Abstract

This paper considers a polluting firm, subject to environmental policy, who seeks to deter the entry of potential competitors. We investigate under which conditions firm profits are enhanced by regulation. We show that, contrary to common belief, inefficient firms may support environmental regulation when their production is especially polluting. In addition, we evaluate how this result is affected by the regulator’s prior beliefs accuracy and the environmental damage from pollution.

Similar content being viewed by others

Notes

Maloney and McCormick (1982) show that when marginal cost of abatement is sufficiently steep, environmental regulation under complete information can increase industry profits.

Maloney and McCormick (1982) empirically analyze which firms support environmental regulation in different U.S. industries, such as textile mills and smelting plants for cooper, lead and zinc. Their study shows that, while these firms are subject to a costly regulation, their market share increases, potentially indicating larger profits.

Denicolò (2008) also examines a signaling model, in which a firm decides whether to acquire advanced technology in order to convey its costs of regulatory compliance to an uninformed regulator. However, firms are always active in the industry, and thus entry deterrence cannot arise. In addition, Denicolò (2008) does not allow for the regulator to sustain different beliefs about the incumbent’s costs. Other studies considering firms’ incentives to signal its costs to a regulator in order to raise rivals’ costs include Heyes (2005) and Lyon and Maxwell (2016).

Espinola-Arredondo and Munoz-Garcia (2013) considers a signaling model in which the regulator perfectly observes the incumbent’s costs and, as a consequence, the only uninformed agent is the potential entrant. In contrast, Espinola-Arredondo and Munoz-Garcia (2015) extends that model to allow for the regulator to have access to different beliefs.

This is a common assumption in the literature of entry-deterrence without regulation, often justified by the lack of experience of the potential entrant in the industry. When environmental regulation is present, this assumption can be rationalized on the basis of the newcomer’s inexperience in complying with the administrative and legal details of the policy.

If environmental regulation uses, instead, a production quota, potential entrants would only observe one signal, i.e., the production level corresponding to the quota. In that setting, environmental policy would nullify the signaling role of the incumbent’s output.

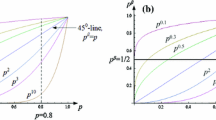

For simplicity, Fig. 1 considers costs \(c_{H}=1/3\), \(c_{L}=1/4\), and no discounting. These cost parameters allow for the separating equilibrium to arise, i.e., \(c_{H}<\frac{\sqrt{3\delta }+(1+2d)c_{L}}{\sqrt{3\delta }+(1+2d) }\). For our numerical example such inequality becomes \(\frac{1}{3}<\frac{4 \sqrt{3}+(1+2d)}{4\sqrt{3}+4(1+2d)}\), which holds for all \(d>\frac{1}{2}\). Other parameter combinations yield similar results and can be provided by the authors upon request.

When \(d=0.51\) emission fees are close to zero. Figure 3 shows that our results predict that \(\pi _{SE}^{L,R}(\rho )<\pi _{CI}^{L,R}\) for all values of \(\rho \), resembling that in standard entry-deterring models without regulation.

In particular, for the PE to arise: (1) the high-cost incumbent must be sufficiently symmetric to the low-cost firm, since otherwise its mimicking effort would be too costly; and (2) the efficiency loss that the regulator generates by “ overtaxing” the high-cost incumbent must be small.

Parameter \(\rho \) affects, however, the regulator’s willingness to support the high-cost incumbent in its concealing strategy. In particular, the regulator behaves as prescribed in this PE if the savings in entry costs arising from deterring entry exceed the (expected) inefficiencies from setting a stringent fee \(t_{1}^{L}\) on a firm which could possibly have high production costs.

References

Denicolò, V. (2008). A signaling model of environmental overcompliance. Journal of Economic Behavior and Organization, 68, 293–303.

Espinola-Arredondo, A., & Munoz-Garcia, F. (2013). When does environmental regulation facilitate entry-deterring practices? Journal of Environmental Economics and Management, 65(1), 133–152.

Espinola-Arredondo, A., & Munoz-Garcia, F. (2015). Can poorly informed regulators hinder competition? Environmental and Resource Economics, 61(3), 433–461.

Farzin, Y. H. (2003). The effects of emission standards on industry. Journal of Regulatory Economics, 24, 315–327.

Harrington, J. E, Jr. (1986). Limit pricing when the potential entrant is uncertain of its cost function. Econometrica, 54, 429–437.

Harrington, J. E, Jr. (1987). Oligopolistic entry deterrence under incomplete information. RAND Journal of Economics, 18(2), 211–231.

Heyes, A. G. (2005). A signaling motive for self-regulation in the shadow of coercion. Journal of Economics and Business, 57, 238–246.

Laffont, J. J., & Tirole, J. (1988). The dynamics of incentive contracts. Econometrica, 56(5), 1153–1175.

Lieberman, M. (1987). Excess capacity as a barrier to entry: an empirical appraisal. The Journal of Industrial Economics, 35(4), 607–627.

Lieberman, M. (2001). The magnesium industry in transition. Review of Industrial Organization, 19(1), 71–80.

Lyon, T., & Maxwell, J. (2016). Self-Regulation and regulatory discretion: Why firms may be reluctant to signal green. Advances in Strategic Management (forthcoming).

Maloney, M., & McCormick, R. (1982). A positive theory of environmental quality regulation. Journal of Law and Economics, 25(1), 99–124.

Milgrom, P., & Roberts, J. (1982). Predation, reputation, and entry deterrence. Journal of Economic Theory, 27, 280–312.

Palmer, K., Oates, W. E., & Portney, P. R. (1995). Tightening environmental standards: The benefit-cost or the no-cost paradigm? The Journal of Economic Perspectives, 9(4), 119–132.

Ridley, D. B. (2008). Herding versus hotelling: market entry with costly information. Journal of Economics and Management Strategy, 17(3), 607–631.

Schoonbeek, L., & de Vries, F. P. (2009). Environmental taxes and industry monopolization. Journal of Regulatory Economics, 36, 94–106.

Schultz, C. (1999). Limit pricing when incumbents have conflicting interests. International Journal of Industrial Organization, 17, 801–825.

Acknowledgments

We are very grateful to the editor, Michael Crew, and two anonymous referees for their valuable comments and their constructive suggestions. We would also like to thank all participants of the 13th International Industrial Organization Conference, especially to Ramya Shankar for her insightful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Appendix 1: Convex production costs

We examine how our equilibrium results are affected by the consideration of convex production costs, i.e., every firm’s costs become \(c_{K}\cdot q^{2}\) where \(K=\{H,L\}\). In particular, we first identify output levels under complete information and under the separating equilibrium. Next we evaluate the low-cost incumbent separating effort (as in Lemma 1), its profits under the separating equilibrium \(\pi _{SE}^{L,R}(\rho )\) (as in Lemma 2) and, finally, the profit difference \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\) (as in Proposition 1).

1.1.1 Complete information

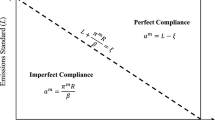

When the incumbent maximizes its first-period profits, \((1-q)q-c_{K}q^{2}-t_{1}q\), it obtains an output function \( q^{K}(t_{1})=\frac{1-t_{1}}{2(1+c_{K})}\). The socially optimal output in this context is \(q_{K}^{SO}=\frac{1}{1+2d+2c_{K}}\). Hence, the regulator sets an emission fee \(t_{1}\) that solves \(\frac{1-t_{1}}{2(1+c_{K})}=\frac{1 }{1+2d+2c_{K}}\), i.e., \(t_{1}^{K}=\frac{2d-1}{1+2d+2c_{K}}\), ultimately yielding an output level \(q^{K}(t_{1}^{K})=q_{K}^{SO}\).

1.1.2 Separating equilibrium

Espinola-Arredondo and Munoz-Garcia (2015), Appendix 2, shows that under convex production costs the low-cost incumbent selects an output function \( q^{A}(t_{1})=\frac{\left( 1-t_{1}\right) \left( 1+2d+2c_{inc}^{H}\right) +\left( 1+c_{inc}^{H}\right) \sqrt{3\delta }}{2\left( 1+c_{inc}^{H}\right) \left( 1+2d+2c_{inc}^{H}\right) }\), and that the regulator, anticipating such output, sets an emission fee \(t_{1}^{*}\). The expression of the emission fee is, however, intractable and thus we next provide it evaluated at the same parameter values considered throughout the paper, \(c_{H}=1/3\), \( c_{L}=1/4\) and \(\delta =1\).

where \(A\equiv 5+6d\). At these parameter values, the low-cost incumbent is, thus, induced to produce

in the separating equilibrium, and \(q^{L}(t_{1}^{L})=\frac{2}{3+4d}\) in the complete information context. Hence, the separating effort is \(q^{A}\left( t_{1}^{*}\right) -q^{L}(t_{1}^{L})\). Figure 6 evaluates the separating effort at the same environmental damages as Fig. 1. Hence, convex costs also yield a separating effort that increases in \(\rho \), and experiences a downward shift as d increases. Unlike with linear costs, the separating effort is larger under convex costs, given that marginal costs are lower than in the linear case.

Equilibrium profits for the low-cost incumbent, \(\pi _{SE}^{L,R}(\rho )\), are also intractable, but for the above parameter values become

when \(d=0.51\), \(\frac{1134+\rho \left[ 117+9\sqrt{3}\left( 9+3\rho \right) -302\rho \right] }{9\left( 18+\rho \right) ^{2}}\) when \(d=3/4\), and \(\frac{ 75816+432\rho (11+27\sqrt{3})+\rho ^{2}\left( 972\sqrt{3}-10883\right) }{ 324\left( 27+\rho \right) ^{2}}\) when \(d=1.5\). Figure 7 depicts these profits as a function of \(\rho \), showing that profits reach a maximum at \( \rho _{1}\cong 0.01\) when \(d=0.51\), but increases to \(\rho _{1}\cong 0.25\) at \(d=3/4\), and to \(\rho _{1}\cong 1\) when \(d=1.5\); thus reflecting a similar pattern as when production costs are linear.

We now compare equilibrium profits under the separating equilibrium and complete information, \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\), where \(\pi _{SE}^{L,R}(\rho )\) was obtained above and \(\pi _{CI}^{L,R}\left( q_{L}^{SO}\right) =\frac{(1+\delta )\left[ 8(d+c_{L})-1\right] }{ 4(1+2d+2c_{L})^{2}}\), which becomes \(\frac{3175}{7938}\) when \(d=0.51\), \( \frac{7}{18}\) when \(d=3/4\), and \(\frac{26}{81}\) when \(d=1.5\). The profit difference as a function of \(\rho \) is depicted in Fig. 8, illustrating that the value of \(\rho \) for which \(\pi _{SE}^{L,R}(\rho )=\pi _{CI}^{L,R}\left( q_{L}^{SO}\right) \), \(\rho _{2}\), increases in d, as in the case of linear costs.

1.1.3 Pooling equilibrium

Let us next analyze the pooling equilibrium (PE) under convex production costs. Specifically, we first find the high-cost incumbent profits, \(\pi _{PE}^{H,R}\) (as in Lemma 3), and compare them relative to complete-information profits, \(\pi _{CI}^{H,R}\) (as in Proposition 2).

Under the PE, in the first period, the high-cost incumbent produces according to the low-cost output function \(q^{L}(t_{1})=\frac{1-t_{1}}{ 2(1+c_{L})}\) and the regulator sets a fee \(t_{1}^{L}=\frac{2d-1}{1+2d+2c_{L}} \) that helps the incumbent conceal its type. In the second period, since entry is deterred, the incumbent produces monopoly output and regulation is set accordingly. Hence, its profits are

which are constant in \(\rho \). In addition, for the above parameter values, \( \pi _{PE}^{H,R}\) is monotonically decreasing in damage d. Intuitively, the negative effect of a more stringent fee dominates its positive effect (ameliorating the incumbent’s mimicking effort), as this effort is cheaper under convex than linear costs, i.e., marginal costs are lower for all inframarginal units.

Finally, comparing \(\pi _{PE}^{H,R}\) against \(\pi _{CI}^{H,R}\), where \(\pi _{CI}^{H,R}=\frac{(4+\delta )(1+c_{H})}{4(1+2d+2c_{H})^{2}}\) we obtain that their difference is

which for our parameter values yields \(\pi _{PE}^{H,R}>\pi _{CI}^{H,R}\) for all values of d.

Proof of Lemma 1

The output difference \(q^{A}(t_{1}^{*})-q^{L}(t_{1}^{L})\) is positive if \(c_{H}<\frac{\sqrt{3\delta }+2c_{L}}{\sqrt{3\delta }+2}\equiv \alpha _{A}\), a cutoff that originates at \(c_{H}=\frac{\sqrt{3\delta }}{\sqrt{3\delta }+2}\) when \(c_{L}=0\) and reaches \(c_{H}=1\) when \(c_{L}=1\). In addition, cutoff \( \alpha _{A}\) satisfies \(\alpha _{A}>\alpha _{1}\equiv \frac{\sqrt{3\delta } +(1+2d)c_{L}}{\sqrt{3\delta }+(1+2d)}\) since \(\alpha _{1}\) originates at \( c_{H}=\frac{\sqrt{3\delta }}{\sqrt{3\delta }+(1+2d)}\) and reaches \(c_{H}=1\) when \(c_{L}=1\), and their vertical intercepts satisfy \(\frac{\sqrt{3\delta } }{\sqrt{3\delta }+(1+2d)}<\frac{\sqrt{3\delta }}{\sqrt{3\delta }+2}\) since \( d>1/2\). Hence, for all parameter values in which the SE exists, \(\alpha <\alpha _{1}\), the output difference \(q^{A}(t_{1}^{*})-q^{L}(t_{1}^{L})\) is positive. Finally, the output difference increases in \(\rho \), reaches its highest value, \(\frac{\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})}{2(1+2d)}\) , when \(\rho =1\); and collapses to zero when \(\rho =0\). \(\square \)

Proof of Lemma 2

First-period profits in the SE are \(\left( 1-q^{A}(t_{1}^{*})\right) q^{A}(t_{1}^{*})-c_{L}\cdot q^{A}(t_{1}^{*})\), and rearranging yields

where \(\lambda \equiv \rho c_{H}(2+\sqrt{3\delta })\). Differentiating with respect to \(\rho \), yields \(\frac{[\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})][ \lambda +c_{L}(1-2d-2\rho )-(1+\sqrt{3\delta }\rho -2d)]}{2(1+2d)^{2}}\) which is zero if \(\rho =\frac{\left( 1-2d\right) \left( c_{L}-1\right) }{ \sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})}\equiv \rho _{1}\). In addition, cutoff \(\rho _{1}\) increases in d. That is, \(\frac{\partial \rho _{1}}{ \partial d}=\frac{2(1-c_{L})}{\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})}>0\) if \(\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})>0\) or \(c_{H}<\frac{\sqrt{3\delta } +2c_{L}}{\sqrt{3\delta }+2}\equiv \overline{c_{H}}\) which always is satisfied since the cost parameter that supports the separating equilibrium is \(c_{H}<\frac{\sqrt{3\delta }+(1+2d)c_{L}}{\sqrt{3\delta }+(1+2d)}< \overline{c_{H}}.\) \(\square \)

Proof of Proposition 1

Profits in the SE, \(\pi _{SE}^{L,R}\left( \rho \right) \), are

since \(x_{inc}^{L}(t_{1}^{L})=\frac{1-c_{L}}{1+2d}\), \(\pi _{SE}^{L,R}\left( \rho \right) \) simplifies

where \(\Gamma \equiv -\sqrt{3\delta }(1-c_{H})\) and \(\gamma \equiv 2(c_{H}-c_{L})\). Under CI, profits \(\pi _{CI}^{L,R}=(1+\delta )\frac{ 2d(1-c_{L})^{2}}{(1+2d)^{2}}\). Hence, the profit difference \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\) is

which becomes zero for all \(\rho \ge \rho _{2}\), where \(\rho _{2}\equiv \frac{2(1-2d)(1-c_{L})(\Gamma +\gamma )}{3\delta (1-c_{H})^{2}+2\Gamma \gamma +\gamma ^{2}}\). In addition, cutoff \(\rho _{2}\) is positive for all feasible values of d, and \(\rho _{2}\le 1\) for all \(d\le \frac{ (2+\sqrt{3\delta })(1-c_{H})}{4(1-c_{L})}\). \(\square \)

Proof of Lemma 3

Profits in the PE are

Plugging output levels \(q^{L}(t_{1}^{L})\) and \(q^{H}(t_{1}^{H})\) into \(\pi _{PE}^{H,R}\) yields

Differentiating \(\pi _{PE}^{H,R}\) with respect to d, and solving for d, we obtain s

\(\square \)

Proof of Proposition 2

Profit \(\pi _{PE}^{H,R}\) is in the proof of Lemma 3, and

Hence, \(\pi _{PE}^{H,R}\ge \pi _{CI}^{H,R}\) for all \(d<d_{5}\); where \( d_{5}\equiv \frac{(c_{H}-c_{L})(1-c_{L})}{(1-c_{H})\left[ \delta +(2-\delta )c_{H}-2c_{L}\right] }\). In addition,

Differentiating with respect to d, and solving for d yields

\(\square \)

Proof of Corollary 1

Profit difference \(\pi _{PE}^{H,R}-\pi _{CI}^{H,R}\) is given in the proof of Proposition 2. Since

and \(\pi _{CI}^{H,NR}=\frac{\left( 1-c_{H}\right) ^{2}}{4}+\delta \frac{ \left( 1-c_{H}\right) ^{2}}{9}\), then

Hence, \(\pi _{PE}^{H,R}-\pi _{CI}^{H,R}\ge \pi _{PE}^{H,NR}-\pi _{CI}^{H,NR} \) for all \(d\in \left[ d_{6},d_{6}^{\prime }\right] \), where

and

where \(\varphi =5\delta +(5\delta -9)c_{H}^{2}\), \(\psi =2c_{H}(5\delta -9c_{L})+9c_{L}^{2}\), \(D\equiv 9(c_{H}-c_{L})(c_{H}+c_{L}-2)-4\delta (1-c_{H})^{2}\), and \(E\equiv \varphi +9c_{L}(3c_{L}-4)-2c_{H}(9c_{L}+5\delta -18)\). \(\square \)

Rights and permissions

About this article

Cite this article

Espínola-Arredondo, A., Muñoz-García, F. Profit-enhancing environmental policy: uninformed regulation in an entry-deterrence model. J Regul Econ 50, 146–163 (2016). https://doi.org/10.1007/s11149-016-9298-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-016-9298-2