Abstract

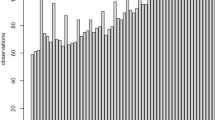

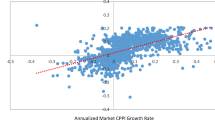

Using a unique dataset of building operating statements from Fannie Mae, we develop repeated measures regression (RMR) indices for NOI, EGI and PGI to track the cash flow performance of Fannie Mae-financed multifamily real estate. Our three-stage RMR estimate shows an average NOI growth of about 1.8 % during 1993–2011, which is lower than inflation rate and significantly lower than what is usually perceived by investors. Based on the RMR estimates, we find that the whole portfolio of Fannie Mae multifamily properties outperforms NCREIF multifamily properties in NOI growth, especially during the 2000–2001 recession and the Great Recession, which helps explain the superior performance of Fannie Mae multifamily mortgage loans during the recent crisis. In the cross section, multifamily properties in supply-constrained areas have substantially larger NOI growth. Workforce housing performs better than low-income housing even after we control for locational differences and property features. We do not find a size effect in NOI growth once we control for supply constraints. We also find EGI growth to be much less volatile than NOI growth, which implies that changes in operating expenses are the main driving factor of the cyclicality of NOI. Operating expenses also tend to be pro-cyclical – they grow faster during recessions. EGI growth (decline) leads PGI growth (decline), which supports the stock-flow model of rental adjustment where vacancy changes before rent. From a methodological perspective, we find that the conventional methods such as simple average and weighted average over-estimate multifamily NOI growth, likely due to significant sample selection bias and outlier influence. In contrast, the RMR indices control for changes in property quality and are much more robust in the presence of data errors and outliers.

Similar content being viewed by others

Notes

Here default is defined as 60+ day delinquency.

“An overview of Fannie Mae’s multifamily mortgage business.” Fannie Mae, May 1, 2012.

While most of the Fannie Mae dataset is “workforce” housing, a statistically usable sub-sample may be classified as “low income.” The NCREIF apartment sample, on the other hand, would largely represent the more upscale and “luxury” rental housing segment. Nevertheless, we would expect both to be affected by general economic trends but not necessarily to the same degree.

See, e.g., Bailey et al. 1963; Kain and Quigley 1970; Rosen 1974; Case and Shiller 1987; Shiller 1991; Geltner 1989; Geltner 1991; Fisher et al. 1994; Quigley 1995; Calhoun 1996; England et al. 1999; Geltner and Goetzmann 2000; Fisher et al. 2003; Cannaday et al. 2005; Fisher et al. 2007; Geltner and Pollakowski 2007; Hwang and Quigley 2010; Deng et al. 2012; Chegut et al. 2013; and many others.

The loan characteristics data contain information about all loans that have been acquired by Fannie Mae, no matter whether they are current. So, loans that have been paid off or defaulted are included.

Some loans are secured by multiple properties and a few properties carry multiple loans.

Because of the aforementioned problem of non-unique loan-property match, this will create some outliers that will be excluded by our outlier removal procedure discussed later.

Lenders and Fannie Mae usually apply “haircut” to operating income when conducting underwriting.

The NOI reported in FNMA data may have been calculated after reserves for capital items. In other industry reports this would be NCF rather than NOI. This might account for the relatively high expense ratio.

Additional analysis of the operating expenses reveals that operating expenses of Fannie Mae properties in the analysis population grew at an average annual rate of 3.6 %. One hypothesis is that it is a characteristic typical of physically older properties, and that Fannie Mae properties tend to be old (as noted, the median age is 34 years). This finding, that same-property NOI growth is less than inflation over the long run, would be reflective of real depreciation in the properties, and is supported by other recent empirical evidence about deprecation in commercial properties, not just in multi-family properties (Bokhari and Geltner 2014).

Given that a large portion of the NCREIF property value information is from appraisals and appraisal values are usually smoothed, Geltner (1989), Geltner (1991), Fisher et al. (1994) (and many other studies) focus on the bias of price returns calculated from smoothed appraisal data and on how to unsmooth the appraisal data to construct arithmetic average indexes for commercial real estate.

Here we use the term “noise” for the dispersion of idiosyncratic NOI growth.

Here we are mixing new leases with existing leases, and we are looking at same-property changes over time (reflecting depreciation), so PGI does not exactly trace the rental market, and our PGI index is not exactly the same thing as a space market rental price index.

In general most NCREIF apartment properties would probably not be well characterized as “workforce housing” or “low-income” housing.

Workforce housing could be housing for ownership but we are only dealing with rental housing in this study.

We experimented with alternative bandwidth of relative income, e.g, 50 to 100 percent of area median income, and found results below to be consistent.

The number of high-income housing is so small in our sample that we are not able to estimate a separate NOI index for high-income housing.

Results are robust to different cut-off points in the definition of workforce housing.

Results are robust to different cutoffs for defining “large” and “small” properties.

Property value and number of units are highly correlated, so we only include size in number of units in the regressions.

References

Ambrose, B., Coulson, E., & Yoshida, J. (2013). The repeat rent index. Penn State University Working Paper.

An, X., & Sanders, A.B... (2010). Default of commercial mortgage loans during the financial crisis. SSRN working paper.

An, X., Deng, Y., Nichols, J. B., & Sanders, A. B. (2013). Local traits and securitized commercial mortgage default. Journal of Real Estate Finance and Economics, 47, 787–813.

An, X., Deng, Y., Fisher, J.D., & Hu, M.R. (2014). Commercial real estate rental index: a dynamic panel data model estimation. Real Estate Economics, forthcoming.

Bailey, M. J., Muth, R. F., & Nourse, H. O. (1963). A regression method for real estate price index construction. Journal of the American Statistical Association, 58, 933–942.

Bokhari, S., & Geltner, D. (2014). Characteristics of depreciation in commercial and multi-family property: an investment perspective. Working Paper, MIT Center for Real Estate.

Calhoun, C. A. (1996). OFHEO house price indexes: HPI technical description. Washington: Working paper, Office of Federal Housing Enterprise Oversight.

Cannaday, R., Munneke, H., & Yang, T. (2005). A multivariate repeat-sales model for estimating house price indices. Journal of Urban Economics, 57, 320–342.

Case, K. E., & Shiller, R. J. (1987). Prices of single-family homes since 1970. New England Economic Review, 1987, 45–56.

Chegut, A. M., Eichholtz, P. M. A., & Rodrigues, P. (2013). The London commercial property price index. Journal of Real Estate Finance and Economics, 47(4), 588–616.

Clapp, J. (2004). A semiparametric method for estimating local house price indices. Real Estate Economics, 32(1), 127–160.

Deng, Y., McMillen, D. P., & Sing, T. F. (2012). Private residential price indices in Singapore: a matching approach. Regional Science and Urban Economics, 42(3), 485–494.

Eichholtz, P., Straetmans, S., & Theebe, M. (2012). The Amsterdam rent index: the housing market and the economy, 1550–1850. Journal of Housing Economics, 21(4), 269–282.

England, P., Quigley, J. M., & Redfearn, C. L. (1999). The choice of methodology for computing housing price indexes: comparisons of temporal aggregation and sample definition. Journal of Real Estate Finance and Economics, 19(2), 91–112.

Fisher, J., Geltner, D., & Webb, B. (1994). Value indices of commercial real estate: a comparison of index construction methods. Journal of Real Estate Finance and Economics, 9, 137–164.

Fisher, J., Gatzlaff, D., Geltner, D., & Haurin, D. (2003). Controlling for the impact of variable liquidity in commercial real estate price indices. Real Estate Economics, 31(2), 269–303.

Fisher, J., Geltner, D., & Pollakowski, H. (2007). Quarterly transactions-based index (TBI) of institutional real estate investment performance and movements in supply and demand. Journal of Real Estate Finance and Economics, 34, 5–33.

Geltner, D. (1989). Bias in appraisal-based returns. AREUEA Journal, 17(3), 338–352.

Geltner, D. (1990). Return risk and cash flow risk with long-term riskless leases in commercial real estate. AREUEA Journal, 18(4), 377–402.

Geltner, D. (1991). Smoothing in appraisal-based returns. Journal of Real Estate Finance and Economics, 4(3), 327–345.

Geltner, D., & Goetzmann, W. (2000). Two decades of commercial property returns: a repeated-measures regression-based version of the NCREIF index. Journal of Real Estate Finance and Economics, 21(1), 5–21.

Geltner, D., & Pollakowski, H. (2007). A set of indexes for trading commercial real estate based on the real capital analytics transaction prices database. MIT Center for Real Estate Commercial Real Estate Data Laboratory working paper.

Geltner, D., Miller, N., Clayton, J., & Eichholtz, P. (2007). Commercial real estate analysis and investment (2nd ed.). Mason: Cengage Learning.

Glaeser, E. L., Gyourkoand, J., & Saks, R. (2005). Why is Manhattan so expensive? Regulation and the rise in house prices. Journal of Law and Economics, 48(2), 331–370.

Goldberg, L., & Capone, C. A., Jr. (2002). A dynamic double-trigger model of multifamily mortgage default. Real Estate Economics, 30(1), 85–113.

Hwang, M., & Quigley, J. M. (2010). House price dynamics in time and space: predictability, liquidity, and investor returns. Journal of Real Estate Finance and Economics, 41, 3–23.

Kain, J. F., & Quigley, J. M. (1970). Measuring the value of housing quality. Journal of the American Statistical Association, 65(440), 532–548.

Malpezzi, S., Chun, G. H., & Green, R. K. (1998). New place-to-place housing price indexes for U.S. metropolitan areas, and their determinants. Real Estate Economics, 26(2), 235–274.

Paciorek, A. (2011). Supply constraints and housing market dynamics. FEDS Working Paper No. 2012-01. Available at SSRN: http://ssrn.com/abstract=1982538 or http://dx.doi.org/10.2139/ssrn.1982538

Quigley, J. M. (1995). A simple hybrid model for estimating price indexes. Journal of Housing Economics, 4(1), 1–12.

Rosen, S. (1974). Hedonic prices and implicit markets: product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Shiller, R. J. (1991). Arithmetic repeat sales price estimators. Journal of Housing Economics, 1, 110–126.

Wheaton, W. C., Torto, R. G., & Southard, J. A. (1997). The CB commercial/torto wheaton database. Journal of Real Estate Literature, 5, 59–66.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank an anonymous referee, Barbara Ann, Kim Betancourt, Shaun Bond, John Clapp, Piet Eichholt, Lori Gagliardi, James Graham, Jon Gross, Mark Lacey, Kazuto Sumita, Rhea Thornton, and participants at the MIT-NUS-Maastricht Real Estate Finance and Investment Symposium for helpful comments. The views here are those of the authors’ but not necessarily of Fannie Mae or its regulator FHFA.

Appendix

Appendix

NCREIF commercial real estate rental index and NPI. Source: An et al. (2014)

Rights and permissions

About this article

Cite this article

An, X., Fisher, J.D. & Geltner, D. Cash Flow Performance of Fannie Mae Multifamily Real Estate: Evidence from Repeated NOI and EGI Indices. J Real Estate Finan Econ 52, 512–542 (2016). https://doi.org/10.1007/s11146-015-9521-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9521-4