Abstract

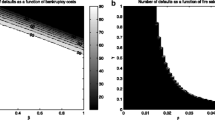

We analyze the treatment and impact of idiosyncratic or firm-specific risk in regulation. Regulatory authorities regularly ignore firm-specific characteristics, such as size or asset ages, implying different risk exposure in incentive regulation. In contrast, it is common to apply only a single benchmark, the weighted average cost of capital, uniformly to all firms. This will lead to implicit discrimination. We combine models of firm-specific risk, liquidity management and regulatory rate setting to investigate impacts on capital costs. We focus on the example of the impact of component failures for electricity network operators. In a simulation model for Germany, we find that capital costs increase by \(\sim \)0.2 to 3.0 % points depending on the size of the firm (in the range of 3–40 % of total cost of capital). Regulation of monopolistic bottlenecks should take these risks into account to avoid implicit discrimination.

Similar content being viewed by others

Notes

Idiosyncratic risk is also known as unsystematic, firm-specific or firm-dependent risk.

Following this rationale, the costs of equity capital are then calculated using well-known models, such as the capital asset pricing model, the three-factor model, or the arbitrage pricing theory.

Guthrie (2005) uses this more correct term of “pure price or revenue based rate regulation” rather than the widely known but less exact term “incentive regulation.”

Also, other firm characteristics may systematically impact the failure behavior of assets, e.g., differences in asset age structure. The term “failure behavior” describes the stochastic properties of the production assets in place, such as the distribution law they follow, its moments and how this distribution law depends on size characteristics, or, for example, on age structure characteristics.

Size effects due to the stochasticity of failure events correspond to some form of economies of scale due to the law of large numbers. Yet, they differ from economies of scale effects usually discussed in the context of firm size and, to our knowledge, have not been discussed in the previous literature. Huettner and Landon (1978), Roberts (1998), and Filippini (1998) present evidence with regard to economies of scale linked to network size from density effects in the production function, which have an impact on average costs. However, they do not consider the impact of network size on risk.

See Scherer and Ross (1990) for a detailed discussion of this and other types of economies of scale. However, these authors also do not consider the indirect type of economies of scale related to reduced idiosyncratic risk and the corresponding lower need for liquidity buffers.

In contrast to the theoretical model of Holmström and Tirole (1998), we exclude hedging (in its classic sense) after the investment decision has been made. Network operators cannot hedge their idiosyncratic risk using traded financial securities. Some hedging, in the form of insurance contracts, can be envisaged in principle. However, so far only limited activities are empirically observable. Moreover, asymmetric information concerning asset states and moral hazard constitute serious problems for a well-functioning secondary market (cf., e.g., Caillaud et al. 2000, who discuss the relevance of costs from asymmetric information in the context of insurance—equivalent to a loan commitment—and debt contracts.

Bank lines of credit are also known as revolving credit facilities or loan commitments.

Analyzing the impact on liquidity management is certainly only one option in demonstrating the possible monetary consequences of additional uncertainty from idiosyncratic risks. It is the alternative of choice in this article because the necessary assumptions for the calculation of liquidity management costs are the least strict and most empirically attestable. Liquidity management in this context is understood as the optimal decision to secure the going concern in possible illiquid states and prevent financial distress. It thereby minimizes expected costs, including distress costs, given a certain distribution of stochastic cash flows resulting from investment decisions. Hedging is complimentary to liquidity management as it is usually understood as a (not necessarily costly) activity to modify the original cash flow distribution.

See, e.g., Sharpe (1964) inter alia.

This study includes all major European countries as well as New Zealand and Australia. Among these, only Kosovo provides a supplementary premium of 1.3 % for size differences.

In general, bankruptcy costs may range from \(\sim \)10 to 25 % of firm value (see, e.g., Bris et al. 2006, who analyze the depreciation of book values of 286 companies during their bankruptcy processes). Reimund et al. (2008) study of 46 German DAX companies draws on analysts’ forecasts concerning market values and similarly determines a depreciation of \(\sim \)28 % on average, but up to 44 % of the enterprise value in extreme cases.

Almeida and Philippon (2007) complement the literature on the value of financial distress using the probabilities of bankruptcy, which are conditional on the state of the economy. As financial distress is more likely to occur in periods of economic downturn, the probability of experiencing distress increases more than threefold in some cases, i.e., from \(\sim \)1.4 % of the NPV of a firm pre distress to \(\sim \)4.5 % for a BBB-rated firm. The authors state that the value of distress can be as important as marginal tax benefits.

Other reasons for market imperfections and therefore engaging in costly hedging include the imperfect diversification of agents, who hold a significant share of their wealth in the firm (see Stulz 1984; Smith and Stulz 1985), moral hazard calling for an effort-inducing rent guaranty to the agent making hedging necessary (see Holmström and Tirole 1998, 2000; Tirole 2005) or asymmetric information concerning the agent’s performance, when volatile results could be misinterpreted as arising from a lack of effort or incompetence. A final reason might simply be convex taxation functions, which lower earnings when losses cannot be carried forward to other periods (see Froot et al. 1993).

We focus on the return on the total asset base disregarding the question of the optimal long-term capital structure (on this issue, see Schaeffler 2011).

Costs resulting from other hedging motives are in general more difficult to assess because of observability and quantification problems. This is notably the case for the risk aversion assumed in the frameworks of Froot and Stein (1998) and Holmström and Tirole (2000). Nevertheless, the estimates obtained from subsequent calculations have to be interpreted as lower boundaries for costs induced by idiosyncratic risks.

Holding additional capital to finance the liquidity buffer is included in \(M\).

Cash flow hedging will reduce the uncertainty in demand for cash, thereby making it easier to satisfy the contingencies of lines of credit. Adding the cost advantage, the authors can analytically and empirically demonstrate a relative increase in the use of credit lines and in firm value.

Holmström and Tirole (1998) add the argument that holding cash is not efficient when adverse cash flow shocks are not highly correlated across firms. It is then more efficient for banks to serve as liquidity pools, issue liquidity insurance, and provide liquidity only to firms that receive liquidity shocks. As a result, credit lines will be a more efficient means of providing liquidity.

The derivation of these solutions is contained in Appendix 1.

Similar to Markowitz (1952), costs and the risk measure are treated separately. Combining the two can be seen as a portfolio menu from which the optimizing network operator is able to choose. A constant level of risk aversion is assumed, which would have to be adjusted for different levels of risk aversion when applied by an authority.

The penalty is based on customer failures. Nevertheless, for an identical customer and network structure, this is equivalent to a revenue-based penalty.

This general setting is described in more detail in Weber et al. (2010). However, the regulatory perspective is not addressed in their article.

In the context of this analytical model, the initial (or starting) age of an asset is not of relevance. However, in dynamic models, the initial age structure of equipment is highly relevant in the context of optimization.

To keep the model analytically tractable, the objective function does not formally incorporate the agent’s risk attitude. If one introduces risk attitude in the function, smaller network operators’ optimal replacement strategy will deviate from larger operators’ strategies as they will attach a higher weight to the risk component in the objective function. This would result in earlier replacements, reducing risk but increasing the expected cost. Overall, a socially suboptimal replacement policy would imply additional costs for smaller operators.

See Weber et al. (2010).

Independence between asset failures is assumed. Cases for positive or negative correlation are both imaginable and would lead to an additional covariance term, which could also be positive or negative. As these effects are second order, they are of minor interest in the analysis.

For example, extra maintenance costs for emergency teams, provisional solutions, and so forth.

See ARegV (2012).

See Appendix 5.

Data from VDN (2005, pp. 66 ff.) show that failure duration distributions are skewed, caused by a small number of very long outages.

This is possible due to the fact that German distribution network operators are obliged to publish a significant amount of structural data in line with legal obligations. See § 27 Stromnetzentgeltverordnung (StromNEV 2011).

These revenues were estimated based on the average transmitted energy in our data samples. Tariffs are based on BNetzA (2008, pp. 45). LV-tariffs were calculated as the average of Dc and lb tariffs, the MV-tariff was calculated as the average of lg values, and only data from 2008 were considered. One has to take into account that only 50 % of total network costs are considered open to influence by the German regulatory authority due to the influences of transmission networks, license fees and subventions for renewable energy sources.

The SAIDI is the average outage duration for each customer served per year. It is calculated by dividing the sum of all customer interruption durations by the total number of customers served.

The SAIFI is calculated analogously to the SAIDI. It is calculated by dividing the sum of all customer interruption frequencies by the total number of customers served.

For the quantification of financial effects, the WACC is taken as 7.38 %, which may be considered conservative in comparison to current international regulatory settings for returns on capital. This is based on the return rate for equity of 9.29 % set by the German regulator and an interest rate on debt of 6.1 %, given a 40 % share of equity in total capital. For the standard network operator, approximate revenues of €38 m and a firm value of approximately €160 m are derived as an approximation from network charges and average customer sizes (see footnote 38). Correspondingly, earnings before interest and taxes (EBT) have to be close to €6 m or 15.65 % of total revenues in order to cover capital costs.

A low, medium, and high cost scenario were defined. Whereas the weighted capital cost rate is set at 7.38 % throughout, in the low-cost scenario, the fixed credit line fee is 0.25 %, the rate for actual usage is an additional 2 %, and short-run capital provision is assured at 12.5 %. The parameters for the medium-cost scenario are 0.5, 3 and 12.5 %. The high-cost scenario then assumes a substantially higher rate of 35 % for short-run capital provision as may occur when asset fire sales become necessary. Interestingly, throughout the different cost scenarios there is only a slight variation of \(\sim \)10 % upwards and downwards respectively. Therefore, we employ the medium-cost scenario in the following exposition of results.

A vast body of empirical research concerning the lifetime of network components has been published to date. One research article regarding cables is Densley (2001). Lindquist et al. (2008) analyze the reliability of circuit breakers. FGH (2006) presents aging models for all sorts of different component types. Unfortunately, there is no single article that summarizes research in this field and is able to provide consistent lifetime distributions for all asset types required in the simulation. A first obstacle is the vast number of possible different definitions of survival age and approach to modeling it. Second, research focuses mostly on transformers, circuit breakers, and cables. To our knowledge, there is no extensive research available on relay stations. Consequently, the cumulative failure distributions are derived as assumptions from practical insights.

References

Acharya, V., Almeida, H., & Campello, M. (2007). A hedging perspective on corporate financial policies. Journal of Financial Intermediation, 16, 515–554.

Acharya, V., Almeida, H., & Campello, M. (2009). Aggregate risk and the choice between cash and lines of credit. New York: Northwestern University.

Almeida, H., & Philippon, T. (2007). The risk-adjusted cost of financial distress. The Journal of Finance, 62, 2557–2586.

ARegV. (2012). Verordnung über die Anreizregulierung der Energieversorgungsnetze (Anreizregulierungs-verordnung ARegV). Retrieved March 25, 2012 form http://www.gesetze-im-internet.de/bundesrecht/aregv/gesamt.pdf.

Banz, R. W. (1981). The relationship between return and market value of common stocks. Journal of Financial Economics, 9, 3–18.

BDEW. (2008). Nettostromverbrauch. Retrieved June 17, 2009 from www.bdew.de.

Billington, R., (2000). Methods to consider customer interruption costs in power system analysis. CIGRE Task Force 38.06.01, 38199.

BNetzA. (2008). Monitoringbericht 2008. Retrieved September 28, 2008 from www.bundesnetzagentur.de.

Bradley, M., Jarrell, G. A., & Kim, E. H. (1984). On the existence of an optimal capital structure: Theory and evidence. The Journal of Finance, 39, 857–878.

Brennan, M. J., & Schwartz, E. S. (1982). Consistent regulatory policy under uncertainty. Bell Journal of Economics, 13, 506–521.

Bris, A., Welch, I., & Zhu, N. (2006). The costs of bankruptcy. Journal of Finance, 61, 1253–1303.

Caillaud, B., Dionne, G., & Jullien, B. (2000). Corporate insurance with optimal financial contracting. Economic Theory, 16, 77–105.

Consentec, IAEW, RZVN and Frontier Economics. (2008). Untersuchung der Voraussetzungen und möglicher Anwendungen analytischer Kostenmodelle in der deutschen Energiewirtschaft. Untersuchung im Auftrag der Bundesnetzagentur, Retrieved November 25, 2006 from http://www.bundesnetzagentur.de/cln_1912/DE/ Sachgebiete/ElektrizitaetGas/Sonderthemen/sonderthemen\_node.html.

Demiroglu, C., & James, C. (2011). The use of bank lines of credit in corporate liquidity management: A review of empirical evidence. Journal of Banking and Finance, 35, 775–782.

Densley, J. (2001). Ageing mechanisms and diagnostics for power cables: An overview. Electrical Insulation Magazine IEEE, 17, 14–22.

Disatnik, D., Duchin, R., & Schmidt B. (2010). Cash flow hedging and liquidity choices. Working Paper. Retrieved February 18, 2011 from http://ssrn.com/abstract=1442166.

Evans, L. T., & Guthrie, G. A. (2005). Risk, price regulation, and irreversible investment. International Journal of Industrial Organization, 23, 109–128.

Fama, E. F., & French, K. (1992). The cross-section of expected stock returns. The Journal of Finance, 47, 427–465.

Fama, E. F., & French, K. (1995). Size and book-to-market factors in earnings and returns. The Journal of Finance, 50, 131–155.

Fama, E. F., & French, K. (1997). Industry costs of equity. Journal of Financial Economics, 43, 153–193.

FGH. (2006). Technischer Bericht 299 - Asset-Management von Verteilungsnetzen - Komponentenverhalten und Analyse des Kostenrisikos. Forschungsgemeinschaft für Elektrische Anlagen und Stromwirtschaft e. V.

Filippini, M. (1998). Are municipal electricity distribution utilities natural monopolies? Annals of Public and Cooperative Economics, 69, 157–174.

Flannery, M., & Lockhart, B. (2009). Credit lines and the substitutability of cash and debt. Working Paper: University of Florida.

Frontier Economics. (2008). Ermittlung des Zuschlags zur Abdeckung netzbetreiberspezifischer Wagnisse im Bereich Strom und Gas. Expertise for the German regulator BNetzA. Retrieved 17, April 2009 from http://www.bundesnetzagentur.de/SharedDocs/Downloads/DE/BNetzA/Sachgebiete/Energie/Sonderthemen/WagnisEigenkapitalverzinsung/GutachtenId13761pdf.pdf?__blob=publicationFile.

Froot, K. A., Scharfstein, D. S., & Stein, J. C. (1993). Risk management: Coordinating corporate investment and financing policies. Journal of Finance, 48, 1629–1658.

Froot, K. A., & Stein, J. C. (1998). Risk management, capital budgeting, and capital structure policy for financial institutions: An integrated approach. Journal of Financial Economics, 47, 55–82.

Guthrie, G. A. (2005). Regulating infrastructure: The impact on risk and investment. Journal of Economic Literature, 54, 925–972.

Holmström, B., & Tirole, J. (1998). Private and public supply of liquidity. Journal of Political Economy, 106, 1–40.

Holmström, B., & Tirole, J. (2000). Liquidity and risk management. Journal of Money, Credit and Banking, 32, 295–319.

Huettner, D. A., & Landon, J. H. (1978). Electric utilities: Scale economies and diseconomies. Southern Economic Journal, 44, 883–912.

Kashyap, A., Rajan, R., & Stein, J. (2002). Banks as liquidity providers: An explanation for the co-existence of lending and deposit-taking. Journal of Finance, 57, 33–73.

Lindquist, T., Bertling, L., & Eriksson, R. (2008). ircuit-breaker failure data and reliability modelling. ET Generation Transmission and Distribution, 6, 813–820.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Obergünner, M. (2005). Bewertung und Optimierung des Instandhaltungsaufwands elektrischer Verteilungs -netze. Aachener Beiträge zur Energieversorgung, 102, Appendix.

Opler, T. C., & Titman, S. (1994). Financial distress and corporate performance. The Journal of Finance, 49, 1015–1040.

Reimund, C., Schwetzler, B., & Zainhofer, F. (2008). Cost of financial distress: The German evidence. SSRN working paper series. Retrieved March 9, 2009 from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=933567.

Roberts, A. (2001). Quality issues for system operators with special reference to European regulators. Brussels: Belgian Transmission System Operator (ELIA).

Roberts, M. E. (1998). Economies of density and size in the production and delivery of electric power. Land Economics, 62, 378–387.

Schaeffler, S. (2011). An evaluation of different approaches to capital structure regulation. Working Paper. Retrieved October 20, 2011 from http://www.ewl.wiwi.uni-due.de/forschung/veroeffentlichungen/publikationen/.

Schaeffler, S., & Weber, C. (2013). The cost of equity of network operators: Empirical evidence and regulatory practice. Journal of Competition and Regulation in Network Industries, 14, 383–408.

Scherer, F. M., & Ross, D. (1990). Industrial market structure and economic performance (3rd ed.). Boston: Houghton Mifflin (Academic).

Scott, J. H. (1976). A theory of optimal capital structure. The Bell Journal of Economics, 7, 33–54.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19, 425–442.

Shleifer, A., & Vishny, R. W. (1992). Liquidation values and debt capacity: A market equilibrium approach. The Journal of Finance, 47, 1343–1366.

Smith, C., & Stulz, R. (1985). The determinants of firms’ hedging policies. Journal of Financial and Quantitative Analysis, 20, 391–405.

Stulz, R. (1984). Optimal hedging policies. Journal of Financial and Quantitative Analysis, 19, 127–140.

StromNEV. (2011). Verordnung über die Entgelte für den Zugang zu Elektrizitätsversorgungsnetzen. Retrieved December 2, 2011 from www.bundesrecht.juris.de/stromnev/index.html.

Tirole, J. (2005). The theory of corporate finance. Princeton: Princeton University Press.

VDN. (2005). VDN-Störungs- und Verfügbarkeitsstatistik. Verband der Netzbetreiber - VDN e.V. beim VDEW.

Weber, C., Schober, D., & Schaeffler, S. (2010). Optimal replacement strategies in network infrastructures under quality penalties. Journal of Business Economics (Zeitschrift für Betriebswirtschaft), 80, 639–665.

Acknowledgments

For useful discussions on earlier versions of the paper, the authors want to thank the participants of the 29th Annual Eastern Conference of the Rutgers Center for Research in Regulated Industries, especially Howard Spinner and Kathleen King, as well as the participants of the 8th Conference on Applied Infrastructure Research at the TU Berlin and the 2nd Annual Competition and Regulation in Network Industries Conference in Brussels. We also would like to thank the participants of an internal workshop at the ZEW in Mannheim, especially Konrad Stahl and Oliver Woll. Remaining errors are solely ours.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

The optimal simultaneous choice of up-front capital provision \(B\) and choice of credit lines \(L\) is implicitly defined by solving the firm’s objective function contained in Eq. (9). Usually, \(s_{1}<< s_{2}\), which does not restrict the following results:

Optimization with respect to \(L\) and \(B\) gives the following results:

Assuming normal distribution characteristics for stochastic cash flows \(x\), an implicit solution of the optimization is possible:

Algebraic transformation leads to \(L=B+\frac{\left( {r+u} \right) F\left( {-L} \right) -s_{1} }{\left( {r+s_{2} } \right) f\left( {-L} \right) }\).

The solution for \(B\) is of course analogous:

Again, assuming normally distributed cash flows will make the following solution possible:

\(\frac{\partial E}{\partial B}=0:\) Algebraic transformation leads to:

Appendix 2

Solving this quadratic equation gives:

Appendix 3

It is sufficient to show that total cost is convex in replacement age:

This is done by showing that the second derivative of this composition of polynomials is positive:

By inspecting the following transformation, this can easily be seen. \(\mu \) is convex in \(t_{j}\).

Appendix 4

This network structure is based on Obergünner (2005), who presents the components of a standard distribution network operator in German electricity distribution. The network components (or asset clusters) are as follows: transformers, circuit breakers, overhead lines (medium and low voltage), cables (medium and low voltage), relay stations. This structure consists of: six transformer stations (with 12 transformers and 90 circuit breakers), 600 relay stations, and 2,000 km of cables and overhead lines.

Transformer stations (with the transformers and circuit breakers), which are connected to the high voltage grid, transform electricity to medium voltage and feed into medium voltage rings. Industry customers are directly connected to transformer stations. Based on the analytical network modeling approach in Consentec, IAEW, RZVN and Frontier Economics (2008), which has also been used by the German regulator for various regulatory purposes, we determine that five medium voltage rings, each 20 km in length, are connected to each transformer station. A medium voltage ring consists of cables and overhead lines, which connect several relay stations per ring. At each relay station, electricity is transformed to low voltage and fed into low voltage cables and overhead lines which provide low voltage customers via a string structure. Each ring includes 20 relay stations, from which four low voltage lines per relay station (each 600 m in length) connect households, commercial customers and others (i.e., traffic, agriculture, public institutions). This corresponds to a typical distribution network operator’s structure.

Appendix 5

The 80 % survival age indicates the age that 80 % of assets will attain without replacement or major repair (the value of the cumulative distribution function CDF attaining 0.2), the 20 % survival age indicates the age at which 80 % of assets in one cluster will have failed (CDF = 0.8). The estimates for these survival ages reflect practitioners’ current expectations of asset lifetimes.Footnote 43Based on these assumptions, Weibull failure distribution laws for the conditional failure rate have been estimated (see Fig. 5 for cumulated distribution functions).

Appendix 6

The customer segment definitions were taken from BNetzA (2008, p. 45), drawing on the overall yearly consumptions from BDEW (2008). The number of customers was derived from the data gathered with reference to the share of total line length (2,000 km compared to \(\sim \)1,600,000 km overall in Germany).

Survival ages were deduced from project experience and the data gathered. AVG failure duration was taken from VDN (2005), and Weibull parameters were estimated based on averages. Asset replacement cost can be found in Consentec et al. (citeyearcon08, p. 113), and additional unplanned replacement costs were estimated at 20 % of planned costs based on project experience. Penalties were calculated based on €10/kWh, customer-specific data in Table 2, average failure durations and assumptions concerning network structure and redundancy (see Table 3).

Rights and permissions

About this article

Cite this article

Schober, D., Schaeffler, S. & Weber, C. Idiosyncratic risk and the cost of capital: the case of electricity networks. J Regul Econ 46, 123–151 (2014). https://doi.org/10.1007/s11149-013-9242-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-013-9242-7

Keywords

- Idiosyncratic/firm-specific risk

- Discrimination

- Incentive-based and quality regulation

- Liquidity management

- Size effects

- Electricity networks