers on the entrepreneurial process. A key reference in this domain is the knowledge spillover theory of entrepreneurship (henceforth KSTE). This theory was conceptualized by Audretsch (1995) and further developed by Audretsch and Lehmann (2005) in order to articulate the link between knowledge spillovers and new firm formation.

This paper is an attempt to contribute to such a debate and aims at investigating the relationship between the features of local economic systems, more precisely the specific influence of the characteristics of local knowledge bases, understood as the set of knowledge and technological competences accumulated over time in a region, and the creation of innovative start-ups. To this aim, the KSTE and the recombinant knowledge approach have been integrated. According to the latter, technological knowledge is the outcome of a combinatorial search activity carried out across a technological space in which combinable elements reside (Weitzman 1998; Fleming 2001; Fleming and Sorenson 2001). This approach allows a set of properties that characterize the internal structure of the local knowledge base to be specified and the traditional measure of knowledge capital stock to be better qualified. In particular, indicators that account for technological differentiation, complementarity and similarity and which are computed by exploiting the information contained in patent documents and, in particular, by looking at the co-occurrence of technological classes to which patents are assigned (Saviotti 2007; Krafft et al. 2014; Quatraro 2010), have been considered.

The present analysis is focused on the patterns of new firm formation in Italian NUTS 3 regions (i.e., the “provincia” level), and it uses data on the creation of innovative start-ups within the framework of a new Italian regulation, which is explained in detail in Sect. 3. This appeared to be an appropriate context for the analysis for different reasons. First, it is expected that the role of knowledge spillover is of particular importance for the creation of innovative start-ups, which are mainly concentrated in the high-tech and knowledge-intensive sectors. Second, the Italian economy appears to be stuck in mature industries and to be significantly behind, from a technological viewpoint, compared to other more advanced countries, so that the investigation should allow us to test the extent to which the relationship between the creation of innovative start-ups and technological knowledge is shaped by the regional technology context.

The results of the present analysis will contribute to shed further light on the role of local knowledge spillovers on the creation of new firms, with specific focus on innovative start-ups. Moreover, when the different features of the local knowledge base are taken into account, the econometric analysis contributes to a better understanding of whether the creation of innovative start-ups in Italian regions is related more to the exploitation of technological knowledge accumulated over time or to the exploration of new research avenues.

The remaining part of the paper is structured as follows. A synthetic account of the theoretical framework underpinning the analysis is provided in Sect. 2, where the rationale for combining the KSTE and the recombinant knowledge approach is presented, and the working hypotheses are articulated. Section 3 describes the new Italian regulation concerning innovative start-ups. The data, the econometric model and the methodology used to test the working hypotheses are presented in Sect. 4. Section 5 presents the results of the econometric tests. The conclusions summarize the results of the analysis and explore the implications.

2 Literature review

In an attempt to analyze the actual source of entrepreneurial opportunities, the seminal contributions of Audretsch (1995), Audretsch and Lehmann (2005) and Acs et al. (2009) have articulated the KSTE. Such an approach moves from a critique to endogenous growth theories (Lucas 1988; Romer 1990) and attempts to complement the prevailing theories of entrepreneurship that have focused on the ability of individuals to recognize opportunities (Venkataraman 1997; Shane and Venkataraman 2000) by linking knowledge spillovers and the entrepreneurship theory.

According to the KSTE, new knowledge and ideas represent a main source of entrepreneurial opportunities (Acs and Armington 2006; Audretsch et al. 2006; Acs et al. 2013). In other words, new knowledge and ideas created in an incumbent organization, such as a firm or a university research laboratory, but left un-commercialized, may serve as a source of entrepreneurial opportunities. In fact, incumbent organizations are often unable or unwilling to fully appropriate and commercialize new knowledge and ideas generated within their research laboratories as they lack capabilities or do not want to take the risks of introducing radically new technologies onto the market, and prefer to focus on small improvements in their existing products and processes. As a consequence, an opportunity to start a new firm is generated in order to exploit and commercialize that knowledge and those ideas. In this context, the start-up of a new firm is a mechanism in which knowledge spillovers from the organization can create opportunities that the new firm can exploit. The KSTE thus suggests that the start-up of a new firm is an endogenous response to opportunities that have been generated, but not fully exploited, by incumbent organizations.

The KSTE is based on an idea developed by Arrow (1962) that knowledge, unlike traditional production factors, is characterized by non-excludability and non-exhaustibility. This implies that knowledge is not fully appropriable and may spill over from the organization that produces it to a new organization (Griliches 1992). An important implication of the KSTE is that contexts characterized by greater amounts of knowledge generate more entrepreneurial opportunities. The main proposition that emerges from the KSTE states that “contexts rich in knowledge should generate more entrepreneurship, thus reflecting more extensive entrepreneurial opportunities. On the other hand, knowledge impoverished contexts should generate less entrepreneurship, thus reflecting fewer extensive entrepreneurial opportunities” (Audretsch and Keilbach 2007, p. 1249).

Empirical analyses have been used to investigate and provide support to the impact of knowledge spillovers on the entrepreneurial process. Audretsch (1995) was the first to provide evidence of the positive link between the stock of knowledge and start-up rates at the industry level of analysis. Subsequently, by combining the KSTE and the mainstream literature that provided evidence on the spatial dimension of knowledge spillovers (Jaffe 1989; Audretsch and Feldman 1996; Audretsch and Stephan 1996), the empirical tests of Audretsch and Lehmann (2005) and Audretsch and Keilbach (2007) showed that new firms are created in spatial proximity to knowledge sources. This evidence suggests that the KSTE can also be verified at the geographical level of analysis.

In the aforementioned seminal works, and in subsequent empirical analyses on the same topic, the local knowledge stock is the key variable and is mainly measured by means of R&D investments (Audretsch and Keilbach 2007; Acs et al. 2009), research activities carried out by universities and research centers (Audretsch and Lehmann 2005; Cassia et al. Cassia et al. 2009; Cassia and Colombelli 2008; Bonaccorsi et al. 2013, 2014), the characteristics of the regional labor force (Bishop 2012) and patent-based measures (Bae and Koo 2008).

However, this approach neglects that not only the size of the knowledge stock, but also its nature is of some significance. Technological knowledge is not a homogenous good. In fact, a variety of competences are necessary to produce new technological knowledge. Recognizing the heterogeneous nature of knowledge means extending the KSTE proposition: not only the amount of knowledge available at the local level, but also the characteristics of that knowledge have a positive impact on the formation of new firms.

According to this line of thought, recent empirical analyses have focused on the effects of the heterogeneous nature of knowledge on the formation of new firms (Bae and Koo 2008; Bishop 2012; Colombelli and Quatraro 2013). These works can be framed within the literature which emphasizes that knowledge spillovers frequently occur across sectors (Jacobs externalities). In this context, diversity in the local knowledge stock may have a positive impact on the generation of opportunities that entrepreneurs can exploit. For example, the empirical analysis on US metropolitan areas by Bae and Koo (2008), based on the argument that diversity may increase the potential for knowledge spillovers, has provided evidence on the positive link between two dimensions of knowledge diversity, i.e., complementarity and dissimilarity, and the creation of new firms. Bishop (2012), in his empirical work on new firm formation in Great Britain, found that both related and unrelated knowledge diversity have a positive impact on the rate of new business formation across spatial areas. Colombelli and Quatraro (2013) have investigated the relationship between the creation of new firms and the properties of the local knowledge bases in Italy. The present article is grounded on the aforementioned literature and has originally added to it by focusing on innovative Italian start-ups within the framework of a new legislation.

In this context, the reconciliation of the KSTE with the recombinant knowledge approach allows the features of the local knowledge that may affect the formation of new firms to be better qualified (Weitzman 1998; Fleming and Sorenson 2001). According to the recombinant knowledge approach, new knowledge is generated through a combination of different technologies, so that the local knowledge base can be represented as a web of connected elements (Krafft et al. 2014; Colombelli, Krafft Quatraro 2014; Quatraro 2010). By observing the frequency with which two technologies are combined together, it is possible to derive useful information on the internal structure of the knowledge base and to characterize it along the following three dimensions: the degree of technological differentiation, as measured by the total variety of the observed pairs of technologies, even when decomposed into its two components, i.e., related and unrelated varieties; the average degree of complementarity of the technological domains featuring the local knowledge base, as measured by the coherence index; proximity of the technologies of which the knowledge bases are made, as measured by similarity (or dissimilarity). The recombinant knowledge approach therefore allows the arguments put forth by the KSTE to be qualified, by explicitly taking into account multiple dimensions of the technological domains that constitute the local knowledge base.

In view of the arguments developed so far, it is now possible to set out the working hypotheses that underlie the present analysis:

H1

The amount of knowledge available locally has a positive effect on the creation of innovative new start-ups in a focal province.

H2

The variety of technological domains that constitute the local knowledge base has a positive effect on the creation of innovative new start-ups in a focal province.

H2a

Both related and unrelated varieties have a positive effect on the creation of innovative new start-ups in a focal province.

H3

The complementarity of the technological domains that constitute the local knowledge base has a positive effect on the creation of innovative new start-ups in a focal province.

H4

The similarity (or dissimilarity) of the technological domains that constitute the local knowledge base has a positive (or negative) effect on the creation of innovative new start-ups in a focal province.

3 The Italian framework

At the end of 2012, the Italian Ministry of Economic Development approved a Law Decree on “Further urgent measures for Italy’s economic growth,” thereby providing specific measures that were aimed at promoting the creation and development of innovative start-ups. This was the first time that the Italian legislation had taken these kinds of companies into consideration. The law recognizes that start-ups are important for the promotion of sustainable growth, technological development and employment, and in particular youth employment, and has had the aim of developing an environment that would foster the creation of entrepreneurial opportunities, innovation and social mobility; strengthen the links between universities and businesses; and attract investments and talented people from abroad to Italy. Taking advantage of this law, by the end of 2013, more than 1500 innovative start-ups had registered at the Chamber of Commerce in Italy.

In order to be included in the register of “innovative start-ups” and to benefit from governmental incentives, a new company needs to fulfill certain requirements. In particular, according to the Law Decree, a start-up is a corporation, not listed and subject to Italian tax laws, which has a turnover of less than 5 million euros, has been operational for <48 months, is owned directly for at least 51 % by physical subjects, and, more importantly, has the social aim of developing innovative products or services, with a high technological content.

In order to satisfy this latter requirement and to be defined as innovative, the start-up needs to fulfill at least one out of three criteria: either 15 % of its costs are related to R&D activities; at least one-third of the team is made up of highly qualified membersFootnote 1; and the enterprise is the holder, depositary or licensee of a registered patent or the owner of an original registered computer program.

All the companies included in the register of “innovative start-ups” benefit from support measures provided by the Law Decree, for example, the possibility of using the specific flexible employment contracts of start-ups, of remunerating their team members and the providers of external services with stock options and work for equity, respectively, and of having access to incentives for the employment of highly qualified personnel. Moreover, the Law Decree introduced a “fail fast” procedure with the aim of offering the entrepreneurs the chance to start a new business project as soon as possible.

In addition to the above-mentioned advantages, in the attempt to stimulate entrepreneurial activities, the Italian Government provides some specific measures and incentives for incubators or accelerators that fulfill specific requirements concerning the physical structures of start-ups, their management, facilities and their track records, and also aims at increasing the resources available for venture capital.

Given the particular nature of the firms included in the Italian register of “innovative start-ups,” this has appeared an appropriate context to test the impact of knowledge spillovers on entrepreneurial activities.

4 Data, variables and methodology

4.1 The data

The sample included 1676 innovative start-ups registered at the Italian Chamber of Commerce. The analysis was restricted to companies enrolled in the online “innovative start-ups” directory registered at the Italian Chamber of Commerce between 2009 and 2013 in 103Footnote 2 Italian NUTS 3 regions.

Tables 1 and 2 report the breakdown of the sample according to the year of registration at the Chamber of Commerce and according to the type of industry.

As knowledge spillovers are geographically bounded, it was necessary to focus on a sufficiently narrow definition of region. The unit of analysis in this study was therefore the NUTS 3 geographical area. The NUTS classification (nomenclature of territorial units for statistics) is a hierarchical system that is used to divide up the economic territory of the EU. According to this nomenclature, EU countries are divided into geographical units at three levels of aggregation: NUTS 1, major socioeconomic regions; NUTS 2, basic regions for the application of regional policies; and NUTS 3, small regions for specific diagnoses. In Italy, NUTS 3 regions correspond to administrative units (province) that groups together different neighboring municipalities. This administrative unit usually includes a city and its satellite municipalities. The NUTS 3 geographical area is characterized by the presence of frequent economic interactions. For example, almost every Italian NUTS 3 region has a chamber of commerce and an employer association. For this reason, this unit of analysis was considered the most appropriate to define the regional boundary of entrepreneurial activities.

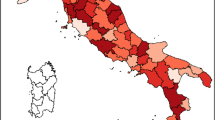

Figure 1 shows the geographical distribution of innovative start-ups across Italian NUTS 3 regions and reveals/highlights that innovative start-ups vary substantially across regions. The most intensive entrepreneurial activities were found in NUTS 3 areas, such as Milan, Turin and Rome. Other things being equal, the model ascribes such regional variations in innovative start-up activities to the differences in the three knowledge dimensions: variety, complementarity and dissimilarity.

In order to analyze the impact of knowledge spillovers on the creation of innovative start-ups, information concerning regional patent applications has been referred to. A KSTE test traditionally adopts the local expenditure for research and development (R&D) as a proxy of the available pool of technological knowledge at the regional level (Audretsch and Lehmann 2005; Audretsch and Keilbach 2007; Acs et al. 2009). Unfortunately, no data are available concerning R&D expenditure at the NUTS 3 level in Italy. For this reason, in this paper an approach that has been used extensively in the literature has been adopted (Jaffe 1989; Acs et al. 1992; Shane 2001) and patent information has been used to measure the local knowledge stock.Footnote 3 Similarly, indicators that account for technological differentiation, complementarity and similarity have been computed by exploiting the information contained in patent documents in order to analyze the impact of the structure of the local knowledge bases on the formation of new firms.

To this aim, data on innovative start-ups, aggregated at the NUTS 3 level of analysis, have been matched with information contained in the OECD RegPat Database and also with data provided by the Italian institute of statistics (ISTAT), that is, the “Indicatori territoriali per le politiche di sviluppo” (local indicators for development policy).

OECD RegPat ensures worldwide coverage and combines applications to both the EPO and the national patent offices. It is thus possible to go back in time for some patent authorities. This allows the traditional limitation of EPO-based longitudinal analysis, due to its relatively young age, to be overcome.

For the aim of the paper, reference has been made to patent applications regionalized at the NUTS 3 level on the basis of the inventors’ addresses. The study is thus limited to the applications submitted by inventors residing in Italian regions. Applications with more than one inventor residing in different regions have been assigned to each of the regions on the basis of the respective share. Finally, the paper refers to the International Patent Classification (IPC) adopted by the EPO to assign applications to technological classes.

4.2 The variables

According to the majority of works that have tested the KSTE from different perspectives (Audretsch and Lehmann 2005; Bae and Koo 2008; Bonaccorsi et al. 2013, 2014; Guerini and Rossi-Lamastra 2014), the dependent variable that has been adopted is the count of innovative start-ups in each Italian NUTS 3 region.Footnote 4

As far as the independent variables are concerned, indicators of the local knowledge stock and the characteristics of the knowledge base have been included in the model as follows.

In order to test the KSTE, the local knowledge stock (KSTOCK), which is calculated using the permanent inventory method to patent applications, has been adopted. KSTOCK has been calculated as the cumulated stock of past patent applications using a rate of obsolescence of 15 % per annumFootnote 5:

where \(\dot {h}_{i,t}\) is the flow of patent applications and δ is the rate of obsolescence, and once again i is the region and t is the time period.

As underlined in Sect. 2, only a few contributions to the determinants of new firm formation have taken into account the heterogeneous nature of technological knowledge. In particular, in order to measure regional knowledge diversity, Bishop (2012) implemented the informational entropy index using data on sectoral shares of employment. The idea was that each sector relies on specific competences, and thus, sectoral data are indirect measures of the tacit knowledge observed in the region. Bae and Koo (2008) relied on patent applications to derive indicators of the knowledge diversity and relatedness of a region. In particular, they used the Herfindal index calculated on knowledge fields assigned by the USPTO and patent citations. Although the new knowledge that is available to nascent entrepreneurs may take on a variety of forms, ranging from tacit and social ideas to explicit and technical inventions, the use of patents to derive information on local knowledge is justified by the fact that legally protected and explicit new inventions are observable and measurable entities and, thus, allow a relatively objective comparison to be made.

Given the high propensities to patents in the firms and industries under study, a similar approach to the one adopted by Bae and Koo (2008) has been adopted in this paper, in that the information contained in patent documents has been used to calculate three measures that can describe the regional knowledge structure.

The implementation of knowledge characteristics that proxy for variety, complementarity and dissimilarity is based on the recombinant knowledge approach outlined in Sect. 2.Footnote 6 According to this approach, patents are considered as a proxy for knowledge, while the technological classes to which patents are assigned are considered as the constituting elements of its structure, i.e., the nodes of the network representation of recombinant knowledge. Each technological class j is linked to another class m when the same patent is assigned to both of them. The higher the number of patents assigned jointly to classes j and m, the stronger is this link. The link between j and m is referred to as the co-occurrence of both technological classes within the same patent document.

On this basis, the following three indicators have been calculated:

-

a.

Knowledge variety (TKV). This variable measures the degree of technological diversification of the regional knowledge base. Consistently with the recombinant knowledge hypothesis, it is based on the multidimensional informational entropy index. In other words, the variety of combinations of technologies is measured rather than the mere variety of technologies. This indicator is also decomposed into two components: within-entropy, labeled as related technological variety (RKV), and between-entropy, labeled as unrelated technological variety (UKV). The measures of related and unrelated varieties (RKV and UKV) are linked to technological knowledge belonging to the same knowledge domain, as defined by the International Patent Classification. The related variety measures the degree of technological differentiation within the macro-field, while the unrelated variety measures the degree of technological differentiation across macro-fields. This means that variety is considered as a global entity, but also as a new combination of existing pieces of knowledge (RKV) versus variety as a combination of new pieces of knowledge (UKV).

-

b.

Knowledge coherence (COH). This variable measures the extent to which the pieces of knowledge that firms combine to generate new technological knowledge are complementary to one another. It thus measures the average degree of complementarity among the technologies that make up the regional knowledge base.

-

c.

Cognitive distance (CD). This variable measures the extent to which the pieces of knowledge used by firms are distant from one another in the technology space. It thus expresses the average degree of dissimilarity among different types of knowledge.

Besides the effects of the knowledge indicators, a number of factors that proved to affect new firm formation in previous empirical settings have been checked. First, according to previous studies in this stream of the literature, the formation of a new firm may be triggered by pull factors, such as a high innovative potential (see Acs and Audretsch 1989a, b; Geroski 1995). For this reason, it is necessary to check the effects of agglomeration economies (POPD), proxied by population density at the NUTS 3 in the vector of control variables. A complementary measure of prospective economic benefits is also represented by the distance (DIST) of each province i from the main administrative town in the NUTS 2 region (Baptista and Mendonça 2010; Bonaccorsi et al. 2013). Moreover, agglomeration economies can also stem from the presence of other firms in the same place, which, to some extent, ensures the availability of local markets for intermediate goods. In this context, firm density (FIRMD), calculated as the ratio between the number of registered firms at time t in region i and the land use area, has also been added as a control variable. In order to control for regional size effects, a regional workforce index (RWF) has been included in the model. As the creation of new firms can be the outcome of an ‘escape from unemployment’ strategy (Audretsch and Vivarelli 1995, 1996), the unemployment rate at the local NUTS 3 level (UNSHARE), calculated as the ratio between the count of unemployed people and the count of individuals in the labor force at time t in region i, has also been considered. Moreover, the numbers of incubators (INC) in each province have been calculated. Business incubators are in fact meant to foster the creation and the growth of innovative new start-ups and are likely to increase their survival rate (Colombo and Delmastro 2002). In order to control the demand effects, the per capita value added (VA) at time t in region i has also been included. Finally, time dummies and, in order to address the issue of geographical differences in terms of new firm creation, dummy variables at the NUTS 2 level have been added. Table 3 provides a summary of the definitions of the variables.

4.3 Methodology

In light of the KSTE and the recombinant knowledge approach, the hypothesis that not only the amount of knowledge locally available affects the creation of innovative start-ups, but also the features of the local knowledge base matter has been formulated in Sect. 2. In this context, the rate of creation of innovative start-ups is likely to be influenced by the variables described above, i.e., knowledge variety (TKV), also decomposed into related and unrelated varieties (RKV, UKV); coherence (COH); and cognitive distance (CD). The test of such hypotheses requires the dependent variable NISUi,t to be modeled as a function of the characteristics of the knowledge base.

The baseline specification is therefore the following:

as the features of local environments may take some time to exert an effect on entrepreneurial dynamics, and in order to avoid endogeneity concerns, a 3-year lag has been applied to the explanatory variables.

However, it is also necessary to control the impact of the economic features of the local context in order to rule out the possibility of such effects being somehow captured by the knowledge-related variables. In view of this, Eq. (1) can be written as follows:

where ∑ ln C i,t−3 represents the set of control variables described above.

Because of the discrete and nonnegative nature of the dependent variable, Eq. 2 can be estimated using count models that have proved more appropriate to deal with nonnegative integers. In other words, Eq. 2 can be estimated by means of either a Poisson or a negative binomial model. Since the dependent variable is over-dispersed, as can be seen in Table 4 from the fact that its variance is far larger than the mean, the negative binomial estimator seems to be more appropriate (Greene 2003). However, to further assess the appropriateness of the negative binomial estimator, a likelihood-ratio test for over-dispersion has been performed. The results (see Table 6) indicate that the negative binomial model is better at fitting all the estimations than the Poisson model.

Table 4 reports the descriptive statistics concerning the variables used in the analysis after log transformation, while Table 5 shows the correlation matrix. As can be seen in Table 5, the correlations between some independent variables are relatively high. In particular, KSTOCK is highly correlated with the knowledge variety measures. This is not surprising since it is quite likely that the extent of differentiation increases with the size of the stock of knowledge. Moreover, the two components of knowledge variety (UTV and RTV) are highly correlated with each other. In order to further detect multicollinearity among the covariates, the variance inflation factor (VIF) has been checked for each covariate. A high value of the VIF indicates the presence of multicollinearity. The VIF in our data is higher than 10, that is, the accepted cutoff value (Neter et al. 1990), but only when KSTOCK is regressed on all the other covariates, including the three knowledge variety measures (TKV, UKV and RKV). However, if KSTOCK is regressed on all the other covariates, including each of the three knowledge variety measures in different regressions, the VIF assumes values in the 1.92–2.14 range, which is much lower than the cutoff value of 10. Finally, when KSTOCK is regressed on all the other covariates, including UKV and RKV, the VIF value is = 2.15. For this reason, different regression models have been run. First, the three specifications of knowledge variety (TKV, UKV and RKV) were included in different regression models. Subsequently, UKV and RKV were included in the same model. Moreover, different regression models were run excluding knowledge stock from the vector of covariates.

5 Econometric results

The results of the econometric estimations of Eq. (2) are reported in Table 6.

Column (1) reports the results of the baseline model, in which only the stock of knowledge is taken into account, due to the high correlation with the other knowledge-related variables. Consistently with the KSTE, the coefficient of regional KSTOCK is positive and significant. This therefore supports the idea that entrepreneurs create new firms by taking advantage of the locally available unexploited knowledge and confirms the first hypothesis set out in Sect. 2.

If the control variables are taken into consideration, it can be seen that the distance from the main town in the region, where agglomeration economies are much more pronounced, shows the expected negative and significant coefficient. The other two proxies for agglomeration economies, POPD and FIRMD, are not significant. The presence of incubators (INC) in the region also shows the expected positive and significant coefficient. Moreover, regional workforce (RWF) shows a positive and significant coefficient, in line with the ‘labor market’ approach to new firm creation. Moreover, demand effects also have a positive and significant impact on innovative new firm creation. Finally, the rate of unemployment (UNSHARE) is not significantly correlated with the creation of innovative new start-ups. This result is interesting in its own right. In addition to simply confirming that unemployment does not affect the formation of innovative start-ups, it shows that such companies are not subject to the ‘escape from unemployment’ hypothesis. This result indicates that the founders of innovative start-ups are ‘Schumpeterian entrepreneurs’ and not ‘necessity entrepreneurs’ (Vivarelli 2004).

According to the second hypothesis, articulated in Sect. 2, not only does the magnitude of local knowledge matter, but also its inherent heterogeneous nature. In this context, among the technological domains composing the local knowledge base, the creation of new firms is expected to be shaped by variety, coherence and cognitive distance.

Table 6 also reports the result obtained from an extension of the baseline model in which KSTOCK has been replaced with knowledge-related indicators. The results reported in Column 2 show that TKV is positively and significantly related to the creation of innovative new firms. This result confirms the second hypothesis. The coefficient on cognitive distance (CD) is instead negatively and significantly related to the creation of innovative new firms. This result confirms the third hypothesis. The coefficient on the coherence is positive but not statistically significant. The fourth hypothesis has therefore not been verified. The results thus indicate that the higher the variety is in the combination of technologies in the firm region, the higher the number of innovative start-ups. In other words, an increase in the scope of recombination of the available competences is likely to favor the creation of new firms. This might be due to the fact that entrepreneurs can try and experiment new combinations of technologies available in the local context and distributed across a wide range of technology domains. However, the negative sign of cognitive distance suggests that a key condition for the creation of innovative start-ups is the availability of local knowledge bases stemming from the combination of similar technologies, i.e., proximate in the technology landscape.

When the effects of related and unrelated varieties are separated, it can be seen that both UTV and RTV are positively and significantly correlated with the creation of innovative new firms (Columns 3–5). The procedure by which the index is derived reveals that the concepts of ‘related’ and ‘unrelated’ varieties refer basically to technologies that belong to the same technological domain, as defined by the classification system that has been used (in the present case, the International Patent Classification). The positive and significant impact of UTV on the formation of new firms would seem to imply that an increase in the regional variety of combined technologies from very different technological domains is associated with an increase in the number of innovative start-ups. However, RTV also exerts a positive and significant impact on the formation of new firms. This result suggests that the increasing opportunities to start a new firm are associated with increasing scope in the combination of technologies belonging to the same field.

6 Conclusions

Innovative start-ups are considered as a powerful instrument for both stagnant economies to recover and developed ones to grow. The financial crisis throughout the world and the subsequent economic downturn have in fact generated severe resource constraints and unpredictable market conditions that have significantly challenged both developed and emerging countries. Such adverse environmental conditions have fostered a greater need for a rethinking of the policy agenda, both in the EU and elsewhere, to boost economic growth in the years to come. In this context, at the end of 2012, the Italian Government approved a Law Decree that provided specific measures to promote the creation and development of start-ups.

The literature focusing on the relationship between the features of the local economy and the dynamics of the formation of new firms is quite recent. A key reference in this domain is the KSTE, which links knowledge spillovers to new firm start-up activities. The present paper reconciles this latter strand of analysis with the recombinant knowledge approach and argues that not only does the amount of technological knowledge matter, but also its nature. In the empirical analysis, a number of indexes have thus been derived that describe the local knowledge base by relying on the information contained in patent applications.

It is possible to state that the present results lend further support to the KSTE and confirm that knowledge spillovers have a positive impact on the creation of innovative start-ups. Moreover, the results make it possible to qualify the argument put forth in the KSTE literature and also confirm that the heterogeneous nature of local knowledge matters. These findings are consistent with the recombinant knowledge hypothesis, according to which knowledge stems from a combination of different pieces of knowledge available from local contexts. In this context, the appreciation of the heterogeneous nature of knowledge calls for the explicit investigation of basic properties, such as variety, similarity and complementarity.

Consistent with this framework, the evidence concerning entrepreneurial dynamics in Italian provinces suggests that the availability of local knowledge spillovers is not sufficient per se to lead to the creation of innovative new firms. If one looks at the characteristics of the local knowledge base, the creation of innovative start-ups in local contexts appears to be triggered by the combination of a large variety of technologies, marked by a high degree of similarity.

The results of this analysis also have important implications on technology policies at the regional level. Technology policy represents one of the key levers that policy makers can use to trigger local development. Owing to the collective and systemic nature of innovation activities, the choice of the correct policy mix is of crucial importance. The promotion of specific technological domains at the local level may affect the effectiveness of knowledge generation processes within a region. In this context, in attempts to foster the creation of innovative new firms, regional policy makers should stimulate innovation processes based upon a combination of a large variety of different and yet similar technologies. Therefore, the present results could also contribute to the recent policy debate on smart specialization strategies (Foray et al. 2011; Boschma 2014). Technological relatedness is therefore important, not only to foster further technological diversification (Colombelli et al. 2014; Rigby 2013), but also to feed the entrepreneurial process by means of the creation of innovative start-ups.

This paper provides useful insights that can help improve the effectiveness of the new Italian regulation by means of complementary policy measures at the technology and regional levels. However, further research needs to be implemented in order to analyze the effectiveness of the Italian regulation in fostering the creation of innovative start-ups and to verify whether the creation of innovative start-ups induced by the new law will be persistent over time.

Notes

By high qualified members, the Law intends all the individuals that either hold a PhD or are PhD candidates at an Italian or foreign university or have conducted research over at least three years. Alternatively, two thirds of the total workforce must hold a Master’s degree.

The actual number of Italian provinces is 110. The Italian NUTS 3 classification changed in the 2005–2009 period, when seven new regions were added. Owing to the lack of information on these new provinces for the whole period covered by the analysis, the sample has been restricted to 103 geographical units. It is worth noting that the total number of innovative start-ups created in the seven new provinces in the aforementioned period is 18 (1 % of the total sample).

The weaknesses and the strengths of patents as reliable and comprehensive indicators of the actual amount of technological knowledge have been the subject of a long debate. It in fact seems difficult to use alternative indicators. See Griliches (1990), Van Zeebroeck (2011), Van Zeebroeck and van Pottelsberghe (2011).

Other works on the same topic use weighted measures of new firms as dependent variables in order to account for variations in the regional size. The number of new firms is generally weighted using the stock of existing firms or the regional workforce. However, weighting the net number of new firms may engender some biases due, for example, to overrepresentation, above all in less developed areas (like Southern Italy). However, it cannot be denied that local markets are not homogenous with respect to size. For this reason, as specified below, a measure of regional size has been introduced among the control variables.

A 15 % obsolescence rate is the most common value used in the literature since it was first introduced by Hall et al. (2005).

References

Acs, Z. J., & Armington, C. (2006). Entrepreneurship, geography and American economic growth. Cambridge: Cambridge University Press.

Acs, Z. J., & Audretsch, D. B. (1989a). Small-firm entry in US manufacturing. Economica, 56, 255–265.

Acs, Z., Audretsch, D., & Feldman, P. (1992). Real effects of academic research: Comment. American Economic Review, 82, 363–367.

Acs, Z. J., & Audretsch, D. B. (1989b). Births and firm size. Southern Economic Journal, 56, 467–475.

Acs, Z. J., Audretsch, D. B., & Lehmann, E. E. (2013). The knowledge spillover theory of entrepreneurship. Small Business Economics, 41(4), 757–774.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60, 323–351.

Arrow, K. (1962). Economic welfare and the allocation of resources for invention. In R. Nelson (Ed.), The rate and direction of inventive activity. Princeton: Princeton University Press.

Audretsch, D. B. (1995). Innovation and industry evolution., Cambridge (Mass): MIT Press.

Audretsch, D. B., & Fritsch, M. (1994). The geography of firm births in Germany. Regional Studies, 28(4), 359–365.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. American Economic Review, 86, 630–640.

Audretsch, D. B., & Keilbach, M. C. (2007). The localisation of entrepreneurship capital: Evidence from Germany. Papers in Regional Science, 86, 351–365.

Audretsch, D. B., Keilbach, M. C., & Lehmann, E. E. (2006). Entrepreneurship and economic growth. Oxford: Oxford University Press.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34, 1191–1202.

Audretsch, D. B., & Stephan, P. E. (1996). Company-scientist locational links: the case of biotechnology. American Economic Review, 86, 641–652.

Audretsch, D. B., & Vivarelli, M. (1995). New firm formation in Italy. Economics Letters, 48, 77–81.

Audretsch, D. B., & Vivarelli, M. (1996). Determinants of new-firm startups in Italy. Empirica, 23, 91–105.

Bae, J., & Koo, J. (2008). The nature of local knowledge and firm formation. Industrial and Corporate Change, 18, 1–24.

Baptista, R., & Mendonça, J. (2010). Proximity to knowledge sources and the location of knowledge-based start-ups. The Annals of Regional Science, 45(1), 5–29.

Bartik, T. (1985). Business location decisions in the United States: estimates of the effects of unionization, taxes, and other characteristics of the states. Journal of Business and Economic Statistics, 3(January), 16–22.

Bishop, P. (2012). Knowledge, diversity and entrepreneurship: a spatial analysis of new firm formation in Great Britain. Entrepreneurship and Regional Development, 24, 641–660.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2013). University specialization and new firm creation across industries. Small Business Economics, 41(4), 837–863.

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2014). The impact of local and external university knowledge on the creation of knowledge-intensive firms: Evidence from the Italian case. Small Business Economics, 43(2), 261–287.

Boschma, R. (2014). Constructing regional advantage and smart specialization: Comparisons of two European policy concepts. Italian Journal of Regional Science, 13(1), 51–68.

Carlton, D. W. (1983). The location and employment choices of new firms: an econometric model with discrete and continuous endogenous variables. Review of Economics and Statistics, 65(3), 440–449.

Carree, M., & Thurik, A. R. (2006). Understanding the Role of Entrepreneurship for Economic Growth. In M. Carree & A. R. Thurik (Eds.), The Handbook of Entrepreneurship and Economic Growth (pp. 9–19). Cheltenham: Elgar.

Cassia, L., & Colombelli, A. (2008). Do universities knowledge spillovers impact on new firm’s growth? Empirical evidence from UK. The International Entrepreneurship and Management Journal, 4, 453–465.

Cassia, L., Colombelli, A., & Paleari, S. (2009). Firms’ growth: Does the innovation system matter? Structural Change and Economic Dynamics, 20, 211–220.

Colombelli, A., Krafft, J., & Quatraro, F. (2014). High-growth firms and technological knowledge: do gazelles follow exploration or exploitation strategies? Industrial and Corporate Change, 23, 261–291.

Colombelli, A., & Quatraro, F. (2013). The properties of local knowledge bases and entrepreneurship: evidence from Italian NUTS3 regions. Evolutionary Economic Geography (PEEG), No. 1303, Utecht University, Section of Economic Geography.

Colombo, M. G., & Delmastro, M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31, 1103–1122.

Dejardin, M., & Fritsch, M. (2011). Entrepreneurial dynamics and regional growth. Small Business Economics, 36(4), 377–382.

Feldman, M. (2001). The entrepreneurial event revisited: Firm formation in regional context. Industrial and Corporate Change, 10, 861–891.

Feldman, M. (2005). Creating a cluster while building a firm: Entrepreneurs and the formation of industrial clusters. Regional Studies, 39, 129–141.

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132.

Fleming, L., & Sorenson, O. (2001). Technology as a complex adaptive system: Evidence from patent data. Research Policy, 30, 1019–1039.

Foray, D., David, P. A., & Hall, B. H. (2011). Smart specialization. From academic idea to political instrument, the surprising career of a concept and the difficulties involved in its implementation, MTEI-working paper, November 2011, Lausanne.

Fritsch, M. (1997). Newfirms and regional employment change. Small Business Economics, 9(5), 437–448.

Fritsch, M., & Schindele, Y. (2011). The contribution of new businesses to regional employment: An empirical analysis. Economic Geography, 87, 153–180.

Geroski, P. A. (1995). What do we know about Entry? International Journal of Industrial Organization, 13, 421–440.

Greene, W. H. (2003). Econometric analysis. New York: Prentice Hall.

Griliches, Z. (1990). Patent statistics as economic indicators: a survey. Journal of Economics Literature, 28, 1661–1707.

Griliches, Z. (1992). The search for R&D spillovers. Scandinavian Journal of Economics, 94, 29–47.

Guerini, M., & Rossi-Lamastra, C. (2014). How university and industry knowledge interact to determine local entrepreneurship. Applied Economics Letters, 21(8), 513–516.

Hall, B., Jaffe, A., & Trajtenberg, M. (2005). Market value and patent citations. The Rand Journal of Economics, 36(1), 16–38.

Jaffe, A. B. (1989). Real effects of academic research. American Economic Review, 79, 957–970.

Krafft, J., Quatraro, F., & Saviotti, P. P. (2014). The dynamics of knowledge-intensive sectors’ knowledge base: Evidence from biotechnology and telecommunications. Industry and Innovation, 21, 215–242.

Lee, S. Y., Florida, R., & Acs, Z. (2004). Creativity and entrepreneurship: A regional analysis of new firm formation. Regional Studies, 38, 879–891.

Lucas, R. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3–42.

Neter, J., Wasserman, W., & Kunter, M. H. (1990). Applied linear statistical models: Regression, analysis of variance, and experimental design (3rd ed.). Homewood, IL: Irwin.

Quatraro, F. (2010). Knowledge coherence, variety and productivity growth: Manufacturing evidence from Italian regions. Research Policy, 39, 1289–1302.

Reynolds, P., Storey, D. J., & Westhead, P. (1994). Cross-national comparisons of the variation in new firm formation rates. Regional Studies, 28(4), 443–456.

Rigby, D. (2013). Technological relatedness and knowledge space: Entry and exit of U.S. cities from knowledge space. Regional Studies, 49(11), 1922–1937.

Romer, P. M. (1990). Endogenous technological change. The Journal of Political Economy, 98, 71–102.

Saviotti, P. P. (2007). On the dynamics of generation and utilisation of knowledge: The local character of knowledge. Structural Change and Economic Dynamics, 18, 387–408.

Shane, S. (2001). Technological opportunities and new firm creation. Management Science, 47(2), 205–220.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Van Zeebroeck, N. (2011). The puzzle of patent value indicators. Economics of Innovation and New Technology, 20, 33–62.

Van Zeebroeck, N., & van Pottelsberghe, B. (2011). The vulnerability of patent value determinants. Economics of Innovation and New Technology, 20, 283–308.

Venkataraman, S. (1997). The distinctive domain of entrepreneurship research: An editor’s perspective. Advances in Entrepreneurship, Firm Emergence, and Growth, 3, 119–138.

Vivarelli, M. (2004). Are all the potential entrepreneurs so Good? Small Business Economics, 23, 41–49.

Weitzman, M. L. (1998). Recombinant growth. Quarterly Journal of Economics, 113, 331–360.

Wennekers, A. R. M., & Thurik, A. R. (1999). Linking entrepreneurship and economic growth. Small Business Economics, 13, 27–55.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Colombelli, A. The impact of local knowledge bases on the creation of innovative start-ups in Italy. Small Bus Econ 47, 383–396 (2016). https://doi.org/10.1007/s11187-016-9722-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9722-0

Keywords

- New firm formation

- Innovative start-ups

- Knowledge-spillover theory of entrepreneurship

- Recombinant knowledge