Abstract

Microfinance institutions (MFIs) target people excluded from the traditional banking system. By providing start-up capital to these under-financed individuals, they enable a greater number of women to start their own business, particularly in sectors where initial capital requirements are high. Our study follows a portfolio of 3,640 microcredit applicants in France over the 2000–2006 time period, identifying MFI client profiles and bringing to light gender differences in borrowers compared to a wider sample of entrepreneurs. This study shows that the male–female gap found amongst company creators is also maintained amongst the clienteles of MFIs. Empirical results also suggest that gender is a decisive factor regarding the amount of credit provided to borrowers when comparing with other factors in the borrower and firm profile. Thus to a certain extent, MFIs are found to reinforce gender inequalities in France.

Similar content being viewed by others

Notes

In France, 31% of microcredit borrowers are unemployed people.

Data for European countries can be found in European Commission (2008).

For a review of gender inequalities and the risks of poverty and social exclusion in 30 European countries, see European Commission (2006).

To our knowledge, the only study is that of Underwood (2006) for the European Microfinance Network.

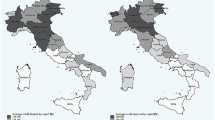

For more details, see Brana and Jegourel (2011).

In France, the durability rate for 3-year-old firms is 70.4% for firms created by men, and 67.7% for firms created by women.

See for example Boden and Nucci (2000).

However, these studies rely on the same database for the United States (SSBFs).

see Carter and Shaw (2006) for the survey.

See Croson and Gneezy (2009) for a survey of gender differences in preferences.

We excluded data from the few businesses created on a family basis.

For Allen et al. (2007), entrepreneurship through necessity refers to people who start their own business because other employment options are either nil or unsatisfactory. They find that necessity entrepreneurship is much more prevalent amongst women than amongst men.

This result confirms the idea that women generally constitute a lower credit risk in microfinance than men (D’Espallier et al. 2010).

The correlation between explanatory variables is very low and the variance inflation factors (VIFs) are low (=1.2).

Even if access to subsidies does not vary statistically depending on gender (cf. Table 2).

Of borrowers with non-zero personal assets.

The gap is smaller between men and women for borrowers without own funds. Within this group, women have projects that are lower than men’s by 10.9% and their microcredit amount is lower by 13%.

See also Eurochambres (2006).

References

Allen, I. E., Langowitz, N., & Minniti, M. (2007). 2006 Report on women and entrepreneurship. UK: Global Entrepreneurship Monitor.

Anderson, S., Carter, S., & Shaw, E. (2001). Women’s business ownership: A review of the academic, popular and internet literature. Small Business Service Research Report, RR002/01. Glasgow: University of Strathclyde.

Barbato, R., & De Martino, R. (2003). Differences between women and men MBA entrepreneurs: Exploring family flexibility and wealth creation as career motivators. Journal of Business Venturing, 18(6), 815–832.

Bellucci, A., Borisov, A., & Zazzaro, A. (2010). Does gender matter in bank-firm relationships? Evidence from small business lending. Journal of Business Banking and Finance, 34(12), 2968–2984.

Bird, B., & Brush, C. (2002). A gendered perspective on organizational creation. Entrepreneurship Theory and Practice, 26(3), 41–65.

Boden, R. J., & Nucci, A. (2000). On the survival prospect of men’s and women’s new business ventures. Journal of Business Venturing, 15(4), 347–362.

Brana, S., & Jegourel, Y. (2011). La réalité de la microfinance à l’échelle régionale: l’exemple de l’Aquitaine. Revue d’économie régionale et urbaine, n°2, 5–28.

Buttner, E. H., & Rosen, B. (1988). Bank loan officers’ perceptions of the characteristics of men, women, and successful entrepreneurs. Journal of Business Venturing, 3(3), 249–258.

Carter, S., Lam, W., Shaw, E., & Wilson, F. (2007). Gender, entrepreneurship, and bank lending, the criteria and processes used by bank loan officers in assessing applications. Entrepreneurship Theory and Practice, 31(3), 427–444.

Carter, S., & Shaw, E. (2006). Women’s business ownership: Recent research and policy developments. DTI Small Business Service Research Report, London, November, pp. 1–96.

Cheston, S. (2007, May). Just the facts, Ma’am’: Gender stories from unexpected sources with morals for microfinance. In ADA dialogue microfinance and gender: New contributions to an old issue, no. 37 (pp. 13–25).

Cole, R. A., & Mehran, H. (2009). Gender and the availability of credit to privately held firms: Evidence from the surveys of small business finances. Staff report no. 383, Federal Reserve Bank of New York.

Coleman, S. (2000). Access to capital and terms of credit: A comparison of men- and women-owned small businesses. Journal of Small Business Management, 38(3), 37–52.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 1–27.

D’Espallier, B., Guérin, I., & Mersland, R. (2010). Women and repayment in microfinance: A global analysis. World Development, 39(5), 758–772.

Danes, S. M., Stafford, K., & Loy, J. T.-C. (2007). Family business performance: The effects of gender and management. Journal of Business Research, 60(10), 1058–1069.

De Bruin, A., Brush, C. G., & Welter, F. (2007). Advancing a framework for coherent research on women’s entrepreneurship. Entrepreneurship Theory and Practice, 31(3), 323–339.

Eurochambres. (2006). How to overcome stereotypes in employment, chambers’ tools and best practices. February: Eurochambres Women Network.

European Commission. (2006). Gender inequalities in the risks of poverty and social exclusion for disadvantaged groups in thirty European countries. Manchester: Expert Group on Gender, Social Inclusion and Employment.

European Commission. (2008). Report on equality between men and women. Luxembourg: Office for Official Publications of the European Communities.

Fabowale, L., Orser, B., & Riding, A. (1995). Gender, structural factors, and credit terms between Canadian small businesses and financial institutions. Entrepreneurship Theory and Practice, 19(4), 41–65.

Fay, M. & Williams, L. (1993). Gender bias and the availability of business loans. Journal of Business Venturing, 8(4), 363–376.

Fernando, J. (Ed.). (2006). Perils and prospects of microfinance. London: Routledge.

Goetz, A., & Gupta, R. S. (1996). Who takes the credit? Gender, power and control over loan use in rural credit programs in Bangladesh. World Development, 24(1), 45–63.

Guérin, I., & Palier, J. (2006). Microfinance and the empowerment of women: Will the silent revolution take place. Finance and the Common Good, 25, 76–82.

Hayen, D., Lahn, S., Lämmermann, S., Guichandut, P., Underwood, T., & Unterberg, M. (2007). Fostering gender equality: Meeting the entrepreneurship & microfinance challenge. European Report.

Insee (2009). Fichier créations et créateurs d’entreprises – Enquête de 2007: la génération 2002 cinq ans après. Insee Résultats, n°39, Economie, Janvier.

Hughes, K. D. (1999). Gender and self-employment in Canada: Assessing trends and policy issues. Ottawa: Canadian Policy Research Networks, CPRN W/04.

Johnsen, G. J., & McMahon, R. G. P. (2005). Owner-manager gender, financial performance and business growth amongst SMEs from Australia’s Business Longitudinal Survey. International Small Business Journal, 23(2), 115–142.

Johnson, S. (2000). Gender impact assessment in microfinance and microenterprise: Why and how. Development in practice, 10(1), 89–93.

Lämmermann, S., & Underwood, T. (2007). Fostering gender equality: Meeting the entrepreneurship & microfinance challenge. Country report, France.

Langowitz, N., & Minniti, M. (2007). The entrepreneurial propensity of women. Entrepreneurship Theory and Practice, 31(3), 341–364.

Marlow, S., & Patton, D. (2005). All credit to men? Entrepreneurship, finance and gender. Entrepreneurship Theory and Practice, 29(6), 717–735.

Mayoux, L. (2007). Not only reaching, but also empowering women: Ways forward for the next microfinance decade. In ADA dialogue, microfinance and gender: New contributions to an old issue no. 37 (pp. 35–60).

Muravyev, A., Talavera, O., & Schäfer, D. (2009). Entrepreneurs’ gender and financial constraints: Evidence from international data. Journal of Comparative Economics, 37(2), 270–286.

Riding, A., & Swift, C. (1990). Women business owners and terms of credit: Some empirical findings of the Canadian experience. Journal of Business Venturing, 5(5), 327–340.

Robb, A., & Wolken, J. (2002). Firm, owner, and financing characteristics: Differences between female- and male-owned small businesses. Finance and economics discussion series, The Federal Reserve Boards, 18, April.

Scalera, D., & Zazzaro, A. (2001). Group reputation and persistent (or permanent) discrimination in credit markets. Journal of Multinational Financial Management, 11(4–5), 483–496.

Underwood, T. (2006, April). Women and microlending in Western Europe. Paris: EMN working paper 2.

Verheul, I., & Thurik, A. R. (2001). Start-up capital: Does gender matter? Small Business Economics, 16(4), 329–345.

Watson, J. (2002). Comparing the performance of male- and female-controlled businesses: Relating outputs to inputs. Entrepreneurship Theory and Practice, 26(3), 91–100.

Watson, J., & Robinson, S. (2003). Adjusting for risk in comparing the performance of male-and female-controlled SMEs. Journal of Business Venturing, 18(6), 773–788.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Brana, S. Microcredit: an answer to the gender problem in funding?. Small Bus Econ 40, 87–100 (2013). https://doi.org/10.1007/s11187-011-9346-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9346-3