Abstract

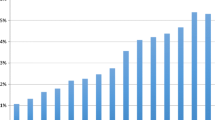

We examine the informational efficiency of size-based US exchange traded funds (ETFs) and comparable Center for Research in Security Prices portfolios. ETFs are better suited for market efficiency tests since they avoid potential asynchronous trading problems, and their negligible bid-ask spreads greatly diminish noise due to the bid-ask bounce. Variance ratio analysis demonstrates that return autocorrelations have diminished significantly over the past decade. Granger causality tests reject the presence of lead-lag effects among size-based ETFs. However, volatility spills over from large firm ETFs to those of smaller firms, and these spillovers extend to ETF option implied volatilities.

Similar content being viewed by others

Notes

The grand average of yearly closing bid-ask spreads for the ETFs considered in this study is 0.073 %, but only 0.021 % since 2003, and even smaller in recent years.

An online search for studies that reference Lo and Mackinlay (1988) results in 2,260 citations, 277 of which occurred since 2010, so their findings and methodology remain as relevant as ever.

Although the small cap Russell ETF (IWC) is correlated with the smallest CRSP portfolio at a slightly higher level than IWM (0.95 vs. 0.87), data for this ETF is available only since its inception in August 2005. We use IWM rather than IWC since it has a longer time-series available. IWC is highly correlated with IWM and yields similar results.

The figures are even lower for NYSE/AMEX firms. The mean (median) effective bid-ask spread for these stocks is 0.76 (0.34) % in 2007 for these firms compared to a mean (median) of 1.64 (0.94) % in 1999.

References

Avramov D, Chordia T, Goyal A (2006) The impact of trades on daily volatility. Rev Financ Stud 19:1241–1277

Badrinath SG, Kale JR, Noe TH (1995) Of shepherds, sheep, and the cross-autocorrelations in equity returns. Rev Financ Stud 8:401–430

Ben-David I, Franzoni FA, Moussawi R (2012) ETFs, arbitrage, and shock propagation. Ohio State University working paper

Boudoukh J, Richardson MP, Whitelaw RE (1994) A tale of three schools: insights on autocorrelations of short-horizon stock returns. Rev Financ Stud 7:539–573

Bradley H, Litan R (2010) Choking the recovery: why new growth companies aren’t going public and unrecognized risks of future market disruptions. Ewing Marion Kauffman Foundation, USA

CFTC-SEC (2010a) Preliminary findings regarding the market events of May 6, 2010. 18 May 2010, U.S. Government Printing Office, Washington, DC

CFTC-SEC (2010b) Findings regarding the market events of 6 May 2010. 30 Sept 2010, U.S. Government Printing Office, Washington, DC

Charles A, Darné O (2009) Variance-ratio tests of random walk: an overview. J Econ Surv 23:503–527

Cheng LTW, Fung H-G, Tse Y (2008) China’s exchange traded fund: is there a trading place bias? Rev Pac Basin Financ Mark Polic 11:61–74

Chordia T, Sarkar A, Subrahmanyam A (2011) Liquidity dynamics and cross-autocorrelations. J Financ Quant Anal 46:709–736

Chung KH, Zhang H (2013) A simple approximation of intraday spreads using daily data. J Financ Mark. http://dx.doi.org/10.1016/j.finmar.2013.02.004

Cochrane JH (2008) The dog that did not bark: a defense of return predictability. Rev Financ Stud 21:1533–1575

Conrad C, Karanasos M (2010) Negative volatility spillovers in the unrestricted ECCC-GARCH model. Econ Theory 26:838–862

Conrad J, Kaul G (1988) Time-variation in expected returns. J Bus 61:409–425

Conrad J, Gultekin MN, Kaul G (1991) Asymmetric predictability of conditional variances. Rev Financ Stud 4:597–622

Datar V, So R, Tse Y (2008) Liquidity commonality and spillover in the US and Japanese markets: an intraday analysis using exchange-traded funds. Rev Quant Financ Acc 31:379–393

Easley D, de Prado M, O’Hara M (2011) The microstructure of the “flash crash”: flow toxicity, liquidity crashes, and the probability of informed trading. J Portf Manag 37:118–128

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20:339–350

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25:383–417

Fama EF, French KR (1988) Permanent and temporary components of stock prices. J Polit Econ 96:246–273

Fargher NL, Weigand RA (1998) Changes in the stock price reaction of small firms to common information. J Financ Res 21:105–121

French KR, Roll R (1986) Stock return variances: the arrival of information and the reaction of traders. J Financ Econ 17:5–26

Glosten LR, Jagannathan R, Runkle DE (1993) On the relation between the expected value and the volatility of the nominal excess return on stocks. J Finance 48:1779–1801

Goyal A, Santa-Clara P (2003) Idiosyncratic risk matters! J Finance 58:975–1007

Griffin JM, Kelly PJ, Nardari F (2010) Do market efficiency measures yield correct inferences? A comparison of developed and emerging markets. Rev Financ Stud 23:3225–3277

Haugen RA (2010) The new finance: overreaction, complexity and uniqueness, 4th edn. Prentice Hall, Upper Saddle River, NJ

Henry ÓT, Sharma J (1999) Asymmetric conditional volatility and firm size: evidence from Australian equity portfolios. Aust Econ Papers 38:393–406

Hibbert AM, Daigler RT, Dupoyet B (2008) A behavioral explanation for the negative asymmetric return–volatility relation. J Bank Finance 32:2254–2266

Hoque HAAB, Kim JH, Pyun CS (2007) A comparison of variance ratio tests of random walk: a case of Asian emerging stock markets. Int Rev Econ Finance 16:488–502

Hou K (2007) Industry information diffusion and the lead-lag effect in stock returns. Rev Financ Stud 20:1113–1138

Hseu M-M, Chung H, Sun E-Y (2007) Price discovery across the stock index futures and the ETF markets: intra-day evidence from the S&P 500, Nasdaq-100 and DJIA indices. Rev Pac Basin Financ Mark Polic 10:215–236

Jegadeesh N, Titman S (1995) Short-horizon return reversals and the bid-ask spread. J Financ Intermed 4:116–132

Jensen MC (1978) Some anomalous evidence regarding market efficiency. J Financ Econ 6:95–101

Keim DB, Stambaugh RF (1986) Predicting returns in the stock and bond markets. J Financ Econ 17:357–390

Llorente G, Michaely R, Saar G, Wang J (2002) Dynamic volume-return relation of individual stocks. Rev Financ Stud 15:1005–1047

Lo AW, MacKinlay AC (1988) Stock market prices do not follow random walks: evidence from a simple specification test. Rev Financ Stud 1:41–66

Lo AW, MacKinlay AC (1990) An econometric analysis of nonsynchronous trading. J Econ 45:181–211

Malinova K, Park A (2011) Trading volume in dealer markets. J Financ Quant Anal 45:1447–1484

Mech TS (1993) Portfolio return autocorrelation. J Financ Econ 34:307–344

O’Hara M, Ye M (2011) Is market fragmentation harming market quality? J Financ Econ 100:459–474

Saffi PAC, Sigurdsson K (2011) Price efficiency and short selling. Rev Financ Stud 24:821–852

Simpson M, Moreno J, Ozuna T (2012) The makings of an information leader: the intraday price discovery process for individual stocks in the DJIA. Rev Quant Financ Acc 38:347–365

Tse Y, Bandyopadhyay P, Shen YP (2006) Intraday price discovery in the DJIA Index markets. J Bus Financ Acc 33:1572–1585

Wright JH (2000) Alternative variance-ratio tests using ranks and signs. J Bus Econ Stat 18:1–9

Wurgler JA (2011) On the economic consequences of index-linked investing. In: Rosenfeld G, Lorsch JW, Khurana R (eds) Challenges to business in the twenty-first century. American Academy of Arts and Sciences, Cambridge, MA, pp 20–34

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kadapakkam, PR., Krause, T. & Tse, Y. Exchange traded funds, size-based portfolios, and market efficiency. Rev Quant Finan Acc 45, 89–110 (2015). https://doi.org/10.1007/s11156-013-0429-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-013-0429-x