Abstract

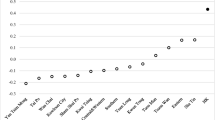

This study is based on survey data on investor expectations for 40 metropolitan statistical areas (MSAs) in the US over the period from 2003:Q2 to 2014:Q2. The paper has two main objectives. These are firstly to identify whether expected rates of return across different commercial real estate markets are positively spatially correlated and secondly to analyze the role of core markets like New York, Washington, DC, Los Angeles, San Francisco, and Chicago in the information-spreading process. All the tests conducted are conditional on the maintained hypothesis that expected returns across different markets are spatially uncorrelated. To carry out these tests, we regress a measure of excess return in each of the 40 markets on (contemporaneous) measures of expected returns in other markets, controlling for the interaction between (neighboring) markets. We find very large spatial interaction coefficients across different markets. Our basic estimates yield a spatial correlation coefficient of near one and statistically significant at standard levels. Chow tests allow rejection of the hypothesis that core markets like New York, Washington, DC, Los Angeles, San Francisco, and Chicago are no different than markets like Cleveland, Columbus, Orlando, Pittsburgh, Salt Lake City, St. Louis, and Tampa in explaining the covariances of the rates of return among different commercial real estate markets. Tests of structural change also imply that core markets currently play a more prominent role that in the past in the transfer of information from one market to another.

Similar content being viewed by others

Notes

First-tier (i.e., Class A) buildings are investment-grade properties that command the highest rents and sales prices in a particular market.

By comparison, the corresponding average annualized realized holding period returns of the NCREIF NPI index are 8.6 % for apartment buildings, 8.3 % for office buildings, 8.6 % for industrial properties, and 10.9 % for retail properties over the same time period, while the average standard deviations are 10.4 % for apartment buildings, 11.0 % for office buildings, 10.2 % for industrial properties, and 9.1 % for retail properties.

Returns may not converge geographically if market imperfections or quasi-monopolistic traits exist (see Downs (1991)).

The results in Meen (1999), Peterson and Gaudoin (2002), and Canarella et al. (2012) build on the work in Tirtiroglu (1992) and Clapp and Tirtiroglu (1994) who find that housing returns are correlated across different submarkets of the same MSA. Pollakowski and Ray (1997) find similar statistical evidence but at the regional level. The pervasive problem in this literature is the way in which shocks in one market are transmitted to another market. While migration could cause these shocks to be transmitted from one market to another if households relocate in response to changes in the spatial distribution in house prices, Haurin (1980) argues that house prices need not equalize among regions because of regional-specific differences in amenities (e.g., “California sunshine,” coastal markets versus non-coastal markets) or scale economies. The important point in connection with our argument here is that house price changes in other markets could be caused by a change in the underlying demand or “taste” for housing. For example, changes in the average buyer’s taste for housing in Miami may be important in determining the demands for individual buyers in New York City and vice versa.

References

An, X., Yongheng, D., and Fisher, J. D. (2011) Commercial Real Estate Rental Index: a dynamic panel data model estimation, A RERI Research Paper.

Andersen, T., Bollersley, T., Diebold, F., & Vega, C. (2007). Real-time price discovery in global stock bonds and foreign exchange markets. Journal of International Economics, 73, 257–277.

Ang, A., & Bekaert, G. (2002). International asset allocation with regime shifts. Review of Financial Studies, 15, 1137–1187.

Ang, A., & Chen, J. (2002). Asymmetric correlations of equity portfolios. Journal of Financial Economics, 63, 463–494.

Boyer, B. H., Kumagai, T., & Yuan, K. (2006). How do crises spread? Evidence from accessible and inaccessible stock indices. Journal of Finance, 61, 95–1003.

Campbell, J. Y., & Shiller, R. J. (1988). the dividend-price ratio and expectations of future dividends and discount factors. Review of Financial Studies, 1, 195–227.

Campbell, J. Y., Polk, C., & Vuolteenaho, T. (2010). Growth or glamour? Fundamentals and systematic risk in stock returns. The Review of Financial Studies, 23, 305–344.

Canarella, G., Miller, S. M., and Pollard, S. K. (2012) Unit Roots and structural change: an application to us house price indices, urban studies, 49, 757–776.

Clapp, J. M., & Tirtiroglu, D. (1994). Positive feedback trading and diffusion of asset price changes: evidence from housing transactions. Journal of Economic Behavior and Organization, 24, 337–355.

Clayton, J., Ling, D., & Naranjo, A. (2009). commercial real estate valuation: fundamentals versus investor sentiment. Journal of Real Estate Finance and Economics, 38, 5–37.

Cliff, A.D. and Ord, J.K. (1969), The problem of spatial auto-correlation, in A. J. Scott, ed., Studies in Regional Science, London: Pion, 25–55.

Devereux, M. B., & Yetman, J. (2010). Leverage constraints and the international transmission of shocks. Journal of Money, Credit and Banking, 42, 71–105.

Downs, A. (1991) What have we learned from the 1980s Experience? Salomon Brothers mimeo.

Dungey, M. and Martin, V. L. (2001) Contagion across financial markets: an empirical assessment. Unpublished working paper, Australian National University.

Ehrmann, M., Fratzscher, M., & Rigobon, R. (2011). Stocks, bonds, money markets and exchange rates: measuring international financial transmission. Journal of Applied Econometrics, 26, 948–974.

Fama, E., & French, K. (1988). Permanent and temporary components of stock prices. Journal of Political Economy, 96, 246–273.

Ferreira, F. and Gyourko, J. (2011) Anatomy of the beginning of the housing boom: U.S. neighborhoods and metropolitan areas, 1993–2009. NBER Working Paper w17671.

Fisher, J. (2012) Is core over-valued? NCREIF Research Corner, mimeo.

Haurin, D. R. (1980). The Regional Distribution of Population, Migration, and Climate. Quarterly Journal of Economics, 95, 293–308.

Karolyi, A., & Stulz, R. M. (1996). Why do markets move together? An investigation of U.S.-Japan stock return comovements. Journal of Finance, 51, 951–986.

King, M. A., & Wadhwani, S. (1990). Transmission of volatility between stock markets. The Review of Financial Studies, 3, 5–33.

King, M. A., Sentana, E., & Wadhwani, S. (1994). Volatility and links between national stock markets. Econometrica, 62, 901–933.

Lerner, J. (2011). The Future of private equity. European Financial Management, 17, 423–435.

Meen, G. (1999). Regional house prices and the ripple effect: a new interpretation. Housing Studies, 14, 733–753.

Ord, K. (1975). Estimation methods for models of spatial interaction. Journal of the American Statistical Association, 70, 120–126.

Peterson, W., Holly, S., and Gaudoin, P., (2002). Further work on an economic model of the demand for social housing. Report to the Department of the Environment, Transport and the Region.

Plazzi, A., Torous, W., & Valkanov, R. (2010). Expected returns and expected growth in rents of commercial real estate. Review of Financial Studies, 23, 3469–3519.

Pollakowski, H. O., & Ray, T. S. (1997). Housing price diffusion patterns at different aggregation levels: an examination of housing market efficiency. Journal of Housing Research, 8, 107–124.

Raddatz, C. and Schmukler, S. L. (2011) On the international transmission of shocks: Micro-evidence from mutual fund portfolios, NBER Working Paper No. 17358.

Rozeff, M. (1984). Dividend yields are equity risk premiums. Journal of Portfolio Management, 11, 68–75.

Shiller, R. J., & Beltratti, A. (1992). Stock prices and bond yields. Journal of Monetary Economics, 30, 25–46.

Shiller, R. J., Konya, F., & Tsutsui, Y. (1991). Investor behavior in the october 1987 stock market crash: The case of Japan. Journal of the Japanese and International Economies, 5, 1–13.

Tirtiroglu, D. (1992). Efficiency in Housing Markets: Temporal and Spatial Dimensions. Journal of Housing Economics, 2, 276–292.

Torous, W., Plazzi, A., & Valkanov, R. (2010). Expected returns and expected growth in rents of commercial real estate. Review of Financial Studies, 23(9), 3469–3519.

Ventura, J. and Martin, A. (2015) The international transmission of credit bubbles: Theory and Policy, NBER Working Paper No. 20933.

Whittle, P. (1963). Stochastic processes in several dimensions. Bulletin of the International Statistical Institute, 40, 974–994.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This appendix describes the method used to identify structural breaks in the period under investigation. Since we do not explicitly know the dates of possible disturbances, we follow the same methodology as in Ferreira and Gyourko (2011) to identify the existence of these structural breaks without imposing economic priors. In the case of Ferreira and Gyourko (2011), they use the methodology expressed concisely in equation (A1) to gain insight into the timeline of the U.S. housing boom over the 2000s. The relevant computations in Ferreira and Gyourko (2011) are carried out using house price growth rate data both at the MSA level and at the neighborhood level from 1993 to 2009. Their results show considerable heterogeneity in terms of when the housing boom began. Using aggregated MSA-level data, Ferreira and Gyourko (2011) find major jumps in price appreciation rates as early as 1997 in some MSAs and as late as 2005 in others, with only a modestly higher concentration of breakpoints around 2004–2005. Using activity in groups of 2 or 3 contiguous census tracts to define a neighborhood, their neighborhood analysis also shows similar heterogeneity in timing, with booms beginning as early as 1996 and as late as 2006.

Our approach differs from that in Ferreira and Gyourko (2011) in the following important respect. We use the methodology to identify structural breaks in the U.S. commercial real estate market. All of our data are at the MSA level. Our sample includes expected rent price growth rates for apartment buildings, CBD office buildings, industrial warehouse properties, and regional malls over the period 2003 Q2 to 2014 Q2. The empirical strategy to identify these structural breakpoints can be described with the following regression model:

where (R n , c , p , t /R 0 , c , p , t ) is the quarterly expected rent price growth rate computed from the equation (1) in the text, δ c , p estimates the importance of the potential breakpoint, q c , p , t is a quarter (with τ c , p , 2004 < q c , p , t < τ c , p , 2011), \( {q}_{c,p,t}^{*} \) is the location of the potential structural break, τ c , p , 2004 is the first quarter of 2004, and τ c , p , 2011 is the fourth quarter of 2011. The subcripts are city (c), property type (p), and quarter (t).

Equation (A1) is essentially a steady state equilibrium model. The model assumes a stable market structure in which rent growth (which may be positive, negative, or zero) is constant over time. A statistically significant structural break occurs in this growth process at that quarter which maximizes the explained variance of the dependent variable. The identification of this breakpoint is achieved recursively. Equation (A1) is estimated repeatedly over the peroid τ c , p , 2004 to τ c , p , 2011, each time by adding one observation at a time. The resulting 32 estimates of the intercept term are then investigated to find if there is a quarter in which the change in the rent price growth series has its greatest impact in explaining the rent price growth series itself.

To get a sense of whether return expectations in different markets are more spatially correlated in crisis periods than in boom periods, the idea is to use these estimated structural break dates to work out if the spatial correlation coefficients in equation (8) increase or decrease during crisis periods. Some caution is warranted in interpreting the estimates in the text, however, since the parameters of the model are estimated over a period when rents were essentailly falling as a result of the great financial crisis and so we do not have data over a full cycle.

Rights and permissions

About this article

Cite this article

Shilling, J.D., Sirmans, C. & Slade, B.A. Spatial Correlation in Expected Returns in Commercial Real Estate Markets and the Role of Core Markets. J Real Estate Finan Econ 54, 297–337 (2017). https://doi.org/10.1007/s11146-016-9581-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-016-9581-0