Abstract

This paper studies long-term private health insurance (PHI) in Germany. It describes the main actuarial principles of premium calculation and relates these to existing theory. In the German PHI policyholders do not commit to renewing their insurance contracts, but insurers commit to offering renewal at a premium rate that does not reflect revealed future information about the insured risk. We show that empirical results are consistent with theoretical predictions from one-sided commitment models: front-loading in premiums generates a lock-in of consumers, and more front-loading is generally associated with lower rates of lapse. Due to a lack of consumer commitment, dynamic information revelation about risk type implies that high-risk policyholders are more likely to retain their PHI contracts than are low-risk types.

Similar content being viewed by others

Notes

In a competitive market environment where premiums are risk-based, individuals face reclassification risk. Reclassification risk is the risk of an increase in the health insurance premium when the policyholder’s health deteriorates. In health economics, reclassification risk is often referred to as premium risk. See Arrow (1963), Pauly et al. (1995) and Cochrane (1995).

A similar structure can only be found in Chile, which also has public and private options. For a theoretical model and more information on the determinants of the choice of health insurance in Chile, we refer to Sapelli and Torsche (2001).

See Thomson et al. (2002), p. 426.

Government regulation is an alternative way to insure premium risk. When community rating is required, health insurers must impose a somewhat uniform price for all individuals who enroll in their health insurance plans. Community rating is then necessarily associated with (a) open enrollment and (b) compulsory insurance. Open enrollment is necessary to avoid cherry picking by insurers. Compulsory insurance is necessary to ensure cross-subsidization between high and low risks. This is because, if insurance were not compulsory, low risks would prefer to purchase risk-based insurance (or remain uninsured) to avoid cross-subsidizing high risks. Government regulation in this form—a combination of community rating, open enrollment and compulsory insurance—is implemented in Belgium, the Netherlands, and Switzerland, and is part of Enthoven’s (1988) proposal to reform the U.S. health care system. See Kifmann (2002), p. 15. Since our focus is on private health insurance in Germany, we do not further discuss Germany’s SHI system. For a more detailed discussion, the reader is referred to Breyer (2004).

See Hendel and Lizzeri (2003), p. 299.

The existence of a coverage-risk correlation itself is viewed as necessary for adverse selection to be present (and its absence as sufficient for rejecting adverse selection). See, for instance, Chiappori and Salanié (2000). However, it may not always be sufficient to confirm the existence of adverse selection given that this correlation is also suggested by moral hazard theory. See, for instance, the discussion in Cohen and Siegelman (2010), pp. 71–74. To test for adverse selection, individuals facing the same set of choices should be examined. To test for moral hazard, similar individuals facing different coinsurance rates should be examined, where price sensitivity can be measured by using the coinsurance variability across individuals. See, e.g., Cardon and Hendel (2001). A detailed discussion can be found in Cohen and Siegelman (2010).

For a detailed review, see Cutler and Zeckhauser (2000). They review a substantial amount of empirical adverse selection studies in health insurance. Virtually all of these studies support the hypothesis of informational asymmetry in favor of policyholders. While our focus is on health, adverse selection is shown to be present in several other insurance markets. See, for instance, Makki and Somwaru (2001) or Cohen (2005).

To our knowledge, there is no empirical study on adverse selection in the private health insurance market in Germany to date, but Nuscheler and Knaus (2005) examine risk selection within the German social health insurance system. They look at why company-based sickness funds were able to attract many new customers during 1995–2000 and study potential determinants of switching behavior. They find no evidence for selection by sickness funds in German SHI.

Self-employed and civil servants are not compulsorily insured in the SHI system. For the latter, there is an entirely tax-financed plan for civil servants (called “Beihilfe”). Depending on marital status and the number of children, this plan covers 50–70% of health care expenditures with the remainder being covered by an additionally purchased PHI contract. As civil servants would lose these entitlements while staying in the public system, there is a strong incentive to (partially) join the PHI system.

In 2012, for instance, annual income before taxes must exceed 50,850 €.

Most children are insured via their parents’ PHI or SHI contract. However, they might change this status and switch systems or contracts when they enter the job market. For instance, it is possible to pause a PHI contract, when a 16-year-old decides to enter an apprenticeship or other work during which he will be insured in the SHI system. Therefore, there is a choice even for young people in choosing between systems or different PHI contracts.

Note that once a policyholder has entered a PHI contract, he or she cannot simply drop out and reenter the SHI system, regardless of how attractive this seems. The policyholder must stay in the PHI system as long as annual income is above the ceiling. However, it is possible to switch within the system and to choose any other PHI contract offered by either the same or another private health insurer.

Taking also into account 31 comparably very small non-members, the overall number of companies in the market amounts to 76.

See German Association of Private Health Insurers [PKV Verband] (2009/2010), pp. 17,29.

Insurers calculate with a maximum life expectancy of 102. Since life expectancy depends on age and risk type of a policyholder, premiums vary for different ages at entry.

In practice, premiums are not constant but depend on external factors. Premiums would be constant if, for instance, the insurer’s insured community and treatment cost did not change. See Milbrodt (2005).

If the policyholder can prove that the precondition(s) that led the insurer to impose a risk loading is no longer present or has become unimportant, the risk loading can be reduced.

It should be noted that this fact has partly changed since 2009. Since January 2009 private health insurers offer an additional base rate (“Basistarif”). Under certain circumstances, switching into such a contract is possible without losing accumulated aging provisions. Since our empirical study is based on data that were collected before 2009, this new law has no impact on our study and we thus ignore it.

See Fuerhaupter and Brechtmann (2002).

Methods for adjusting aging provisions are regulated. Financial resources for this adjustment stem from separate sources or insurers’ financial surplus.

In this case, individuals can either cancel or pause their PHI contract. Pausing may be attractive if the individual’s work status may change again in the future. Then the individual can reenter the PHI contract at the same conditions. If, however, the person feels that he or she is a low risk and that the SHI system can do equally well, the person may cancel the PHI contract. We take this effect into account in our empirical analysis below.

Note that we observe a given number of policyholders over time. In practice, new policyholders joining the collective tend to dilute these effects.

See Baumann et al. 2006, p. 16.

See Bowers et al. (1997), ch. 2.

See Frees (2010), p. 424.

The logarithmic transformation nearly eliminates the typical undesirable skewness in the distribution of medical expenditures, making the model more robust. In particular, it yields nearly symmetric and roughly normal error distributions, for which the least squares estimate is efficient. See Duan et al. (1983).

Note that we could also predict medical expenditures (without the log scale) but this would require a retransformation to the normal scale. A shortcoming of this procedure is that the error terms in the log expenditures equation are often not normally distributed but still skewed so that normal retransformation estimates are biased. Therefore, the “smearing estimate”, developed by Duan (1983), is often used to estimate the retransformation factor. The smearing estimate is given by the sample average of the exponentiated least squares residuals. Yet estimating expected expenditures in this way complicates our analysis without providing further insights: since there is a positive relationship between expected losses and expected logarithmic losses (and since we only need a risk classification proxy here) we can use predicted expenses on the log scale as a proxy for risk type.

According to Section 6 of the Order of Premium Calculation Methods in Private Health Insurance in Germany (Kalkulationsverordnung - KalV), CpC is defined as average benefits per insured. It needs to be calculated based on age and sex of the policyholder for a given period (a year) and tariff. The calculation of CpC must take into account former claims and actuarial methods mustbe used in order to smooth random fluctuation.

Note that this final age category makes sense when taking into account that, above the age of 55, switching is no longer possible (following German law).

Note that we do not have any information on a policyholder’s chronic conditions and his or her chance of developing such, but we do know whether a policyholder is charged a risk loading on his or her premium at contract entry. The risk loading is taken into account in our Prediction Model which therefore uses this available information on policyholders’ potential decline in future healthstatus.

Note that this is true for over 99.8% of all Germans since the proportion of uninsured people in Germany is below 0.2%. Therefore, we ignore the decision to drop health insurance coverage.

Since we look at the policyholders’ switching behavior, it seems intuitive to consider only adults for the analysis, i.e., policyholders with a minimum age of 18. Therefore, then umber of observations differs from Table 1. Children can be dropped in the Test Model without substantially changing our results. We present the results without children here.

See Rostocker Zentrum fuer demographischen Wandel (2005), p. 78.

Remember that by German law individuals in Age Category 5 are not permitted to switch policies. The seemingly anomalous result that the size of the Age Category 5 coefficients is lessthan the size of the Age Category 4 coefficients is likely attributable to the higher rate of death inAge Category 5 relative to the other Age Categories.

Life insurance contracts are comparatively simple and explicit; health insurance is more sophisticated, and thus asymmetric information seems a more important issue. In contrast to Hendel and Lizzeri (2003), we look at these more sophisticated contracts evolving over time. Inthis context, asymmetric information seems an important problem since distortions due todynamic information revelation on health status can be large. Compared to Hendel and Lizzeri,who found that asymmetric information is not important in the case of life insurance, our resultssuggest that dynamic information revelation in health insurance may involve significant riskselection. This may be particularly the case when premiums include partial risk pooling as in thecase of Germany.

See Frick (1998).

Note that the model easily extends to different risk categories captured by different values of p.

For simplicity, we assume there are no capital markets and that the borrowing rate is higher than the lending rate. Therefore, consumers with higher g are more tightly constrained since their income in period 1 is lower.

As a reference point, we assume that the constrained maximization problem is constructed viafully contingent contracts, i.e., the contracts are fully contingent on future health states. As a result, there is no lapsing. However, the argument can be extended to non-contingent contracts.

See Hendel and Lizzeri (2003), pp. 311–312.

The alternative contracts are associated with equal zero expected profits of insurers since instates \(1,...,s-1\), premiums are actuarially fair and thus insurers are indifferent between retaining and not retaining consumers.

References

Akerlof, G.A. (1970). The market for lemons: qualitative uncertainty and the market mechanism. Quarterly Journal of Economics, 84, 488–500.

Arrow, K.J. (1963). Uncertainty and the welfare economics of medical care. American Economic Review, 53, 941–973.

Baumann, F., Meier, V., Werding, M. (2006). Transferable ageing provisions in individual health insurance contracts. Ifo Working Paper, No. 32, University of Munich.

Bowers, N.L., Gerber, H.U., Hickman, J.C., Jones, D.A., Nesbitt, C.J. (1997). Actuarial mathematics. Schaumburg, IL: Society of Actuaries.

Breyer, F. (2004). How to finance social health insurance: issues in the German reform debate. Geneva Papers on Risk and Insurance, 29(4), 679–688.

Browne, M.J. (1992). Evidence of adverse selection in the individual health insurance market. Journal of Risk and Insurance, 59(1), 13–33.

Browne, M.J. (2006). Adverse selection in the long-term care insurance market. In P.-A. Chiappori, & C. Gollier (Eds.), Competitive failures in insurance markets: Theory and policy implications. CESifo Seminar Series: MIT Press.

Browne, M.J., & Doerpinghaus, H. (1993). Information asymmetries and adverse selection in the market for individual medical expense insurance. Journal of Risk and Insurance, 60(2), 300–312.

Browne, M.J., & Doerpinghaus, H. (1994). Asymmetric information and the demand for medigap insurance. Inquiry, 31(4), 445–450.

Cardon, J.H., & Hendel, I. (2001). Asymmetric information in health insurance: evidence from the national medical expenditure survey. RAND Journal of Economics, 32(3), 408–427.

Chiappori, P.-A., & Salanié, B. (2000). Testing for asymmetric information in insurance markets. Journal of Political Economy, 108, 56–78.

Cochrane, J.H. (1995). Time-consistent health insurance. Journal of Political Economy, 103, 445–473.

Cohen, A. (2005). Asymmetric information and learning: evidence from the automobile insurance market. Review of Economics and Statistics, 87(2), 197–207.

Cohen, A., & Siegelman, P. (2010). Testing for adverse selection in insurance markets. Journal of Risk and Insurance, 77(1), 39–84.

Cutler, D.M., & Reber, S.J. (1998). Paying for health insurance: the trade-off between competition and adverse selection. Quarterly Journal of Economics, 113, 433–466.

Cutler, D.M., & Zeckhauser, R.J. (2000). The anatomy of health insurance. In Culyer, A.J., & Newhouse, J.P. (Eds.), Handbook of health economics (Vol. 1, pp. 563–643). Amsterdam: Elsevier Science.

Crocker, K.J., & Moran, R. (2003). Contracting with limited commitment: evidence from employment-based health insurance contracts. RAND Journal of Economics, 34(4), 694–718.

De Meza, D., & Webb, D.C. (2001). Advantageous selection in insurance markets. RAND Journal of Economics, 32, 249–62.

Dionne, G., & Doherty, N.A. (1994). Adverse selection, commitment, and renegotiation: extension to and evidence from insurance markets. Journal of Political Economy, 102(2), 209–235.

Dionne, G., Doherty, N.A., Fombaron, N. (2001). Adverse selection in insurance markets. In Dionne, G. (Ed.), Handbook of insurance (pp. 185–243). Boston: Kluwer Academic Publishers.

Duan, N. (1983). Smearing estimate: a nonparametric retransformation method. Journal of the American Statistical Association, 78(383), 605–610.

Duan, N., Manning, W.G., Morris, C.N., Newhouse, J.P. (1983). A comparison of alternative models for the demand for medical care. Journal of Economic and Business Statistics, 1, 115–126.

Eekhoff, J., Jankowski, M., Zimmermann, A. (2006). Risk-adjustment in long-term health insurance contracts in Germany. Geneva Papers on Risk and Insurance, 31, 692–704.

Enthoven, A.C. (1988). Theory and practice of managed competition in health care finance. Amsterdam.

Fang, H., Keane, M.P., Silverman, D. (2008). Sources of advantageous selection: evidence from the medigap insurance market. Journal of Political Economy, 116(2), 303–349.

Finkelstein, A., & McGarry, K. (2006). Multiple dimensions of private information: evidence from the long-term care insurance market. American Economic Review, 96, 938–958.

Finkelstein, A., McGarry, K., Sufi, A. (2005). Dynamic inefficiencies in insurance markets: evidence from long-term care insurance. American Economic Review Papers and Proceedings, 95, 224–228.

Frees, E. (2010). Regression modeling with actuarial and financial applications. Cambridge.

Frick, K. (1998). Consumer capital market constraints and guaranteed renewable insurance. Journal of Risk and Uncertainty, 16, 271–278.

Fuerhaupter, R., & Brechtmann, C. (2002). A survey of the private health insurance in Germany. ICA Working Paper.

German Association of Private Health Insurers [PKV Verband] (2009/2010). http://www.pkv.de/publikationen/rechenschafts_und_zahlenberichte/archiv_der_pkv_zahlenberichte/zahlenbericht-2009-2010.pdf. Accessed May 2012.

Harrington, S.E. (2010). The health insurance reform debate. Journal of Risk and Insurance, 77(1), 5–38.

Harris, M., & Holmstrom, B. (1982). A theory of wage dynamics. Review of Economic Studies, (pp. 315–333): XL.

Hendel, I., & Lizzeri, A. (2003). The role of commitment in dynamic contracts: evidence from life insurance. Quarterly Journal of Economics, 118(1), 299–327.

Herring, B., & Pauly, M.V. (2006). Incentive-compatible guaranteed renewable health insurance premiums. Journal of Health Economics, 25, 395–417.

Kifmann, M. (2002). Premium risk in competitive health insurance markets, Tuebingen.

Makki, S.S., & Somwaru, A. (2001). Evidence of adverse selection in crop insurance markets. Journal of Risk and Insurance, 68(4), 685–708.

Manning, W.G., Newhouse, J.P., Duan, N., Keeler, E.B., Leibowitz, A., Marquis, M.S. (1987). Health insurance and the demand for medical care: evidence from a randomized experiment. American Economic Review, 77, 251–277.

Milbrodt, H. (2005). Aktuarielle Methoden der deutschen Privaten Krankenversicherung (Actuarial Methods in German Private Health Insurance). Schriftenreihe Angewandte Versicherungsmathematik. 34, Karlsruhe.

Nuscheler, R., & Knaus, T. (2005). Risk selection in the German public health insurance system. Health Economics, 14(12), 1253–1271.

Pauly, M.V., Kunreuther, H., Hirth, R. (1995). Guaranteed renewability in insurance. Journal of Risk and Uncertainty, 10, 143–156.

Phelps, C. (1976). The demand for reimbursement insurance. In Rossett, R.N. (Ed.), The role of health insurance in health services sector. NBER.

Rosenbrock, S. (2010). Einflussfaktoren für die Entscheidung bei Altersvorsorgeprodukten - IFRS - Gesundheitspolitik Beiträge zur 19. Wissenschaftstagung des Bundes der Versicherten und zum Workshop ‘Junge Versicherungswissenschaft’, Versicherungswissenschaftliche Studien (Vol. 38, 241–265).

Rostocker Zentrum fuer demographischen Wandel. (2005). Deutschland im demographischen Wandel - Fakten und Trends 2005, Vol. 7. (Germany within Demographic Change - Facts and Trends 2005).

Rothschild, M., & Stiglitz, J.E. (1976). Equilibrium in competitive insurance markets: an essay on the economics of imperfect information. Quarterly Journal of Economics, 90, 630–649.

Sapelli, C., & Torsche, A. (2001). The mandatory health insurance system in Chile: explaining the choice between public and private insurance. International Journal of Health Care Finance and Economics, 1, 97–110.

Thomson, S., Busse, R., Mossialos, E. (2002). Low demand for substitutive voluntary health insurance in Germany. Croatian Medical Journal, 43(4), 425–432.

Wilson, C. (1977). A model of insurance markets with incomplete information. Journal of Economic Theory, 16, 167–207.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

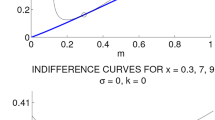

Consider a competitive two-period health insurance market with a high number of buyers and sellers. Buyers wish to insure potentially worse health states in the future. A health status can be described as a certain probability of suffering medical loss and a certain severity of the loss in the event the individual experiences medical loss. In the first period, individuals are identical with regard to loss probability and severity, i.e., they face identical medical expenses m in case of illness, and they have identical probability p of suffering an illness.Footnote 41 In period 2, multiple health statuses are possible so that policyholders differ in both their probability \(p_{i}\) of experiencing some medical loss and the severity or size of the loss. If an individual is in health status i in period 2, he or she faces potential medical loss \(m_{2}^{i}\), which may represent physician visits, time and money invested in obtaining treatment, etc. We order health states so that \(p_{1}<p_{2}<...<p_N\) and \(m_{2}^{1}<m_{2}^{2}<....<m_{2}^N\) and assume \(p\leq p_{1}\) and \(m\leq m_{2}^{1}\), i.e., health worsens over time in both frequency and severity. The probability of being in health state i is given by \(\pi _{i}\). Individuals’ utility function is \(u(c)\) when they consume \(c \geq 0\) in each period. Individuals are risk-averse: the utility function is strictly concave and twice continuously differentiable.

Period 1 involves three stages: first, insurers offer contracts; second, buyers choose a contract; third, uncertainty about medical loss is revealed and consumption takes place. Period 2 involves four stages: first, uncertainty about a policyholder’s health status is revealed. The realized health status of a policyholder can be observed by the insurer. The following stages are equivalent tostages 1 to 3 in the first period.

A first-period premium consists of a first-period premium \(P_{1}\) and coverage amount \(C_{1}\), and a vector of premiums and coverage amounts \((P_{2}^{1},C_{2}^{1})...(P_{2}^N,C_{2}^N)\) indexed by the second-period health states. Thus a first-period contract is a long-term contract to which the insurer unilaterally commits. In contrast, the second-period contract is ashort-term contract. Note that a short-term contract may depend on information revealed at the beginning of the second period. It consists of a premium and coverage amount \((P_{2}^{i},C_{2}^{i})\) indexed by second-period health status. There is one-sided commitment: insurers can commit tofuture premiums while consumers freely choose between staying with their period 1 contract and switching to a competitor offering a short-term spot contract in period 2.

Consumer heterogeneity is given by differences in the income process. We assume that consumers differ in income growth. While some minimum income \(\tilde {y}\) is needed in order to enter into a PHI contract, consumers with minimum income \(\tilde {y}\) may differ in income growth. To capture this, we assume that a consumer receives an income of \(y-g \geq \tilde {y}\) in the first period and \(y+g\) in the second period, and the variation in consumers’ income growth is represented by \(g>0\). In our model, \(\tilde {y}\) represents the minimum income needed in order to enter the PHI market.Footnote 42

In competitive equilibrium, allocations maximize individuals’ expected utility subject to a zero expected profit constraint and a set of no-lapse constraints that capture individuals’ in ability to commit to the PHI contract. Solving this constrained maximization problem gives the set of prices and coverage amounts that must be available to individuals in a competitive PHI market.Footnote 43

In equilibrium, premiums and coverage amounts that are fully contingent on health states, \((P_{1},C_{1})\), and \((P_{2}^{1},C_{2}^{1})...(P_{2}^N,C_{2}^N)\) must maximize individuals’ expected utility:

subject to a zero profit constraint (i.e., contracts break even on average)

and no-lapse constraints imposed by lack of consumer commitment: for all possible future health states, \(i=1,...N\), and for all \(\tilde {P}_{2}^{i},\tilde {C}_{2}^{i}\) such that \(\tilde {P}_{2}^{i}-p_{i} \tilde {C}_{2}^{i}>0\), we must have \(EU(P_{2}^{i},C_{2}^{i})\geq EU(\tilde {P}_{2}^{i},\tilde {C}_{2}^{i})\) or equivalently

The no-lapse constraints imply that an equilibrium contract is such that there isno other contract that is profitable and offers potential buyers higher expectedutility in any state of period 2. We refer to the actuarially fair premium that guarantees full insurance in health state i and guarantees zero expected profits as \(P_{2}^{i}(FI)\).

Proposition 1

In the equilibrium set of contracts:

-

(i)

All consumers obtain full insurance in period 1 and for all health states of period 2.

-

(ii)

For health states s and worse, premiums are capped at a price that is below the fair price for each of these states, i.e. for every g there is an s such that \(P_{2}^{i}=P_{2}^{i}(FI)\) for \(i=1,...,s-1\) and \(P_{2}^{i}<P_{2}^{i}(FI)\) for \(i=s+1,...,N\).

-

(iii)

Insurance contracts are front-loaded as long as g is not “too high”. That is, there is a \(\hat {g}\) such that, if \(g<\hat {g}\) , then PHI contracts involve front-loading.

-

(iv)

More front-loaded contracts appeal to buyers with higher first-period income (i.e. consumers with lower g who find front-loading less costly). Contracts with higher \(P_{1}\) involve a lower cutoff s. Policyholders with higher income growth g choose PHI contracts with less front-loading.

-

(v)

Consumers are eligible for PHI as long as g is not “too high”. That is, there is a \(\tilde {g}\) so that \(y-\tilde {g}<\tilde {y}\) and the consumer drops out of the PHI market.

Proof of Proposition 1

We can replace the set of constraints (10) with the following simpler set

This is because if \(P_{1}\), \(C_{1}\), \((P_{2}^{1},C_{2}^{1})...(P_{2}^N,C_{2}^N)\) maximize Eq. 8 subject to Eqs. 9 and 11 then there is no state i and no \((\tilde {P}_{2}^{i},\tilde {C}_{2}^{i})\) that results in positive expected profits and offers consumers a higher expected utility in state i. Hence, Eq. 10 is satisfied. Conversely, if \((P_{2}^{i},C_{2}^{i})\) are such that Eq. 11 is violated, then Eq. 10 is violated as well since a competing company may offer terms slightly better for consumers than \((P_{2}^{i},C_{2}^{i})\) while still making positive expected profits.

Let \(\mu \) be the Lagrange multiplier for the constraint in Eq. 9 and \(\lambda _{i}\) be the multiplier for the ith constraint in Eq. 11. Then the Lagrangian is

and the first-order conditions for an optimum are given by

Combining first-order conditions (12) and (13) gives \(C_{1}=m\) which implies full insurance in period 1. Combining conditions (14) and (15) results in \(m_{2}^{i}=C_{2}^{i} \forall i \) which implies full insurance in all states of period 2. This proves part (i) of Proposition 1.

To prove part (ii), note that if constraint i in Eq. 11 is binding, then \(P_{2}^{i}=p_{i} C_{2}^{i}\) which implies actuarially fair insurance. It follows that if i and j are two binding constraints and \(i>j\) (and thus \(p_{i}>p_{j}\) and \(m_{2}^{i}>m_{2}^{j}\)) then it must be that \(P_{2}^{i}>P_{2}^{j}\). In contrast, if k in Eq. 11 is non-binding, then \(P_{2}^{k}<p_{k} C_{2}^{k}\) and thus \(\lambda _{k}=0\). Then Eq. 14 reduces to

As a result, if constraints k and l are non-binding, then \(P_{2}^{k}=P_{2}^{l}\). If in contrast constraint i in Eq. 11 is binding, then Eq. 14 becomes

where the inequality on the right-hand side holds because \(\lambda _{i}<0\) if constraint i in Eq. 11 is binding. As a consequence, if constraint i is binding and k is not, it follows that \(P_{2}^{i}<P_{2}^{k}\). Finally, we show that if i is binding and k is not, then \(i<k\). To see this, note that since k is non-binding, we have \(P_{2}^{k}<p_{k} C_{2}^{k}\), which, together with \(P_{2}^{i}<P_{2}^{k}\), leads to

Assume \(i>k\). Then \(C_{2}^{i}>C_{2}^{k}\) (due to \(m_{2}^{i}>m_{2}^{k}\)) and \(p_{i}>p_{k}\). This would render \(P_{2}^{i}<P_{2}^{k}\) impossible and sowe must have \(i<k\). This proves part (ii).

To show that part (iii) holds, we need to show that the first-period premium \(P_{1}\) is larger than the actuarially fair premium \(P_{1}(FI)\). If any of the no-lapse constraints (11) is nonbinding, then\(P_{1}>P_{1}(FI)\) is immediate from the zero expected profit condition (9) above. Assume instead that all no-lapse constraints in Eq. 11 are binding. Keeping in mind full insurance in optimum and then substituting Eq. 12 into Eq. 14, we obtain

which, since \(\lambda _{i}<0\) if all no-lapse constraints are binding, gives \(P_{1}>P_{2}^N(FI)-2g=p_N \cdot m_{2}^N-2g\). This inequality requires that \(P_{1}>P_{1}(FI)\) if g is small enough since \(p_N>p\) and \(m_{2}^N>m\).

To prove part (iv), note that as g increases, more and more of the no-lapse constraints become binding and thus as g grows so does the cutoff s. When s becomes larger, \(P_{1}\) decreases.

Finally, part (v) is obvious from our assumptions. □

Following Hendel and Lizzeri (2003), Proposition 1 can be extended to non-contingent contracts.Footnote 44 A non-contingent contract is also an equilibrium contract if a consumer for whom the contingent contract is optimal can obtain the same utility from the noncontingent contract (in each state), and insurance companies earn the same profits. In states \(i=1,...,s-1\), premiums and coverage amounts of the contingent contract equal those offered on the spot market. Fixing the terms of the non-contingent contract to be the same as those of the contingent contract in the first period and in the bad states of the second period (i.e. states \(s,...,N\)), both contracts are equivalent except for states \(1,...,s-1\), in which the contingent contract offers better terms. Note, however, that a consumer can drop out of the alternative non-contingent contract and purchase spot contracts. As a result, the alternative contracts are equivalent.Footnote 45 Taking into account equivalence of contingent and non-contingent contracts, we state:

Proposition 2

Consider two PHI contracts that are offered in period 1 and not contingent on the health state in period 2. In competitive equilibrium, the contract with the higher first-period premium is chosen by those consumers with lower income growth (i.e., higher first-period income \(y-g\)), and has lower lapse rates.

Proof of Proposition 2

The proof follows Hendel and Lizzeri (2003). The contract with the higher first-period premium must involve a lower second-period premium, otherwise no consumer would chooseit. Thus, in the second period this contract retains a healthier pool of consumers (since a higher \(P_{1}\) involves a lower cutoff s). This implies that the average cost of this contract is lower. Under competition (and due to the equivalence principle used in German PHI premium calculations), the present value of the premiums must be lower. Proposition 1 implies that the contract with the higher first-period premium is chosen by consumers with lower income growth. □

Rights and permissions

About this article

Cite this article

Hofmann, A., Browne, M. One-sided commitment in dynamic insurance contracts: Evidence from private health insurance in Germany. J Risk Uncertain 46, 81–112 (2013). https://doi.org/10.1007/s11166-012-9160-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-012-9160-6